Dear Bankless Nation,

After a 2022 of doom and gloom, January has seemed to be a pretty bullish start for the year. But is it sustainable?

Today, we look on-chain for signs that this market pump is more than a flash in the pan.

- Bankless team

Don’t call it a comeback.

After a quiet start to the week, crypto is once again ripping. The total crypto market cap has risen 21.6% to start the year, reclaiming the $1 trillion mark, powered by 36% and 39% rallies in BTC and ETH respectively.

It seems hard to believe, but the majors have retracted the entire post-FTX dump.

Much of this rally has been driven by a massive short-squeeze. There have been more than $2.2B in short positions liquidated YTD, compared to just $1.0B in long-liquidations.

After a down-only 2022 filled with numerous fake-out rallies, it may be easy to dismiss this move as another scam pump, destined to fail like all of the others.

However, there are reasons to believe that this rally could have legs. This is not to suggest that we are about to zoom back to fresh all-time highs…but perhaps we won’t head straight-back to Goblin Town either.

Let’s touch on a few of the reasons why we think markets may continue to head higher:

Leverage Has Been Wiped

Crypto experienced a major de-leveraging in 2022 as the CeFi credit complex came crumbling down.

While we don’t know what hidden CeFi leverage remains, from publicly available CEX data as well as on-chain data, we can see that a gigantic portion of leverage has been flushed from the system.

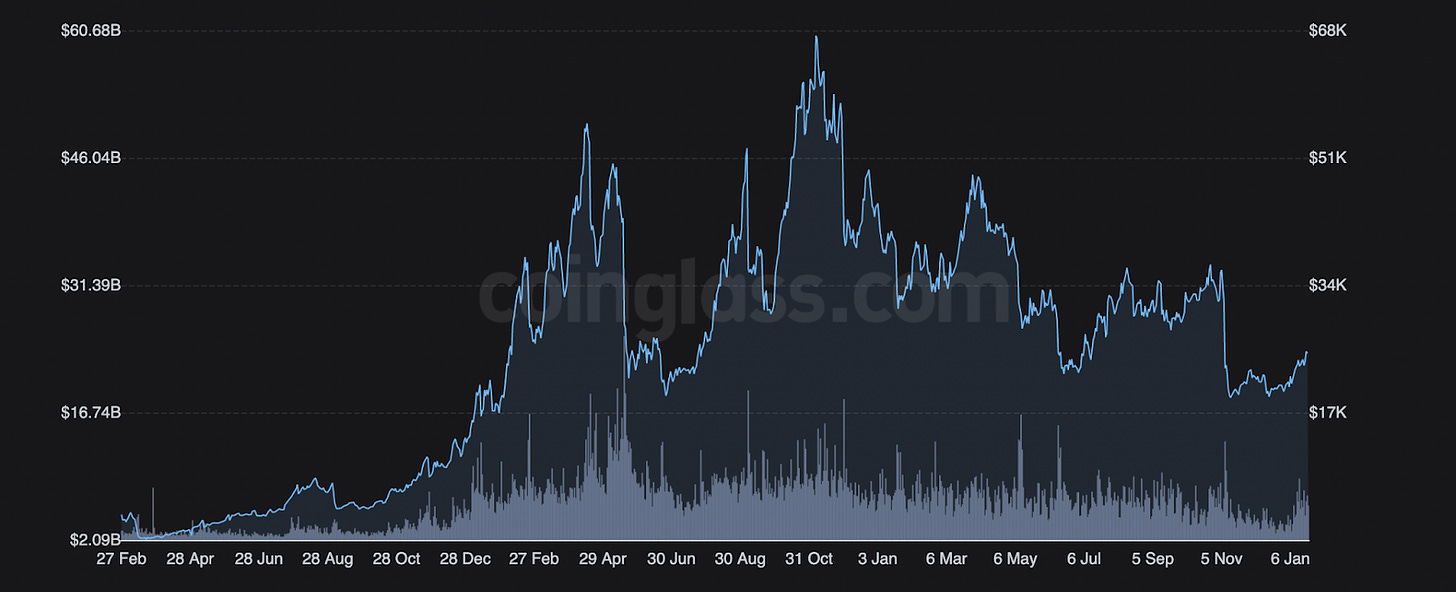

As we can see, open-interest on perpetual futures has declined 60.4% from the top in November 2021, and now sits at levels not seen since June 2021, the period after the massive May 2021 crash and before the “second pump” in August-November of that year.

In hindsight, we’ve learned that much of that second-half rally was in-organic, driven by borrowing from (once) massive funds like 3AC and Alameda. The leverage which propped up that move now appears to be completely wiped.

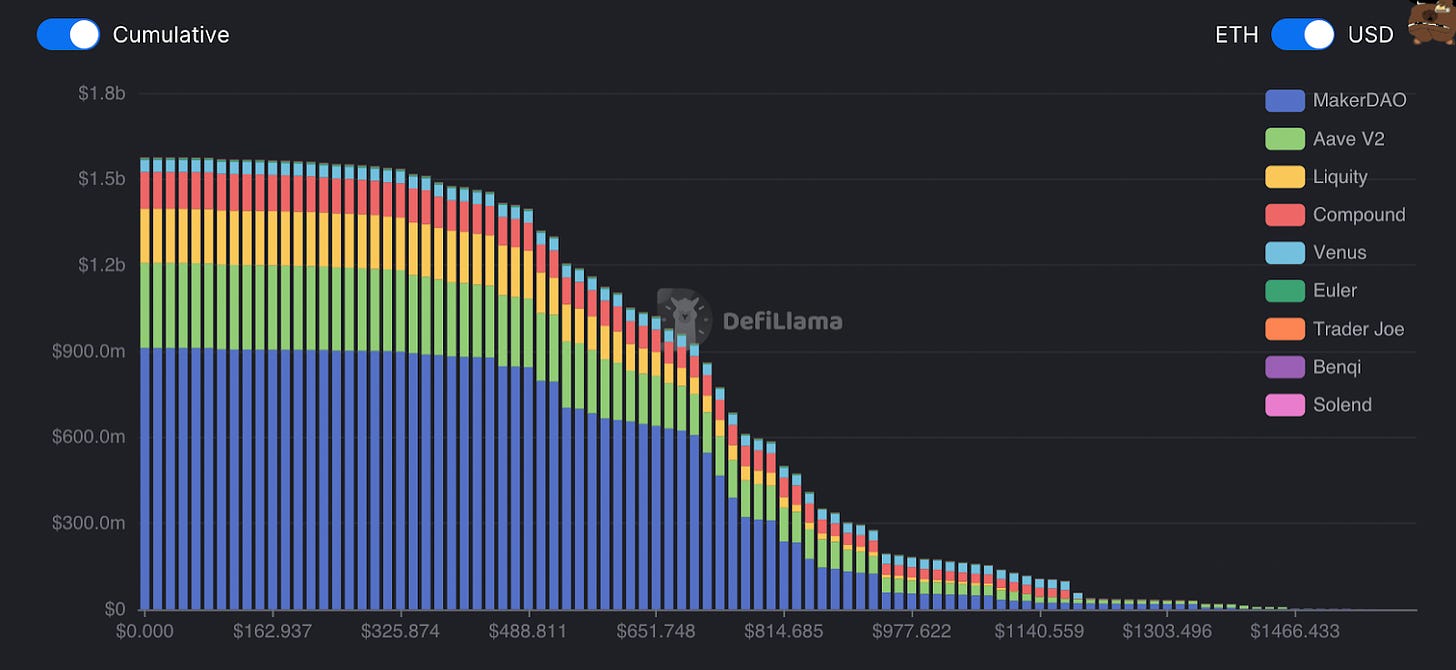

Taking a peak on-chain, we can also see that DeFi whales are not particularly over-leveraged. There is “just” $164M of liquidatable ETH positions above $1000 across lending protocols like Maker, Aave, Compound, Euler, and Liquity, suggesting that it would take a truly exogenous shock on the scale of FTX or COVID to trigger another liquidation cascade.

Although battered players like DCG remain, there is little to suggest that the market is over-leveraged. Given the massive amount of short liquidations YTD, it appears as though it’s bears, not bulls, who are out over their skies.

Dry Powder Remains

Investor and trader positioning also suggest that this rally may have some legs. When looking on-chain, we can see that even after this move, investors are holding a large portion of their assets in cash.

Nansen Smart Money stablecoin positions, which measures the percentage of large whales portfolios that are held in cash, currently sits at 25%. Although it has fallen from its peak of 40% in the immediate aftermath of FTX, it's still at a historically elevated level, at roughly the same value as the days following the LUNA crash.

This positioning data suggests that investors are nowhere near fully allocated, and there is plenty of ammo remaining on the sidelines to drive prices higher.

Although the overall stablecoin market-cap has decreased 4.2% from $142.4B to $136.4B, which indicates that some liquidity has left the ecosystem, it appears as though the remaining capital in crypto still has a considerable amount of dry powder.

Loosening Financial Conditions

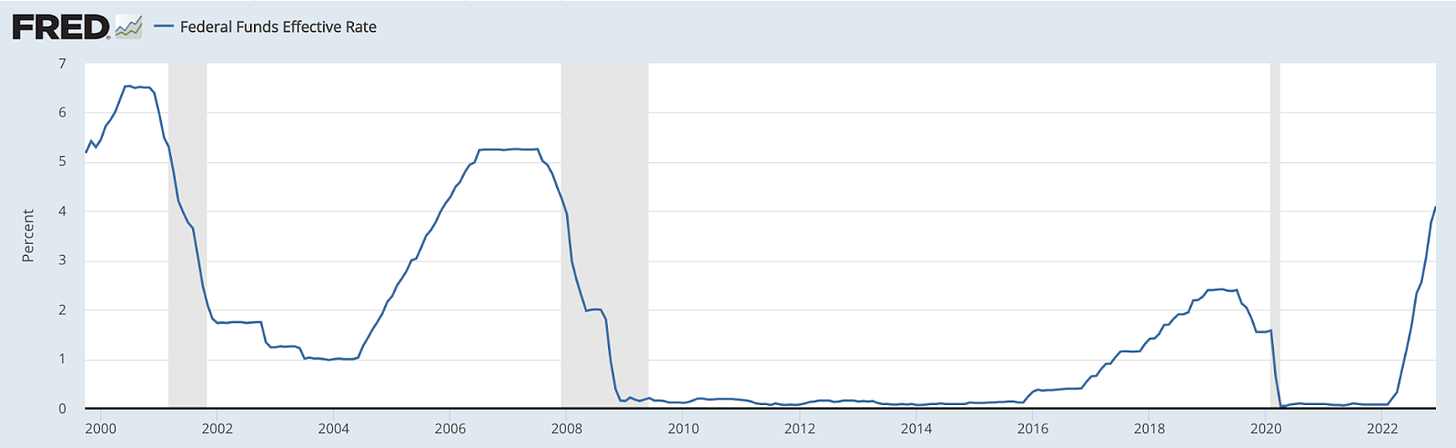

Macro headwinds helped contribute to last year's bloodbath, with the Fed rapidly raising rates in order to combat the worst bout of inflation we’ve seen in decades.

This tightening cycle hammered all risk-assets, with stocks, bonds, and crypto losing more than $32 trillion in combined value over the course of the year.

Thankfully for investors, inflation has decelerated over the past several months and is showing further signs of cooling.

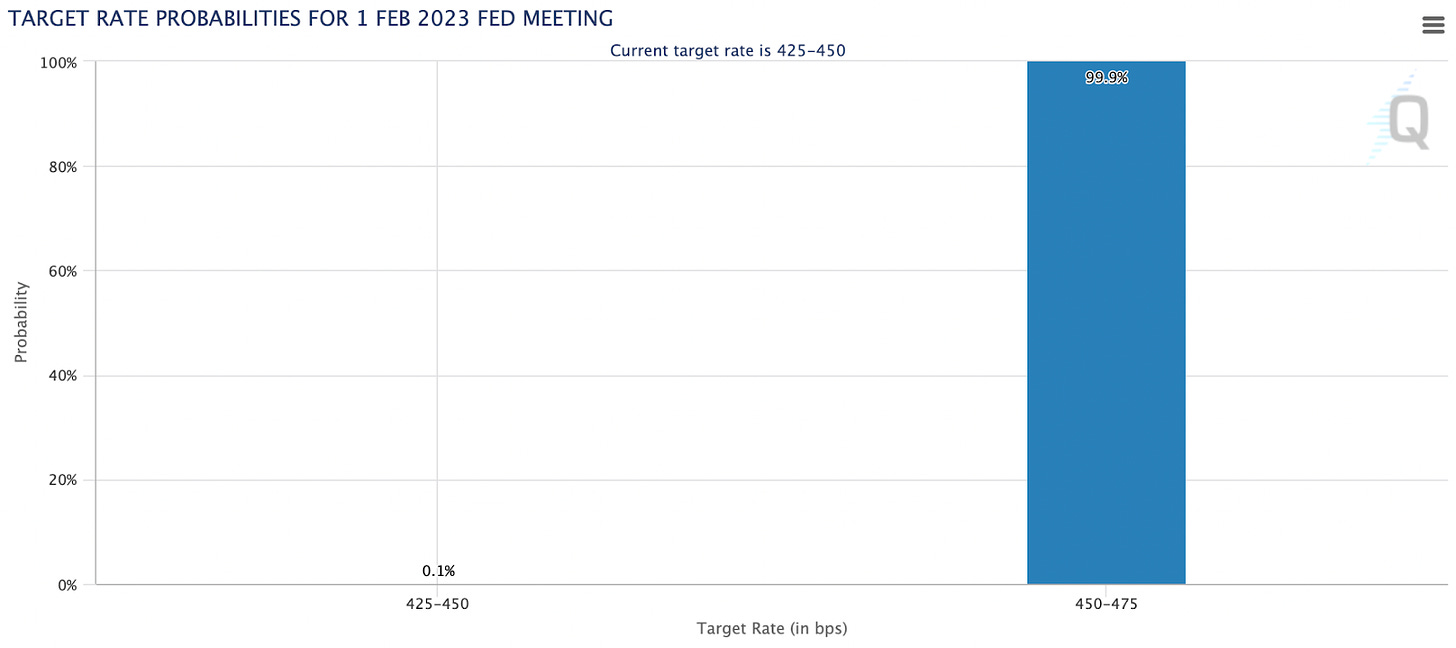

This caused the Fed to decrease the size of its rate hikes from the previous level of 75 bps to 50 bps at the last FOMC meeting in December. Because of this, it appears as though we are past the point of “peak Fed hawkishness” meaning that the Fed will not be tightening financial conditions as aggressively.

This is a major catalyst for risk assets, as it suggests that we are moving towards the end of interest rate hikes, and moving closer towards a pause in rate hikes, or maybe even a “pivot” towards rate cuts.

The markets have begun to sniff out this change in Fed posture, with the dollar and yields falling, and bond, gold, equity, and crypto prices rising to begin the year. The market is currently pricing in a 25 bps hike at the February FOMC meeting and rate cuts later this year.

Any loosening of financial conditions should act as a major boon for crypto prices, as the asset class is highly sensitive to liquidity in the broader financial system.

Are We Back?

It may be hard to believe after a brutal 2022, but there are a variety of different indicators which point to this rally having some legs.

Crypto has been de-leveraged, positioning by historical standards remains light, and macro headwinds from tight monetary policy may be on the verge of abating.

Uncertainty remains in both crypto and macro. And yes, every rally over the past year-plus ultimately ended in new lows.

But there is ample evidence to suggest that, yes, this time may be different.