Why ATOM 2.0 Is a Gamechanger

The Cosmos narrative has always been one of sovereignty.

An ecosystem of blockchains that operate by their own rules and logic.

With it, every blockchain that launches with Cosmos uses their own token, validator set, etc. The problem with this approach is that Cosmos’ native token ATOM falls to the wayside.

It’s not the primary form of collateral in its ever-expanding ecosystem.

Cosmos 2.0 changes that.

At the Cosmoverse conference in Colombia last month, the Cosmos team set out a three-year roadmap of changes.

This overhaul, if passed in governance, repositions the Cosmos Hub at the centre of the ecosystem and ATOM as preferred collateral.

On the newsletter today is Zee Prime Capital’s Longsolitude, an investor at the fund, to break down these changes in a digestible format.

ATOM 2.0 coming to the appchains near you

You’re affectionate towards Ethereum, and applaud the heavy lifting of core devs that made the Merge happen. However, unless you fancy the MEV-boost dashboards, chances are that since the Merge went through you don’t know how to occupy yourself in this space.

A few galaxies away, all-stars of the Cosmos ecosystem gathered a few weeks back at Cosmoverse in Medellín, Colombia to discuss the future of ATOM. The key underpinning of this event was “ATOM 2.0”, or the vision of core Cosmos contributors for how to bring additional utility and value to the ATOM token and Cosmos Hub as a whole.

This post covers why the status quo of ATOM is undesirable, what’s in ATOM 2.0, and what are the implications for DeFi.

We don’t want the meme coins!

ATOM as a token has been around for a long time, and, unlike its many contemporaries, didn’t decay into irrelevance.

Cosmos ecosystem provides best in class tools for application developers to launch their own application-specific chains (appchains), and it was instrumental to launch of many well known projects, such as Osmosis, Thorchain, the now ill-fated Terra and many more. The key tools include Cosmos SDK for developing the execution layer for blockchain’s logic, Tendermint for fast-finality consensus engine, and IBC for secure blockchain interoperability.

Some of the key frustrations around the ATOM token, which represents the Cosmos Hub, was its lack of utility and underutilized potential. Any appchain launched within the Cosmos ecosystem could do without the ATOM token. That’s because the fee logic is native to every appchain (developers select in which tokens gas is paid, what different types of transactions cost), and every appchain has its own validator network.

Cosmos advocates sovereignty and blockchain customizability, so it only makes sense that ATOM utility is not enforced by brute force, right? In a nutshell, that’s how the Cosmos meme of “no value accrual” was born.

While some would argue that other appchain token airdrops to ATOM stakers is in fact a form of value accrual, let’s be intellectually honest about it — airdrops are neither a sustainable nor good use of appchain’s token capital. Airdrops shouldn’t be wide and untargeted — they should attract specific users, and incentivize specific behavior beneficial to the appchain (more on this topic here).

Next, ATOM currently has a high staking APR (around 20%) to incentivize and compensate Cosmos Hub validators for their work. While people tend to disregard inflation in “up only” markets, it takes its toll during the bear, putting additional sell pressure on the token. That’s another reason for the frustrating performance of ATOM.

This now brings us the dilemma of ATOM stakers. Do you stake the ATOM for the 20% yield, or do you use it across DeFi products in the Cosmos ecosystem and get inflated away, as a competitive yield in DeFi is hard to find?

This conundrum leads to a situation where ATOM’s utilization in DeFi is low, and only made practical thanks to heavy liquidity mining incentives offered by appchains in their own native tokens (most generous indeed). A greater use of ATOM as collateral, as well as deeper liquidity, would be beneficial not only to ATOM itself, but the broader ecosystem too.

These are some of the problems ATOM 2.0 looks to resolve over the coming years.

Making ATOM relevant again

The ATOM 2.0 whitepaper/proposal was published during the last week of September, and you can read it here. It’s still in the community discussion phase.

To address the aforementioned problems, Cosmos developers are introducing four key pillars:

- Interchain Security, or ICS

- Liquid Staking

- Interchain Scheduler

- Interchain Allocator

Let’s look at these one by one.

1️⃣ Interchain Security (ICS)

At present, any application developer in Cosmos is responsible for starting the blockchain from scratch, bootstrapping and maintaining appchain’s validator set, and taking care of the economic security. That is the whole point of Cosmos: sovereignty. Building an application and a blockchain simultaneously is not an easy task, though. This has been acknowledged by the Cosmos community, and the new security concept was put together to address this issue.

The idea of ICS is simple. Instead of struggling with own validators and questionable economic security, why not let application developers simply “rent” this security from a much stronger monetary zone like the Cosmos Hub (ATOM) itself? The developers can focus on building the application instead, and still enjoy most of the customizable benefits associated with an appchain (owning the block space, customizing the fee logic, etc.)

ICS would turn the Cosmos Hub into a “provider chain”, and the appchain into a “consumer chain”. The exchange between them is straightforward — the provider chain produces blocks for the consumer chain, while the latter issues the block rewards (inflation) to the provider chain and its validators. The level of economic security procured in this manner is dependent on how many of provider chain validators opt in to produce blocks for a given consumer chain. Cosmos Hub has already selected five consumer chains which will be supported starting 2023.

Interchain Security will be a significant change, but not the sole approach to solving the security needs of Cosmos appchains.

For more, see Zee Prime’s recently published article on different versions of ICS discussing the tradeoffs and available alternatives.

2️⃣ Liquid Staking

Cosmos Hub looks to see liquid staking products adopted via a competitive process among different providers. There are teams like Quicksilver, Persistence, Stride and Lido who will offer liquid staking not only for ATOM, but for other tokens in the Cosmos ecosystem as well.

The objective from Cosmos Hub perspective is to ensure trust minimization and safety, so it makes sense for its validators to align with liquid staking providers.

Quicksilver will procure the full economic security of Cosmos Hub through ICS, which likely means this will be the preferred liquid staking provider for ATOM (but not enforced upon the stakers).

In the context of using liquid staking to replace staking rewards, it should be noted that liquid staking essentially asks stakers to take on more risk through DeFi activities. Therefore, the yield for stakers in ATOM 2.0 will have a different, and higher, risk profile than the status quo.

3️⃣ Interchain Scheduler

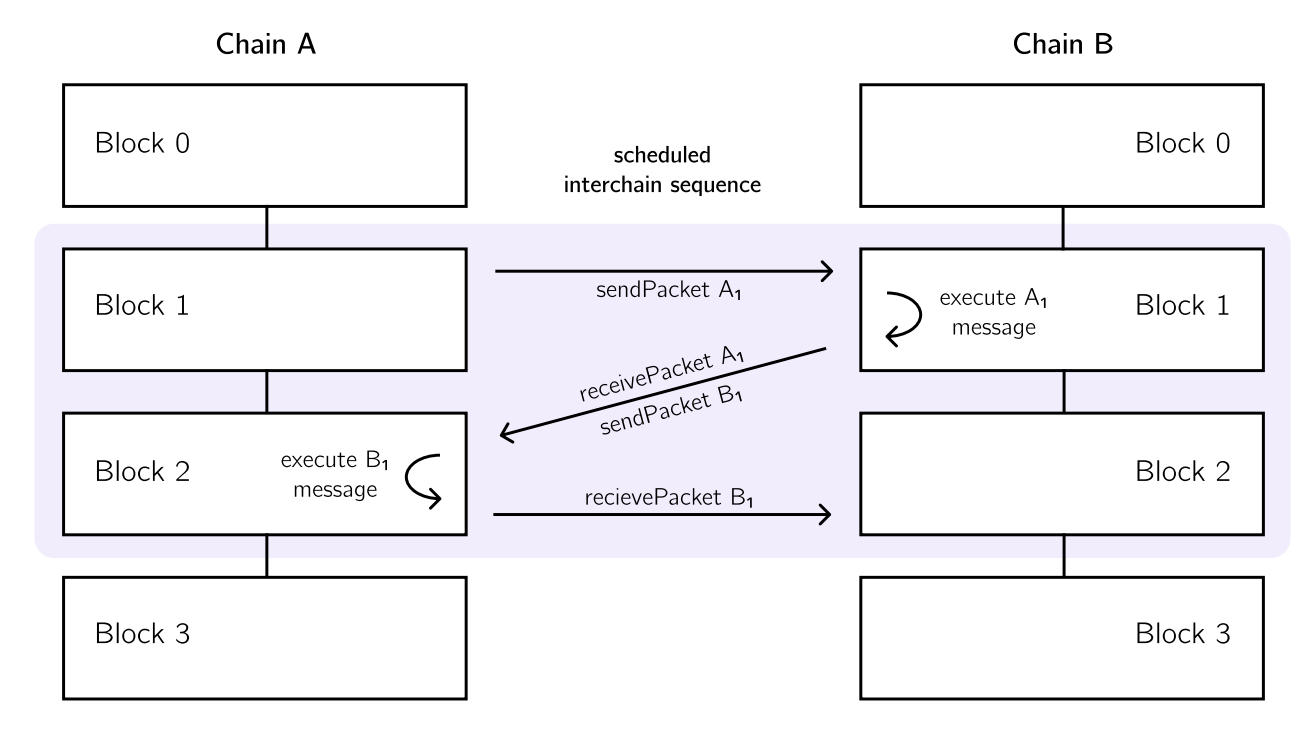

Cosmos ecosystem is a group of asynchronous blockchains. What this means is that there is an opportunity to establish an on-chain marketplace for blockspace across the appchains who are secured by ICS.

This is one of the ways to establish a more egalitarian way to distribute MEV (maximal extractable value), which otherwise might concentrate exclusively in the hands of searchers and validators, and not the transaction originators.

The consumer chains in ICS would voluntarily opt in to sell their blockspace in this market enabled by the Scheduler module. Then, a trader could bid to acquire blockspace on two consumer chains simultaneously, and ensure strong execution guarantees for his cross-appchain arbitrage.

The proceeds from the sale would be split among the consumer chain who has sold its blockspace, and the Interchain Scheduler who has enabled it. However, the earnings of the latter would not accrue to ATOM token holders directly, and instead will be used to fund Interchain Allocator and grow the Cosmos ecosystem. This design enables a non-fungible-tokenization of rights to order transactions, and also secondary sale of it to other willing market participants.

There are several design approaches to MEV in Cosmos. In addition to the Interchain Scheduler, there is also Skip (on-chain module for appchains to capture their own native MEV, e.g. arbitrage) and Mekatek (off-chain marketplace for block building, similar to what Flashbots has done).

In essence, every appchain will have to decide how to deal with MEV and monetize it for the good of its own ecosystem.

4️⃣ Interchain Allocator

Unlike other ecosystems, for example Solana or Ethereum, who invested either directly into the ecosystem projects and/or provided funding for the public goods, Cosmos Hub has not taken such an active role.

The Interchain Allocator changes this. Its role will be to fund new projects on-chain in the Cosmos ecosystem and provide support in a way which is incentive-aligned. This is intended to speed up velocity of new projects in the ecosystem, and increase relevance of services that the Cosmos Hub can provide (some of which are ICS and Interchain Scheduler).

Such collaboration can take many different directions, but some of the initial ideas include token swaps, help in bootstrapping liquidity, treasury management, participating in each other’s governance processes, under-collateralized financing, etc.

These would be formalized through so-called on-chain covenants which streamline the protocol-to-protocol coordination.

Perhaps the most interesting question relating to Allocator is how those involved in ATOM governance will organize to successfully deploy and manage an ever-increasing amount of capital across different objectives, what checks and balances will be established, etc.

At today’s ATOM price, the treasury is expected to hold around 55M ATOM, or $700M. What will Cosmos-focused VCs do?

Decreasing ATOM inflation

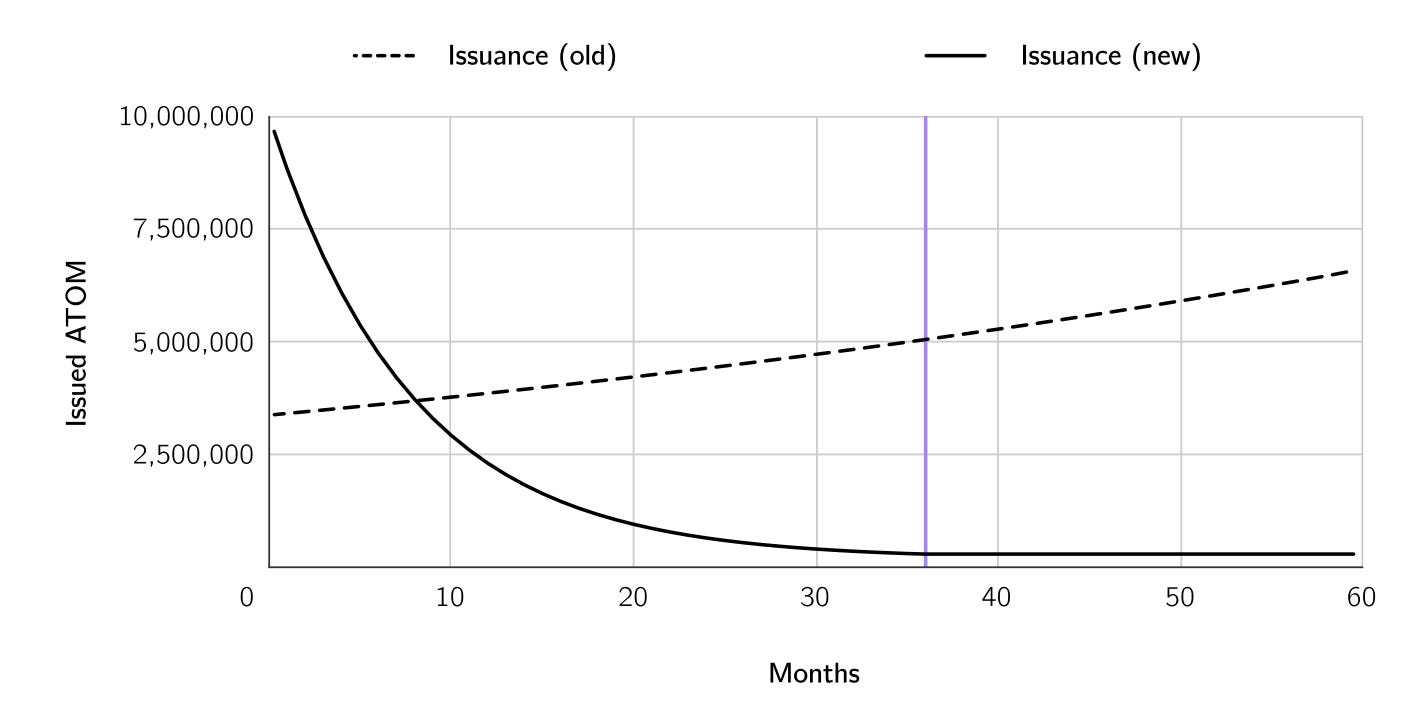

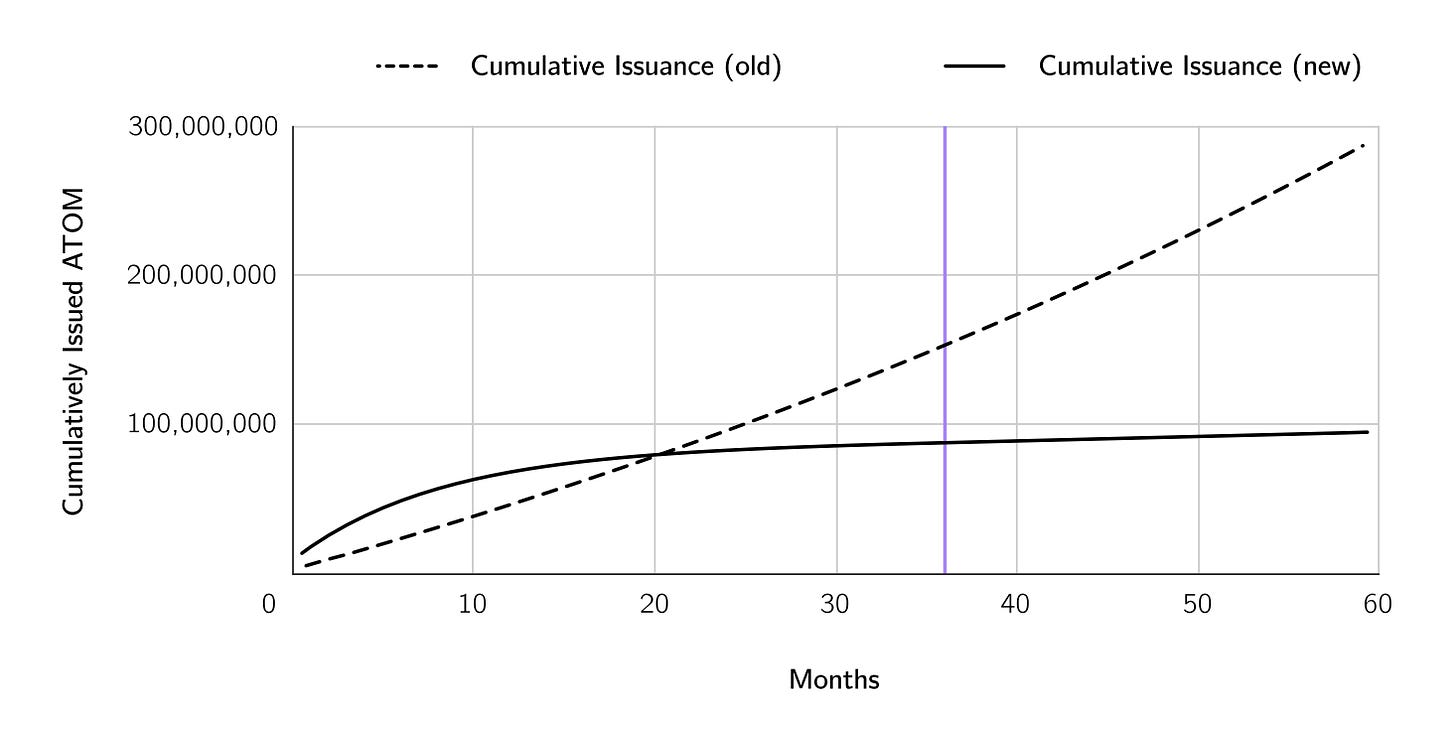

The combination of these initiatives - most notably ICS and Liquid Staking - will bring down the long-term inflation of ATOM, and substitute it with alternative sources of yield. Validator rewards will not be issued in ATOM anymore. This is where interception between liquid staking and DeFi, as well as receiving the token rewards from ICS consumer chains becomes important. ATOM will go through a new inflation schedule over the course of 36 months, most likely starting at the end of 2023.

The idea is to step up the inflation in the early months to help bootstrap the Cosmos Hub treasury so that the Interchain Allocator can work. Realistically, this is at the expense of ATOM holders because inflation rewards applicable to them are not going up pro-rata. During the first 9 months, the ATOM inflation would be up to 3x higher compared to the status quo, but then quickly fall due to liquid staking and inflation rewards from ICS consumer chains.

The temporary increase in inflation shouldn’t be the source of concern. Instead, the question becomes who can ensure a good economic return on this ATOM printed into the treasury, how, and what amount of time it takes. It is expected that there will be multiple sub-DAOs responsible for allocating. They could also access capital in increments, based on their ability to achieve objectives of Cosmos Hub.

Over a longer term this is expected to result in a much lower outstanding ATOM (there will no longer be a security subsidy issued to validators), but there are a lot of economic assumptions embedded around revenues from ICS and yields from liquid staking products that could lead to inflation being higher than currently anticipated. The run-rate ATOM issuance post the 36-month window is expected to be just under 1% per year (compared to over 10% now), which would be directed only to Cosmos Hub treasury.

DeFi in Cosmos

The collapse of UST has cast a long shadow over Cosmos DeFi. UST was adopted not only on Terra appchain, but also on Osmosis, the largest DEX of Cosmos, and elsewhere. DeFi without a stablecoin is a futile endeavor.

This situation is now changing for the better, with Circle launching a native USDC in early 2023 from one of the consumer chains secured through ICS — a testament to the utility of shared security design. Also, a decentralized stablecoin IST is being built on Agoric, which is meant to be a multi-collateral asset like DAI on Ethereum, with a planned launch in October this year.

Liquid staking, which is now being rolled out through multiple providers, essentially unlocks capital efficiency and allows more of it to flow to money markets and DEX. ATOM should be the primary beneficiary, but this applies to appchain tokens too.

One of potential issues could be fragmentation of liquidity — for example, there might be many different versions of staked ATOM. That being said, this could be addressed by having stableswap pools or wrapped versions of staked ATOM that aggregate all the different staking derivatives.

Since every application on Cosmos is its own appchain, there is the aspect of asynchronous execution across different DeFi environments. To work around this, Cosmos is using the IBC, or Inter-Blockchain Communication protocol, and Interchain Accounts in order to send cross-chain messages and execute smart contract calls.

As an example, Mars Protocol, which can be thought of as a leverage primitive with credit accounts, will have its own appchain for governance and coordination primitives, yet deploy smart contracts on every supported appchain through so-called “outposts”, starting with Osmosis.

Then, IBC would be used to both move the liquidity around from one appchain to the other, and redirect the fees earned back to the Mars appchain.

IBC is also perfect for having on-chain oracles. Instead of relying on off-chain systems, the price oracles from Osmosis DEX can be used across the entire Cosmos.

ATOM 2.0 is coming

The idea behind ATOM 2.0 is to start a flywheel effect, where ATOM becomes more desired and useful in the ecosystem.

It all starts and ends with the ICS — the more it is adopted, the more economically attractive ATOM becomes. The liquid staking helps in this regard, because it tightens the monetary policy and reinforces ATOM’s role as default and desired collateral.

The Interchain Allocator and the Interchain Scheduler will not directly accrue value to ATOM token holders, but they will provide valuable services and funding to the ecosystem, which results in more demand for ICS. In case the adoption of ICS is not sufficient, the inflation of ATOM would come back in order to compensate validators.

ATOM 2.0 is a multi-year effort, with a high degree of complexity.

The success or failure of it will not be apparent in the next one or two years, considering how long it will take for the inflation schedule to adapt.

We’re not yet convinced these changes will create a massive value accrual towards ATOM. There will be alternative security approaches to ICS on Cosmos with different trade-offs, while the ATOM 2.0 staking yield will have a higher risk profile due to liquid staking and potential validator slashing across multiple consumer chains.

That being said, the Cosmos ecosystem seems to have the best shot at bringing the appchain thesis to the finish line, and one of the most engaged communities to course-correct along the way.

Action steps

📚 Read more about Cosmos 2.0

Author Bio

Longsolitude is part of investing team at Zee Prime Capital. As evidenced on the most recent Bankless podcast appearance, Zee Prime bought the right coins at the right time and generally like to entertain boring and uninspiring ideas.