Why We’re Launching Bankless Ventures

Since its founding, Ryan and I have been building Bankless with a lofty, singular ambition: to onboard one billion people to crypto.

With the help of a thriving community, Bankless has grown from a scrappy passion project into a thesis-driven media company serving podcasts and articles to educate the industry on the core philosophy of “why crypto is good for humanity”.

Crypto is, of course, an industry about money and finance, which has given Ryan and I the opportunity to place bets in our vision for the future as we’ve navigated the space. Now, we’re looking to level-up those ambitions with the launch of an early-stage venture fund called Bankless Ventures! 🎉

Raising a Fund

Ryan and I briefly talked about this effort after a Coindesk article surfaced last month, “Hosts of Bankless Podcast Raising $35M Crypto Venture Fund: Sources”. Since then, we’ve been quietly building, but now we’re ready to share more about the fund, the team, the vision and how we’re uniquely positioned in the broad landscape of crypto VC.

SCOOP: The founders of crypto media brand @BanklessHQ are raising an early stage venture capital fund, moving beyond their podcasting roots.@realdannynelson and @0x_tracy report from #ETHDenverhttps://t.co/QZiI83uRDG

— CoinDesk (@CoinDesk) March 2, 2023

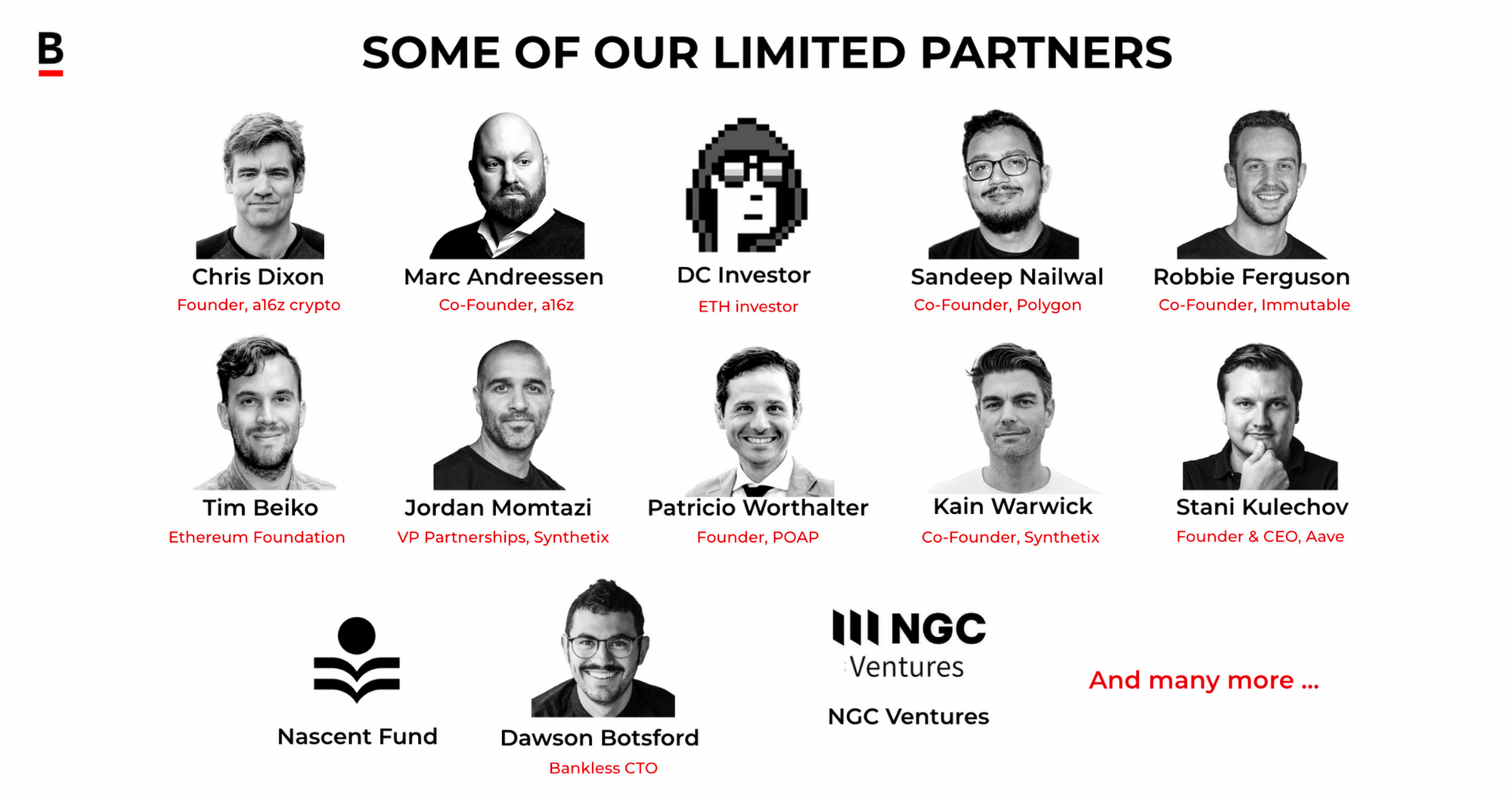

The relationships we’ve built through the podcast have helped us meet more and more pioneers with a shared vision for crypto’s ultimate potential. Through our angel investments, Ryan and I have helped finance small teams that eventually grew to become pillars of the crypto industry.

We’ve been fortunate that the growing network of Bankless has given us access to a substantial amount of dealflow, and it’s become much more than two individuals can handle.

Building a Team

In mid-2021, I floated the prospect of a dedicated venture fund with Ryan – the idea was, between angel investing and advisory work, we were already halfway towards operating a venture fund, so why not take it all the way?

We ultimately decided to finish out the bull market fully focused on scaling the Bankless Nation through Bankless Media, while getting the work started on a fund aimed at realizing some of the coming bear market opportunities.

To build Bankless Ventures, we wanted some help.

Enter Ben Lakoff.

See you at NFTLA this week

— Ben Lakoff (@benlakoff) March 21, 2023

New @BanklessHQ merch 👋

📸 : @skidrowcrypto pic.twitter.com/Y8U22IGEpU

Ben and I go back almost as far as Ryan and I do. Throughout the bull market, we would consistently find each other at the same conferences and we quickly became close friends. At the end of a thrilling, exhausting DevCon in Bogotá, Ben and I decided to round out the week hiking Monserrate, a climb that brought us to a whopping 10,300 ft in elevation.

In between breaths of thin air, we discussed our experiences working with and investing in startups. It became immediately clear that Ben was the missing piece of the Bankless Ventures puzzle. With Ben as our third General Partner, Bankless Ventures went from an idea on a roadmap, to a real VC firm currently closing out its first raise.

Advisors

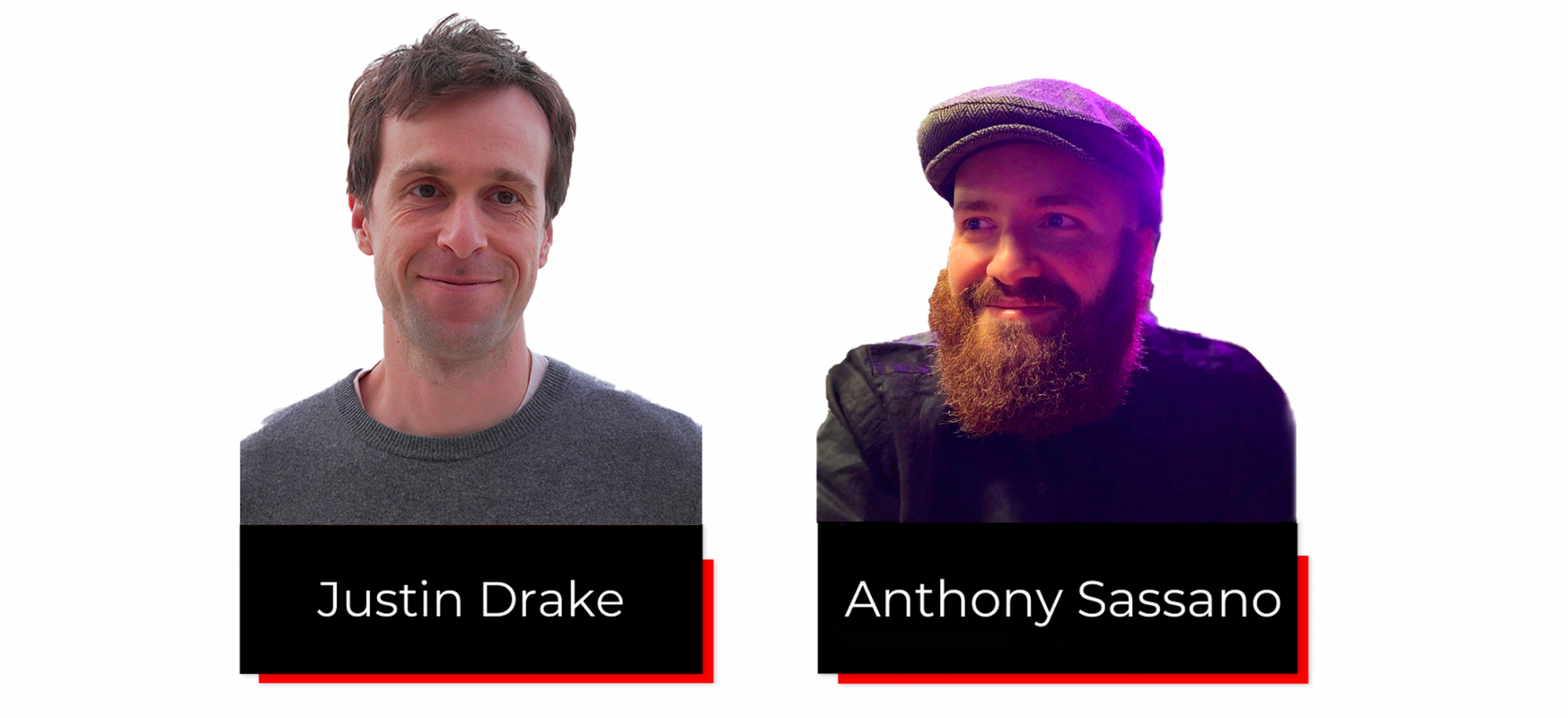

Joining us as advisors are two figures who will be very familiar to regular Bankless podcast listeners: Justin Drake and Anthony Sassano. Justin brings his experience as a world-leading explorer of the crypto-economic frontier, and our media brother-in-arms Anthony is perhaps the only person out there who produces more content than Ryan or myself on Ethereum and its values.

Growing the Frontier

This has so far been a story in how Bankless Ventures (BVC) came to be, but the deeper question is: why are we doing this?

Through the course of scaling Bankless Media from a barebones passion project to a well-oiled 20-person team, we’ve grown to appreciate the efficiency that comes from working with smart, dedicated people. We want this same treatment for the investment and advisory work we’re doing so we can make the most of the opportunities that we have to empower crypto’s pioneers and grow the crypto frontier.

Bankless Media has already committed itself to that vision, educating crypto natives and the crypto curious alike, bringing them into the fold as citizens of the Bankless Nation. BVC wants to double-down and give pioneers the investment they need to grow the frontier themselves. We’re focusing on early-stage opportunities because we want to do everything we can to make sure the right ideas get off the ground.

Bankless Media teaches you how to explore the frontier. Bankless Ventures gives you the money you need to build a settlement :)

There’s a small gap of time in which humans can meaningfully direct the future of this industry, and we intend for Bankless Ventures to be a force for ensuring the right people have the resources to push crypto to be the best it can be for humankind.

The Media/Ventures Divide

Bankless Ventures won’t be your typical VC firm. Most firms try to build a successful media business after they’ve raised their first couple funds. We’ve already built one. What this advantage affords us is the platform to continue sharing our thesis for the future of crypto like we always have, while using Bankless Ventures to help bankroll companies building towards this same vision.

One of the strengths that has made our media network so successful in a sea of competitors has been our ability to story-tell. It’s a skill Ryan and I have honed as podcasters and writers for years now, and is personally the thing that excites me the most about starting Bankless Ventures.

There are so many stories out there worth telling!

That said, we want the Bankless nation to continue trusting how we curate the projects we talk about, the interviews we choose to do, and the insights we share in both the podcast and newsletter. This isn’t changing. Despite Ryan and I having made many dozens of angel investments over the years, we’ve never seen Bankless Media as a venue to draw attention to our bags, that’s never interested us and our audience is too smart for those shenanigans anyway.

Nailed it 🙌🫡 pic.twitter.com/GD7Ync9IWc

— Ben Lakoff (@benlakoff) March 2, 2023

We’ll continue to interview founders building projects that align with our vision of the future, but Bankless Media is a sacred place. It has gotten where it has because Ryan and I haven’t taken shortcuts, we’ve focused on building trust with our listeners and readers.

We don’t do paid interviews. We don’t do paid newsletters. Companies that want to reach our audience can buy advertising slots, which are always clearly labeled as such. Bankless Ventures portfolio companies won’t be getting special access to Bankless Media and won’t get special sponsorship deals, they’ll get the same rates as anyone else.

Balancing our roles at Bankless Media and Bankless Ventures may not always be straightforward for us, but we’re committed to doing right by our readers and listeners. We take our disclosures extremely seriously and always have. Ethics in crypto are serious business and we intend to lead the industry. Have a suggestion on how we can disclose even better? We’re listening.

We want to onboard one billion people to crypto. It’s our mission and it’s the thesis for both Bankless Media and Bankless Ventures. We’re extremely excited by the opportunities ahead and we’re being very thoughtful about how we realize them.

Sharing the message of going bankless is not just a “job” for us, it’s what we stand for.

What’s Next?

Bankless Ventures is about 75% full of committed capital, and we’re targeting an end-of-May close. We’ve begun the process of warehousing deals and will start fully deploying capital immediately post-close.

If you want to invest in the Bankless Ventures fund, you can submit an interest form as an LP. (Sorry, accredited investors only. The SEC made us do it.)

If you’re a startup who wants to be reviewed by our investment team, the button below is for you.

Education, tools, and capital…to help 1 billion people go bankless. See you on the other side.

🚀

- David Hoffman