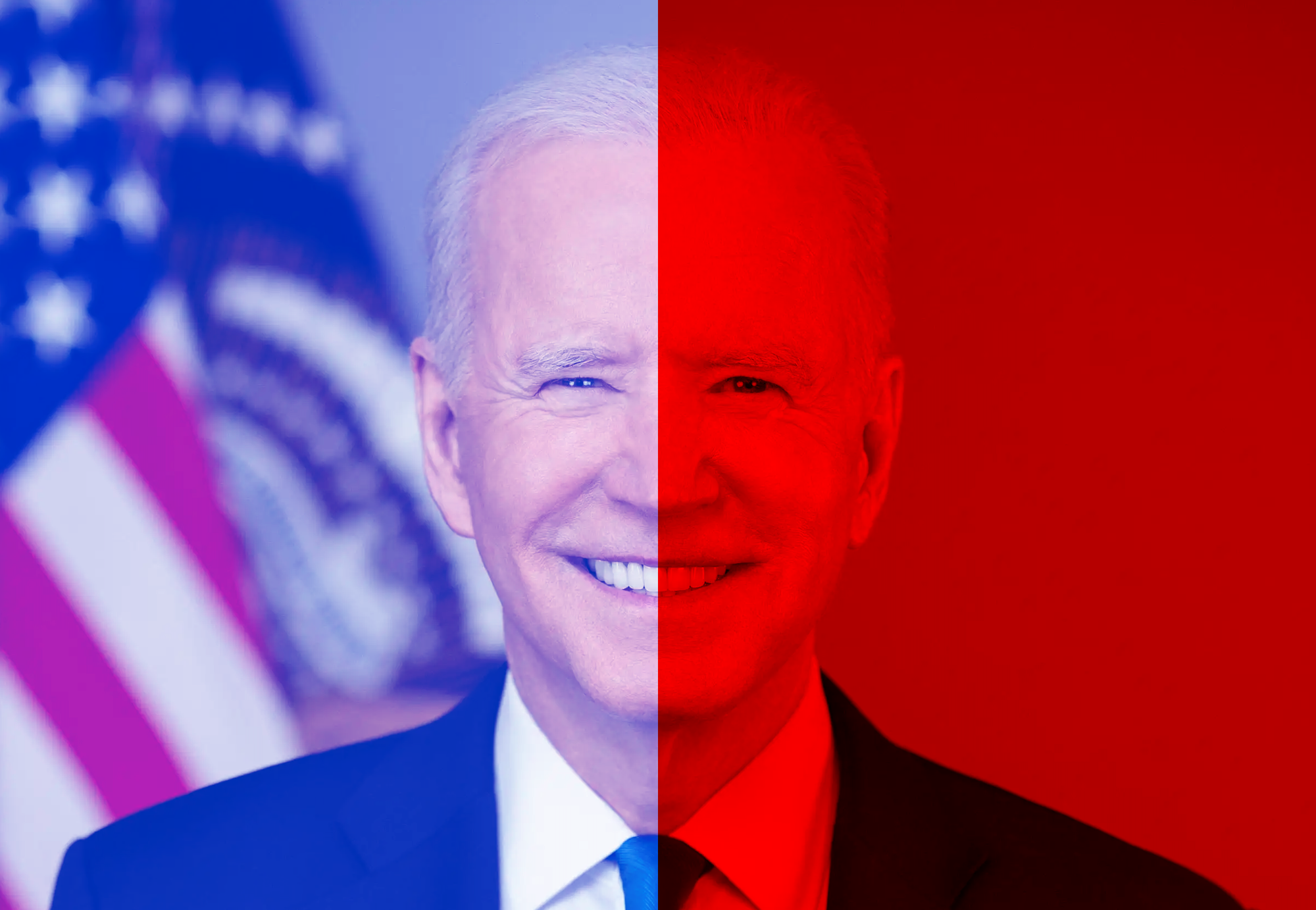

Which Way Joe?

President Biden's campaign has reportedly changed its tune towards crypto, starting outreach to the industry two weeks ago for guidance on policy, according to a new report from The Block.

What's the scoop?

- Significant Shift: The Block's sources said they have seen a noticeable change in tone from the Biden administration towards digital assets recently, reflecting a new willingness to understand the industry. This, of course, follows backlash around the administration's highly publicized plan to veto the repeal of a controversial crypto bill, SAB 121, and the political influence on the ETH ETF’s approval.

- Campaign Competition: The change comes after the Trump campaign's recent pro-crypto announcements, including accepting crypto donations, voicing opposition towards central bank digital currencies (CBDCs), and stating he would commute Silk Road founder Ross Ulbricht’s sentence, which the industry views as gravely unjust.

- Impending Decision: Biden has until June 3 to veto or sign a resolution overturning the SEC's SAB 121. The resolution passed both the House and Senate despite a veto threat from the White House.

Bankless Take:

With the 2024 presidential race heating up, both campaigns have begun competing for an electoral edge through crypto. This shift could signal that a more balanced approach lies on the horizon for crypto regulation. Most notably, the Biden administration's recent outreach suggests a potential change in its stance on SAB 121, possibly leading Biden to reconsider his veto threat. Especially since his initial strong language suggested swift action, which has not yet occurred. If the administration ends up changing its stance, it could go a long way to overcoming industry skepticism towards the Biden administration and reshape power dynamics around the SEC without an administration change.