What Jack Dorsey Doesn't Get about Web3

Dear Bankless Nation

If you were on Crypto Twitter during the holidays, you may have noticed how 2021 ended in perfect crypto fashion: heated debate.

Rather than being about Alt L1’s vs Ethereum L2’s, this time it was about the legitimacy of Web3. And instead of two factions of the crypto industry going head to head, it was Jack Dorsey versus the VCs.

Lighting the Match

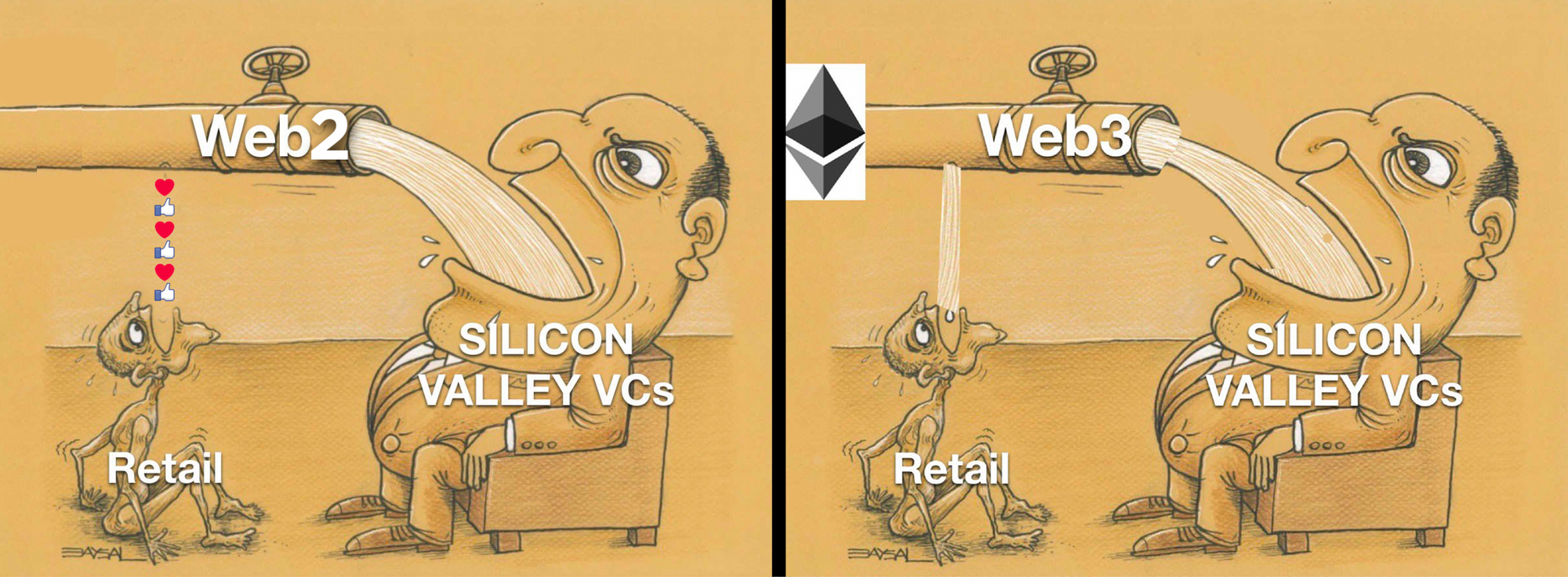

Things started with Jack Dorsey retweeting a meme about how Web3 is funneling all its value into the mouths of Silicon Valley VCs while leaving just mere droplets for retail investors.

The critique is that early seed rounds for ‘Web3’ investments are dominated by privileged VCs, and leave little to nothing for retail investors. This means that, if retail investors want a piece of these Web3 platforms, they’ll need to be buying them from the VC funds that were able to get early access to discounted valuations.

Jack thinks that this dynamic invalidates the power of Web3. If Web3 protocols are owned by VCs, then it’s not Web3 at all, according to Jack.

I’ve seen this sentiment echoed elsewhere as well, so it’s not just Jack. To some, ‘Web3’ is a marketing term that VCs are capitalizing on for short-term flips. VCs are investing in hype—not substance—and then using that hype to turn around and dump their bags on retail investors who don’t have the same access to Web3 investments.

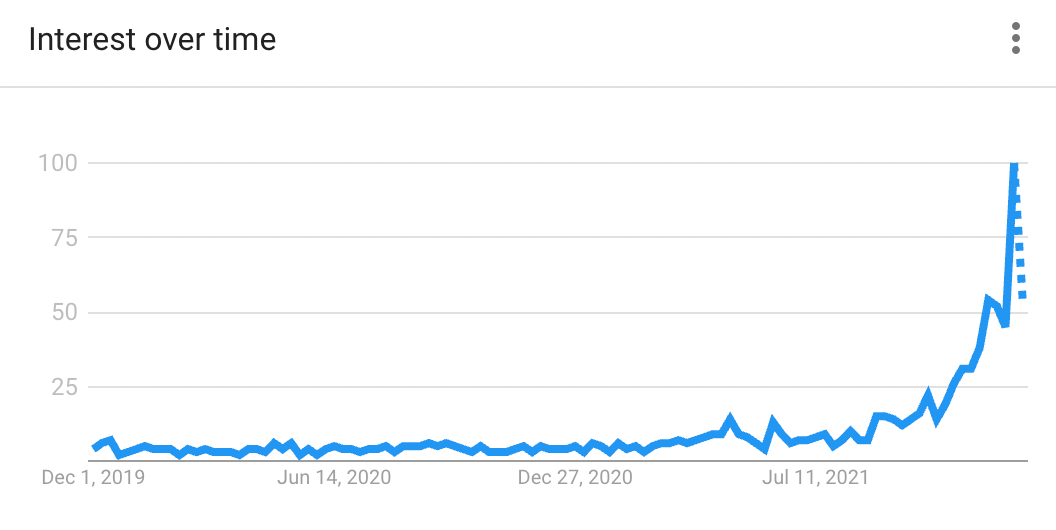

I’m sure there’s some truth to this. The hype around Web3 is significant.

A16z has even sponsored a public opinion survey to gauge people’s opinions of the term ‘Web3’.

Spoiler: people like it.

So are VC’s capitalizing on this by front-running retail into seed rounds? Will the future of Web3 be forever delegitimized because of this?

Or is something entirely different happening?

Let’s unpack.

Shifting the Overton Window

Uniswap

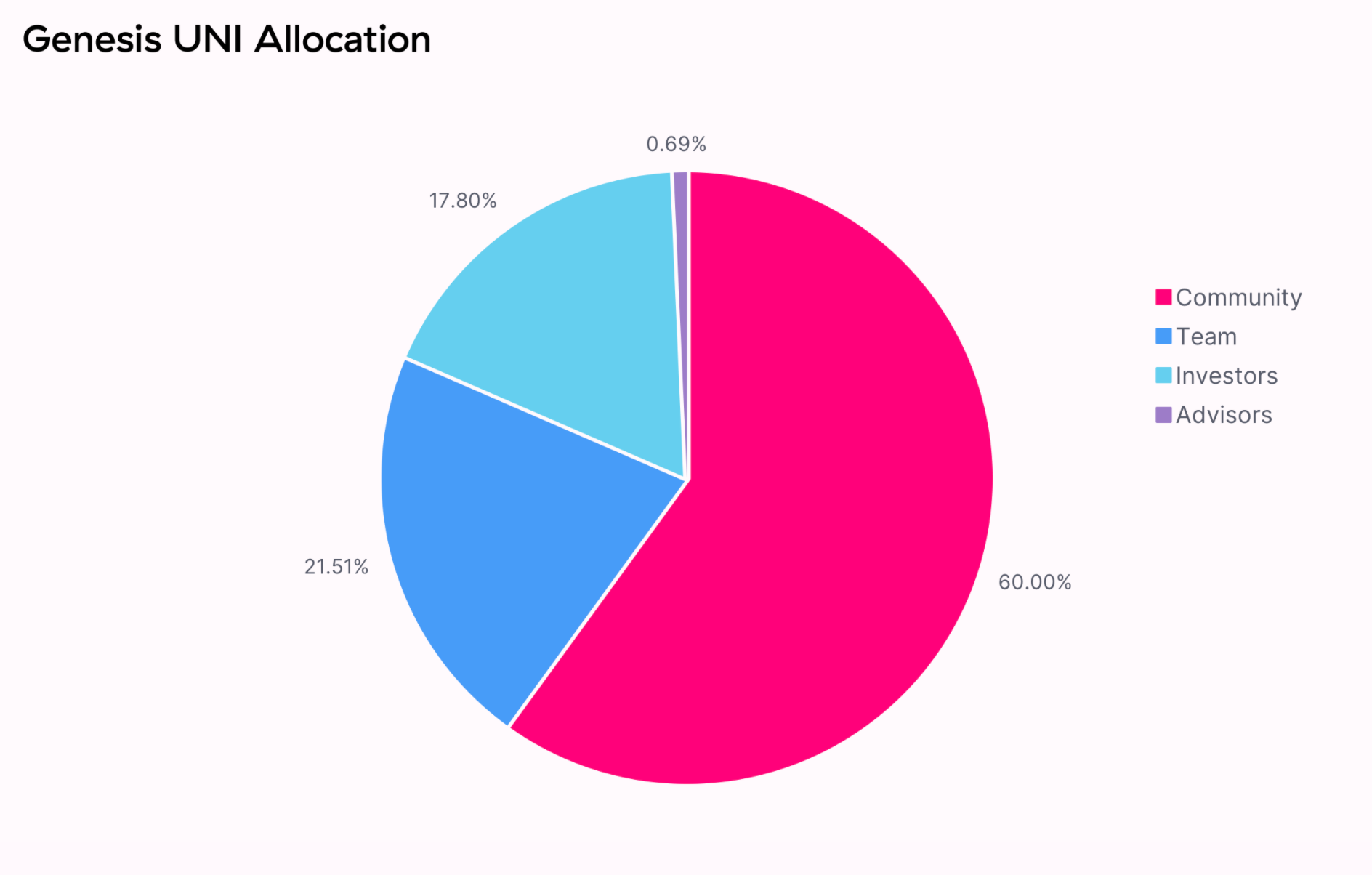

On September 16th, 2020, Uniswap minted the UNI token and airdropped 60% of the supply to the community (via a combination of the retroactive airdrop and community treasury). For reference, the retroactive airdrop included over 250,000 unique addresses on Ethereum.

Uniswap kicked off the Retroactive Airdrop movement, and hundreds of retroactive airdrops have happened since then, distributing billions of dollars in capital to hundreds of thousands of unique individuals who have interacted with some crypto-app in some capacity.

The Uniswap Series A seed round raised $11m and was led by a16z, with other VCs also participating in the round.

Ask yourself: Did the Uniswap airdrop increase or decrease the value of the seed investments that these VC firms made in Uniswap? I would argue that the increased distribution and significant retail ownership over Uniswap added orders of magnitude more value to the investments made by VC firms.

Value arises from aligned incentives, and the Uniswap scenario illustrates how it is economically rational for VCs to fairly engage and distribute capital to retail investors. The Uniswap airdrop gave free capital to 250,000 unique Ethereum addresses, while simultaneously providing a liquidity event for the early VCs.

Not all Web3 investments have the same elegant outcome that Uniswap did, however. Some are even better.

ENS

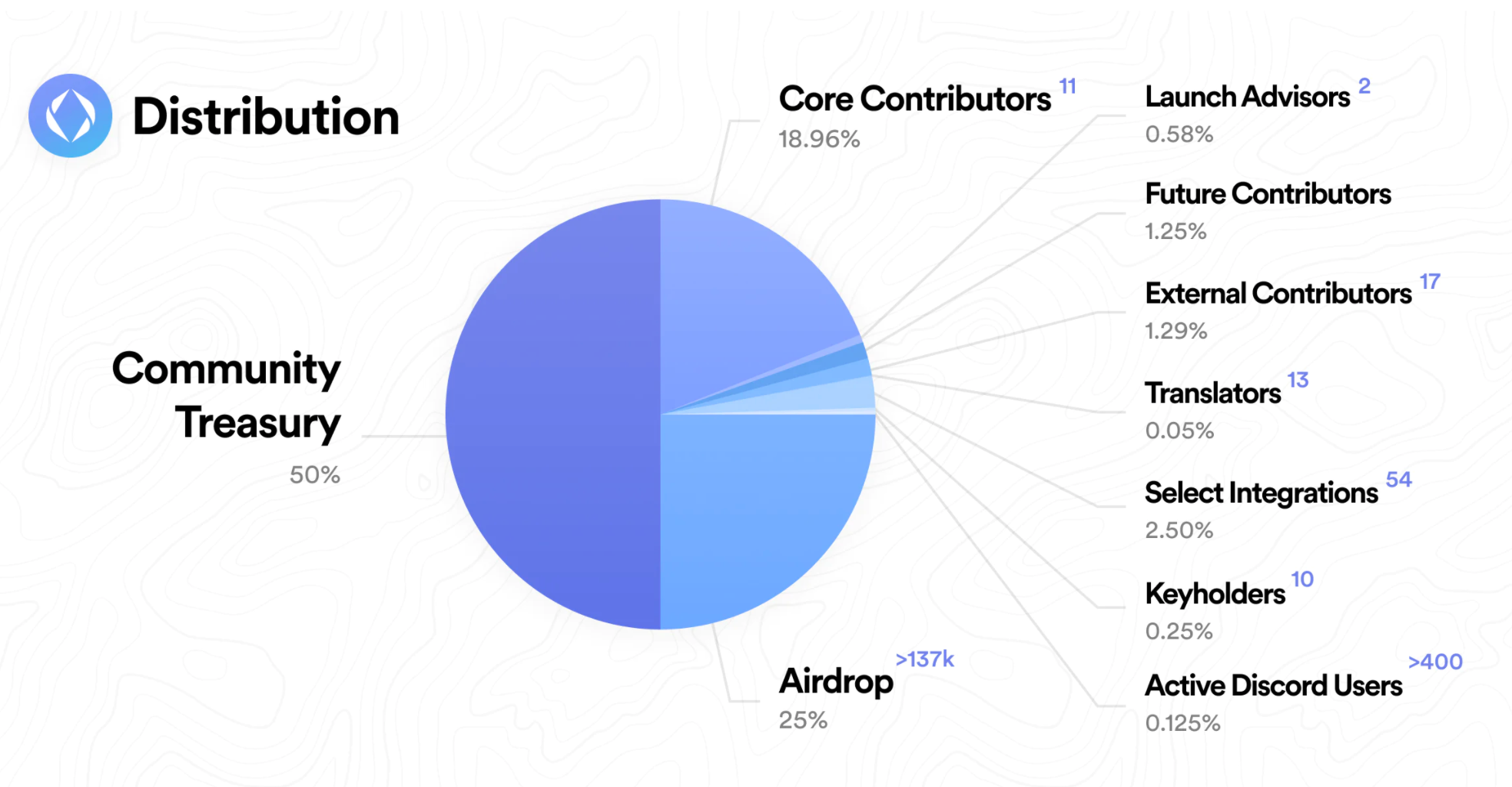

The Ethereum Name service airdropped 50% of the total supply of ENS to its users, with the other 50% being distributed to ~500 early contributors and ecosystem players to the project.

ENS never raised a dime from VCs. If any funds want ENS exposure, they’re going to have to buy it from the hands of the ENS users.

Coinbase

Web3 has shifted the Overton window of capital distribution so well that it’s impacted the traditional equity markets.

When Coinbase had its direct listing of COIN into public markets, it airdropped 100 shares to each of its 1,700 employees. With COIN opening at $250 per share, it was a $25,000 “thank you” to every Coinbase employee.

When’s the last time a traditional company gifted its employees equity? This is the culture that is being exported by crypto to the rest of the world.

Web3: A Work In Progress

The above examples are perhaps some of the best that Web3 has to offer. There are plenty of other examples that aren’t this good, and even more that are unfavorable to retail investors. And, of course, plenty that don’t even consider retail investors at all.

But, we have to remember what the paradigm was before Web3 ever came around.

Retail never had an opportunity at all, anywhere, ever. Crypto has always been about giving everyone an equal footing on everything. One of the big driving forces behind the 2017 mania was that retail investors could ‘get in’ before any of the institutions. This has been true about Bitcoin in 2010, Ethereum in 2015, and is still very true about many of the Web3 platforms being built today.

Prior to crypto, retail investors would have to wait for companies like Twitter to publically list on the NASDAQ or NYSE. Then, finally, retail investors could buy these companies via their brokerages from the VC funds that lead the Series A, B, C, D, E… of the now public companies.

With Web3, VC’s have to pay money to get what is given out to users for free. VC’s pay money, users receive capital.

This is the paradigm shift that Web3 is bringing to the world. It’s not black and white, but these are the new incentives that rule the land.

Follow the Incentives

Jack’s follow-up tweet talked about how the incentives of VC firms will corrupt Web3.

“You don’t own “web3.” The VCs and their LPs do. It will never escape their incentives.”

All the biggest airdrops that have happened have been the ones that have disproportionately rewarded users in the cap table. I believe Jack doesn’t understand the alignment between VCs and retail investors that Web3 brings to the table.

Web3 platforms that put ownership into the hands of the community are the ones that succeed. The Web3 platforms depend on community ownership. Without community ownership and involvement, then it’s not Web3 at all.

If you believe my claim above then significant inclusion of retail investors via airdrops or other methods is economically rational for VC firms to consider. Web3 platforms that give ownership are going to succeed versus ones that don’t. Therefore, VCs need to be considering retail inclusion when placing their investments.

It’s not VC incentives that are the issue, Jack is just stuck inside of a Web2 paradigm. And that’s fine!

Raising capital and liquidity through community is a novel paradigm and crypto hasn’t figured out best practices yet. Uniswap kicked it off, but the “how” continues to evolve.

However, I can’t help but photoshop his meme into two versions that I think more accurately reflect reality:

Follow the Incentives Part 2

What about Jack’s incentives? Why is he so loudly grieving about Web3?

It’s no secret that the only thing inside of crypto that Jack cares about is Bitcoin. He’s frequently discredited anything about crypto that’s not Bitcoin, and now it’s Web3’s turn I guess.

I think Jack has it out for Web3 because he, like many Bitcoiners, thinks that the only truly decentralized thing is Bitcoin, and everything else is decentralization theater. He’s trying to manifest this fake, twisted version of Web3 by magnifying its flaws and ignoring its merits.

He’s trying to meme this corrupted version of Web3 into reality so that he can dance on its grave.

I see Jack both in denial about the realities of Web3, and also projecting his Web2 mindset upon an entire industry. Sadly, there’s always a basal level of anti-crypto sentiment in the world at all times, that a leader like Jack can drum up enough vitriol in order to legitimize the critiques.

What about US-Accredited Investor Regulations?

The fact that Jack Dorsey doesn’t bring up the terrible accredited investor regulations while critiquing Web3 speaks volumes.

It’s not like Web3 startups want to take money from VC firms. They’re forced to, because the SEC doesn’t allow unaccredited investors to invest in private securities. That’s why it’s so difficult to find ways to include retail investors, even when Web3 platforms badly desire to do so.

Web3 is supposed to be owned and operated by its users. It’s the SEC that’s preventing this reality from manifesting, not VCs. Jack didn’t mention this anywhere.

I see this as evidence that unfairly Jack has it out for Web3, and is spreading misinformation and falsities in order to create a narrative that answers to Jack’s cognitive dissonance about being a Bitcoin maxi.

¯\_(ツ)_/¯

- David

P.S. let’s not forget where the Web3 movement started from: