We're Opening Bankless Ventures Fund II

tl;dr–We’re opening up Fund II starting today. Here’s what we’ve been up to over the past 21 months at Bankless Ventures, including deals we’ve done, results we’ve seen, and a thing or two we've learned.

Back in April of 2023, we launched Bankless Ventures. Our thesis at the time was simple: We believed a small fund with a powerful brand could punch well above its weight class.

Over the past 21 months, we’ve been able to test that thesis as Ryan, Ben, and I evolved from opportunistic angel investors to competitive deal-winners. As angels, deal flow often found us. But as VCs, we had to secure that deal flow in a fiercely competitive ecosystem.

Could Bankless Ventures succeed? In order to win, we had to answer yes to these four questions:

- Can we get into the right deals?

- Can we deliver massive value to our portcos?

- Can we keep nailing hits?

- Can we build the best team?

Now that Bankless Ventures Fund I is 90% deployed and our gaze turns to Fund II, let’s take a moment to evaluate our performance and measure results.

Can we get into the right deals? ✅

Keeping Fund I small (under $40 million) was the right call. Our nimble size has allowed us to slip meaningful checks into early-stage deals, where larger VCs simply cannot fit. The combination of a powerful brand with $500K check sizes has allowed us to consistently win the deals we’ve wanted at stages optimized for venture scale returns. Most boutique funds fail to get on the cap table–larger players squeeze them out, and founders don’t know the reputation. Bankless is different.

"It feels like I'm on the podcast" is the number one quote we hear when joining a pitch call. Almost every founder we talk to has already spent hours listening to Bankless and knows our values before we enter the chat. Some thank us for getting them into crypto. This helps accelerate the deal-making process.

When they know us, they trust us, and want us involved. This is how we won our position in some of the most hotly contested deals of the last funding cycle.

Can we deliver massive value to our portcos? ✅

Our value proposition to portcos is the two Ns: Narrative liquidity and network liquidity.

- Narrative liquidity is the ability to propagate a story in crypto–this industry thrives on stories, and we are good at telling stories that scale. We drive education and understanding about the sectors that we also invest in–to great effect.

- Network liquidity is who you know; it's the total value of your network, and we have found ourselves in the fortunate position of being 1 to 2 degrees of separation from the key people a founder needs to give their project rocket fuel–a well-timed introduction to the right person is worth millions.

Billions in capital listens to Bankless on a weekly basis and uses Bankless as a signal for large trends in the industry as a whole. The themes that Bankless has pounded the table on (DeFi, L1s as money, L2s) have focused outside capital into the same themes that Bankless Ventures invests in.

While remaining neutral about specific portfolio companies, Bankless has been able to direct attention, talent and capital toward the sectors that excite us.

Can we keep nailing hits? ✅

We've nailed many of the major value accrual themes of crypto during our first seven years as investors. We saw Ethereum in 2016 as programmable money; we saw DeFi in 2019 as composable money legos; we saw L2s in 2020 as high-bandwidth blockspace–we’ve captured many of the deca-corns that crypto has birthed.

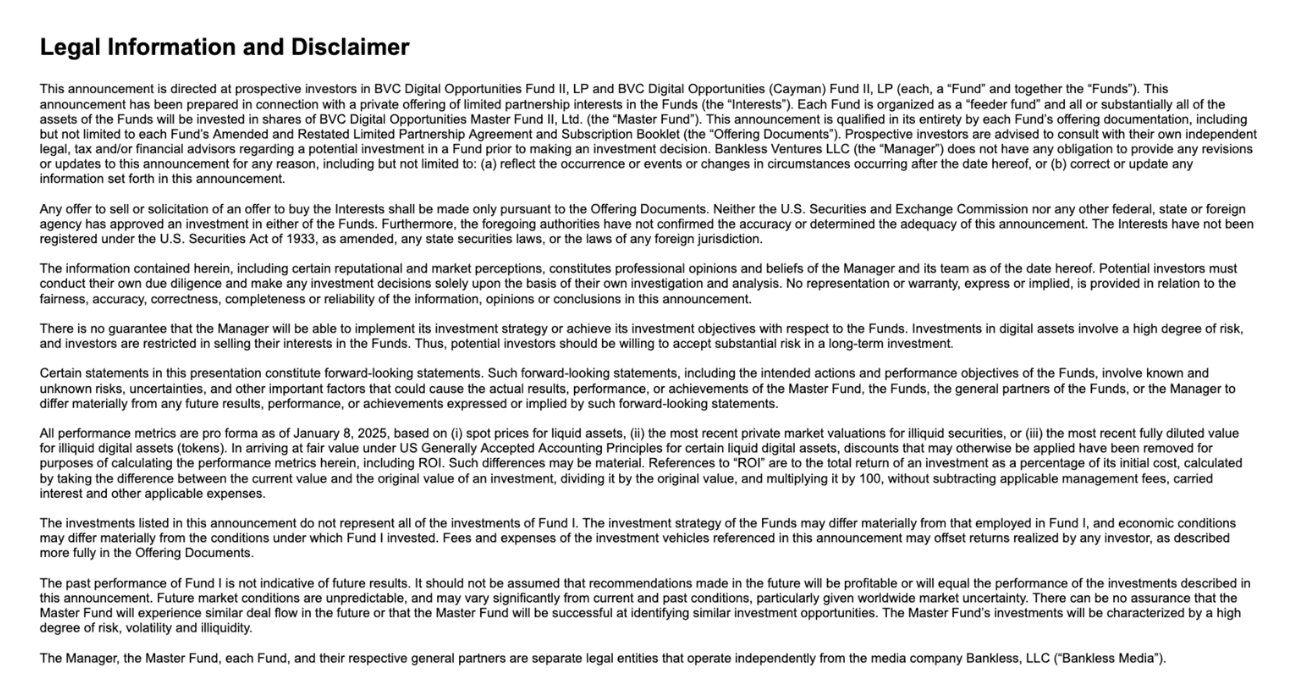

But the past is not always a predictor of future success, and for each new year, there's the question of whether we can keep nailing the hits. Our record in Fund I says yes. We nailed several of the frontier investment categories early on in this, with strong, high-ROI bets across restaking, zkProver tech, Bitcoin L2s, and Crypto x AI.

On the back of Fund I successes, we have further confidence that our approach to identifying, vetting, and making heat-seeking conviction plays is scalable and repeatable in Fund II.

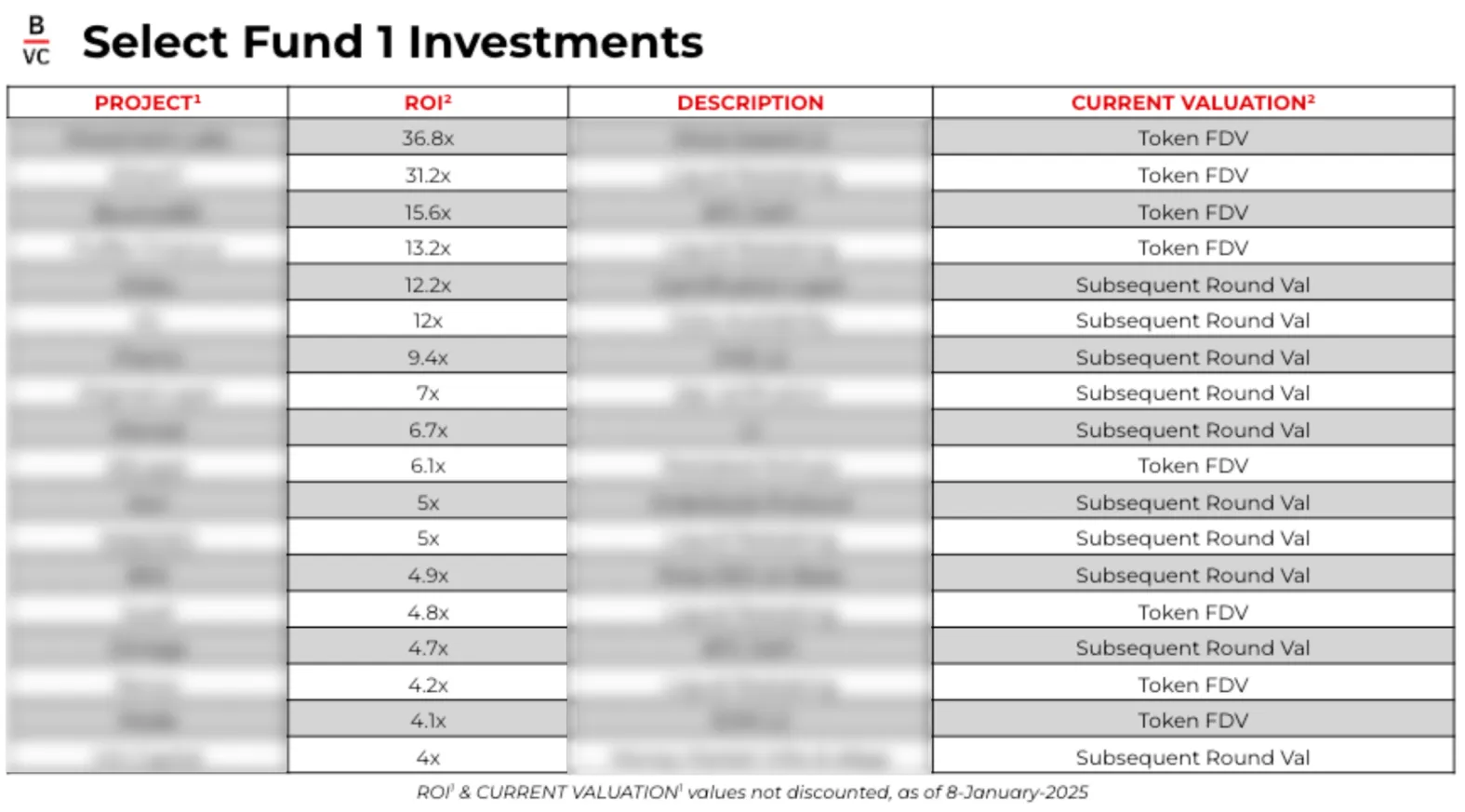

Fund I is still early in its return cycle, but we deployed aggressively in 2023 and 2024 with purpose–we aimed to sow during the build market and reap the benefits during the bull market. While the typical venture cycle J-curve means that returns are often negative in the first few years of a fund, we are currently showing returns of 2.3x MOIC. (Next time I write an article reflecting on Bankless Ventures performance, I look forward to discussing DPI instead of MOIC)

Can we build the best team? ✅

Ryan and I bootstrapped Bankless Media from zero to a profitable 8-figure ARR business within a year without outside capital. Today, Bankless Media has a talented leadership team and 20 contributors who help us run it day-to-day.

We built a media company, but could we build a Venture Fund with the operational excellence of the best funds in tech? The answer again has been yes.

With full-time chad leadership from Ben Lakoff – and Ryan and I solely incentivized by fund performance, not salaries – Bankless Ventures Fund I has been resourced as a $100M fund at a $40M size.

Our superb team also boasts Brent Matterson focused on deal sourcing and curation, Kim Adams on providing portfolio support, and Ryan O’Meara dialed in on operations.

In Fund II we’re bringing an additional investment partner to our bench. This to-be-announced addition is one of the best crypto investors we know; he’ll specialize in “truffle-hunting” for incredible founding teams and deals we can lead, allowing us to get more surgical and enter opportunities even earlier. Stay tuned!

We’re raising $50M for Fund II

To recap, yes, we get in the right deals, we deliver massive value to portcos, we nail the hits, we have the team. We’ve never been better positioned to deploy capital in crypto.

We’ve just officially started raising for Fund II, and already have a ton of interest from great partners. Today, we’re opening up LP applications for Fund II. We want to talk to you.

What’s next on the crypto frontier?

- Trillions of AI agents going bankless

- Stablecoins bringing open finance to the world

- ZK tech solving identity, privacy, and opening 1000 new rabbit holes

No matter where it happens, we’ll be there. Because this is the frontier, it’s not for everyone, but we’re glad you’re with us on the bankless journey.