View in Browser

Sponsor: Unichain — Faster swaps. Lower fees. Deeper liquidity. Explore Unichain on web and wallet.

- 🏦 Pantera Capital Prepping $1.25B Solana Treasury Firm. Major crypto trading firms are reportedly placing their bets that DAT enthusiasm moves to Solana next.

- 🤑 Trump Media Goes All-In on Crypto.com Partnership. Trump Media is putting the CRO token at the center of its Truth Social ecosystem and will create a treasury company for the token.

- 🔷 SharpLink Adds $252M in ETH. The firm holds approximately $3.6 billion worth of ETH.

| Prices as of 4pm ET | 24hr | 7d |

|

Crypto $3.87T | ↗ 2.0% | ↗ 1.3% |

|

BTC $111,232 | ↗ 1.2% | ↘ 2.0% |

|

ETH $4,582 | ↗ 4.6% | ↗ 10.4% |

"Every rollup will be a ZK rollup."

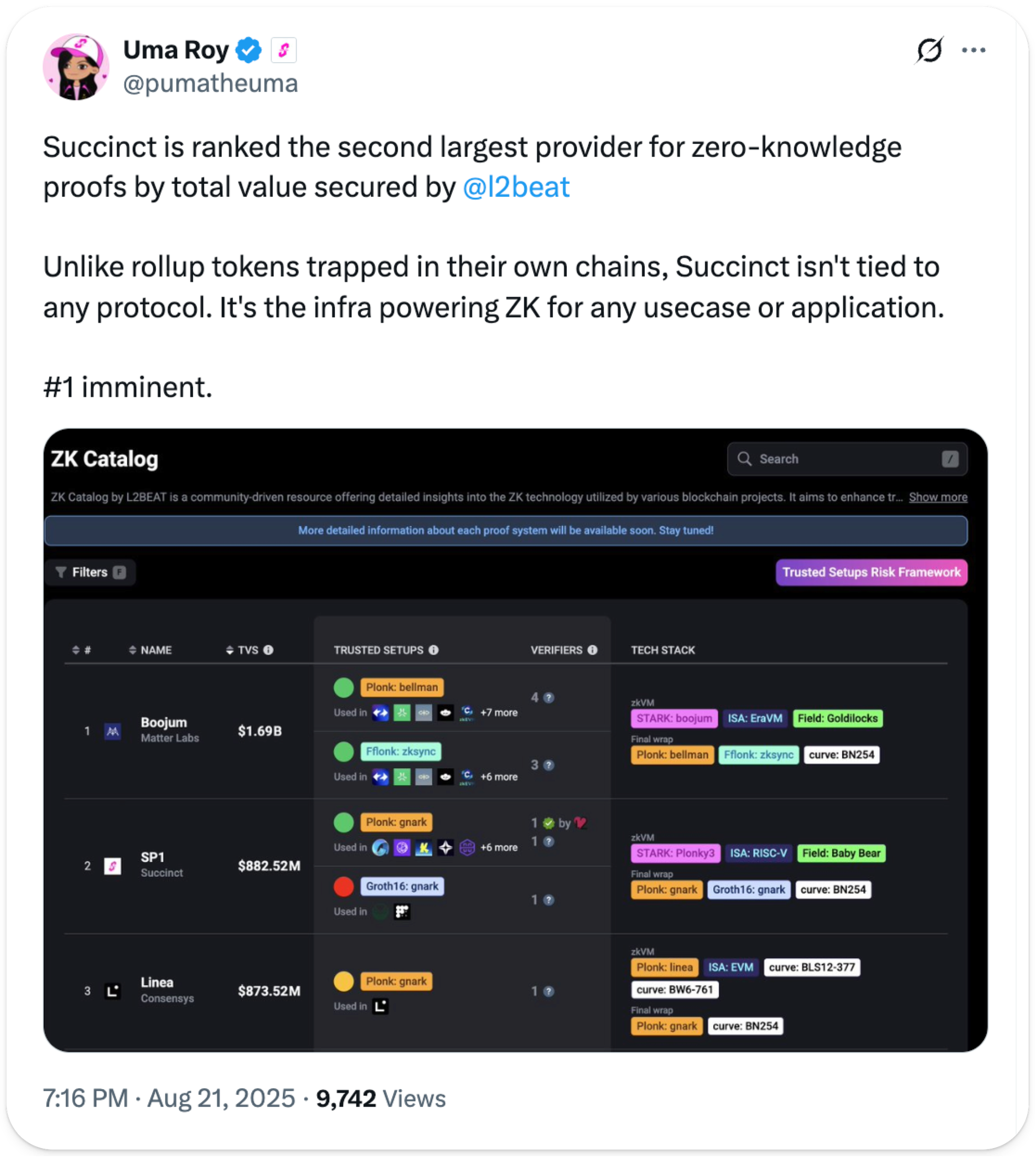

That's the bold claim Succinct's Uma Roy has been making for some time now, and it's becoming more and more true by the day. Ethereum's Layer 2s – first Mantle, then World Chain, and now Arbitrum and its ecosystem – are shifting from "optimistic" assumptions to cryptographic certainty through zero-knowledge proofs.

Ethereum's original scaling challenge was simple to understand but hard to solve: the L1 got congested, fees skyrocketed, and users suffered. Rollups emerged as the answer, bundling transactions offchain before settling on Ethereum. But we ended up with two flavors: optimistic and zero-knowledge.

The former, which is the dominant standard for rollups like Arbitrum or Base today, assumes transactions are valid unless someone challenges them within a week, meaning some illegitimate transactions could slip through to mainnet. The latter guarantees transaction legitimacy via cryptography and high-level math.

Today, Succinct and Arbitrum developer Offchain Labs’ Tandem studio announced a formal partnership to integrate Succinct's proving system into the Arbitrum network stack, a major injection of momentum into the trend of L2s embracing ZK. To make the significance of this announcement clear, we'll run through how ZK brings superior speed, security, and efficiency to rollups, and how prover marketplaces like Succinct enable this to happen.

Let's dig in 👇

The Core Advantages of ZK Rollups

Using ZK's mathematical methods to bundle and settle transactions to mainnet brings several advantages like:

- Faster Finality and Settlement — ZK rollups slash withdrawal and settlement times from 7 days to minutes. No more waiting a week to move funds back to mainnet, delayed by the optimistic challenge period. ZK proofs offer instant verification instead, ditching disputes altogether.

- Enhanced Security and Trustlessness — ZK proofs are "validity proofs" — they mathematically guarantee correctness, meaning if they are submitted to mainnet, you can trust their data one hundred percent. Think of it like an exhaustive verification that reruns transactions or any action taken on blockchain, preventing invalid states before they ever hit the chain.

Offchain Labs CEO Steven Goldfeder highlighted how prover networks like Succinct create "increased security" and progress L2s toward stage-two decentralization (fully trustless with no centralized components). ZK's magic lies in fast verification — simple hardware like a $7 Raspberry Pi can check proofs, ensuring decentralization even as throughput scales. - Cost Reductions — Proofs are tiny compared to full transaction data. This compressed data posting produces significant cost savings, boosted by proving systems where provers compete to generate the cheapest, fastest proofs, making money for the chain and its users alike.

- Improved L2 Interoperability — As a result of enabling faster settlements, ZK rollups provide easier state verification between L2s, refining the experience and functionality of cross-chain apps, atomic swaps, and unified liquidity pools. Put simply, it's a net upgrade for the entire ecosystem — more ZK L2s create a unified "superchain" with less fragmentation.

These four benefits — instant finality, mathematical security, lower costs, and seamless interoperability — make ZK rollups categorically superior to optimistic designs. Together, they represent not just incremental improvements but a fundamental upgrade to how L2s operate.

How ZK Proving Systems Work

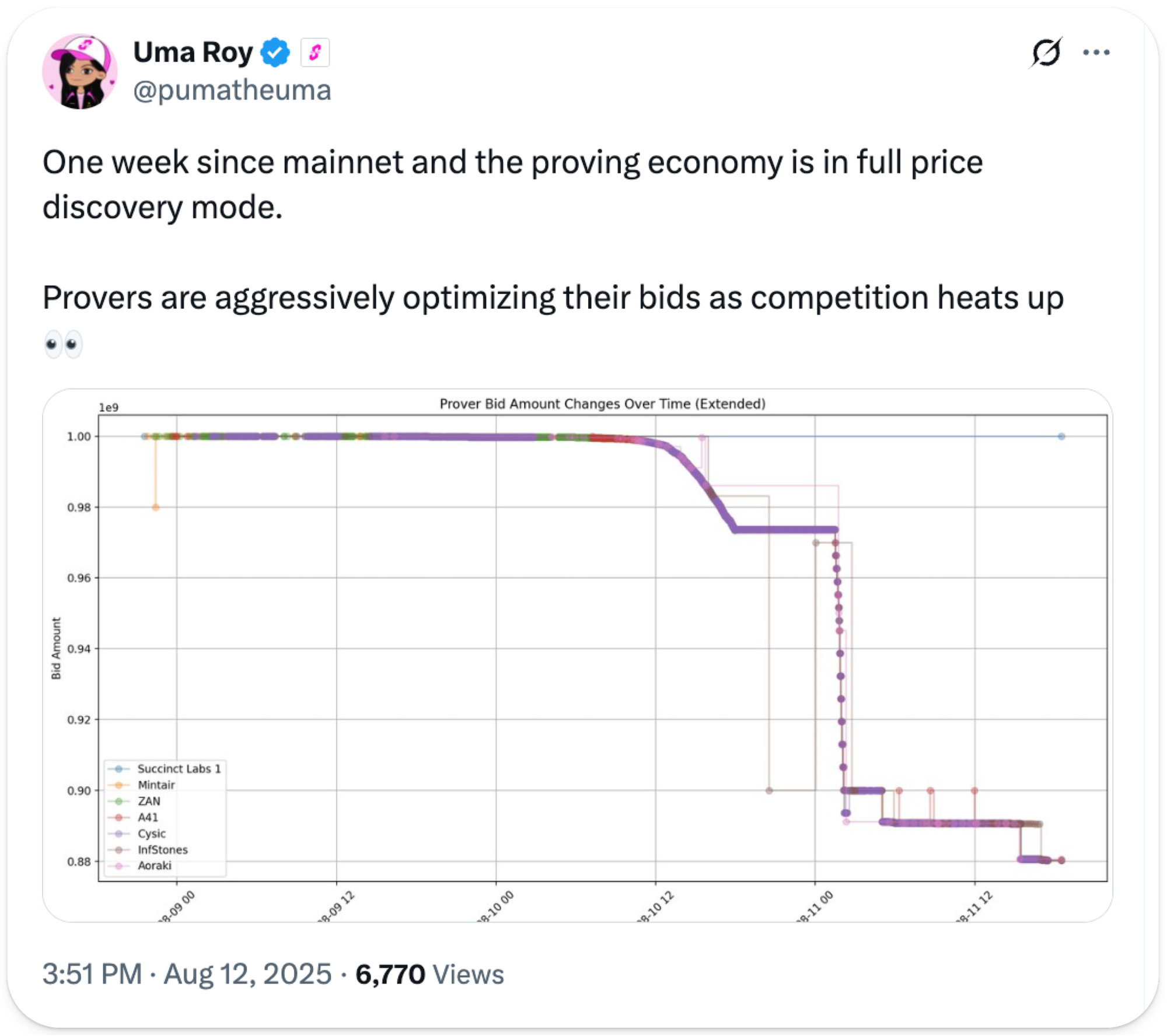

As mentioned above, proving systems power these advantages by creating mathematical proofs that transactions are valid without revealing their contents. Rather than each chain building and maintaining its own single prover, which would lock in fixed costs and limit scalability, these decentralized networks outsource the work to a competitive marketplace of independent provers, driving down expenses through economies of scale and network effects while boosting reliability and decentralization.

At the core, these systems work through a simple but powerful process. A prover takes a batch of transactions and re-executes them offchain in a controlled environment. This generates a succinct proof — a tiny piece of cryptographic data that the L1 verifies cheaply. The proof acts as an unforgeable certificate saying "these transactions are valid" without showing the transactions themselves.

These proving systems typically use zkVMs — zero-knowledge virtual machines simulating blockchain execution in this provable manner. Think of a zkVM as a secure computer that can prove it ran a program correctly without revealing what happened inside. Multiple prover marketplaces can compete to generate proofs for the same L2, driving down costs and increasing reliability through redundancy.

If ultimately approved by Arbitrum's DAO, Succinct's SP1 zkVM would power a decentralized network of provers competing to generate proofs for the ecosystem, just as it's already doing for a myriad of other chains.

Think of proving systems as an "all-knowing check" — replaying batches in a cryptographic sandbox. If, when the check is run, everything looks valid, the proof seals it. If not, no proof is possible. This preventive approach fundamentally shifts the security model from "trust but verify" to "never trust, always prove," saving everyone time, money, and endless monitoring.

Why Now? The Timing and Inevitability of the ZK Transition

Four or five years ago, ZK was computationally intensive, slow, and expensive. Proving took hours or days, and it wasn't compatible with the EVM.

Recent advances changed everything. Better cryptographic algorithms (SNARKs/STARKs), faster hardware (GPUs), and Ethereum upgrades like Dencun made ZK practical rather than just theoretical.

Goldfeder explained in his conversation with Bankless that ZK simply wasn't ready earlier — the infrastructure didn't exist, but now, as Uma puts it, "ZK is cheap, easy, [and] fast," thanks to dedicated teams and competitive provers.

While the partnership's ultimate integration of Succinct's proving network into Arbitrum will need to be approved by the DAO, its significance can't be overstated. With the Arbitrum ecosystem securing over $12B in TVL, plus serving as the platform for future launches like Robinhood's chain, this marks a pivotal step for consensus forming around ZK as the endgame.

It won't happen overnight — governance and legacy systems create friction — but the trajectory looks increasingly inevitable as the tech matures.

The more chains that shift to ZK, the more Ethereum's scaling endgame comes into focus. Faster finality, provable security, lower costs, and seamless interoperability — all brought about by ZK.

After years of developments, prover marketplaces are finally generating real proofs for real L2s with billions in TVL. The technology that seemed impossibly complex just years ago now runs in production, securing massive value and improving daily. With announcements like today's from the Arbitrum ecosystem, the pieces look to be continually aligning to make Uma's prediction of every rollup becoming a ZK rollup a reality.

Unichain offers the most liquid Uniswap v4 deployment on any L2 – giving you better prices, less slippage, and smoother swaps on top trading pairs. All on a fast, low-cost, and fully transparent network. Start swapping on Unichain today.

Crypto cycles have always topped on a four-year rhythm, but are we heading for a Q4 2025 peak or an extended run into 2026?

Michael Nadeau from The DeFi Report joins Ryan to break down the onchain and macro signals shaping this cycle. We cover Powell’s dovish pivot at Jackson Hole, global liquidity trends, and why loosening bank lending standards could fuel risk-on markets. Michael explains how whale Bitcoin selling, ETH’s breakout, and muted altcoin flows fit into the bigger cycle map. Finally, we dive into portfolio strategy, from core holdings to high-beta “hot sauce” bets, and why holding fewer, higher-conviction assets is the edge most investors miss.

Listen to the full episode 👇