Will Quantum Crack Bitcoin?

View in Browser

Sponsor: Mantle — Mass adoption of decentralized & token-governed technologies.

1️⃣ Bitcoin Climbs Back Up Over $100K

After dipping as low as $94.5K on Tuesday, Bitcoin chopped back up to $100K this week despite conflicting economic data. Amid all of this, ETF flows remained positive every day, netting over $1.7B since Monday. For the next big announcement, all eyes are on the Fed meeting next week which the market expects to bring another 25 bps rate cut. Fingers crossed.

Contributing to positive sentiment was BlackRock, who stated they see Bitcoin as a reasonable addition to traditional portfolios. Their recommendation? A modest 1-2% allocation for balanced exposure. While Microsoft rejected adding BTC to its treasury, crypto mining companies like Riot and Mara embraced it wholeheartedly, adding billions to their treasuries. Meanwhile, MicroStrategy, which has been buying BTC at a faster clip than ever, is set to enter the Nasdaq 100.

2️⃣ New Altcoins (and Aave) Outperform

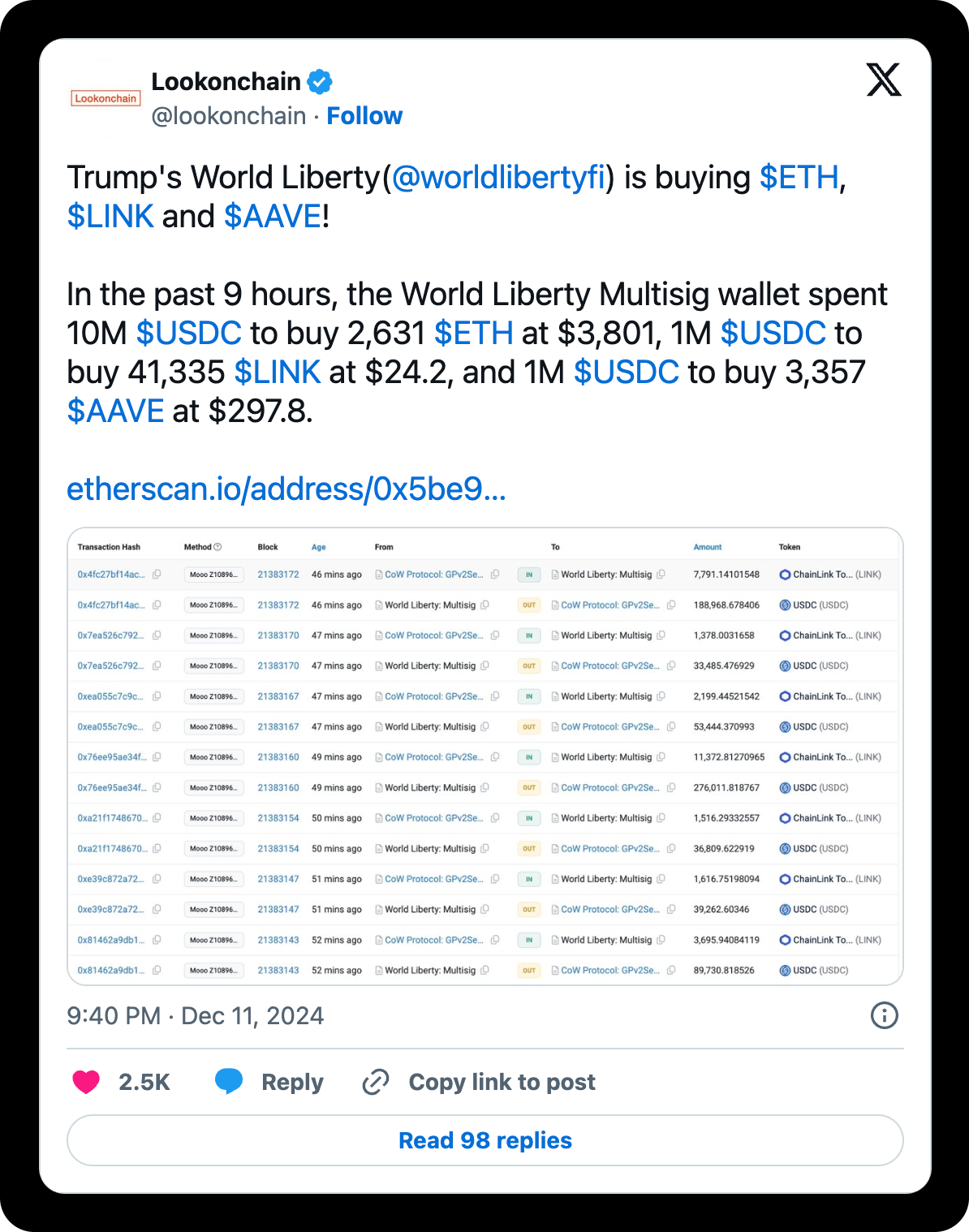

While other majors stalled, a handful of select altcoins outperformed this week, including HYPE, VIRTUAL, SUI, and AAVE. The first three hit new all-time highs amid appetites for next-generation L1s and AI agents, rising 40%, 37%, and 13%, respectively over the past 7 days.

Aave, up 30%, had its gains attributed to buys from Trump-backed World LibertyFi’s wallet, which also purchased more ETH and LINK too. As a result, people believe the president-elect is bidding our coins. Separately, many Solana-based AI tokens put up good performances this week, with flagship AI agent framework, ai16z, reaching a new all-time high market cap above $1B alongside strong gains in smaller tokens.

3️⃣ Circle and Binance Partner for USDC Expansion

Stablecoin issuer Circle and Binance, the world’s largest exchange, teamed up this week, forging a strategic partnership aimed at expanding the global adoption of USDC. Binance will integrate USDC into its vast suite of products, showcasing the stablecoin’s growing role as a reliable onchain asset for trading, savings, payments, and even application in corporate treasuries.

This alliance marks a critical moment for USDC, potentially giving it a big leg-up against Tether through Binance’s immense user base. The stablecoin wars are real, and it will be interesting to see how they play out, especially as regulation around these assets evolves.

4️⃣ Airdrops Arrive: Magic Eden, Fuel, and Suilend

NFT marketplace Magic Eden rolled out its long-awaited ME token this week. Users can now claim ME by linking their wallets. Early stakers are set to reap additional rewards through upcoming cross-chain challenges and “Magic Eden Magic Eden Quests.”

Beyond Magic Eden, L2 Fuel also announced their token, with 20% slated for its first airdrop (though no launch date has been shared), while Suilend launched its SEND token, requiring users to pay $1 of SUI per SEND for airdrop access. While an annoying detail, it seems to be working for reducing sell pressure, with SEND up since launch while ME is down.

5️⃣ Anxieties Around Quantum Computing

This week, Google made a big step forward in quantum computing with its new "Willow" chip, which has improved error correction and shows progress toward creating "logical qubits" (a key building block for powerful quantum computers). While we're still far from having quantum computers that can crack today's encryption systems, this progress reminds us that such a future is possible. Breaking security systems like Bitcoin's would need thousands of these qubits, still a long way off, though experts predict it could happen in 5-10 years, so best to start preparing now.

One way to prepare is by switching to "post-quantum cryptography," which uses new, quantum-resistant algorithms. These have been standardized by NIST (a U.S. standards organization), providing a clear plan for the transition.

Season 2: Methamorphosis is now live on mETH Protocol, following the launch of their governance token, COOK, and cmETH, the liquid restaked version of mETH. With cmETH, holders can enjoy yields across multiple restaking protocols like Karak, EigenLayer, Symbiotic, while earning Powder for more COOK.

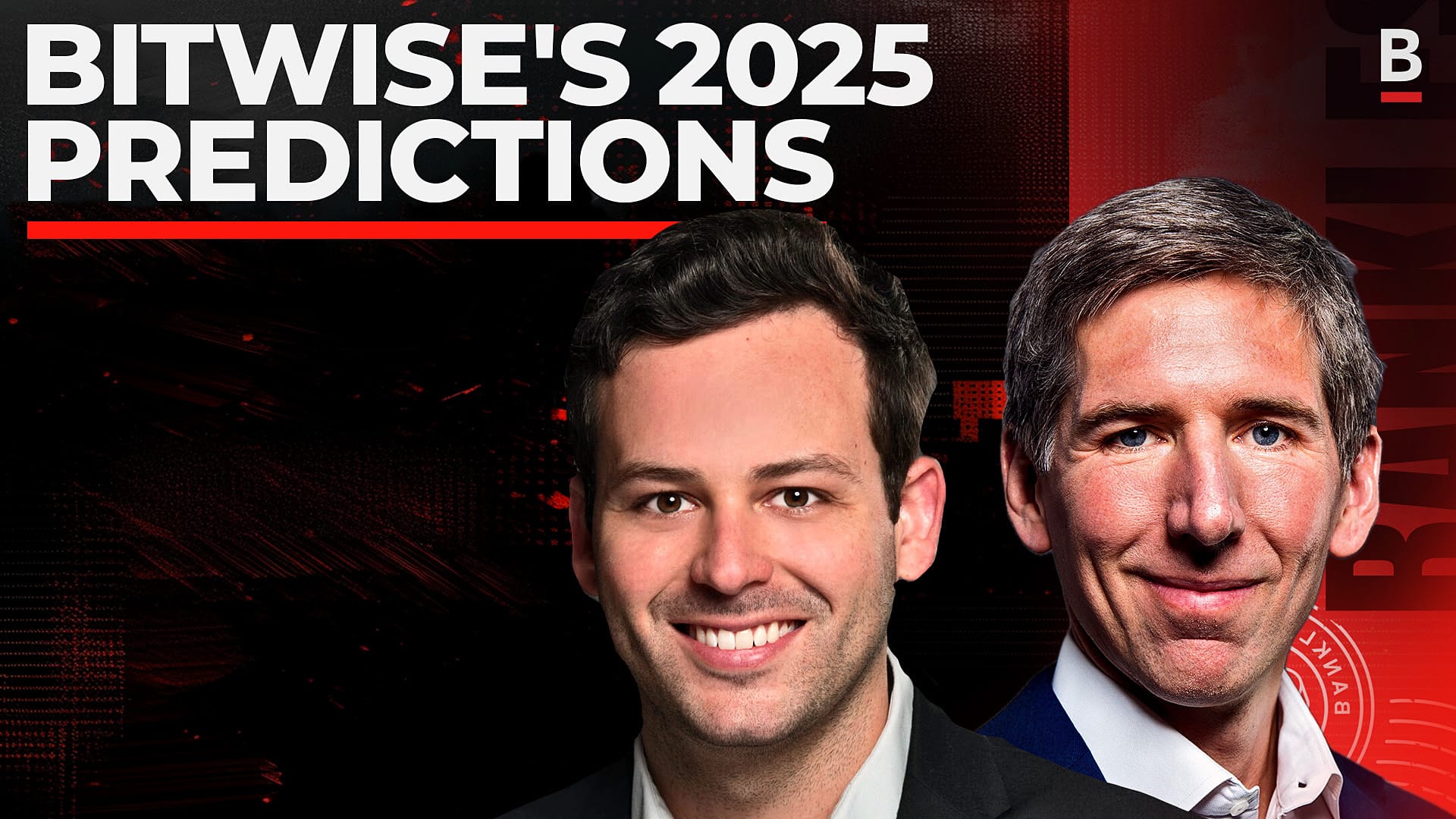

It's Bankless Weekly Rollup time!

This week, Bitcoin plunged amid $1.1B in crypto liquidations, marking the largest single-day event since 2021 with $815M liquidated from long positions. Ethereum ETFs saw a record $428M inflow, and Layer 2 solutions like Mantle are advancing with nearly 1M ETH bridged to Base.

On the regulatory front, Trump appoints David Sacks as Crypto Czar, while Microsoft shareholders reject Bitcoin on their balance sheet. Despite volatility, the market remains bullish with predictions of Bitcoin hitting $250K and milestones like 1B unique crypto addresses.

Tune in for all this and more to unpack the biggest stories shaping the crypto-economy right now! 👇

📰 Articles:

📺 Shows: