Why ONDO Keeps Surging

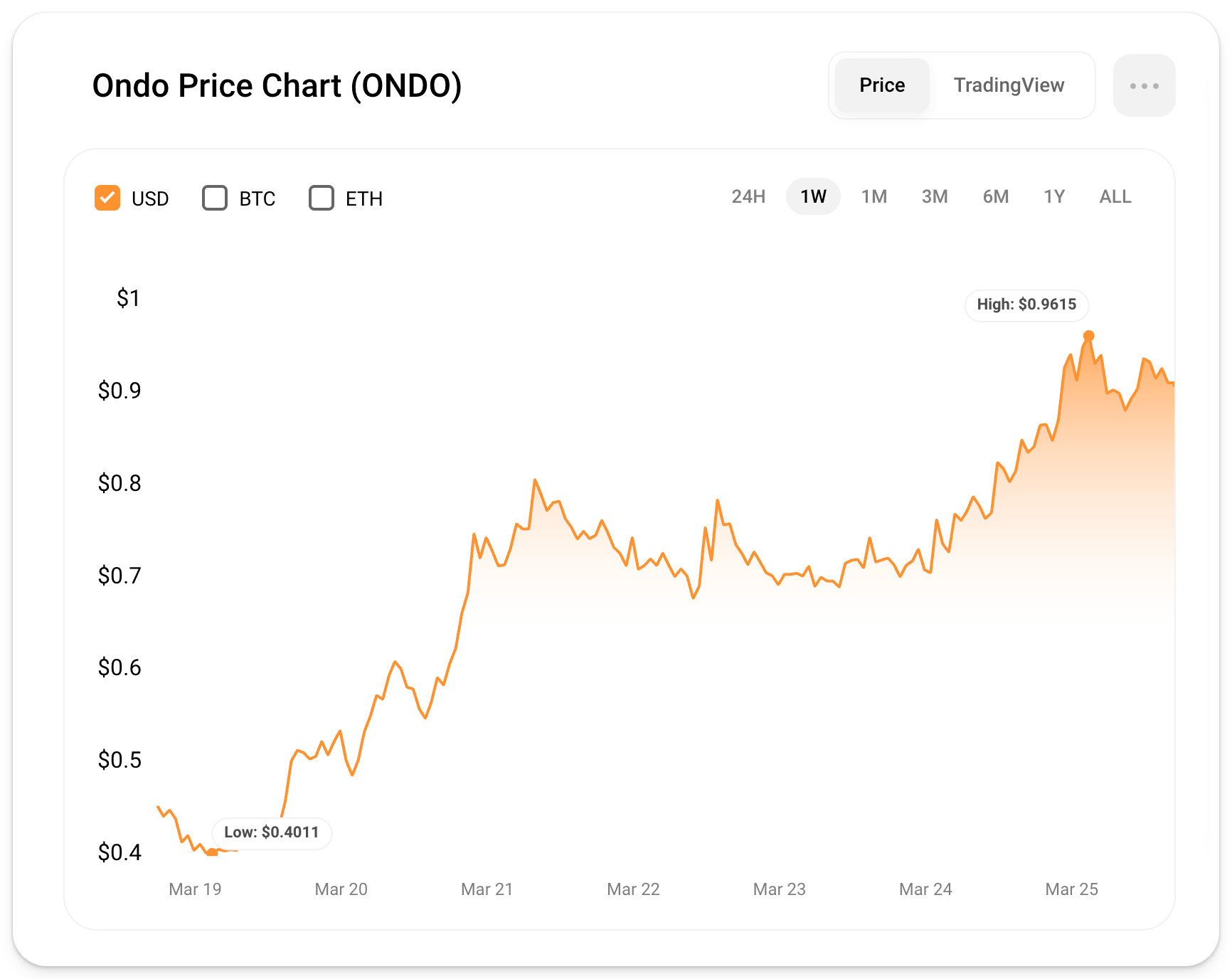

ONDO surged another ~10% today, capping ~100% in weekly gain despite the crypto market's rough past week. Is the surge over, or is crypto waking up to the outsized opportunities in the Real-World Assets (RWA) world?

The RWA platform, offering treasury-backed products onchain for accredited investors, benefitted significantly from BlackRock's BUIDL Fund announcement last week — as BlackRock helps Ondo issue its bonds.

This TradFi titan's new fund boosted ONDO and other RWA tokens, all posting impressive gains last week. Overall, given its TradFi ties, token locks, and multi-chain product launches, Ondo positions itself as a standout RWA play, arguably now the flagship token in the category.

- TradFi Ties: Besides working with BlackRock, Ondo's team boasts experience at Goldman Sachs and Bridgewater, two leading investment managers. These histories lend credibility to the team, ensuring they have the expertise needed for the job.

- Ondo Cross-Chain: Ondo's yield product, USDY, launched not only on Ethereum but also on Mantle, Sui, and Solana, enhancing liquidity and tying Ondo into these ecosystems as a potential beta play. Next, its upcoming Aptos debut will integrate them with Aptos’s leading DEX, linking RWAs with Aptos DeFi.

- Upcoming Securities Platform: Recently, Ondo announced its Global Markets initiative, allowing access to tokenized securities. Anticipation over the boost this may provide to Ondo's adoption further fuels interest in the token and distinguishes it from other projects just bringing treasuries onchain.

With TradFi ties, especially to BlackRock, secure tokens, cross-chain products, and an onchain securities platform, ONDO sits poised to be this cycle's top RWA play. But, while RWAs were hot during the bear, they have not netted returns like AI or meme tokens. Maybe BlackRock will fix that.

my condos have condos with $ONDO

— pickle (@Pickle_cRypto) March 25, 2024