Which Blockchains Actually Make Money? ($)

View in Browser

Sponsor: Cartesi — build app-specific rollups with Web2 tooling without the constraints of Web3!

- 🇺🇸 Trump Campaign Scores Millions from Crypto Donors. Trump banked over $21 million in donations from crypto donors tied to his Bitcoin 2024 appearance.

Read more on Bankless.com - 🎰 DraftKings Kills Off NFT Business. The sports betting platform discontinues Reignmakers product and marketplace over legal concerns.

Read more on Bankless.com - 🇷🇺 Russia Legalizes Crypto Mining. The Duma passed a law to fully legalize crypto mining starting in November.

Read more on Bankless.com

📸 Daily Market Snapshot: Bitcoin fell below $65K Wednesday as traders dealt with political uncertainty. Tensions flared across the Middle East following the assassination of the leader of Hamas in Tehran. Meanwhile, polls began showing that Harris had already reversed Trump's momentum in swing states.

| Prices as of 6pm ET | 24hr | 7d |

|

Crypto $2.33T | ↘1.7% | ↘2.1% |

|

BTC $64,939 | ↘2.0% | ↘1.1% |

|

ETH $3,236 | ↘1.4% | ↘3.1% |

|

AAVE $109.02 | ↗4.0% | ↗20.3% |

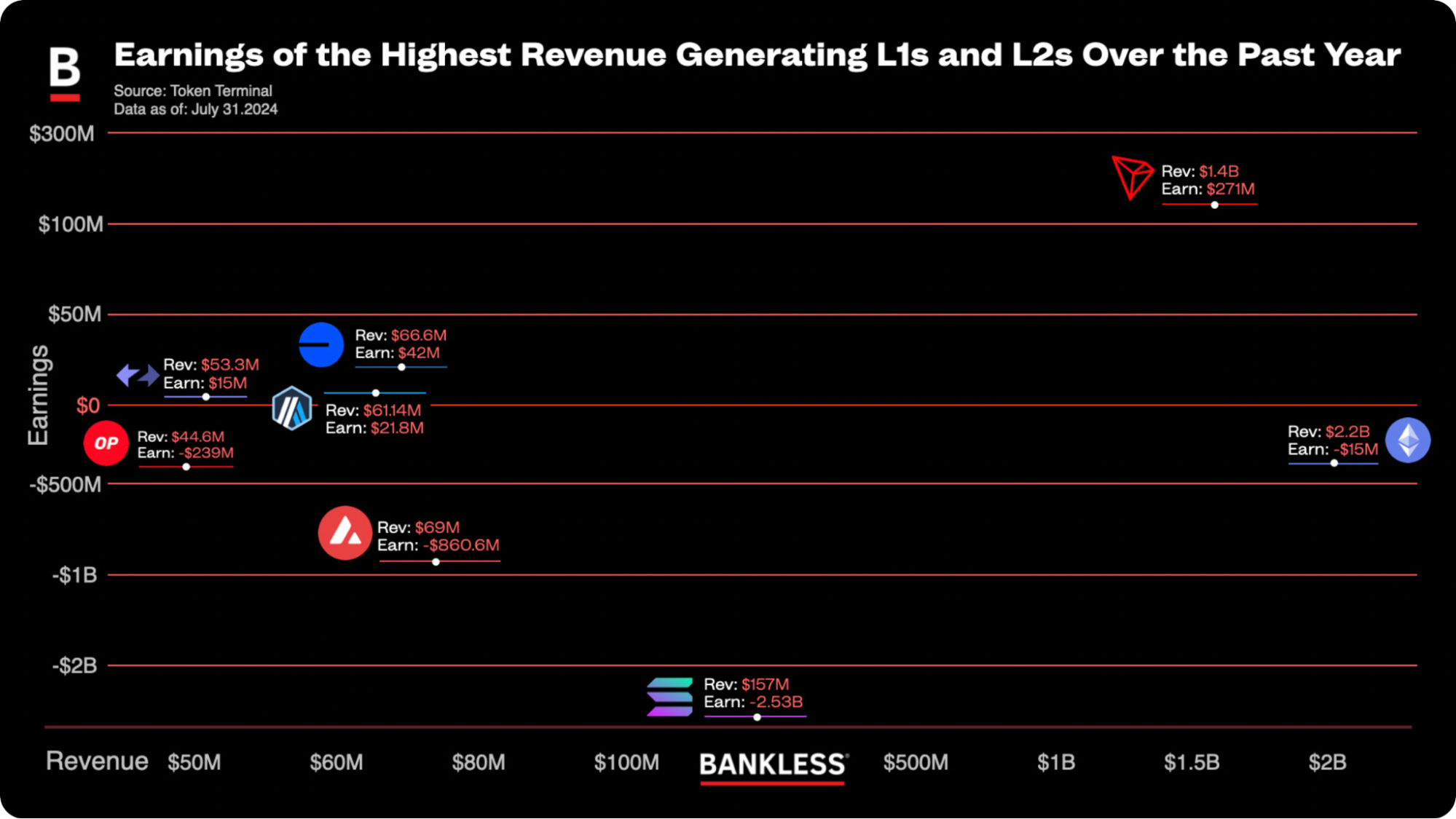

Two weeks ago, we wrote about the protocols with strong fundamentals, such as outsized revenue or token supply, that were showing promise amid the latest wave of price appreciation. Now, we're taking that same fundamentals-driven approach to dive deeper into L1s and L2s.

Whether it's the influx of institutional investment or the general disillusionment with high-FDV token launches, the recent surge presents a potential opportunity to take a closer look at the fundamentals of blockchains overall.

Today, we’ll explore just this, analyzing the top 4 L1s and L2s by revenue before delving deeper to explore just how much, if any, of the revenues that these blockchains actually keep 👇

Cartesi has a challenge for all talented devs! Try to hack their Honeypot dApp. Compete in a bug-bounty initiative to test, scrutinize, and refine the underlying code of Cartesi Rollups!

China is decoupling from the Dollar. Are we on the brink of using the yuan as the new global currency, or will crypto take the spotlight?

We’ve explored crypto’s role in disrupting the global monetary order before, but there’s another force that’s going to have just as much of an impact... China!

What does it look like when the world’s second-largest economy de-dollarizes? That’s what we explore on today’s episode with China expert and economist Diana Choyleva.

Hear all of the analysis! 👇