Dear Bankless Nation,

Has being in crypto changed how you think about pretty much everything? In this week's David's Take, we dig into how Web3 alters your brain.

- Bankless team

David's Take: How Crypto Protocols Impact Our Psychology

Bankless Writer: David Hoffman | disclosures

One of crypto’s most famous sayings is “come for the money, stay for the technology.”

Meaning, the lure of wealth may pull you towards the crypto-rabbithole, but it’s the depth of the technology that sucks you in. This depth is why the “crypto-person” in normie social circles is such a salient archetype.

Seeing just how deep crypto goes can change you. Take a moment to reflect upon who you are as a person since you got into crypto: how have you grown? Has your worldview shifted? What do you consider important now – that you didn’t before? Are you different now?

One of the more magical things about crypto is that it provides a new lens for viewing the world. Let's dig into this worldview further and showcase what crypto gives the individual and demands of us, too:

The Web3 Psychology

There is a trichotomy of tech, society and the individual. Societies nurture individuals. Individuals produce technologies. Technologies help individuals express ideas. Ideas change societies. This is the arc of history.

Now, technology has a special role to play in the above trichotomy. Societies adapt. Individuals die. But technology, once discovered, stays locked in. There’s no putting the technology genie back into the bottle. There’s no undoing foundational structures like the internet.

Technologies are pigeonholes for progress, and society adapts to the most revolutionary marginal technology that its individuals are pioneering in the current age. Perhaps this is why Twitter feels like such a special place where the margins of society can become mainstream ideas.

Web2 is the ‘current meta’ of social structures. Facebook, Instagram, Twitter, etc., are technologies that have defined much of what society looks like. They are platforms for ideas, and therefore are idea-mediators.

Web2, along with the Nation-State, represents a huge chunk of how society operates. When individuals want to do something, express some idea, or exert some change upon the world, they must do it through these mediums. If they want to change the rules, they must push their idea through the trials of Nation State legislation. If they want help with this, they must share their idea through Web2 platforms.

On Bankless, and in crypto broadly, we often dump on Web2 and Nation-States. We focus on their shortcomings and their oppressive natures. We are merely serfs on Zuckerberg's estate! And we are mere subjects of our Nation-State laws and taxation systems! But... these are also the best systems that we’ve come up with so far. Thanks to Web2, our ideas can scale, and thanks to the Constitution, many freedoms are protected.

But these are just the current metas of social technologies, and metas change!

Technologies are adopted simply because they offer a better service than their predecessors. If they don’t, then they’re not adopted and we don’t talk about them. They stay as ideas that never caught on – tweets that never took off.

All of that said, Web3 is here to stay. It is both a technology and an idea, and the Web3 genie is violently out of its bottle. Like I said in the opening, crypto is a lens for viewing the world. It allows you to see the emperor without their clothes... the person behind the curtain... the puppeteer and their strings etc., etc..

Web3 is a platform for individuals to become the best versions of themselves.

Web3 brings us powerful tools. New DeFi primitives. Direct ownership. The ability to be your own bank. The ability to produce a financial asset. All of these things are revolutionary and each one will have its own impact on what society looks like.

But crypto is a very deep technology. It penetrates beyond all other technologies and goes straight to the core of what it means to be human. We are lucky to be alive during the maturation of a technology that has implications that go so deep. Nation-States must contend with it. The internet will adapt with it. Web2 must answer it.

But what about you – the individual? How will you change, as a result of the shifting platforms under your feet? Who will you become when the protocols that you operate on become more powerful?

Cryptography is an asymmetric technology that shifts power to the individual.

Using cryptography is trivial, but breaking it is hard. It gives individuals the same level of power as a bank with a vault or a nation-state with an army. No amount of tanks, planes, and steel can part you from your assets. All of the worldly powers-that-be must ask for your permission, not your forgiveness.

Go direct to DeFi with the Uniswap mobile wallet. Buy crypto on any available chain with your debit card. Seamlessly swap on Mainnet and L2s. Explore tokens, wallets and NFTs. Safe, simple self-custody from the most trusted team in DeFi.

The Responsibility of Web3

With all of that, we can finally get to the punchline of this article.

Crypto protocols imbue us with responsibility.

The ability to be our own bank, hold our own assets, vote on our own protocols – these are all powers that individuals have not had before. Our previous technologies have didn't enable them. We’ve only had representative democracies, in which we give up our voice to a representative we must trust. We’ve had banks we trust to hold our money, custodians we trust to hold our assets, and brokers we trust to fairly fulfill our orders.

While each singular instance of releasing responsibility isn’t significant, micro-absconsions from responsibility coagulate and coalesce into singular, large scale problems that turn into society's darkest clouds. These choices that we are forced to make turn into the incumbents that define the status quo. Banks that are too big to fail. Misaligned career-politicians. Facebook, Twitter, and all of the other Web2 platforms that lock us in.

Cryptographic private keys are vehicles for responsibility.

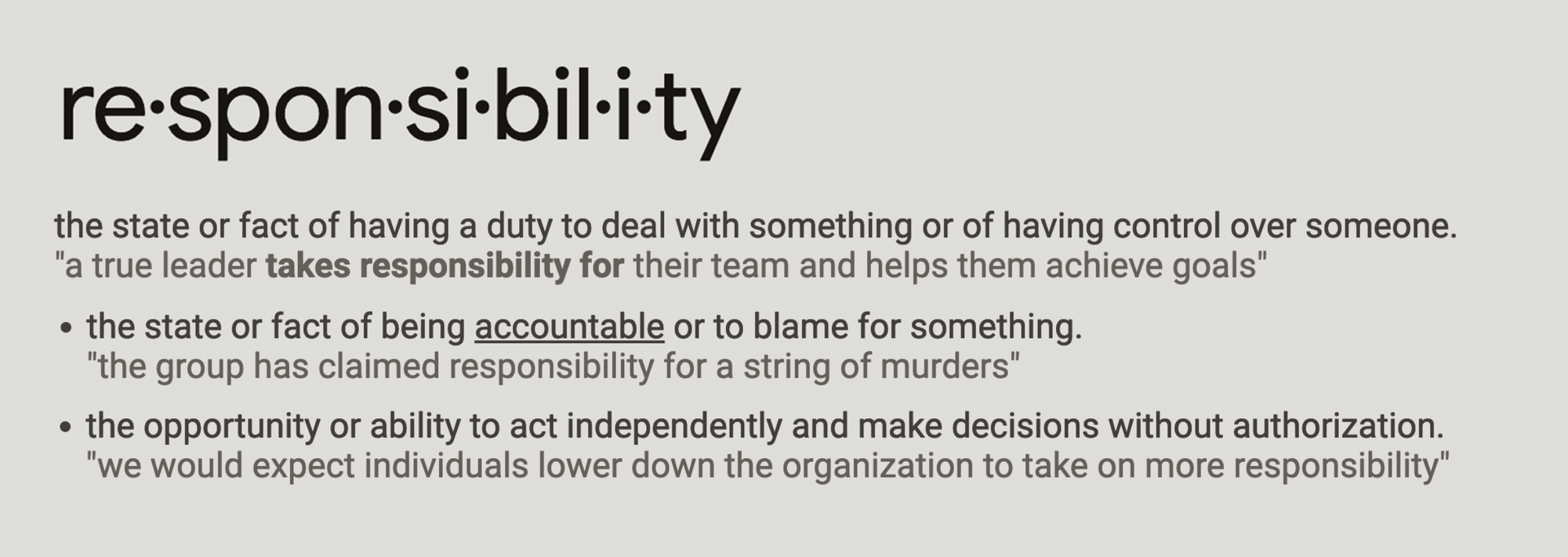

The definition of the word responsibility is something that I think all Web3-ers would enjoy 👇

That line “the opportunity or ability to act independently and make decisions without authorization,” sticks out to me – this is what permissionlessness is! This is what crypto enables! This is also what the current state of society lacks.

Anything that goes inside of our private keys become things that we are responsible for. The ‘things’ that can go inside can be anything! This is the power of smart contracts – anything that can be imagined, can be coded, deployed, and minted into our wallets. If it is something of value, then it can be codified into an asset that we then become responsible for.

With cryptographic private keys, we have the means of direct control over our lives. Not just by being our own bank and custodying our own assets, but also by participating in governance and dictating how our protocols behave! In Web2, we are served a product that we have no say in. In Web3, our protocols respond to our choices, and therefore the choices we make really matter!

We, for the first time, have direct responsibility over the protocols that dictate our lives. Never before have we had the tools to accept so much responsibility, so easily. So my question to you, reader, is similar to the one we started with. Now that you have full control… who will you become?

With the power of private keys at your finger tips, and an army of developers building doors for you to open… what doors will you choose? When the power of private keys trickles down to all of society – how will society react? What radical new ideas will individuals create that change the arc of humanity? What will humanity be like after the pendulum of responsibility shifts from the few to the many? These are very deep questions, and only time will tell!

We have seen both great good and great evil spawn from the crypto rabbit-hole. If there is one thing that is certain, it is that every individual having the power of cryptography at their fingertips brings a lot of chaos to the world, but I choose to believe that over the fullness of time, it is not chaotic evil, but chaotic good.

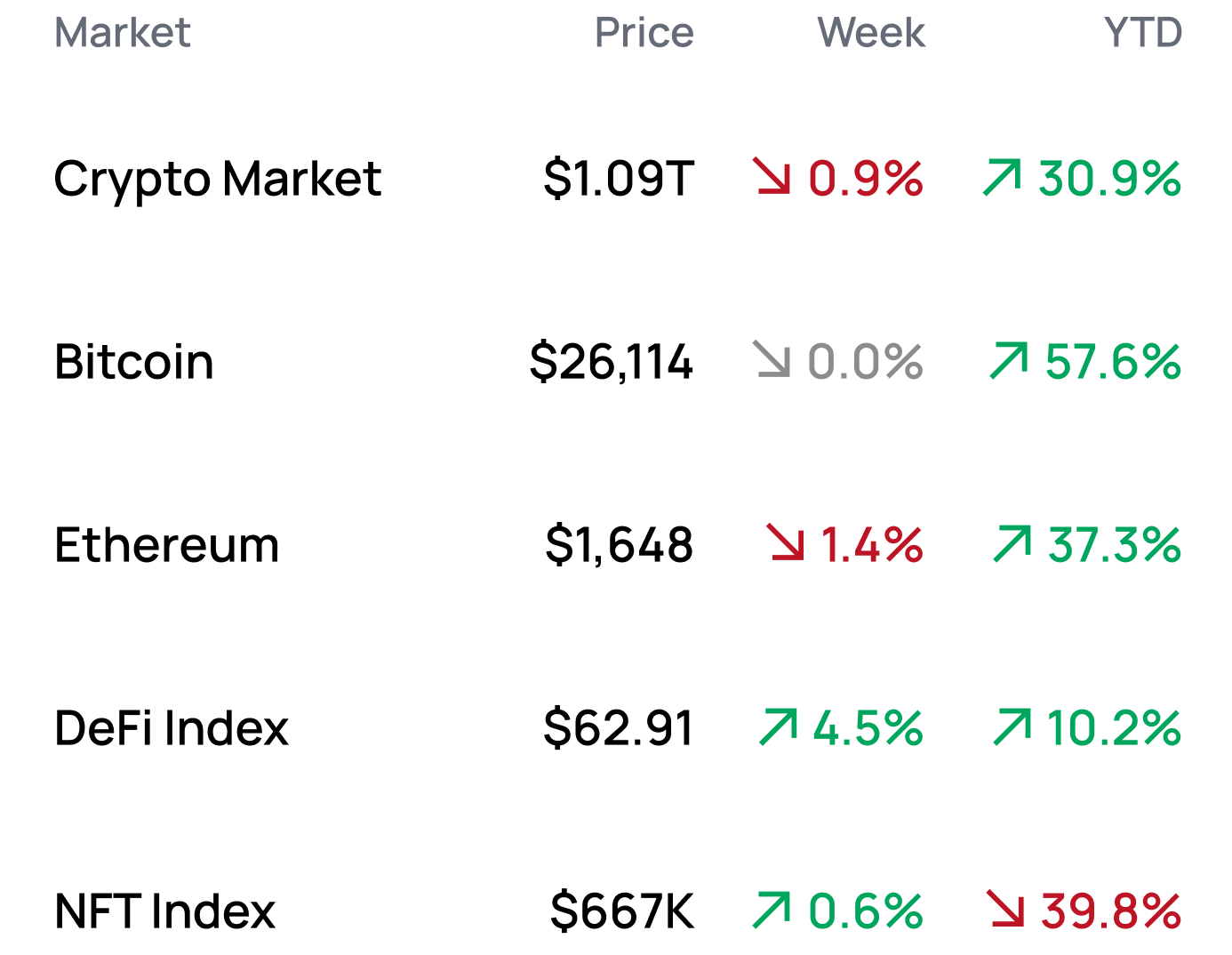

MARKET MONDAY:

Scan this section and dig into anything interesting

*Data from 8/28 2:30 pm EST (DeFi Index = $DPI, NFT Index = $Blue-Chip-10)

✳️ Learn more and build on core.safe.global ✳️

Market Opportunities 💰

- Migrate your liquidity from compromised Balancer V2 pools

- Deploy a lending market for any two ERC-20 tokens with Ajna

- Send photos to your key holders on friend.tech

- Participate in Taho’s campaign to earn OP token incentives

- Lend and Borrow without fear on Base using Aave

Yield Opportunities 🌾

- BTC: Earn up to 13.9% APR with Umami’s WBTC vault on Arbitrum

- ETH: Earn up to 20.0% APR with Balancer’s WETH-rETH vault on Arbitrum

- USD: Earn up to 21.5% APY with Beefy’s DOLA-USDC vault on Arbitrum

- USD: Earn up to 12.9% APR with Hop’s USDC pool on Base

- USD: Earn up to 11.9% APR with Velodrome’s FRAX-DOLA pool on Optimism

What’s Hot 🔥

- Two Tornado Cash devs charged for money laundering, one arrested

- Starkware moves to open-source prover

- zkSync to upgrade blocks to record L2 block details

- Web3 social platform Farcaster to migrate to Optimism

- Coinbase reaffirms support for Tornado Cash OFAC complainants

- Base provides an update on commitments to Optimism

- FTX estate to sell ~$500M in crypto majors over coming weeks

- Galaxy tapped by FTX for assistance offloading its crypto

- USDC coming to six new blockchain ecosystems

- What is a BRICS currency and is the US dollar in trouble?

- Fed Chair Powell resolute in messaging that the fight against inflation is not over

- Sweeping US tax proposal met with boos from crypto industry

- GHO minting temporarily paused to fix integration issue

- PEPE deployer cashes out, decreases required signers on multisig

Money reads 📚

- Crypto Builders Should Forget American Users - Antonio

- Announcing Zeth: the first Type 0 zkEVM - RISC Zero

- The Bank of Japan is TRAPPED - Peruvian Bull

- Kite or Board - Arthur Hayes

Governance Alpha 🚨

- Rarible proposes integration with Arbitrum to kickstart the NFT ecosystem

- Aave governance proposal seeks to increase GHO borrow rate to 1.5%

- New Order DAO approves pivot to become crosschain lending platform

- Stargate accepts ownership of TheAptosBridge from LayerZero

- Uniswap considers deploying V2 to all chains with V3

- Wintermute’s YFI loan proposal gets sent to token holder vote

Token Hub: SYNO 📈

Analyst: Jack Inabinet

We are downgrading our rating of SYNO from bullish to neutral

Catalyst Overview:

Synonym Finance is a project incubated by New Order DAO set to deploy to mainnet in October. It will be a cross-chain lending protocol built on top of Wormhole and Circle’s CCTP where users can lend, borrow, repay, or withdraw on any chain using a single unified interface.

Prior to its merging with Synonym Finance, New Order was an incubator DAO that spawned multiple well-known DeFi protocols, including Redacted Cartel (BTRFLY) and Y2K Finance (Y2K). The New Order DAO team’s stated reasoning for merging with Synonym was a recognition of the “disparity between the enduring objectives of our incubation platform and the short term incentives… desired by token holders,” but it is undeniable what is occurring here: the current model has stalled.

As part of this merger, Synonym will receive all the majority of New Order’s assets, including all stablecoins and onchain treasury assets, but sadly, token holders will be forced into taking a haircut. Equity and token warrants from investments in Wynd, Motherboard, and Base Camp 2 projects will be retained by the New Order Foundation before being transferred to a separate entity. The team claims this is because these projects require “ongoing administration and venture activity.”

Price Impact:

Many were left with a bitter taste in their mouth after hearing the announcement and New Order’s transition is certainly a disappointing development for those bullish on the incubator model.

The Project’s pivot to cross-chain lending, however, could prove its savior: NEWO looks like roadkill on the charts and this refresh could be just what it needs! Paper handed HODLers may be flushed out in the transition and capitulation could finally be near, however future success will be largely contingent on Synonym's ability to attract users and TVL (which remains to be seen).

See more ratings in the Token Hub.

Meme of the Week 😂