Your Ethereum Pectra Upgrade Cheat Sheet

After months of delays, bug fixes, and testnet reruns, the long-awaited Pectra upgrade is finally here.

Originally slated for late 2024, Pectra brings a sweeping set of changes focused on improving Ethereum’s staking experience, upgrading account functionality, and refining the network’s core performance.

It didn’t come easy. Developers worked through a series of critical bugs during the first two testnet upgrades, forcing the creation of a third testnet to fully resolve the issues. That final delay pushed the mainnet upgrade to today, far later than the initial target date.

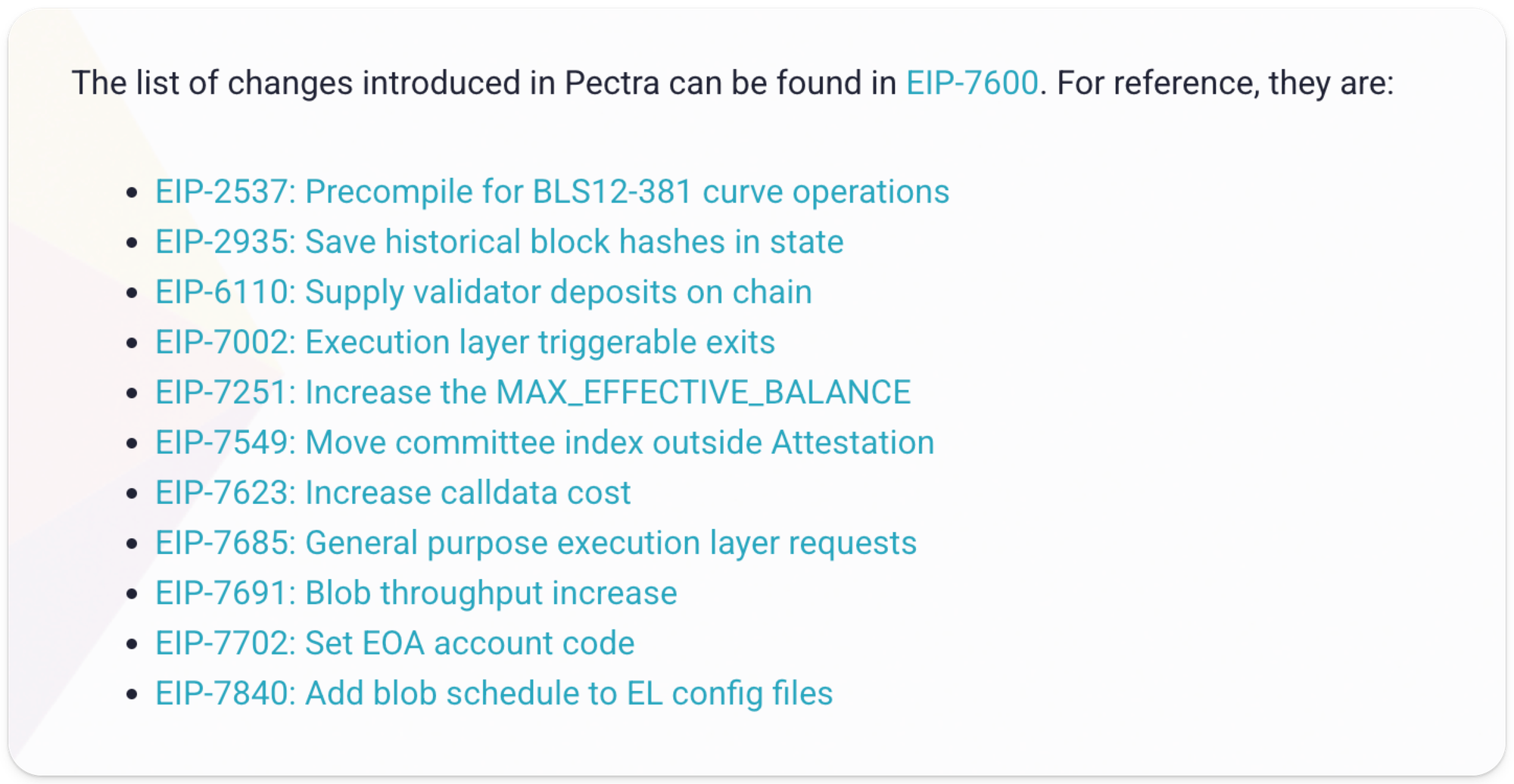

But now, it’s happening. And with 11 major EIPs packed in, Pectra marks Ethereum’s most significant code change since The Merge.

Below, we’ve explained each included EIP in digestible terms and how you’ll feel their impact onchain. 👇

The Pectra Upgrade’s 11 EIPs:

✍️ EIP-2537:

"Precompile for BLS12-381 curve operations" — Speeds up and lowers the cost of verifying many digital signatures at once, which proves especially useful for staking and proof systems and helps Ethereum scale securely.

You’ll notice faster verification for aggregate signatures in staking and bridging protocols, leading to reduced gas costs in their operations.

🧮 EIP-2935:

"Save historical block hashes in state" — Gives Ethereum a memory by saving the last 8,192 block hashes, helping clients and rollups verify recent history without needing full data.

Lightweight clients and stateless rollups will operate more reliably, with fewer external data dependencies.

🏦 EIP-6110:

"Supply validator deposits onchain" — Speeds up validator onboarding by embedding deposits directly into blocks, cutting out slower, offchain processes.

New validator deposits will become visible and finalized onchain within a single epoch (~6.4 mins), reducing wait times to minutes instead of hours.

🚪 EIP-7002:

"Execution layer triggerable exits" — Lets stakers trigger withdrawals directly through smart contracts, improving fund safety if validator keys are lost or compromised.

You’ll likely see this reflected in new non-custodial staking setups where users can exit without needing validator key access, reducing the trust needed in staking providers.

⏫ EIP-7251:

"Increase the MAX_EFFECTIVE_BALANCE" — Raises the cap on validator balances from 32 to 2,048 ETH, allowing fewer, larger validators and reducing network overhead.

Once implemented, large staking pools like Lido or Coinbase will likely consolidate many smaller validators, leading to a noticeable decrease in their total validator count.

🚛 EIP-7549:

"Move committee index outside Attestation" — Cuts consensus load dramatically, from 1,300+ votes to just 22, by restructuring how vote data is organized.

As a result, blocks will be confirmed faster, especially during high network activity.

💰 EIP-7623:

"Increase calldata cost" — Raises the cost of storing raw data in transactions to encourage developers to use blobs instead, reducing block size variability.

Smaller rollups still relying on calldata for storage will see increased gas costs, while blob-optimized rollups will become more efficient.

⚙️ EIP-7685:

"General purpose execution layer requests" — Lets smart contracts send requests to validators directly, opening up new ways to coordinate activity onchain without changing block structure.

While invisible to most users, this lays the foundation for advanced staking and validator tooling.

📊 EIP-7691:

"Blob throughput increase" — Raises the number of blobs per block from 3 to 4 (target) and 6 to 8 (max), giving rollups more bandwidth for data and scaling.

Rollup transaction fees could drop as more blob space opens up, especially during periods of high L2 usage.

🤖 EIP-7702:

"Set EOA (Externally Owned Account) account code" — Allows regular wallets to act like smart contract wallets during a transaction, unlocking features like gas sponsorship and temporary programmability.

Wallets may soon let users bundle multiple actions or use alternative gas tokens like $USDC without fully switching to smart contract wallets.

🛠️ EIP-7840:

"Add blob schedule to EL config files" — Moves blob configuration into Ethereum’s settings, making it easier to adjust blob space over time and improving cost estimates for rollups.

Fee calculators and L2 dashboards will reflect more accurate blob pricing without requiring engine-level updates.

Pectra lands in under 24 hours - it's lowkey an underrated Ethereum hardfork

— David Hoffman (@TrustlessState) May 6, 2025

1️⃣7702: All 0x wallets become smart contact wallets

2️⃣7691: Blob capacity 2xs, from 3→6

3️⃣7251: Validators stake can range between 32-2,048 ETH

They're are more, but EIP7702 is the huge unlock👇

Overall, Pectra marks major upgrades to Ethereum under the hood, tightening validator logic, upgrading account flexibility, and clearing a path for rollup growth. Most of these changes won’t grab headlines, but they’ll be felt in the form of faster onboarding, cheaper L2s, better wallet UX, and more programmable infrastructure.

It’s a big milestone for ETH, and specifically delivering on L2 upgrades. Next will be Fusaka, slated for September/October this year. If you want to know more about what the next upgrade holds, read up on Fusaka here.

Join the Pectra Watch Call

Lastly, for those who want to follow the upgrade in real time, the Ethereum community is hosting a live Pectra Watch Call early this morning, organized by EthStaker and the Ethereum Cat Herders.

The call starts at 5:30am ET, with the upgrade expected at 6:05am. Co-hosted by our very own David Hoffman and Anthony Sassano, it’ll run for ~90 minutes and include a mix of technical breakdowns and accessible explanations from Nixo (Protocol Support at the EF), Pooja Ranjan (ETH Cat Herders), superphiz.eth (Beloved grassroots ETH community member), and others involved in the upgrade.

It’s the most significant protocol change since The Merge — a good moment to tune in.