🏴 What’s Going On With Aptos?

Tax season is here again but it doesn’t have to be a nightmare. Sort out your crypto taxes with Crypto Tax Calculator, a software supporting 300,000+ currencies across various L1s and L2s.

Dear Bankless Nation,

Not every pump has a rhyme or a reason. That being said, it’s hard to ignore the January growth of APT, the token connected to VC darling blockchain startup Aptos Labs.

We take a closer look at the pump and attempt to answer whether we should be salivating at the opportunity or shrugging it off.

- Bankless team

🙏 Together with ⚡️KRAKEN⚡️

Kraken, the secure, transparent, reliable digital asset exchange, makes it easy to instantly buy 200+ cryptocurrencies with fast, flexible funding options. Your account is covered with industry-leading security and award-winning Client Engagement, available 24/7.

👉 Visit Kraken.com to learn more and start your experience today.

What’s Going On With Aptos?

Bankless Writer: Ben Giove

Whether it be during the height of a bull or the throes of a bear, during every crypto rally we ask ourselves the same question: Why is this project with seemingly dubious fundamentals pumping?

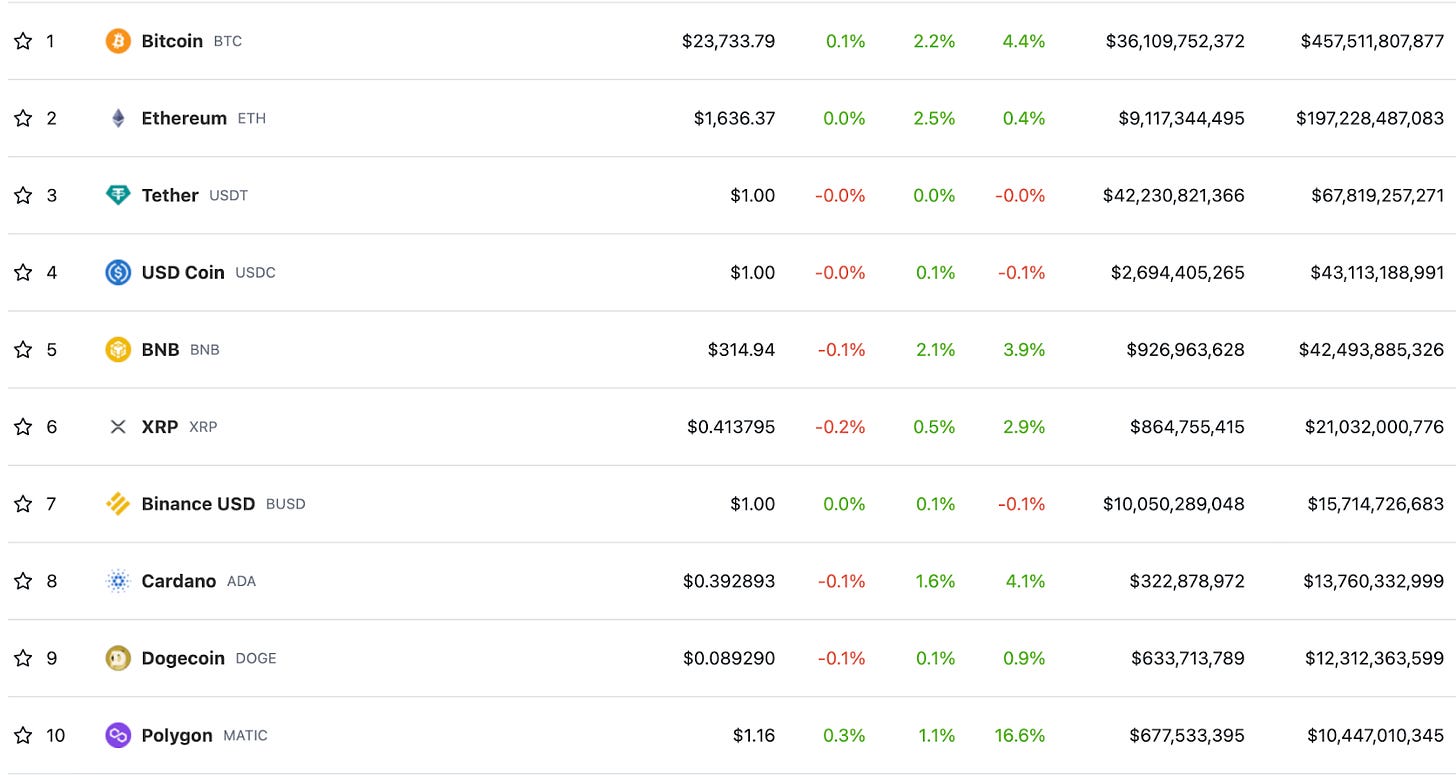

In many instances, it’s a valid question. While cryptoasset analysis has matured considerably over the past several years, several of the largest tokens by market-cap are still tied to projects with limited usage.

I’ll let you decide which of these belong and which don’t.

In 2021 the winners of the “most head-scratching pump” awards were dog coins like DOGE and SHIB. Their now infamous rallies were legendary, enriching normies while leaving fuming crypto natives trapped on the sidelines (maybe I’m just speaking for myself on that one).

To start 2023, the front-runner for this ignominious honor has to be Aptos (APT), which is up 459.5% YTD and has been the best performing asset in the Top 200. The network now trades at a fully-diluted valuation (FDV) of $19.1B, good for sixth highest of any crypto project and nearly 10% that of Ethereum.

One of 2022’s most hyped projects, this pump comes despite Aptos having seen limited traction to date. It’s currently the 31st largest network by TVL at $63.6M, behind “lightly used” networks like EOS and Cardano.

This brings us back to our never ending question…why is this project with seemingly dubious fundamentals pumping?

Let’s explore and see if we can find an answer.

A History of Aptos

Aptos is an L1 developed by former engineers for Facebook’s Diem project. The network’s primary value proposition is scalability, claiming to be able to process 10,000 TPS while aiming to reach 100,000 TPS. Aptos also uses the Move programming language, which has been lauded by developers for its security properties and ease of use.

Aptos is also known for its massive venture raises at nosebleed valuations, raising $200M at a more than $1B valuation in March 2022 and $150M at a valuation north of $2B in July 2022. Notably, these rounds were participated in by the now-bankrupt FTX Ventures. Furthermore, a September follow-on investment from Binance valued the L1 at more than $4B.

Aptos launched in October 2022, with APT at as high as a $13B valuation on the day it went live.

The markets plunged following the collapse of FTX, but APT, along with other “Sam Coins” were acutely hit, falling 55.9% between November 7 and December 29. Its $3.08 low in December valued the network at roughly $3.1B FDV, below the valuation at its most recent raise.

Sentiment was pitch black across the entire space, but given Aptos’s limited usage and the threat of perpetual long-term sell pressure from its largest investor going belly up, APT was particularly radioactive.

The Mother Of All Short-Squeezes

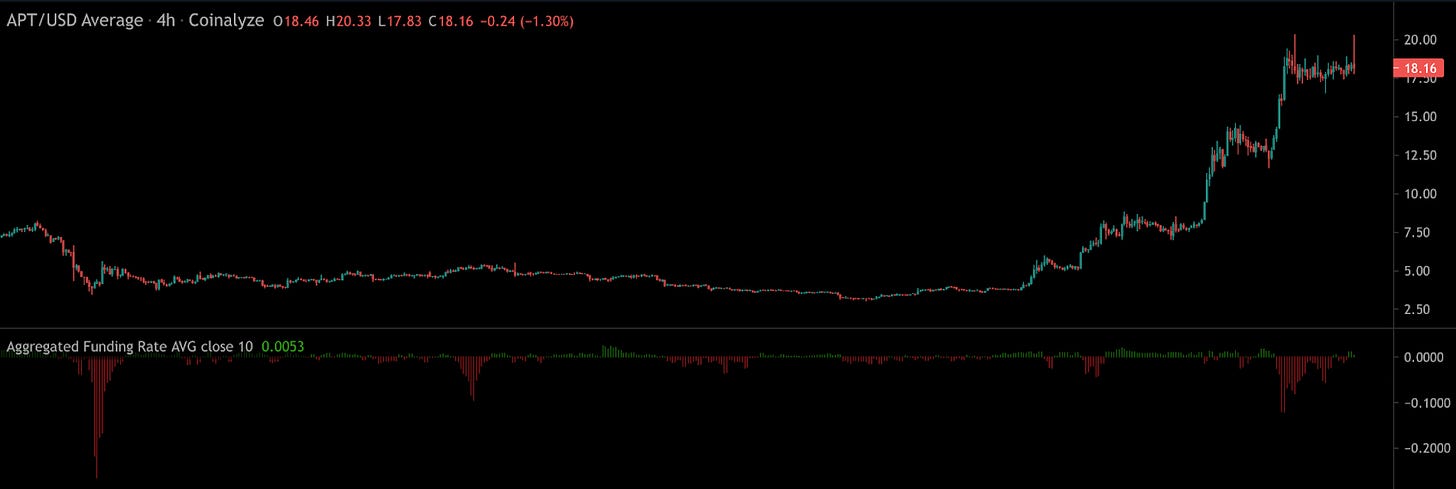

Bears smelt blood, and shorts unsurprisingly began to pile in. The annualized funding rate for APT was at times negative triple digits in the weeks following FTX and Alameda’s implosion. This means that demand to short APT was so great, traders were in essence willing to pay triple digits in annualized interest to do so.

It was an incredibly crowded trade, and the extreme negative positioning in the name laid the groundwork for a massive short-squeeze when the market began to turn.

Since January 8, the price of APT has exploded 368% from $3.88 to $18.16. The face-ripping rally has left a trail of bear carcasses in its wake, with $112.0M in short positions liquidated compared to $63.9M in long liquidations during this period.

Just as long liquidations provide fuel that exacerbate downward moves, short liquidations have a similar impact in the opposite direction, adding rocket fuel to pumps.

As we can see from those figures above, Aptos has had a lot of fuel in an illiquid market that is still reeling from FTX. This was compounded by bears seemingly choosing to fight the move by piling into more shorts, as APT funding again dipped into extreme negative territory, reaching as low as -136% annualized on January 25.

It may not just be Aptos bears who’ve gotten blown out by this massive pump. Conceivably, Aptos’s own investors could be among the casualties, as those looking to hedge their paper profits may have shorted APT perps to do so. Though given the opacity of CEXs, we’re just speculating here.

With APT investor unlocks not set to begin until October 2023, the token has also benefited from no structural sellers pushing down price. If January is any indication, it also means that any VCs hedging with APT perps have a long and treacherous road ahead of them.

What Comes Next

As we can see, there is a simple, rational reason as to why APT has pumped massively to begin the year: It underwent a good old-fashioned short-squeeze.

In the short-term, positioning and market structure overrule fundamentals. APT was oversold, with traders at times paying triple-digits in annualized funding to bet against the name. The unwinding of these bearish bets created violent price action, but to the upside rather than to the downside as we’ve become accustomed to over the past year plus.

Looking beyond this move, it’s unclear what the future holds for Aptos. Like with many L1s, perhaps this rally can be reflexive, spurring more users, developers, and liquidity to migrate onto the network.

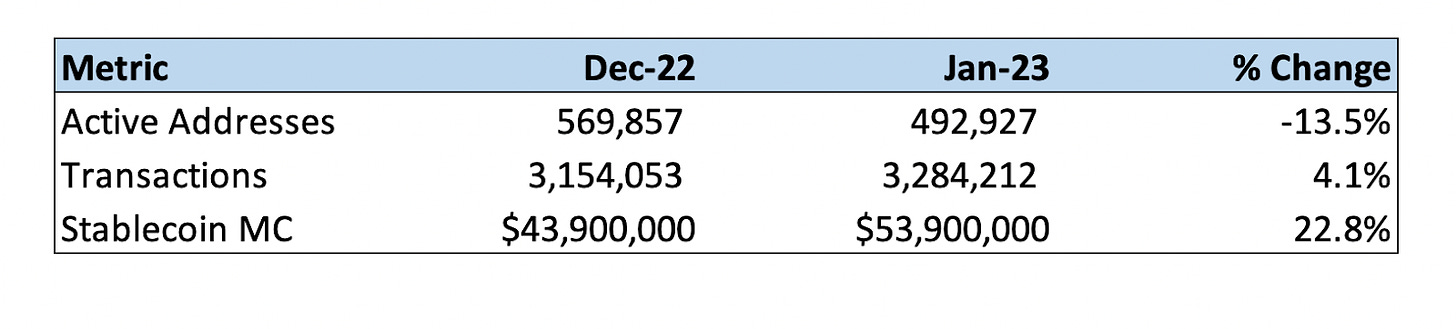

So far, we have not seen much evidence to suggest that is occurring, though there are some encouraging signs. While Monthly Active Addresses for January 2023 are on pace to be slightly down compared to December 2022, transactions and market cap of stablecoins on the network are both on track to slightly increase.

For APT to have a shot at backing up its massive FDV over the long-run, it will need to grow these metrics significantly over the coming months before VC unlocks kick-in. That seems like a tall task, but hyper-growth is always possible in crypto.

It’s unclear whether this short-squeeze has run its course, or whether more pain is in store for bears. But regardless of price, given the technical nature of the move, fundamental investors shouldn’t be pulling their hair out.

MARKET MONDAY:

Scan this section and dig into anything interesting

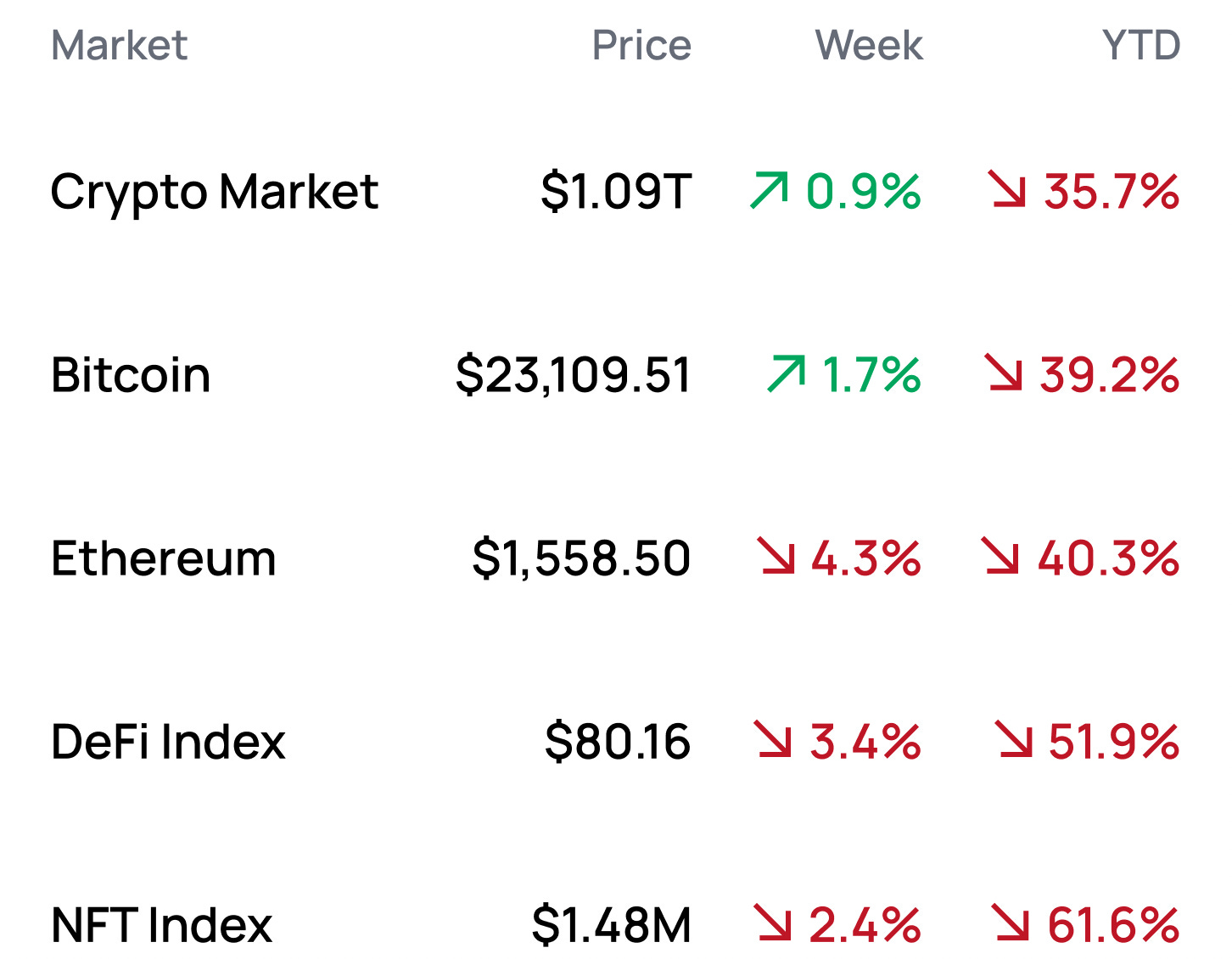

Market Numbers 📊

*Data from 1/30 2:30 pm EST (DeFi Index = $DPI, NFT Index = $Blue-Chip-10)

Market Opportunities 💰

- Deposit USDC in Lyra Finance on Arbitrum

- Learn a profitable LP provision strategy on Sudoswap

- Watch out for mfers creator curated art collection “Life Death & Cryptoart”

- Sturdy Finance to launch leveraged liquid staking

- Peep the Ultimate Ethereum Hackathon Survival Guide for 2023

Yield Opportunities 🌾

- ETH: Earn 7.22% APY staking FRXETH in Frax

- BTC: Earn 17.5% APY staking BTC-DFI on DefiChain DEX

- USD: Earn 40.8% APY staking USDC-WETH on Uniswap V3

- USD: Earn 12.2% APY staking USDT-WBNB on PancakeSwap

What’s Hot 🔥

- Friktion is sunsetting

- Aave launches v3 on Ethereum mainnet

- Azuki’s twitter account was hacked

- Index Coop launches Diversified Staked ETH Index

- Doodles 2 to launch on Flow

- Pudgy Penguins is experimenting with soulbound tokens

- Treasure launches MagicSwap v2 AMM

- Vest Exchange, a new perpetuals exchange on Arbitrum is coming

- Introducing another cross-chain AMM, Dove Protocol

- Worldcoin shares details on digital identity system Orb

Money reads 📚

- ZK rollups vs Optimistic rollups

- Next Gen NFTs - Logris

- Not Companies, Not DAOs But a Third More Secret Thing - Leighton

- Stablecoins part one: Battle lines at the top - Chris Powers

- Power conflict puts dollar’s exorbitant privilege under threat - Zolton Poszar

- Ethereum 2.0's Monetary Policy: A Financial Model - 3pointO Capital

Governance Alpha 🚨

- Secret Labs proposal to structure a new Secret Foundation (drama!)

- Olympus deposits $77M into Maker

- Index Coop proposal to launch Diversified Staked ETH Index

- Lido discussions to begin planning for ETH staking withdrawals

Trending Project: Gains Network 📈

Analyst: Ben Giove

- Ticker: GNS

- Sector: DeFi - Perpetuals

- Network: Polygon, Arbitrum

- FDV: $192.8M

- Hotness Rating: 🔥🔥🔥🔥

- Gains Network is a decentralized perpetual futures exchange currently deployed on Polygon and Arbitrum. Gains employs a model similar to GMX’s GLP, in which a DAI vault acts as the liquidity provider and counterparty for traders on the platform. Gains is unique in that it offers equities, crypto, and forex trading with 100x, 150x, and 1000x leverage respectively. The protocol is governed by the GNS token, which can be staked to earn a share of protocol fees. The protocol is governed by the GNS token, which can be staked to earn a share of protocol fees. GNS will also be burned when the DAI vault is overcollateralized, and minted as a backstop when it becomes undercollateralized.

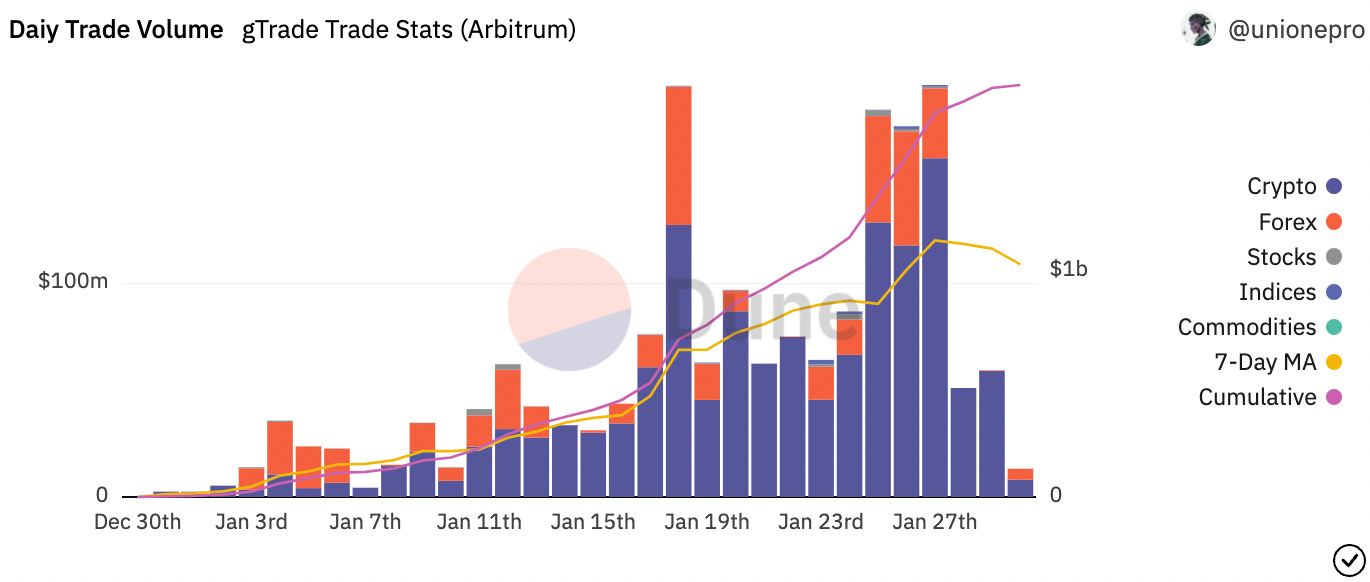

- Gains recently deployed on Arbitrum. To date, this instantiation has been a massive success, having facilitated $1.8B in trading volumes since going live on December 30. The DAI vault on Arbitrum also has more collateral than the one on Polygon, with $24.5M for the former compared to $14.9M for the latter.

- This growth of the Arbitrum deployment has helped fuel considerable outperformance in GNS, with the token soaring 81.7% against USD and 75.3% against ETH during this period. The yield for GNS stakers on Arbitrum currently sits at 12.1%, with these tokenholders having earned $446K in trading fees since December 30.

Hotness Rating (🔥🔥🔥🔥/5): GNS has outperformed on the backs of its fast-growing Arbitrum deployment. While competition in the perpetuals exchange remains fierce, investors looking to gain exposure to L2-based, secularly growing projects with large addressable markets would be wise to take a closer look at Gains.

Meme of the Week 😂

Maker Edition (updated 24th Jan) https://t.co/6ep4IImH5c pic.twitter.com/2XCAhREOOr

— 0xGeeGee (@0xGeeGee) January 24, 2023

Job opportunities 🧑💼

- Bankless: Director of Business Development

- Uniswap Labs: Senior Software Engineer, Protocols

Browse more roles (or add your own) at the Bankless Jobs Board

Action steps

- 🤑 Execute any good market opportunities that you saw

Subscribe to Bankless. $22 per mo. Includes archive access, Inner Circle & Badge.

🙏 Thanks to our sponsor KRAKEN

👉 Kraken has been on the forefront of the blockchain revolution since 2011 ✨