Why the SEC is Suing Binance

Dear Bankless Nation,

This was quite the Monday. Apple jumped into the metaverse, Taylor Swift broke up with her boyfriend, and Gary Gensler & Co declared war on Binance.

Today, we dig into the SEC complaint against Binance, unpacking what it alleges and what could come next.

- Bankless team

Bankless Writer: Jack Inabinet & Ben Giove

The SEC is going after Binance and CZ.

Just over two months ago, the CFTC fired off an opening salvo in the battle between U.S. regulators and Binance, highlighting a litany of alleged compliance violations and the exchange’s subversion of internal AML/KYC controls.

Today, Gary Gensler and the SEC came out with their own set of allegations against CZ and his empire. While this most recent suit also attacks Binance for providing select U.S. customers with access to Binance.com, it significantly expands on the allegations leveled by the CFTC.

The SEC explicitly labels multiple products (including specific tokens) offered on the U.S. platform as securities, questions the degree of independence that Binance International afforded its U.S. subsidiary, provides evidence for the commingling and diversion of customer funds, and highlights internal wash trading and self-dealing activities undertaken to artificially inflate trading volumes on Binance.US.

Today, we’re dissecting the SEC’s complaint, surfacing the very real concerns it raises about both Binance's actions and the regulator's broader intentions.

The Independence of Binance.US

Extending jurisdiction beyond the U.S. subsidiary to the broader Binance International organization is crucial for the SEC if it wants to strike directly at CZ's empire. If this complaint's allegations prove correct, it seems Binance International has made that task pretty straightforward for the SEC.

After initially coming to the realization that serving U.S. consumers on Binance.com made the CEX an unlicensed securities exchange (a point seized upon by the SEC’s Twitter account), Binance hired numerous advisors to consult them on how to mitigate potential legal strategy.

One of these consultants proposed the “Tai Chi Plan,” an approach that would allow Binance to circumvent collaboration with U.S. regulators, while continuing U.S. operations in a "‘moderate’ risk" fashion.

The plan involved the establishment of the Tai Chi entity – Binance.US – which they hoped would be “the target of all built-up enforcement tensions,” “reveal, retard, and resolve built-up enforcement tensions,” and “insulate Binance from legacy and future liabilities.” Under this structure, Binance International would forgo U.S.-sourced trading fees, supplementing them for licensing and service fees paid out by the U.S. entity.

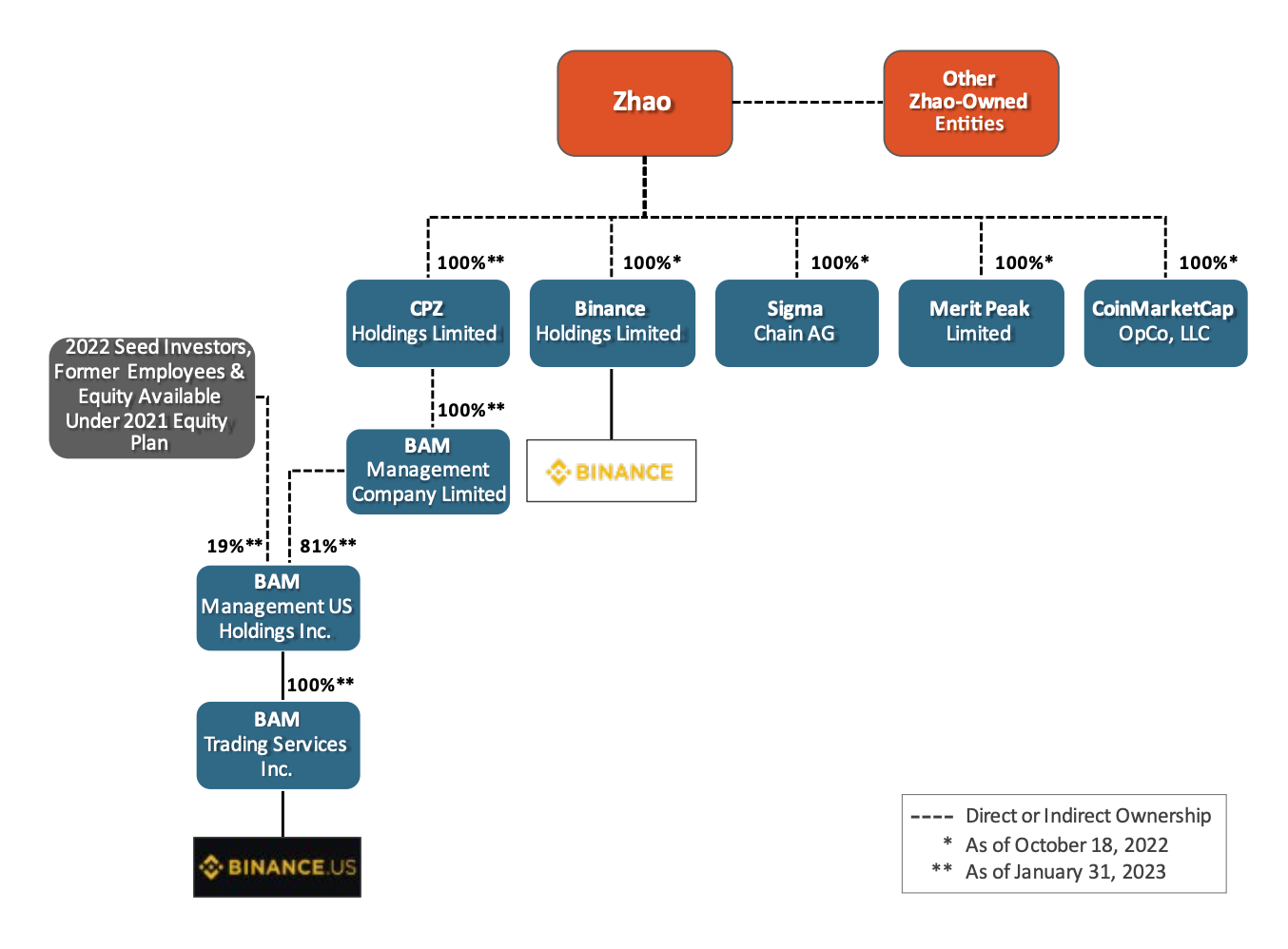

While this plan intended to silo off Binance.US control from CZ and the broader Binance corporation, in reality, an incredibly close corroboration continues to exist between the two – CZ has held at least 81% ownership over the entities controlling Binance.US since its inception.

Former CEO Brian Brooks (“CEO B” in the complaint), highlighted his concerns over the dependance on Binance.US liquidity from two CZ-linked market makers, stating under oath to the SEC that he “thought that was a real problem” and suggested that heavy dependance on CZ both as a control person and economic counterparty were problematic and should be deplatformed.

At least through December 2022, Binance International, through service agreements with its U.S. subsidiary, served as the “designated custodian for crypto assets deposited, held, traded, and/or accrued on the Binance.US Platform.” This structure provided Binance with “sufficient control to manage and authorize the transfer of crypto assets, including between various omnibus wallets,” without receiving any authorization from Binance.US.

Concerningly, the SEC indicates that as of the publication of their complaint, not all crypto assets stored on Binance.US are “within [its] exclusive custody and control,” indicating that Binance International maintains custodianship over some portion of the exchange’s funds.

Security Offerings

Multiple offerings on Binance have caught the ire of the SEC, which has flagged them as potential securities. These alleged securities not only include staking-as-a-service (SaaS) programs offered by Binance.US, but also include Binance’s BNB, BUSD, BNB Vault, and Simple Earn programs.

Staking Services

Contentiously, the SEC has yet again chosen to go after a litany of third-party assets, seemingly beyond the scope of their issues with Binance by going after many of the most popular assets that Binance.US offers staking services for.

Their target? Proof of Stake tokens, including Solana, Cardano, Filecoin, Atom, and Axie Infinity. At least they didn’t include Ether this time 😅

While it remains unlikely that the SEC will prevail in achieving regulation of all PoS tokens through this enforcement action, it is yet another display of the contentious relationship between the crypto ecosystem and American regulators.

BNB

The SEC attempts to establish BNB as a security, by highlighting that funds raised from “investors” would “help” the Binance team “build a world-class crypto exchange.” The whitepaper leans on the expertise of CZ and the founding team, potentially communicating that the success of an investment in BNB is dependent on Binance’s management.

Perhaps the most damning indication of the security-like properties of BNB, in the eyes of the SEC, comes from the usage of Binance’s profits to buy back and burn tokens, further linking the success of the centralized Binance corporation with the token’s price.

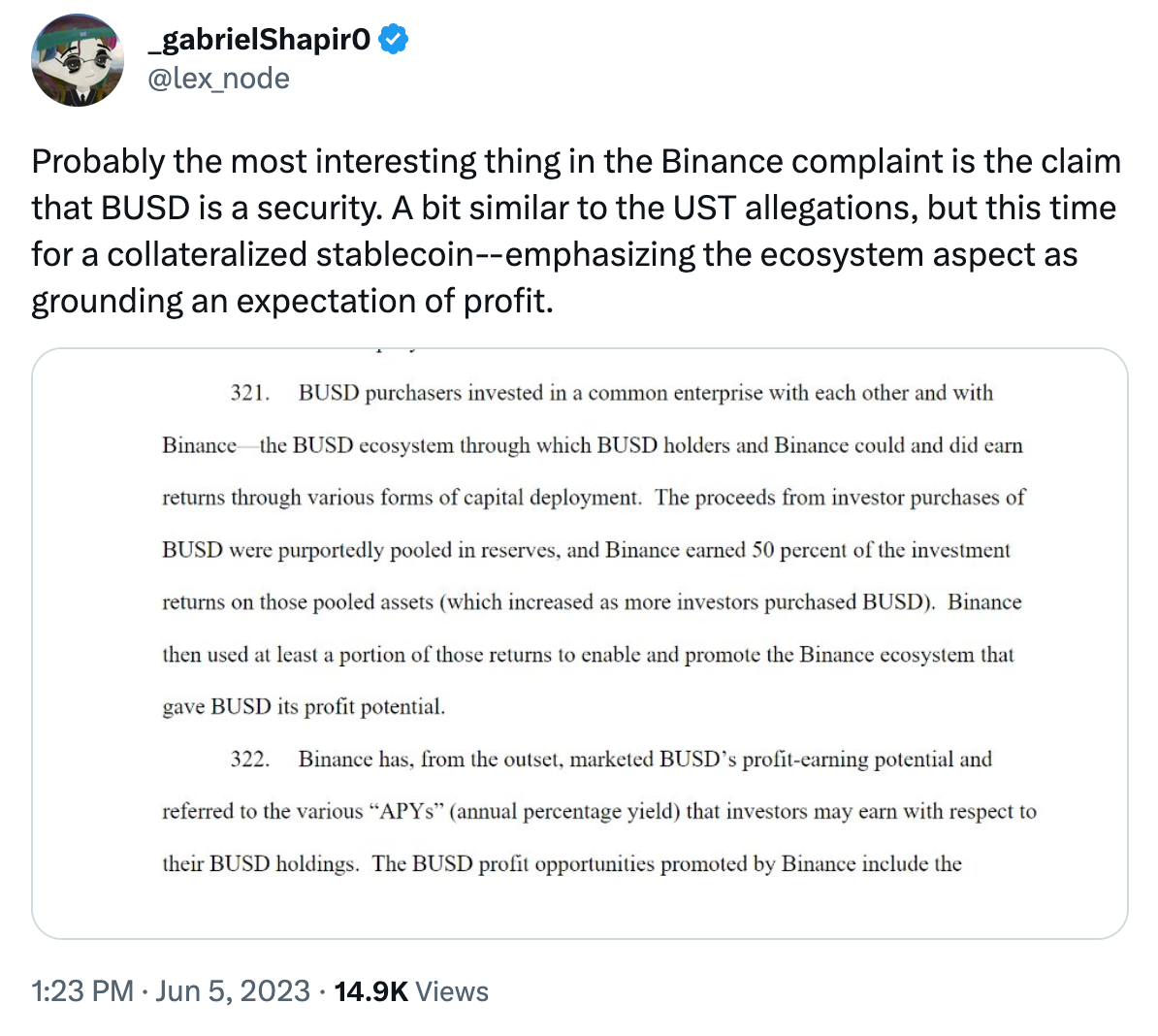

BUSD

The SEC views Binance’s marketing of BUSD APY opportunities and establishment of the “BUSD Reward Program” as indications that investors may have expected profits from the stablecoin.

While certainly not an unexpected take from an agency that appears a little too trigger happy in declaring crypto assets as securities, the SEC is indeed operating under untried legal theory, with the rationale mirroring that previously found in their complaint against Luna’s UST.

BNB Vault and Simple Earn

BNB Vault and Simple Earn programs appear to be an easy target for the SEC to attack. These programs pool user assets to generate returns through a variety of methods (including staking, lending, or operational usage by internal Binance groups) and provide pro-rata returns to investors

Both of the above offerings are likely classified as securities under US law, as the success of the investment is dependent on managerial expertise and derived from the efforts of others.

Commingling of Funds

Recall how FTX had commingled customer funds and lent them out to Alameda, causing the eventual insolvency of the exchange?

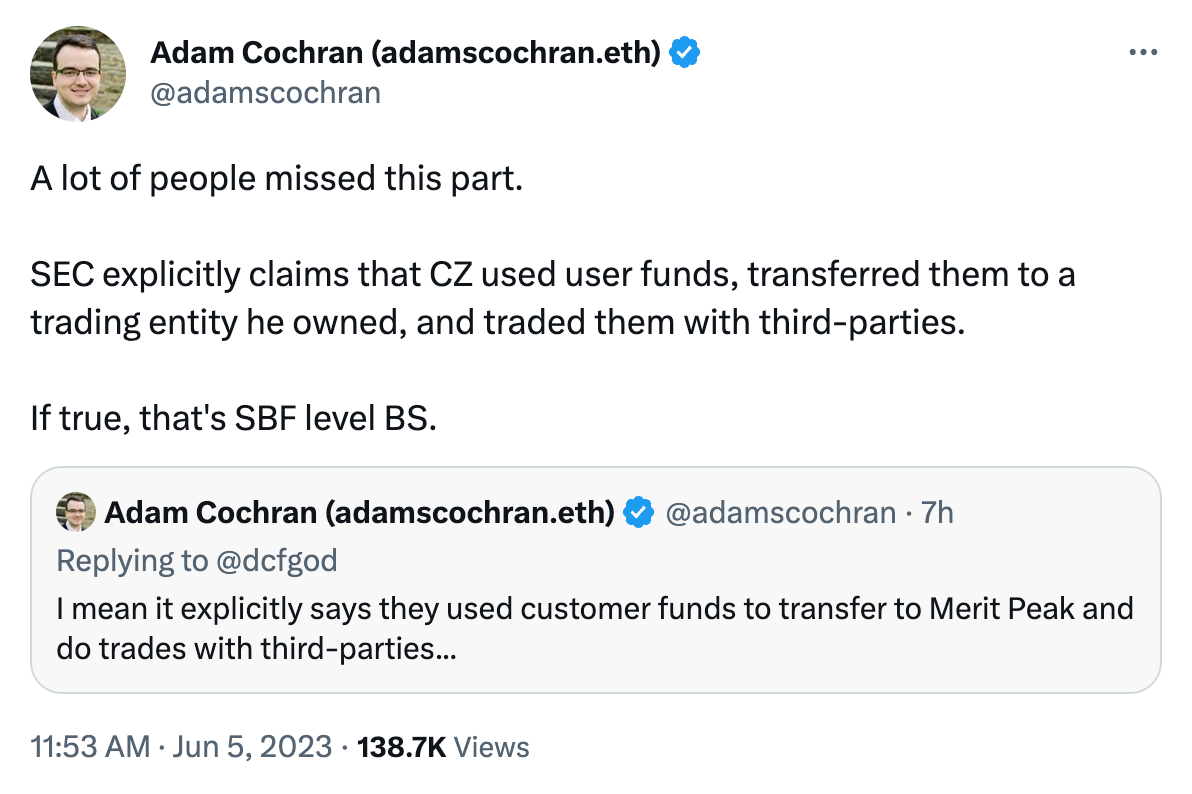

While the SEC is not alleging insolvency, an apparent lack of effective internal controls meant that customer funds were frequently diverted, with some even going to fund personal expenditures. This is an extremely concerning allegation!

Between October 2022 and January 2023, CZ is alleged to have personally received $62.5m from one of the Binance bank accounts. Despite maintaining the independence of Binance.US, “billions of dollars of customer funds,” from both the U.S. and International entities, were commingled into a single account controlled by a CZ entity. Funds from this account were transferred to third-parties in apparent connection with the purchase and sale of crypto assets, the complaint alleges.

Further, the SEC highlights the transfer of $190M in 2021 from Binance.US to another Zhao controlled entity, Sigma Chain. The bank account that received these customer funds proceeded to spend $11M on a yacht.

Just More FUD?

Make no mistake: the SEC’s claims against Binance are concerning. Also concerning though are the SEC's concerted efforts to stifle a broad range of actors across the crypto industry.

Given the commission's poor faith efforts to help seemingly benevolent actors in the space navigate existing rules, it’s more than fair to question the SEC's motivations in this complaint as well, even with the eyebrow-raising allegations against CZ & Co.

This suit indicates that we as an industry are going to to have plenty of regulatory battles ahead of us. However, in a way, this situation is also a testament to the resilience of the industry.

All of the assets that the SEC is alleging are securities will continue to trade freely on decentralized exchanges. Networks named in the suit like Polygon, Solana, Alogrand, and the Cosmos Hub will keep producing blocks.

Despite what it seems is the government's best effort, the crypto economy will continue chugging along.