Will Tokenization Change Pokémon Forever?

Pokémon stands as the highest-grossing media franchise in the world, boasting $100B in total revenue. Slated to celebrate its 30th anniversary next year, the juggernaut shows no signs of slowing, thanks to continuous rollouts of new creatures, games, and merchandise.

At its heart is the Pokémon Trading Card Game (TCG), which has printed over 34K unique cards in English alone. These cards aren't released all at once; instead, they come in new generation sets every two years, creating the scarcity that’s responsible for, not only constant collector demand, but infamously high secondary market prices. Average annual returns reached 46% in 2025 — outpacing Nvidia — with certain rare cards surging multiples.

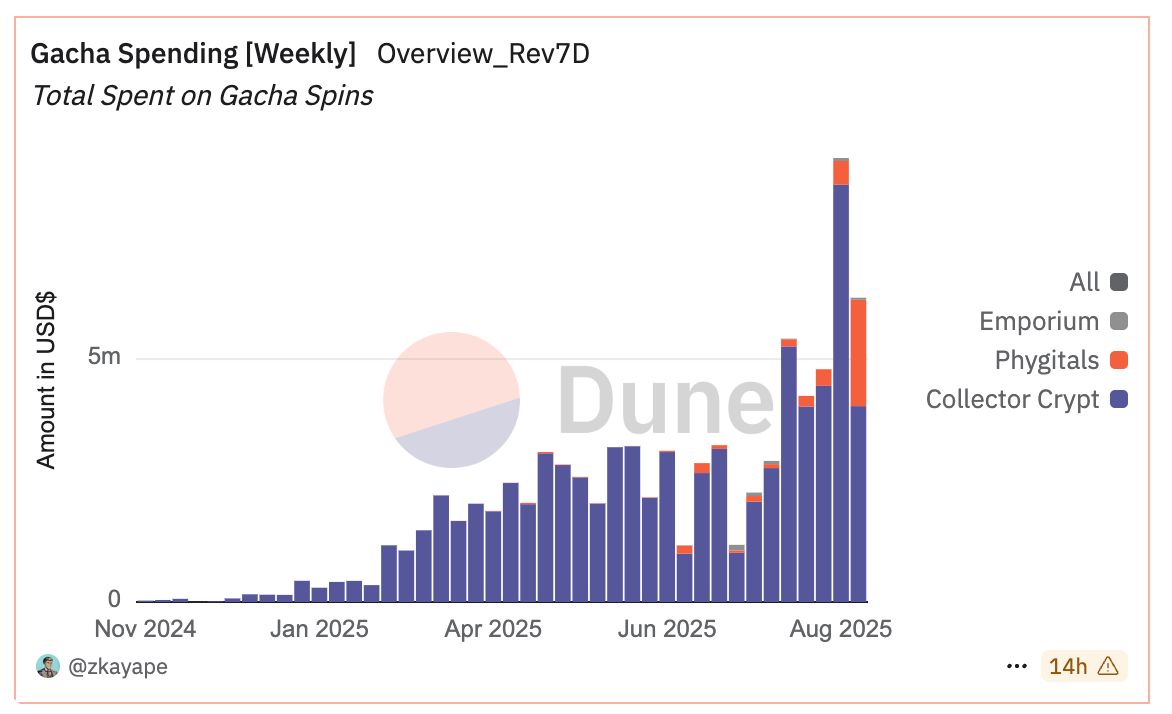

Over the past year, TCG collectibles have also surged into crypto, with top marketplaces like Courtyard, Collector Crypt, and Phygitals generating over half a billion in sales volume through tokenized, secondary markets and "gacha" blind pack opening experiences, harnessing the investment mania around these cardboard collectibles.

First time redeeming some of my Pokemon cards on @Courtyard_io

— Coop 💿 (@Cooopahtroopa) September 3, 2025

From digital collectibles to the physical cards in a few clicks is a pretty awesome experience

Super well packaged and preserved

Highly recommend! pic.twitter.com/cfiNnQuEXL

While there have been murmurs about this phenomenon for months, Collector Crypt's $CARDS token launch last week brought it all to a head — serving an investable narrative with "real world" ties to a bored, hungry market. From Monday to Wednesday, $CARDS 10x'd, reaching a $450M FDV, though circulating supply is just 20% of this. Other collectibles tokens followed suit, with $ZARD, $MAGIK, and $TCG all up multiples by midweek (though many of these gains have been given back to the market).

Typically, these platforms provide three options:

- Buy tokenized cards and redeem them for the real thing

- Buy tokenized cards to flip at higher prices

- Try your luck on gacha boxes hoping to "pull" rare cards

The third currently drives the most activity and revenue — not surprising given it mirrors the broad market embrace of gambling in crypto this cycle. Beyond this, Crypto and Pokémon share similar demographic interest, with their volatile markets appealing to risk-on investors during risk-on periods.

Below, let's take a deeper look at the relationship between Crypto and Pokémon, centering on advantages like TCGfi and lower fees, and risks such as volatility bleed-over.

What Can Crypto Really Offer Pokémon?

Propelled by a new cohort rich off of $CARDS, the timeline is aflame with discussion of crypto's unique ability to supercharge these collectibles via a number of claims (which I'll give you my takes on below as well):

- Claim: Crypto brings more competitive fees than traditional marketplaces. Traditional venues like eBay and TCGPlayer charge up to 13%, 2-5x their blockchain counterparts like Courtyard, Collector Crypt, and Phygitals. Plus, crypto enables "programmability elements" (Phygital's platform gives users 1% fees when packs they sold resell), though this likely only appeals to "crypto-first" collectors, those coming to Pokémon via crypto.

- Claim: These platforms bring trust guarantees beyond vendor ratings. I'm mostly doubtful that "blockchain trust guarantees" will appeal much to existing collectors. Most sales already occur on eBay or TCGPlayer with established vendor profiles. This history, taken against crypto's shady reputation to outsiders, makes Pokémon collectors coming to crypto for “better trust guarantees” a little unlikely to me.

- Claim: Crypto uniquely enables borrowing and lending against collectibles. What I’m calling "TCGfi" feels like the most uniquely suited innovations here. Given these assets' uptrend and $6-7B market size on par with NFTs, there's likely a desire to realize value via borrowing/lending without parting with cards, as well as a desire to provide this service. This is particularly relevant since Pokémon enthusiasts are collectors first, not investors — in it for nostalgia rather than gains. TCGfi offers the best of both worlds.

- Claim: Instant buyback options for opened cards greatly reduces sales friction. Instant buybacks that let users sell "pulls" back for ~85% of market value, limit downside. This behavior seems to "crypto-first" investors more than the collector crowd that has typically made up the bulk of Pokémon card buyers.

Something fundamental is shifting in how we hold and trade assets.

— Solana (@solana) September 4, 2025

Walk into any Pokemon card trading floor — middlemen, settlement delays, paper trails. Now watch a PSA 10 Charizard card move on Solana.

Startups like Collector Crypt ($44M monthly volume, 124.1% MoM growth) and… pic.twitter.com/c3R6VSSjHv

Potential Downsides

While early uptake certainly showcases some investor enthusiasm, plenty of long-time Pokémon collectors seem skeptical that this early hype will spread.

This popular thread from CT user @simplepeanut3 highlights many of the most dominant points of pushback. I tend to agree with their read that argues the crypto/Pokémon crossover is hype-driven and risks intensifying boom-bust cycles in the TCG market. It feels less like the start of a durable trend and more like another round of speculative boredom akin to the rolling waves of chatter around prediction markets, which I've anecdotally observed seem to spike when token prices stall.

Overall, this is to say that, for those unfamiliar with Pokémon, it may be best to sit this one out. Or, at the very least, take the time to understand the Pokémon market before entering. Phygital’s wiki provides a pretty good starting point for this.

If you do want to participate though and already have knowledge, check out my colleague William Peaster’s overview of the new platforms, especially the tokenless ones. Many of these boast a points program which, as we know, could yield token allocation down the road.

Lasting Trend?

While prices are running hot for both tokens and cards alike, the synergy between crypto and collectibles looks more nuanced than the timeline would have you believe. Yes, crypto offers real advantages — fees 2-3x lower than traditional platforms, instant buybacks limiting downside, and the genuinely novel promise of TCGfi letting collectors unlock value without parting with cherished cards.

These aren't trivial.

But the overwhelming majority of Pokémon card enthusiasts are collectors, not investors. They're in it for the nostalgia, the hunt, the physical experience of cracking packs — not the 85% buyback guarantee or the programmable fee structures. Meanwhile, crypto natives flooding these platforms are largely investors, treating cards like any other volatile asset to flip. This fundamental mismatch in motivations suggests we're watching two different games play out on the same field. The current frenzy feels more like crypto finding its next shiny object during a choppy market than a genuine convergence of communities.

That's not to say this intersection won't matter long-term. TCGfi genuinely solves a problem for collectors who want liquidity without losing their cards. But these changes will evolve slowly, through cycles of hype and disappointment, as two different cultures figure out what they actually want from each other.

For now, what we're seeing isn't the breakthrough moment — it's just the messy first attempt at something that might, eventually, make sense.