Friendly Forks, Fresh Yields: What's New in Liquity V2

Liquity, the decentralized borrowing protocol, launched its V2 platform on Ethereum this month. The V2 offers new borrowing and earning opportunities and could mark the start of a new era of "friendly forks" in DeFi.

Let's catch you up with a quickstart primer...

What's New?

With its minimized governance and its ETH-only collateral policy, Liquity V1 and its $LUSD stablecoin were bastions of decentralization in DeFi.

The goal with the V2 system, then, is to expand upon this solid foundation toward more flexible and more profitable ends.

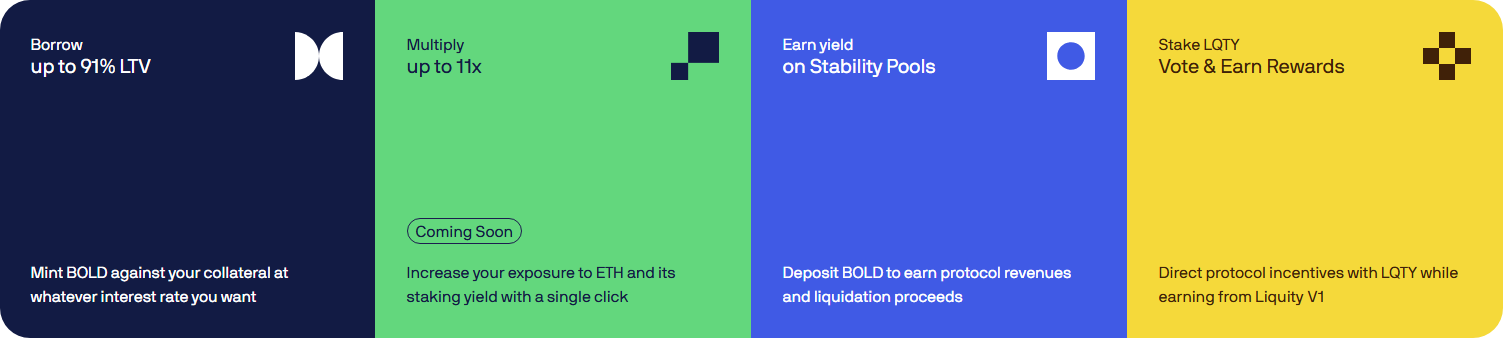

For starters, V2 supports ETH and popular liquid staking tokens like rETH and wstETH, while its new $BOLD stablecoin—which is always redeemable for $1 of collateral—is the keystone of the protocol's flywheel design.

Here, the wheel starts when users deposit ETH or LSTs as collateral and borrow $BOLD. Unlike V1’s one-time fee, borrowers in V2 set their own ongoing interest rates. Lower rates = higher risk, while higher rates reduce redemption risk.

The ensuing interest payments from borrowers are continuously collected in $BOLD. At this point:

- 75% of the interest revenue goes to depositors in the Stability Pools, who supply $BOLD to absorb liquidations. Note, depositors also earn from the distribution of collateral seized from these liquidations.

- 25% of the interest revenue is allocated to liquidity providers on external decentralized exchanges, e.g. Uniswap or Curve, as Protocol Incentivized Liquidity (PIL) for fostering $BOLD liquidity across DeFi.

Going back to the Stability Pools, liquidations remove "cheap" debt, forcing up interest rates and increasing yield for Stability Pool depositors. This dynamic boosts demand for $BOLD as access to this yield, which in turn helps stabilize the stablecoin's $1 USD peg.

All that said, the $BOLD idea is to create a positive feedback loop:

- Borrowers pay interest → Interest rewards depositors and LPs → More demand for BOLD → Peg stability and liquidity → Attracts more borrowers and depositors, etc.

Also, as an NFT aficionado myself, it's worth mentioning that another major change in Liquity V2 is the protocol now represents its borrow positions, a.k.a. Troves, as ERC-721 NFTs similar to how Uniswap V3 LP NFTs work.

This design wrinkle has paved the way for 1) easy management of multiple Troves within a single wallet, and 2) secondary markets for Liquity's borrow positions on NFT marketplaces, e.g. OpenSea.

What About Friendly Forks?

Liquity published its V2 codebase under a Business Source License (BUSL).

Anyone can read the contracts, but to deploy a commercial copy before September 2027 you need a license from the Liquity AG team.

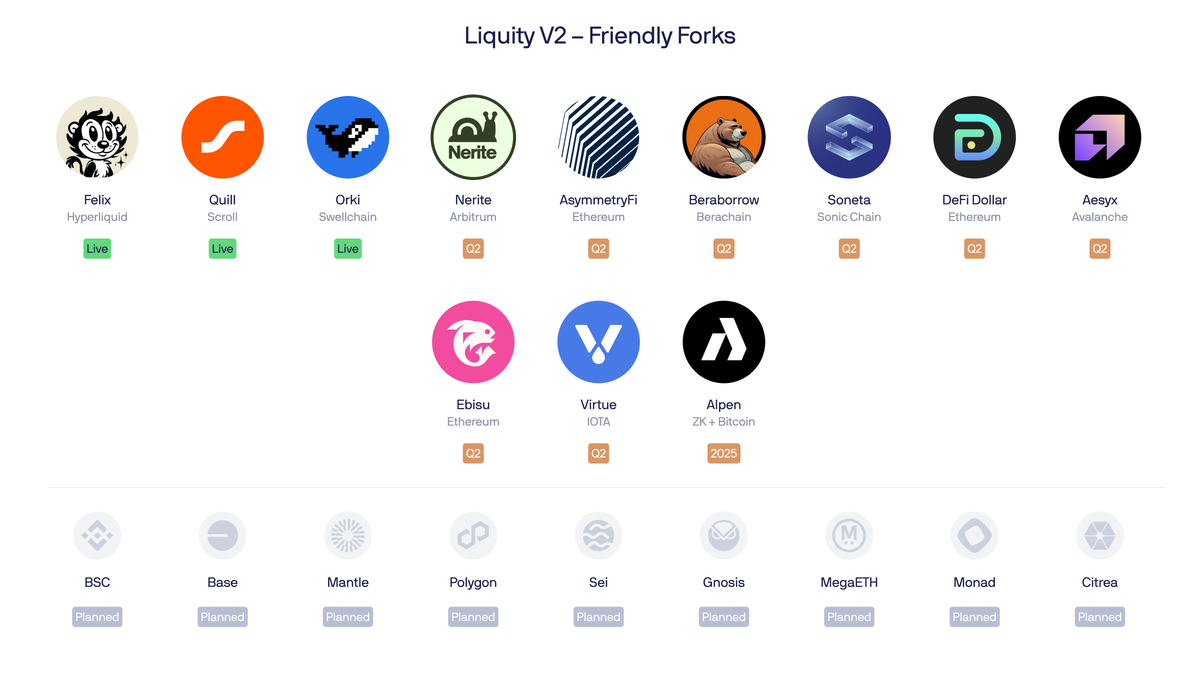

Mind you, Liquity V1 was forked over 30 times. But with V2 the builders have leaned in and created a collaborative “Friendly Fork” program.

Accordingly, +15 teams have already signed up to release their own V2-based stablecoins, e.g. Nerite's $USDN on Arbitrum, Felix's $feUSD on HyperLiquid, Beraborrow's $NECT on Berachain, etc.

Liquity calls this model “forkonomics.” Instead of dozens of unaffiliated clones fighting for scraps, the network effect flows both ways:

- New apps can tap a next-gen stablecoin design and monetize their chain's native assets without begging USDC to bridge in.

- $BOLD users can enjoy airdrop-like opportunities for fresh deployments—early yield on Stability Pools plus extra LP rewards when you seed liquidity against the new fork's dollar.

As for Liquity itself, this fork system facilitates $BOLD demand and a web of integrations without Liquity proper having to stretch beyond Ethereum. If the experiment works, expect future DeFi heavyweights to adapt this “licensed but aligned” playbook for their own projects.

How to Get Started

Right now, there are three main ways you can interact with Liquity V2: borrowing $BOLD, depositing to the Stability Pools, or staking $LQTY.

Borrowing is a means to acquire $BOLD for depositing into the Stability Pools, while staking $LQTY allows you to 1) earn revenues from the ongoing Liquity V1 protocol, and 2) vote on which external liquidity pools receive the V2 PIL incentives.

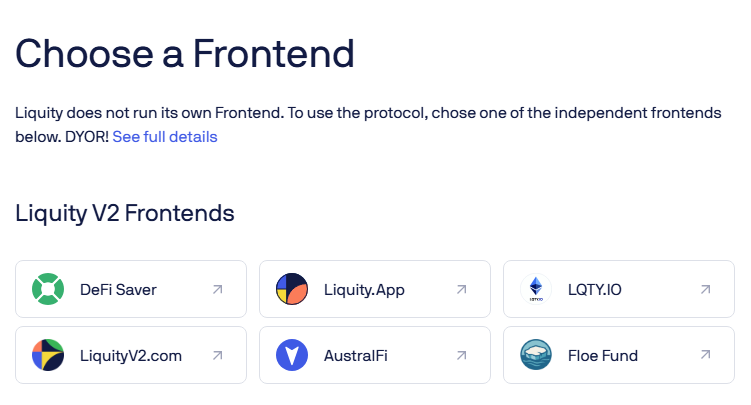

However, Liquity doesn't maintain its own V2 frontend for the sake of decentralization, so to dive in you'll have to pick from one of the independent community-run options.

I recently wrote about DeFi Saver, and I'm a huge fan of that platform, so I can personally recommend it for Liquity V2 users. It offers the basics, like the ability to create Trove borrow positions and deposit to the Stability Pools, plus more advanced functionalities like automated leverage management, stop losses, simulated positions, and beyond.

You can also stake $LQTY on DeFi Saver (just flick over "Stake" tab in the platform's Liquity V2 hub) to earn V1 fees, but if you want to also vote on V2 PIL incentives, consider using other frontends like liquity.app that offer voting dashboards for stakers.