Which Crypto Tokens Have Strong Fundamentals?

While narrative and sentiment certainly play a huge role in short-term price action for tokens, this cycle’s tides seem to be shifting back to fundamentals.

Consensus has formed around the fact that the upside for many of the most hyped token drops was already captured long ago when VCs signed their token warrant deals. This building disillusionment, with multiple tokens launching with fully-diluted values (FDVs) above $10B, has been a driving force in the rise of memecoins this cycle. While memecoins may only have value as long as they capture attention, at least they don’t have swaths of tokens squirreled away to be dumped on the market at later dates.

In the past month, older, revenue-generating protocols with most of their tokens already in circulation have also caught a bid. While this may be partially due to the inflow of institutional interest this cycle, there's value in keeping a close eye on tokens with solid fundamentals, whether they be revenue-generating, have most of their tokens unlocked, or, ideally, have both of those properties.

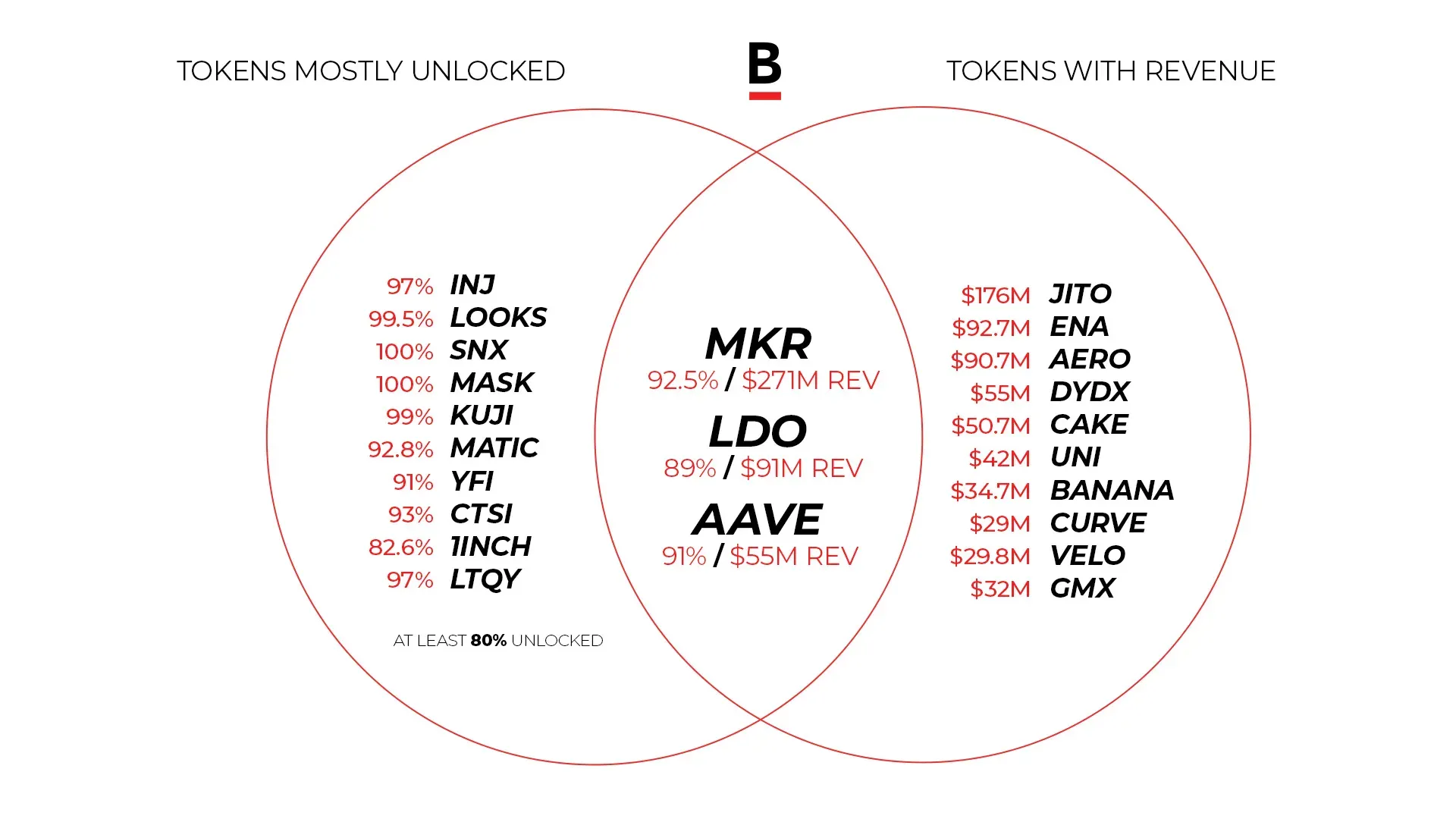

This article will do just that, mapping out protocols and their tokens in all three categories to identify which may attract fundamental-focused investors. This list of 23 tokens is far from exhaustive, but we think there's still plenty of value below. 👇

🔴 Revenue-Generating & Mostly Unlocked

Let's dig into a few of the most substantial tokens that fit into this bucket. There are others! But these are some of the most-recognized.

▪️ Lido:

The largest liquid staking provider, with 29% of the total market share, Lido Finance has remained a key player in the Ethereum staking ecosystem. Over the past year, it generated $91M in revenue, with 100% of its tokens unlocked, 89% of which are in circulation.

While its market share had declined since 2023, when it staked one of every three ETH, its recent launch of the Lido Alliance, an initiative focused on making stETH a cornerstone of restaking, returned it to center stage. Symbiotic, a multi-asset restaking protocol backed by Lido’s founders and part of the Lido Alliance, and Mellow Finance, a stETH-centric restaking service also part of the Lido Alliance, have restored momentum to Lido staking, returning deposits to an uptrend after its peak and subsequent decline from February through May — in turn boosting the protocol’s revenue. Lido earns its keep by charging a 10% fee on staking rewards, which it keeps half. Lido is up 21% over the past week.

▪️ MakerDAO:

Established in 2014, MakerDAO, the lending protocol and issuer of decentralized stablecoin DAI, has earned $271M in revenue over the past year, with 92.5% of its supply unlocked and in circulation.

Over the past year, Maker has doubled down on its integration of RWAs, opening vaults for minting DAI against U.S. Treasuries and allocating funds from its treasury to the purchase of U.S. Treasuries and corporate bonds — an investment which has paid off handsomely, generating at times half of its total revenue. Currently, MakerDAO's RWA holdings exceed $2.2B. To expand on this, they have also announced the Spark Tokenization Grand Prix, an open competition to invest $1B in tokenized U.S. Treasury products, for which BlackRock, Securitize, and Ondo have all expressed their interest in participating. This will further increase their revenue, which they generate from borrowing fees, liquidation fees, and, of course, RWA deposits and holdings. Maker is up ~25% over this past week.

MKR is the most under appreciated token in crypto but will not be for long

— Vance Spencer (@pythianism) July 15, 2024

- Captures nearly 40% of all DeFi profits on Ethereum

- #3 crypto app in revenue behind ETH, SOL

- Largest holdings of RWAs of any protocol, Blackrock et al competing for allocation of portfolio

- Trades… pic.twitter.com/oJLTCH6Jlx

▪️ Aave:

Over the past year, Aave, crypto’s largest decentralized lending market, has earned $55M in revenue, with 91% of its tokens unlocked, 93% of which are currently in circulation.

Beyond having $13.7B in TVL, Aave’s codebase also accounts for 75% of the value in DeFi lending protocols, meaning many other protocols have forked or incorporated its code into their projects. In May, Aave unveiled its plans to launch its v4 within three years, featuring a unified cross-chain liquidity layer powered by Chainlink’s Cross-Chain Interoperability Protocol (CCIP). This will allow borrowers to access instant liquidity across all supported networks, scaling Aave into a fully cross-chain liquidity protocol. Further, it plans to launch the Aave Network chain, which will serve as the hub for the protocol and its GHO stablecoin. Like Maker, Aave generates revenue in multiple manners, from borrower interest, liquidation and flash loan — (loans repaid within one transaction block) — fees, depositor interest, and through GHO, for which all interest payments are paid directly to the Aave DAO treasury. Aave is up ~10% over the past week.

Introducing Aave 2030 pic.twitter.com/ZncA5YqHaT

— Aave Labs (@aave) May 1, 2024

⭕️ Just Revenue-Generating

Several projects, both new and old, have netted substantial revenue over the past year by bringing the market novelty or carving out their own specific niche. These include:

- Jito (JTO): Besides capturing nearly half of Solana’s LST market share, the liquid staking protocol with MEV-boosted rewards has produced $176M in revenue over the past year.

- Ethena (ENA): Despite only launching at the end of February this year, Ethena, the Ethereum-based protocol behind the delta-hedged stablecoin, USDe, has already generated $92.7M.

- Aerodrome (AERO): Launched by Velodrome’s team in 2023, the top DEX on Base has earned $90.7M in revenue over the past year, fueled by the L2’s success.

- dYdX (DYDX): Operating on its own chain, dYdX, a non-custodial trading and derivatives protocol, generated $55M in revenue over the past year.

- Pancake Swap (CAKE): BSC’s favorite DEX, originally forked by Uniswap and launched by an anon team in 2020, yielded $50.7M in revenue over the past 365 days.

- Uniswap (UNI): The EVM’s largest and most popular DEX deployed across 11 chains has generated ~$42M in the past year.

- Banana Gun (BANANA): This past year, the popular Telegram trading bot available on Ethereum, Blast, Base, and Solana made $34.7M in revenue.

- Curve Finance (CURVE): Despite its recent issues, the DeFi staple for trading stables has brought in $29M in revenue within the past year.

- Velodrome (VELO): Launched by members of veDAO, originally a next-gen DEX on Fantom, Velodrome is a DEX operating primarily on Optimism, which has raked in $29.8M in revenue over the past year.

- GMX (GMX): The most popular perps DEX on Arbitrum and Avalanche, GMX netted $32M in revenue over the past year.

Back again to look at DEX figures, this time with a focus on @aerodromefi which just hit $1 bil FDV today!!

— cookies 🍪 (@jinglingcookies) March 25, 2024

1. Total Value Locked (TVL)

- TVL hit an inflection point towards the end of Feb 2024, increasing significantly throughout March

2. Trading Volume

- Spiked on 27th Feb… pic.twitter.com/LPGZmYFNki

⭕️ Mostly Unlocked Supply

As the industry continues to mature, more protocols complete their token vesting schedules, releasing most of, or in some cases all, their supply into the open market. Projects in this category include:

- Injective (INJ): A Cosmos-based L1 for DeFi, Injective boasts unique primitives like a fully decentralized MEV-resistant orderbook and has 100% of its supply unlocked and 97% in circulation.

- LooksRare (LOOKS): The anon-founded NFT marketplace known for rewarding active users with LOOKS and WETH and supporting creator royalties is 100% unlocked with 99.5% in circulation.

- Synthetix (SNX): Founded in 2017, Synthetix is a decentralized derivatives exchange protocol on Ethereum that recently ended inflation and switched to a deflationary model with buybacks and burns. Its token is 100% unlocked, with 99.8% in circulation.

- Mask Network (MASK): A browser extension focused on bridging Web 2.0 and Web 3.0, Mask integrates dApps into traditional social networks and has its token 100% unlocked with 100% in circulation.

- Kujira (KUJI): A Terra collapse survivor, Kujira spun out into its own Cosmos-based L1 which has matured into its own full-fledged ecosystem, and has 100% of its supply unlocked with 99% in circulation.

- Polygon (MATIC): One of the first ETH L2s, Polygon not only has a suite for scaling Ethereum, but is 100% unlocked with 92.8% of its token circulating.

- Yearn (YFI): A product of 2020’s DeFi Summer, Yearn is a decentralized suite of yield products with 99.9% of its token unlocked with 91% in circulation.

- Cartesi (CTSI): Cartesi, an app-specific rollup protocol that uses a virtual machine running Linux is 93% unlocked with 82% in circulation.

- 1inch (1INCH): A leading EVM DEX aggregator, 1inch’s token is 86% unlocked with 82.6% in circulation.

- Liquity (LQTY): A decentralized borrowing protocol with 0% interest loans against ETH collateral, Liquity has 97% of its supply unlocked with 96.3% in circulation.

Launching at a high FDV meta is completely over with majority of assets bleeding 70-80% since TGE.

— McKenna (@Crypto_McKenna) July 5, 2024

Bitcoin and Ethereum were so successful because earlier buyers were massively rewarded and created a cult like following. How the market operates right now is exactly the inverse…

Fundamentals Szn?

While still early, this recent uptrend for blue-chip DeFi protocols with substantial revenue and the majority of their supply in circulation may signal a shift from hype-driven narratives to a focus on fundamental metrics, partly responding to this cycle’s disillusionment with outrageous launch-FDVs.

With the influence of institutional investors this cycle and their traditional processes of evaluation, protocols with solid fundamentals may see substantial returns as this bull run continues, making the industry more mature and thus increasing its longevity.