Is China Changing its Crypto Tune?

Dear Bankless Nation,

With its new research offering a friendlier viewpoint on Web3 innovation, many are wondering whether China is ready to warm relations with the crypto sector.

For our weekly recap, we dig into:

- Is China flirting with crypto?

- The Celsius endgame

- Blur's Blend powers up

- Maker votes to ditch USDP

- Uniswap says no to fee switch (again)

- Bankless team

P.S. Listen to our interview with EigenLayer's Sreeram Kannan, available now in Early Access for Bankless Citizens.

📅 Weekly Recap

1. Is China flirting with crypto?

China’s hostility to crypto was first demonstrated when the People’s Bank of China banned all crypto exchanges in 2017, before moving to ban crypto transactions and the mining of crypto in September 2021.

But is China warming up to crypto again? The Beijing Municipal Science & Technology Commission released the Web3 Innovation and Development White Paper hinting at a move towards promoting crypto usage. The white paper cites Web3 as an “inevitable trend for future Internet industry development” and plans to spend about $14 million annually until 2025 to promote the domestic Web3 sector, the Metaverse and NFTs.

Meanwhile, Hong Kong’s securities regulator, the Securities and Futures Commission, has opened up crypto investment to retail investors as of June 1.

2. The Celsius endgame

The crypto group Fahrenheit has finally won the bid to acquire the insolvent loan portfolio and mining unit of Celsius Network, valued at about $2 billion. Fahrenheit is a consortium of companies including Arrington Capital and US Bitcoin Corp.

Fahrenheit’s plan proposes that 100% of Celsius’ assets be transferred to a newly formed company NewCo, which will then be distributed to Celsius creditors as equity as long as their stake is above a certain threshold. For a much fuller analysis, see this Twitter thread by wassielawyer.

Celsius first filed for bankruptcy in July 2022 after being hit with the cascading effects of Terra’s collapse.

3. Blur's Blend powers up

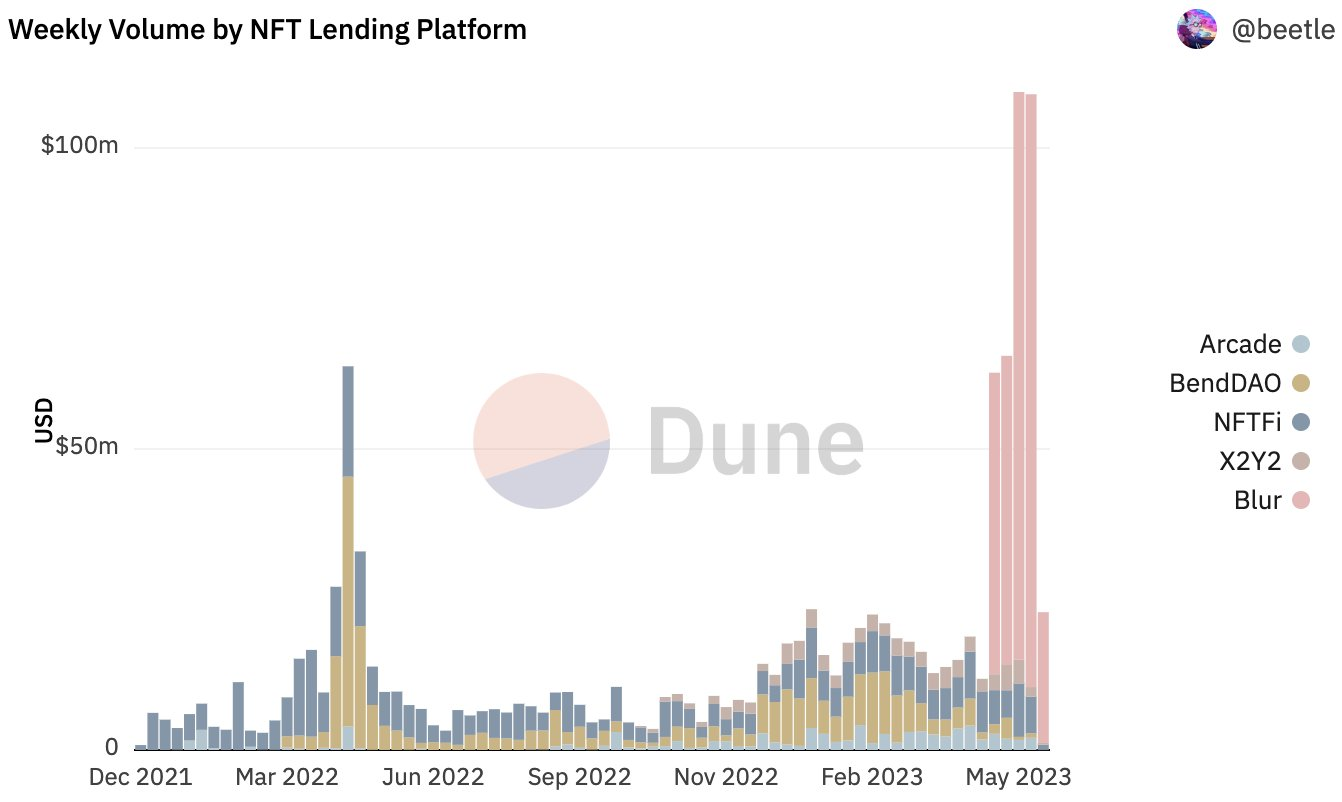

The Blur NFT marketplace first made its mark on the NFT scene when it toppled OpenSea’s dominance in February 2023.

Blur then launched its lending/borrowing platform Blend on 1st May. In less than a month, Blend has amassed an impressive total loan volume of 169,900 ETH ($308 million), representing an ~82% share of the NFT lending market.

According to Dappradar, Blend’s growth is dominated by three NFT collections: Azuki, CryptoPunks and Milady Maker.

- Azuki: Amassed an astounding 70,031 ETH in loan volume, stemming from 6,455 loans

- CryptoPunks: Generated 34,960 ETH in loan volume, originating from 953 loans.

- Milady Maker: Garnered 22,510 ETH in loan volume, through a total of 7,621 loans.

4. Maker votes to ditch USDP

A Maker DAO vote has unanimously voted to axe the Paxos Dollar stablecoin (USDP) from DAI’s reserves. This comes after New York regulators clamped down on Paxos’s Binance USD (BUSD) stablecoin in February.

USDP makes up about $500 million (5.8%) of DAI’s reserves. USDP also does not earn the DAO any revenue, unlike its USDC and GUSD reserves thanks to the DAO’s partnerships with Coinbase and Gemini.

This ties in with Maker’s plans to boost the yield-generation on its DAI reserves. In a separate governance proposal, Maker also recently voted to purchase another $1.28 billion of U.S. Treasuries (in addition to its existing $1.1 billion worth of RWA bonds).

Kraken, the secure, transparent, reliable digital asset platform, makes it easy to instantly buy 200+ cryptocurrencies with fast, flexible funding options. For the advanced traders, look no further then Kraken Pro, a highly customizable, all in one trading experience and our most powerful tool yet.

5. Uniswap says no to fee switch (again)

A recent Uniswap governance proposal to turn on the “fee switch” on Polygon has been narrowly shot down by the DAO. The Snapshot poll saw 45.32% of voters voting towards “no”, while remaining votes were split between choices to turn on fees at ⅕ or 1/10 of pool fees.

The “fee switch” refers to a longstanding governance dispute amongst Uniswap stakeholders to levy protocol fees on Uniswap liquidity providers (LPs), and redirecting some of those fees to UNI tokenholders. Actual users of Uniswap would not be impacted. By default, Uniswap v3 fees are set to zero.

Arguments in favor of the fee switch typically point to the revenue-earning potential of the protocol, while opposing arguments fear that it might make Uniswap less competitive to other DEXs and also expose the DAO to increased legal and tax implications.

📺 Bankless Weekly Roll-Up

Other news:

- Coinbase wallet introduces gas-free USDC transactions

- Coinbase replaces U.S. Treasuries with overnight repos

- Rocket Pool deploys on zkSync Era

- MoonPay executives cashed out $150 million before crypto crashed

- Binance lays off employees

- Nansen cuts 30% of workforce

♦ Follow along with Asymetrix Protocol ♦