Why CBDCs Are Not Your Friend

Dear Bankless Nation,

Financial inclusion. Privacy. Innovation.

These are all outcomes that the Bankless movement fights for every day.

We need these pillars to build a better, more democratized, and equitable future. Crypto looks to achieve this.

But there’s a threat. It’s one of the buzzwords you'll hear from talking heads on mainstream media: CBDCs — Central Bank Digital Currencies.

If you can imagine, there’s a lot to unpack with these emerging, centralized, digitally native currencies.

The benefits and drawbacks are hotly contested amongst analysts and thinkers.

Is all innovation good innovation?

Donovan offers his perspective on CBDC's in today's newsletter.

Whether we like 'em or not, CBDCs are coming.

Let's position accordingly for what that means...

- Bankless Team

Here’s why CBDCs are a (very) bad thing

Central bank digital currencies (CBDCs) are in vogue lately — for liberal, authoritarian, and oligarchic governments alike. A BIS survey of 81 central banks finds that 90% of them are in the works of creating their own CBDC.

Most notable is The People’s Bank of China’s notorious Digital Yuan. The Fed too has made explicit in a fresh Executive Order that the Biden Administration will place the “highest urgency” on “design and deployment options of a United States CBDC.”

If you’re inclined to take the word of your local federal banker for it — lol — CBDCs have been cast as a magical panacea that will increase financial inclusion for the unbanked, combat money laundering, increase financial stability, improve privacy, spur private-sector innovation, improve cross-border payments, and the grandaddy goal of them all: buttress American global hegemony.

But most are likely to be big, huge fails.

Casual observers may even see the proliferation of CBDCs as a positive sign of mainstream “crypto” adoption. But despite all the noise from the halls of power, CBDCs will not effectively serve as a public good for any of us.

Here’s why CBDCs are not your friend.

CBDCs = The Empire Strikes Back against crypto

While reliant on similar tech, CBDCs are fundamentally different from cryptocurrencies like Bitcoin and Ethereum — in fact, they’re diametrically opposed. The very motive of CBDCs is to further centralize fiat issuance and capture the digital currency market away from crypto.

CBDCs exist on centralized ledgers surveilled and controlled by central banking institutions and government bodies. Crypto means decentralization, while CBDCs necessitate a consolidation of control over finance by central banks.

That’s hardly a surprise. Governments have maintained their power through a coercive monopoly over fiat for hundreds of years. Expecting central banks to voluntarily relinquish power now is a political non-starter. Even the most minimalist CBDC implementation invites the nationalization of an already highly-politicized banking system.

To billions of people, CBDCs may be conflated with cryptocurrencies, and it’s easy to see why. Both exist as a digital token on a blockchain ledger tied to a unique digital ID.

Again: CBDCs are not cryptocurrency.

What makes crypto attractive — its properties of decentralization, immutability, transparency, scarcity, and anonymity — are the very problems that governments are spinning up their own CBDCs to solve.

CBDCs mean the end of stablecoins

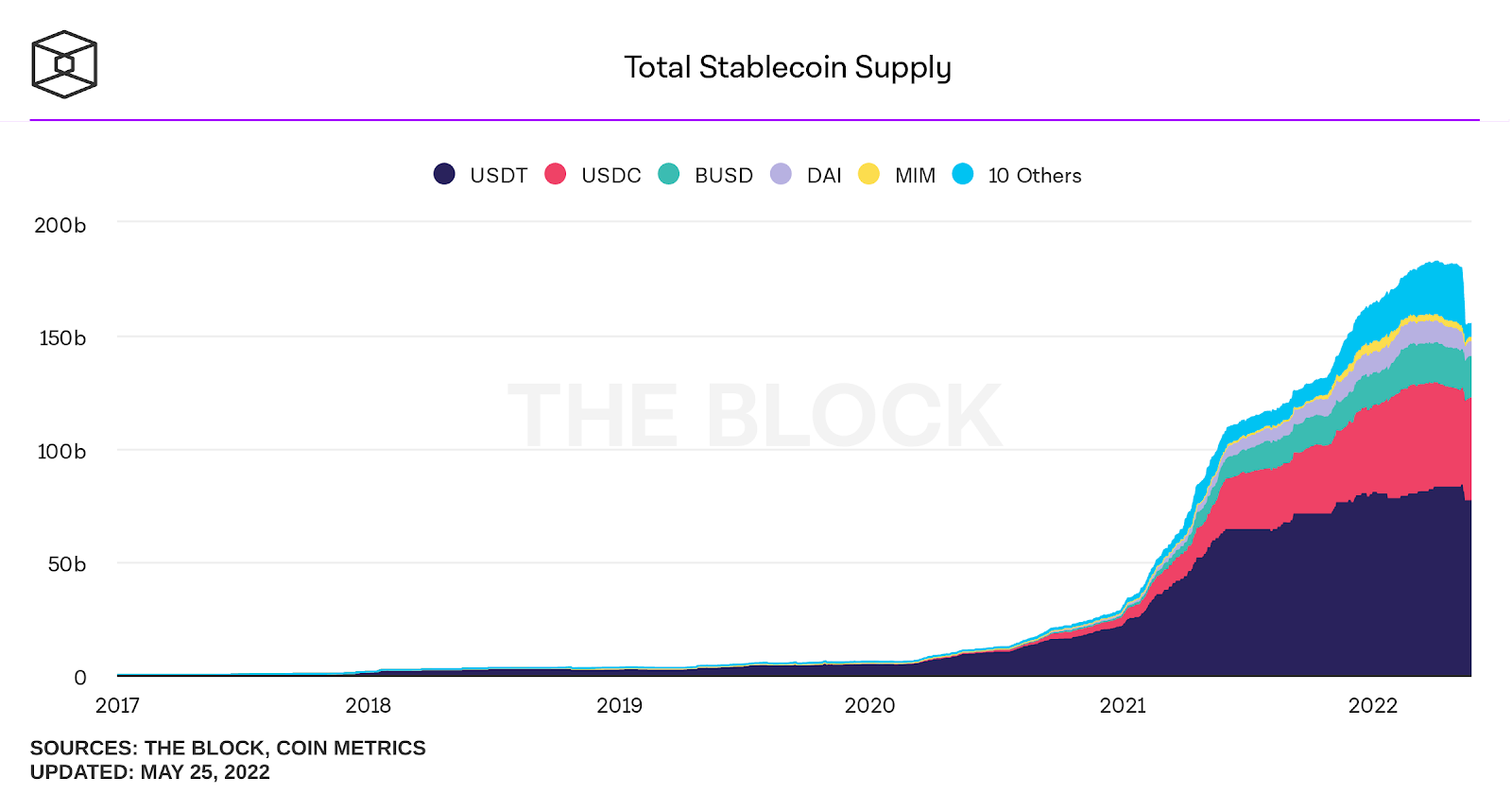

Since 2021, the total stablecoin circulating supply has seen an exponential growth of 534% from ~$29B to ~$155B today. That’s because stablecoins already solve most of the purported problems CBDCs are designed to target.

Stablecoins have been called crypto’s “killer app” for its real-world utility. The tech is life-changing (literally) for citizens in inflation-ravaged economies where currency debasement is the norm. That “utility”, less obvious to those of us in developed countries with financial privilege, is possible only because decentralized blockchains are free from traditional banking systems.

Millions of Nigerians, Ethiopians, Afghans, Cubans, Venezuelans, Ukrainians and more are afforded the basic economic freedom to transact, precisely because the rails upon which stablecoins sit on are outside of the state apparatus.

Central bankers are well aware of that.

That’s why a BIS paper openly states how CBDCs help central banks “avoid competition from global stablecoins.” Read: to protect their monopoly power through political coercion. That’s why federal-level crypto regulation across the globe have zeroed in on stymying stablecoins as the primary crypto policy agenda.

Enter the dystopian omnipotent fiscal panopticon

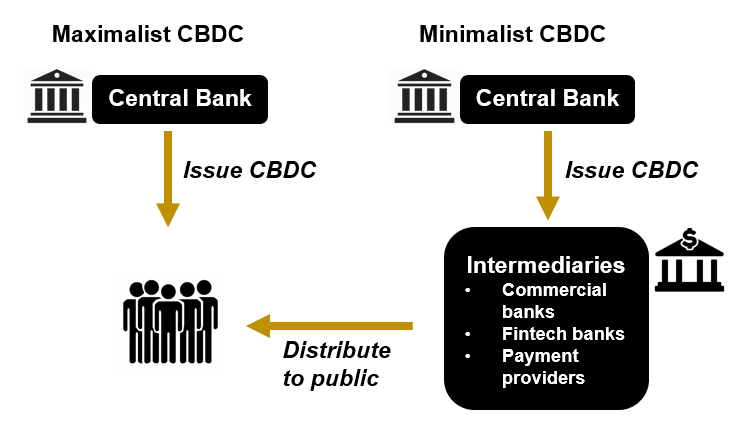

CBDC designs can vary, but there are two main designs: Minimalist CBDC design, wherein a CB issues the DC, intermediated through private banking accounts in a franchisor-franchisee relationship.

The Maximalist model, though, sees a government directly issue and oversee your very own government issued, managed, and controlled bank account. This frightening model is being considered by central bankers, with the idea being floated in the US for the government to issue “FedAccounts” to all American residents directly.

On a daily basis now, we’re witnessing global market chaos and inflation caused by mismanagement of monetary policy by the Federal Reserve.

For all the existing problems and faults with today’s banking system though, the Fed is at least incapable of targeting citizens directly. The Fed clumsily maneuvers the economy through macroeconomic levers but CBDCs would equip the Fed and financial institutions with surgically precise tools to target individuals/groups.

As already evident in many CBDC designs, the programmability of CBDCs permits governments to track movements of currency from its origin, reverse transactions, and set and revoke arbitrary rules. A CBDC would greatly empower governments to manipulate economies in a discriminatory fashion.

It’s hardly far-fetched to expect that governments will deploy CBDCs as such. They already suppress marginalized communities, political opponents, and whole nation-states (Russia). They block the national imports/exports of goods in pursuit of protectionist goals and impose sanctions and embargoes on states representing hundreds of millions of people.

The maximalist CBDC “solution” would be accompanied by staggering economic costs with massive potential for political abuse. It would necessitate a radical expansion and increased upkeep of a larger government bureaucracy to maintain — an estimated 20,000 people are employed for KYC/AML compliance in the U.S. private sector alone.

Inclusion? AML? Privacy?! Nope.

Today, about 5-6% of U.S. households (~7.1 million) remained unbanked, with the most widely cited reasons due to distrust of banks and the inability to pay banking fees. A minimalist US Dollar CBDC that is intermediated through private banks — thereby requiring consumers to give up personal data and pay banking fees — is not going to help with that.

Moreover, the case for a CBDC on the grounds of anti-money-laundering is weak in light of robust cryptocurrency alternatives. Chainalysis research shows that transaction volumes tied to criminal activity are a minuscule fraction of total trading volumes: In 2021, this was a mere 0.15% of all crypto trading volumes, down from 0.62% in 2020. The CBDC AML argument is a straw man — against crypto at least.

Cash is private. Crypto is anonymous. CBDCs are neither. They pursue an endgame of eliminating privacy and anonymity from the economy altogether. Are you seeing a pattern here? Every benefit touted by politicians and bankers in favor of CBDCs is an empty promise at best and Orwellian doublethink at worst.

A threat to growth and innovation

Even if one concedes the staggering assumption that central banks will not exploit their newfound powers with CBDCs, its very implementation would throttle economic growth.

As many economists have pointed out, via a maximalist CBDC, if Americans deposit their savings as CBDCs with the Fed, that would grant central banks unprecedented power in the market of liquidity/credit provision.

The money supply in the private sector would be dramatically shrunk, crippling banks of their largest source of income: loan interests. This forces banks to raise interest rates on loans, thereby hurting small businesses who depend on these cheap loans the most and impeding overall market innovation.

Designing CBDCs as non-interest-bearing might solve this problem (or limiting the amount of CBDCs users can hold). But these decisions open up a can of worms by allowing central banks to meddle even more actively in monetary affairs.

They also deter users from keeping their savings in CBDCs, begging the question of why the program is needed at all.

CBDC advocates want to have their cake and eat it too, but that wonderland doesn’t exist.

This is only the beginning

Money is the grammar of all economic relationships. CBDCs would accelerate the centralized codification of that language, which crypto is making a bold attempt at resisting.

I’ve been harsh on CBDCs, and yet have only begun to scratch the surface of its problems (Don’t get me started on centralized cybersecurity risks and privacy issues that accompany CBDC programs).

And to be sure, CBDCs can be beneficial. For instance: “airdropping” a fiscal stimulus to millions of people during the COVID pandemic would be more efficient than having a government bureaucracy dispensing money. Maybe the digitization of financial rails all over the world could serve as a trojan horse for crypto and decentralized offerings.

A strong case for CBDCs must rest on a cost-benefit analysis considerate of today’s imperfect political institutions, rather than cherry-picking a select few potential benefits under highly unusual circumstances.

No matter how you slice it, the costs of a CBDC far outweigh the benefits.

Action steps

- 👀 Watch Richard Turris explain China’s CBDC Revolution

- 📚 Brush up on The Stablecoin Wars