Who Really Controls the Dollar?

View in Browser

Sponsor: Unichain — Faster swaps. Lower fees. Deeper liquidity. Explore Unichain on web and wallet.

- 🇨🇳 China May Greenlight Yuan-Backed Stablecoins. Beijing eyes stablecoin framework as yuan’s share in international payments slips.

- 🦃 Lummis Says Crypto Market Structure Bill to Reach Trump by Thanksgiving. Lawmakers are pushing their stated timing expectations for delivery of the much-hyped crypto legislation.

- 🇺🇸 Fed Official Says Staff Should Be Allowed to Hold Crypto. The Vice Chair floated the idea of “practical exposure” for staff as crypto's potential grows.

| Prices as of 4pm ET | 24hr | 7d |

|

Crypto $3.85T | ↗ 0.8% | ↘ 7.2% |

|

BTC $114,129 | ↗ 1.0% | ↘ 7.0% |

|

ETH $4,339 | ↗ 5.0% | ↘ 8.0% |

PoolTogether has quietly become one of the most fun places to park idle stablecoins – no-loss savings with a shot at jackpots.

I last wrote about PoolTogether, DeFi's gamified savings protocol, in November 2023. The project was in the news at the time because of its V5 rollout, which made its infra autonomous, immutable, extendable, and capable of being openly incentivized.

It's a commendable design, as it fully leans into the superpowers of onchainness. It's always-on, transparent, permissionless, and empowering.

For users, the basics here have remained the same, in a good way. You deposit funds to a prize vault. Yield accrues from deposits. The yield forms a prize pool. Routine random draws determine winners, who receive their earnings without needing to claim anything.

Best of all? You can withdraw your underlying deposit at any time, so you don't use and lose what you put in. Save money while potentially earning more money!

Since the V5 release PoolTogether has added new features, new chains, and new rewards. The platform has continued to work well, and the prizes are flowing. For example, someone just won 22.91 ETH from a 2,500 USDC deposit on Base.

Imagine waking up $80,000 richer.

— PoolTogether (@PoolTogether_) July 18, 2025

That’s exactly what happened to one lucky PoolTogether user today.

They deposited 2,500 USDC in August.

This morning, they won 22.91 ETH! pic.twitter.com/Rgzz5hF9De

This risk/return profile is very attractive. That's why when I just ran a review of top DeFi projects for places I might deploy my next wave of my idle funds, PoolTogether was up there with Yearn at the top of my list.

It checks the boxes that I'm looking for right now. It's simple to use, it's set and forget, and it's not drenched in risk. So if you're like me and wouldn't mind turning 2.5k USDC into $100k worth of ETH but you haven't tried PoolTogether in a while, where should you begin?

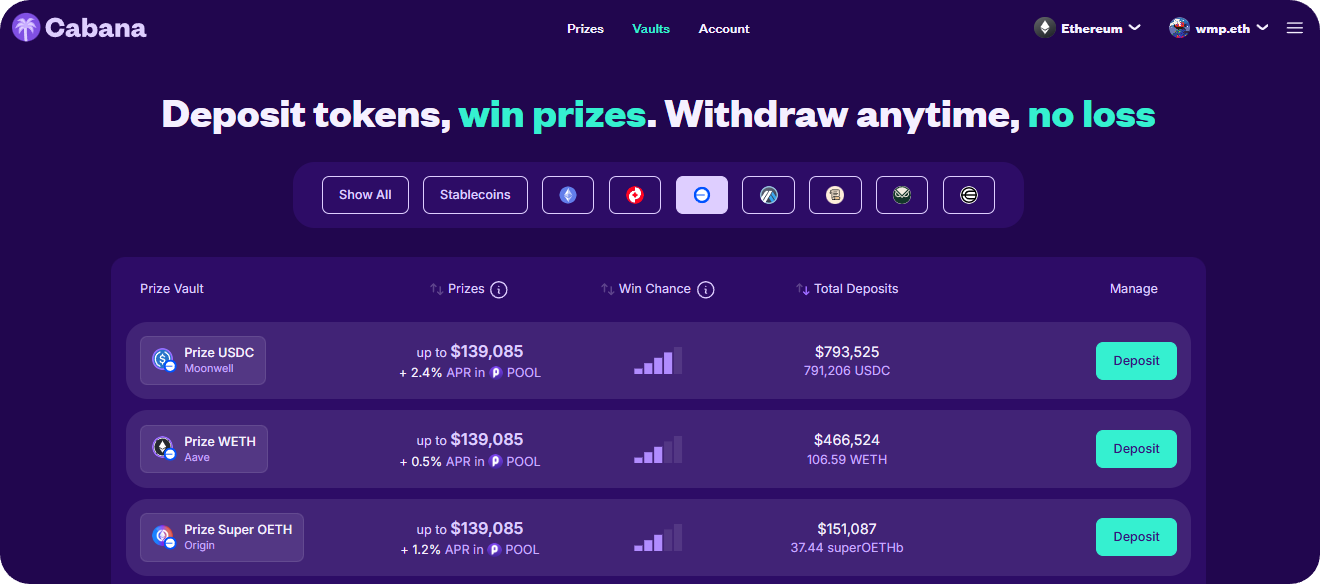

First things first, there's no official PoolTogether frontend for the sake of decentralization. Instead, there are multiple interfaces you can use to interact with the protocol. The 5 main options you have right now are Cabana, PoolTime, Superform, WinETH, and Yearn.

These are all solid interfaces, but personally I prefer Cabana. I just find it the easiest to navigate. But you might enjoy one of the other options more, so explore around and see which one clicks for you.

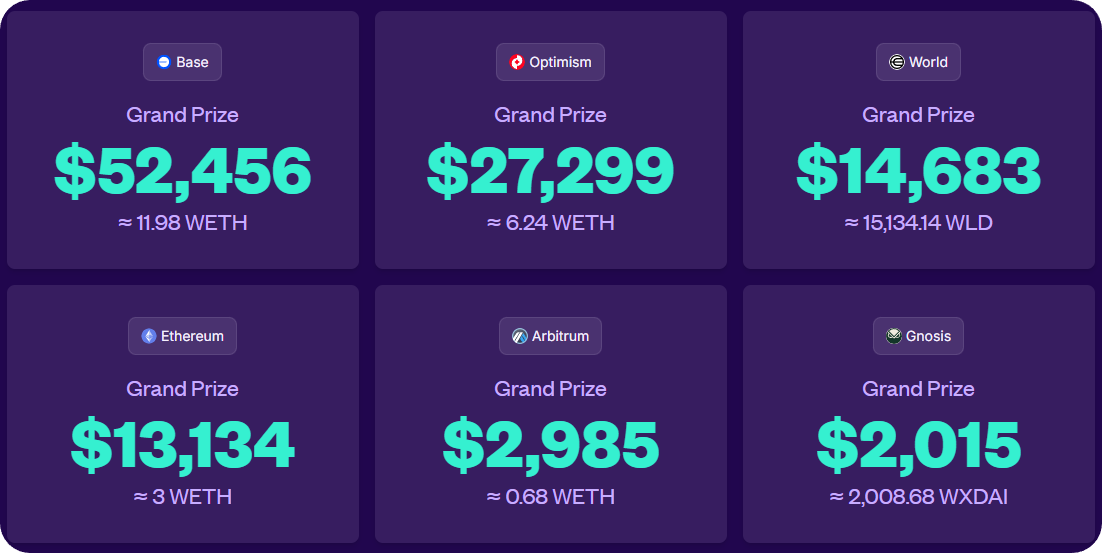

Whichever interface you choose, go there and connect your wallet and then start reviewing the available prize vaults. For instance, as you can see in the screenshot above, the biggest prizes on Cabana right now are on Base ($52k) and Optimism ($27k), so you might start with vaults on these chains.

The UX flow will be slightly different from platform to platform, but generally you'll be looking for a "Deposit" button once you find a vault that you like.

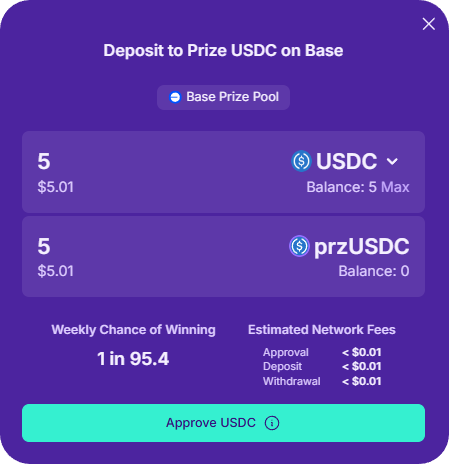

Clicking in will bring you to a UI where you can input the amount of funds you want to deposit. Here, Cabana also shows what your weekly chances of winning are, which is nice. Then just approve your spending token (e.g. USDC) and confirm your deposit, and boom! You'll be entered into the prize draws.

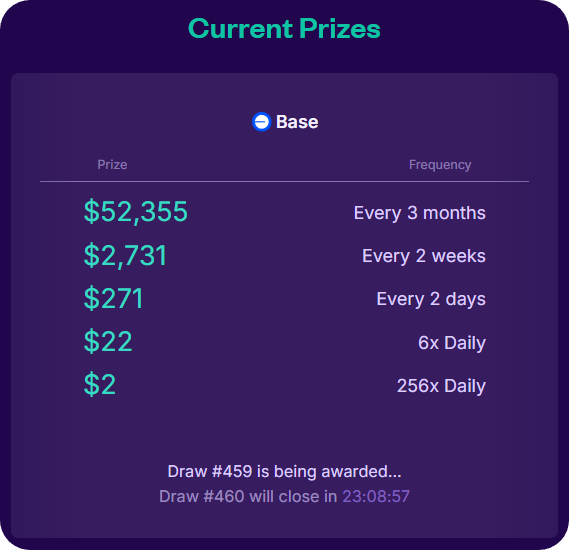

Of course, don't expect huge instant wins. Currently, Cabana estimates that on Base $2 will be won 256 times daily while the grand prize—$52k at the moment—can be expected every three months.

Yet if you're like me and you have some idle funds that you'd like to be able to access fully later, PoolTogether is a great place to maintain your money while potentially winning big.

And keep in mind that you don't have to get lucky and win the grand prize to still stack earnings here. Winning a lot of the smaller prizes with much better odds can definitely add up over time.

A simple playbook is to slap some stablecoins in here and set a monthly check-in to rebalance or withdraw. If you win big, great! If not, you’ve still kept liquidity and avoided the do-nothing drag. That upside skew is why PoolTogether is worth another look if you haven’t jumped in yet.

Unichain offers the most liquid Uniswap v4 deployment on any L2 – giving you better prices, less slippage, and smoother swaps on top trading pairs. All on a fast, low-cost, and fully transparent network. Start swapping on Unichain today.

What if everything you thought about the dollar was wrong?

Monetary historian Jeff Snider joins Bankless to deliver a radical thesis: the Federal Reserve doesn't control the U.S. dollar; a sprawling offshore system of interbank ledger money does. This hidden network, known as the Eurodollar system, is the real engine of global finance, and it’s been breaking down for over 15 years.

In this episode, we unpack how Eurodollars work, why the Fed lost control, the eerie similarities between stablecoins and shadow banking, and why Jeff sees a “Silent Depression,” masked by asset booms but driven by deflationary forces.

If you’ve been bullish on crypto because of debasement fears, Jeff’s counter-narrative might challenge everything you believe.

Listen to the full episode 👇