Where Will FTX Contagion Spread Next?

Dear Bankless nation,

Here’s a recap of the biggest crypto news in the third week of November.

1. FTX drama continued

When a financial catastrophe like FTX happens, its figureheads typically fade out of the public eye.

Not SBF. The now-vilified man fired off a series of cryptic tweets with no meaning, adding fuel to the still-raging flames from last week.

FTX Insider shares a message from the company Slack pic.twitter.com/vnQqDJzC86

— Autism Capital 🧩 (@AutismCapital) November 15, 2022

It gets worse. A Vox journalist leaked her private correspondences with SBF where he brazenly admitted that his regulatory activities were “just PR” and regulators “don’t protect customers at all” (he reverts on this stance in a later tweet). He also claimed that filing bankruptcy was his “biggest single fuckup” and that “everything would be ~70% fixed right now if i hadn’t”.

FTX’s bankruptcy filings are also revealing the company’s day-to-day operations to be completely haphazard.

Alameda Research was giving personal loans to SBF ($1B) and Director of Engineering Nishad Singh ($543M), records of payments or even employees hired weren’t properly kept, corporate funds were used to purchase real estate assets, there was no formal management system in place to keep track of cash flows, regular board meetings never took place and perhaps the worse: customer deposits into FTX weren’t recorded on any balance sheet. You can read the full document here.

I just read FTX's Chapter 11 First Day Affidavit.

— jonwu.eth (@jonwu_) November 17, 2022

In it, the appointed restructuring CEO John Jay Ray III, who oversaw Enron's bankruptcy proceedings, calls FTX's case the worst of his career.

Its contents are shocking.

Here are the highlights:

👇

The WSJ reports that $300M of a $420M sum fundraised last October went directly to SBF, who then sold his personal stake.

FTX’s newly appointed CEO John Ray who previously oversaw the restructuring of Enron has this to say:

Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here. From compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals, this situation is unprecedented.

Am I reading this correctly? FTX's coded it's auto liquidation protocol to exempt Alameda from being liquidated? pic.twitter.com/upEsOVg9oD

— Steven (@Dogetoshi) November 17, 2022

The real surprise is that FTX went on for as long as it did.

2. Genesis Halts Withdrawals

FTX invested into almost every corner of the industry and the contagion from its collapse has only just begun to reveal itself.

Genesis Trading reported on 11 November that though they had ~$175M locked in FTX, that loss doesn’t impact their active operations. Yet, just five days later, Genesis suspended withdrawals. According to its official website, Genesis has $2.8B in total active loans as of Q3 2022.

Genesis is owned by Digital Currency Group (DCG), who also owns CoinDesk, the largest crypto fund Grayscale, the Luno exchange and crypto-mining provider Foundry Digital.

At present, Grayscale is distancing itself from Genesis, citing no exposure to Genesis and that all its Grayscale products are safe. Cathie Wood of Ark Investment reportedly purchased 315,259 shares of Grayscale’s GBTC fund, which is currently trading at the largest ever discount (~43%) relative to Bitcoin.

In the wake of recent events, our investors should know that the safety and security of the holdings underlying Grayscale digital asset products are unaffected. 🧵

— Grayscale (@Grayscale) November 16, 2022

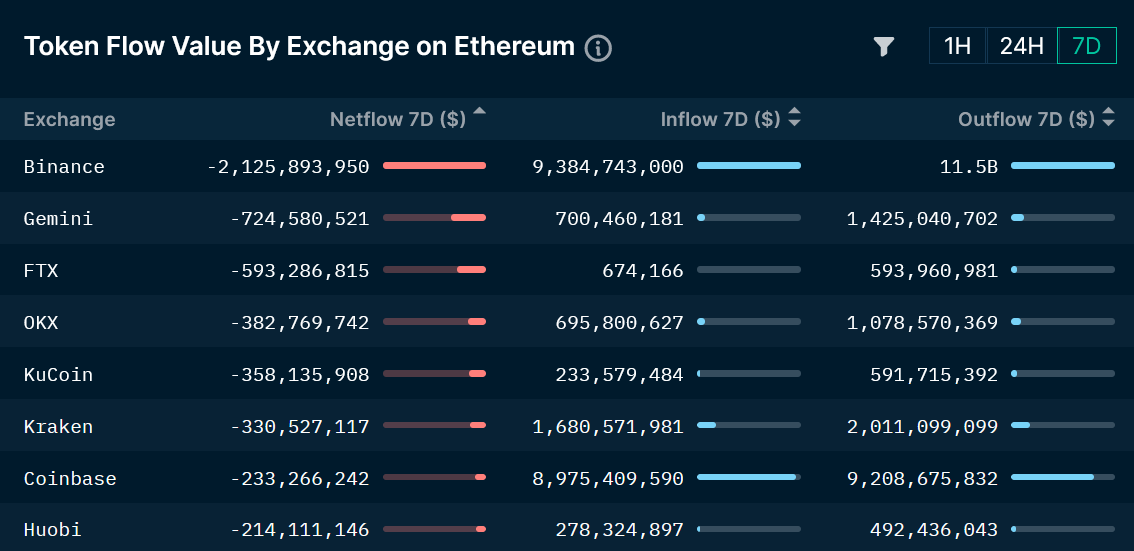

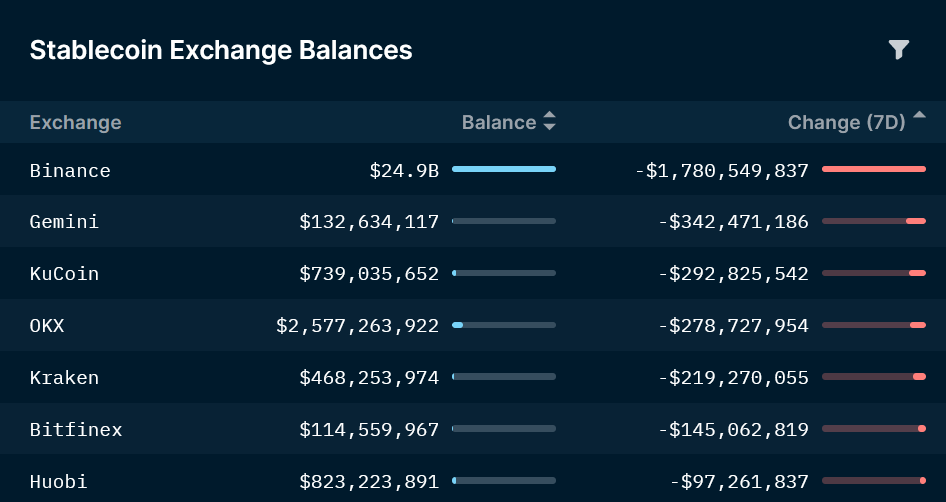

Genesis’s withdrawal halt has also directly impacted the Gemini exchange, a partner in the Gemini Earn program. In response, Gemini has paused Earn, leading to a rush in outflows on Gemini’s exchange. Nansen data shows Gemini having the second highest net outflows of all exchanges for both Ethereum tokens and stablecoins in the past seven days.

The contagion elsewhere:

- Crypto lender BlockFi who had a $400M from FTX US also halted withdrawals last week and are rumored to be filing bankruptcy.

- Galois Capital had 50% of its capital ($100M) on FTX

- Multicoin Lost More Than Half Its Crypto Fund’s Capital This Month

- Circle’s yield product APY has been reduced to 0%

- Binance US is bidding for bankrupt lender Voyager, previously won by FTX

- Binance halts Solana-based USDC and USDT deposits

- Tether conducts a $1B USDT chain swap from Solana to Ethereum

3. Redemption Arc

When’s the best time to apologize and seek forgiveness if you’ve previously lost millions in dollars of investors money? When people’s anger is focused on something else of course.

Emerging out the woodwork this past week was the disgraced founders of Three Arrows Capital who lost billions of dollars in investor money.

There I was, surfing the wave of waves, next moment wiped out, board broken, rocks reefs everywhere

— Zhu Su 🔺 (@zhusu) November 9, 2022

The sudden pain of business failure and loss of purpose, as a golden child of the industry + biz cycle more broadly, was as difficult as the ensuing ostracization and demonization

The universe works in mysterious ways. Over the past year, I’ve seen the highest high and lowest low of my life. I know many reading this have as well.

— Kyle Davies 🔺 (@KyleLDavies) November 13, 2022

Humanity, community, happiness are worth it. Love.

The Luna Foundation Guard also took this opportune time to release a report by a third-party auditor that proves all efforts that could be taken to defend UST’s peg were taken, and there were no embezzlement or misuse of funds.

1/ Today, LFG releases the technical audit report conducted by JS Held, an experienced third-party auditing firm, providing full transparency into the trading, blockchain records, and efforts of LFG and TFL to defend the price of TerraUSD ($UST) between May 8th & May 12th, 2022.

— LFG | Luna Foundation Guard (@LFG_org) November 16, 2022

4. Bankless news

Bankless is launching podcast collectibles! These are limited edition NFTs for the 100 true fans of Bankless’s most iconic podcast episodes. The first collectible was released this past Friday for the SBF vs Erik Voorhees debate that we hosted just two weeks ago, with 100% of proceeds going to CoinCenter. See here for full details.

We’re also kicking off Permissionless 2023 in Austin, Texas September 11-13!

Yeehaw, anons: @Permissionless 2023 is coming to Austin 🤠

— Bankmanless (@BanklessHQ) November 18, 2022

The best conference in crypto for builders and investors alike is back for more, and we can’t wait to see you there.

250 tickets open every two weeks, prices going up with every unlock.

LFG 👉 https://t.co/YzEpxxH6G2 pic.twitter.com/8jtVqyujFw

Premium Bankless subscribers can enjoy a 30% discount code here. Prices start at $199 and increase every two weeks. Don’t wait.

5. Cosmos says no to Atom 2.0

Cosmos’ ATOM 2.0 governance proposal offers to overhaul the Cosmos ecosystem into one that puts ATOM at the centre of its universe. I’ve written about it previously in Here Comes Cosmos 2.0.

That governance proposal was surprisingly shot down this week with ~37% vetoing the proposal against ~48% in favor, and ~13% abstaining.

General sentiment among vetoers in the Cosmos community felt that the Cosmos 2.0 white paper was lacking in details, lacked risk analysis and needed further deliberation.

We voted NoWithVeto on Prop 82.

— Takumi Asano (朝野巧己)| GAME ⚛️ | (@takumiasano_jp) November 14, 2022

The reasons are as follows. pic.twitter.com/Khh92jgjXQ

The discussions on Proposal #82 on the Cosmos Hub are heating up. Current "NoWithVeto" votes are piling up. If it reaches 33.4%, it will be gone for good.

— Tosch ⚛️ (@ToschDev) November 11, 2022

This is my first ever thread, my reasoning to vote "Yes" 🧵 pic.twitter.com/0ICATcMMjF

Instead of drafting a whitepaper in closed circles, let’s have discussions out in the open and see who can make a solid case for minimal changes we can all agree on. We should do this in open forums where we can spend more time deliberating, rather than in chat apps.

— ☀️☀️☀️ Jae Kwon ☀️☀️☀️ (@jaekwon) November 14, 2022

Other news:

- Flashbots open-sources its block builder

- DeFiLlama is launching a Web3 meta-aggregator?

- StarkNet’s STRK token is deployed on Ethereum Mainnet

- FED and big banks launches digital ledger project

- Crypto investors are launching a class-action lawsuit against FTX's Bankman-Fried, Tom Brady, Larry David and other celebrity promoters

- Businesses can now accept USDC with Apple Pay

- Yuga Labs buys Beeple

- Nike launches .Swoosh platform for its digital wearables (on Polygon)

- Sony files patent for NFT and blockchain technology