Where Does Ethereum Go Next?

Dear Bankless Nation,

Last week's Shapella upgrade was pretty huge for Ethereum, but the work to scale the network is still just getting started.

Today, we take a look at where Ethereum is headed post-Shapella.

- Bankless team

Bankless Writer: Donovan Choy

✔️ EIP-1559 done

✔️ Merge done

✔️ Shapella done

It may be a bear market, but that hasn't stopped the Ethereum developer community from shipping.

What’s next on the Ethereum roadmap for the rest of 2023? Enter the EIP-4844 Cancun hardfork and efforts like distributed validator technology and proposer-builder separation. Let's dig in.

1. EIP-4844 Cancun hardfork

EIP-4844 is the next big hard fork – one that aims to tackle Ethereum’s scalability problem. We’ve heard this comparison a million times: Visa processes thousands of transactions per second while Ethereum can manage low double-digit volumes per second at best. The network needs to solve the motherlode of usability problems: scalability.

Today, the scalability problem is eased by rollup chains (Arbitrum, Optimism). The basic idea of how rollups scale Ethereum is that they push the computational burden of processing transactions onto a second layer. When that’s done, they post the transaction data back onto the underlying Layer-1 Beacon chain for consensus and storage.

Unfortunately, rollups are only an interim solution that are still too expensive and slow. That’s no fault of rollups – it’s largely due to the design architecture of the underlying Layer-1 chain. The fastest rollups still have to submit a ton of data to build consensus on the Layer-1 chain, which lacks the space to store it freely. Moreover, it places a heavy burden on nodes to download this data – an estimated 95% of transaction fees on rollups are just for posting data costs.

That takes us to EIP-4844. Named after Ethereum researcher Dankrad Feist, EIP-4844 is the “proto-danksharding” proposal that aims to supercharge the speed and costs of using rollups. In Dankrad’s words, it’s an afterburner for rollups. Proto-danksharding is an early precursor to full danksharding that is still years away on the Ethereum roadmap, hence the "proto" prefix. But even this early proposal promises great changes for Ethereum.

EIP-4844 splits the blockchain network into different databases, which increase the space (a whole new data availability layer) for millions more transactions on Ethereum. This splitting is known as “sharding”. Simply explained, sharding is akin to adding lanes onto the congested highway that is the current Ethereum network. Hence why EIP-4844 folds into the stage of Ethereum’s roadmap once known as the “Surge”.

Updated roadmap diagram! pic.twitter.com/MT9BKgYcJH

— vitalik.eth (@VitalikButerin) November 4, 2022

When proto-danksharding is said and done, Ethereum blocks can store 1-2 megabytes of data (current capacity 50-100 kilobytes), significantly reducing the costs of using rollups by an estimated 20x (full danksharding will allow blocks to carry 16-32 megabytes eventually. For a fuller discussion, watch the 📺 Bankless podcast with Vitalik and Dankrad).

With the increased space from danksharding, there is more space for “blob-carrying transactions”, a new transaction type which is retained in Beacon chain nodes for a limited time of weeks or months. During that time, node validators employ a nifty technique known as “data availability sampling” that randomly samples parts of the data blobs for verification without actually having to download all the data.

Why is EIP-4844 a big deal? Ethereum rollups (as they currently work) are unusable for use cases like games or social media that require a higher transaction load. But builders can't wait, so they've found ways to scale by compromising on decentralization, as we've seen in most crypto games and sidechain bridge designs. EIP-4844 is the unlock to fully on-chain use cases, with the potential to usher in a wave of builder innovation.

When will proto-danksharding be complete? At present, we know that EIP-4844 is scheduled for sometime in Q3-Q4 2023. But as with most huge Ethereum network upgrades, expect it to be subject to potential delays.

2. Distributed validator technology

Another key technical innovation to look out for in Ethereum’s near-term future is the rise of distributed validator technology (DVT), an area of research that the Ethereum foundation has explored since 2019.

Today, operating an Ethereum node is a technically burdensome solo venture that requires the operator to solo stake 32 ETH. Node operators can reduce the burden and opt to stake it via Coinbase or Lido, but these alternatives make a critical decentralization tradeoff.

DVT is an attempt to make node validation easy without sacrificing decentralization. It does so by enabling a kind of independent "squad staking". Rather than staking 32 ETH alone, a group of friends can collectively stake different amounts of ETH and run a node. This is achieved through multi-party computation (MPC), which lets a group of individuals share one private key like a multisig and run a “distributed validator” together.

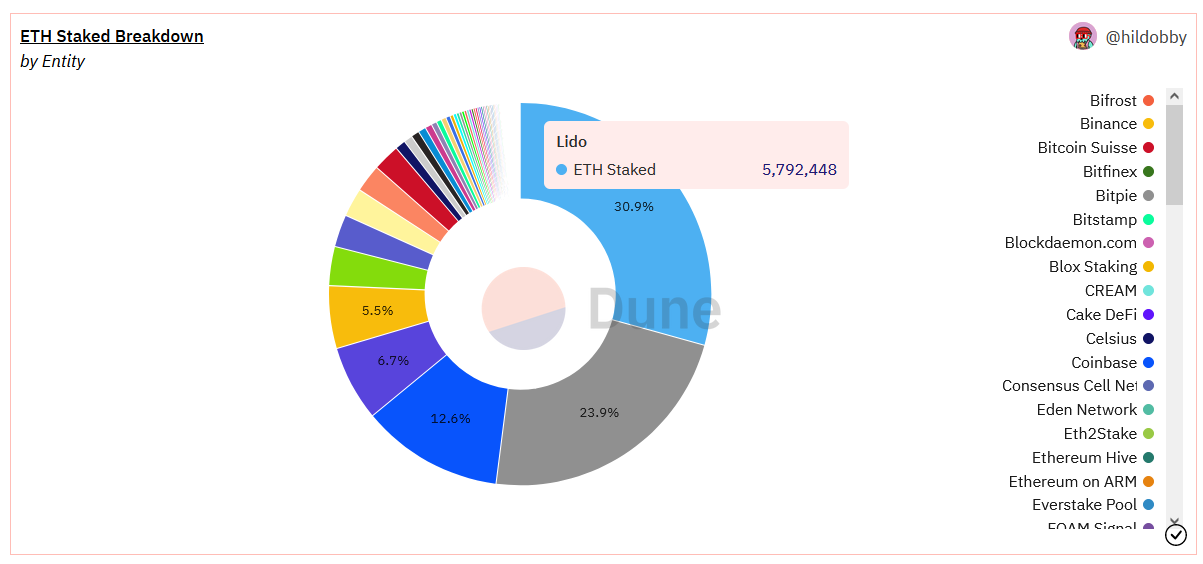

DVT decentralizes the cost of solo staking by reducing the financial barrier for individuals or small DAOs to participate as a validator on Ethereum. This could go a long way in reducing the market concentration of ETH staking that has accumulated today in Lido and centralized exchanges.

DVT also makes node validation an overall more robust process. Distributed validators operating the same node can stand in for one another when there is hardware malfunction. And just like a multisig, shared private keys through DVT make it harder for attackers to exploit.

DVT is not available for public use just yet, but companies like Obol are just now starting to test deployment on mainnet, and will likely be ready by Q3 2023. For more on DVT, check out companies like RockX, SafeStake and ssv.network.

3. Proposer-builder separation

The word "decentralization" is thrown around a lot in crypto but the open secret is that most blockchains are anything but so.

One major centralization vector on the Ethereum protocol layer lies in how blocks are built. When we submit transactions on our wallets, they enter a sea of pending transactions in a memory pool (mempool). Block validators (miners in PoW, stakers in PoS) with a birds-eye-view of this mempool, spotted a profit opportunity and started selling priority access to block building in an underground bribery market to arbitrage bots (searchers).

These kinds of value extraction techniques are known as maximal-extractable-value (MEV) attacks. They are largely hidden from the everyday user, but remain an existential threat to the decentralization ethos of Ethereum, with block miners having extracted an estimated $676 million pre-Merge.

Proposer-builder separation (PBS) is the Ethereum development community's answer to that problem. As its name suggests, PBS aims to create a division of labour between two crucial tasks of blockbuilding: proposing a block, and building it. By doing so, block validators are stripped of their ability to discriminate between individual transactions, as the contents of a block is not decided by the same entity who eventually builds it on-chain (for more on this, see Bankless's A Beginner's Guide to Ethereum Censorship).

PBS will not be ready by 2023, and likely won't happen for another two years. Until then, third-party solutions like Flashbots' MEV-Boost have emerged to mitigate this problem in the meantime by creating an open free market in blockbuilding.

Zooming out

Ethereum is now fully proof-of-stake. With the Merge and Shapella out of the way, the Ethereum community can move on to its other problems: lack of scalability, capital inefficiency and block validator centralization.

EIP-4844, distributed validator technology and proposer-builder separation are just some of the big solutions to keep your eyes peeled for.

Action steps

- 📺 Check out the Bankless podcast with Vitalik and Dankrad on danksharding