Weaponized Banks

Dear Bankless Nation,

We’re now into our 5th day of the Russian invasion of Ukraine.

Here’s my tl;dr: of the conflict:

- Ukrainian forces have been surprisingly effective. Morale is reportedly high, and Russia has been unable to secure any major victory in the country.

- Many Russian forces seem confused and bewildered as to why they are in Ukraine at all.

- Ukrainian president Volodymyr Zelenskyy has emerged as a hero, instilling confidence in Ukrainian forces.

- Nevertheless, the sheer magnitude of Russian forces has been able to surround the Ukrainian capital of Kyiv. Concerns about the Ukrainian forces’ ability to maintain the fight are unabated.

See this tweet thread on the first 96 hours of the war for a more comprehensive update.

Putin’s invasion of Ukraine has far-reaching implications for crypto which will become obvious in the weeks and months ahead.

And for the first time in a while, governments across the world are on the same page about something: they all plan to financially sanction Russia.

The Sanctioning of Russia

Sanctions from around the world are coming in FAST. The USA, UK, EU, Japan, Australia, New Zealand, Taiwan each hit Moscow with economic sanctions.

Notably, Taiwan has banned all semiconductor shipments to Russia. While this doesn’t immediately impact Russia today, no country can last long without semiconductors.

Computer chips are in everything and >90% of them are produced by Taiwan.

Russia gets SWIFTed

The US, UK, France, Germany, Italy, Canada, and the European Commission have also collectively agreed to expel Russian banks from the SWIFT payments network, in an “unprecedented act of global sanctions coordination”

This means that the target Russian banks have almost no ability to send or receive money outside of Russia, rendering them nearly useless as financial institutions.

Central Bank Assets Frozen

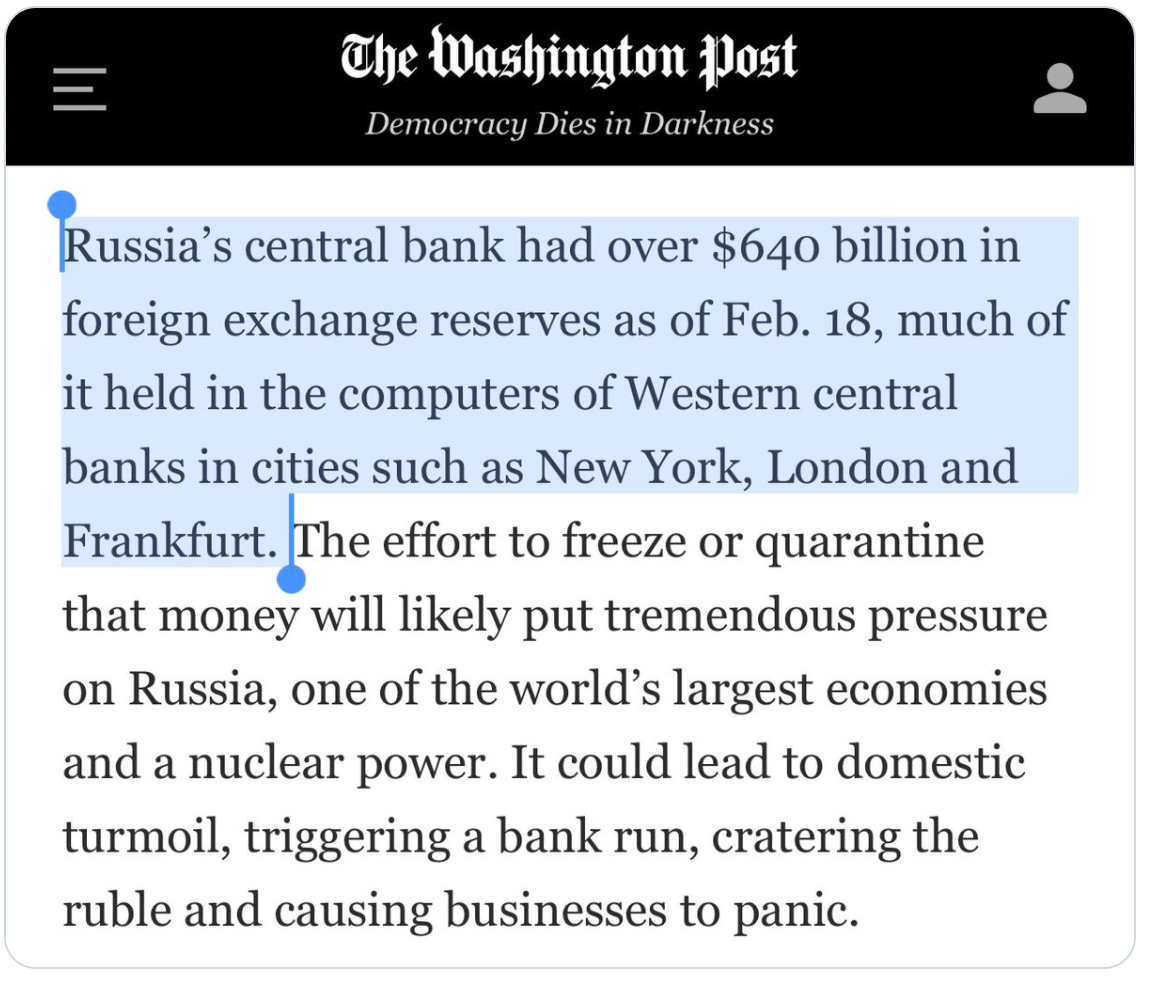

Perhaps most painfully, the EU and US coalition has also imposed sanctions on the Russian Central Bank paralyzing over $640 billion in Russia’s foreign currencies.

As of now, no US persons or companies can engage with the central bank of Russia.

Russia’s billions in central banks reserves are only useful to Putin if the money can actually be used, and with frozen accounts, Putin can no longer access this money.

Fall of the Russian Ruble

Without escape hatches to the rest of the financial world, the Russian Ruble has taken a huge hit. Going from 80 Rubles per $1 to almost 120 Rubles per $1, marking the largest single-day declines in the value of Moscow’s currency ever recorded.

Russian citizens both inside and outside of Russia have been waiting in hour-long queues to withdraw their cash from Russian bank accounts.

The devaluation of the Ruble has stoked fears of hyperinflation. To fight this, the Russian central bank more than doubled interest rates to 20% today.

Even the Moscow stock exchange decided not to open today. If it had, I’d expect to see a bloodbath in the devaluation of Russian companies too.

Russia’s financial world is effectively “closed”.

What about crypto?

There are two parts of how crypto is relevant:

- How crypto is helping right now

- The crypto will impact future economic sanctions in the future

Crypto Is Helping Ukrainians

Ukraine DAO

Ukraine DAO has been spun up with the help from Pussy Riot’s Nadya Tolokonnikova which has raised nearly $4 million for Ukraine.

You can join the Party Bid to purchase a JPEG of the Ukrainian flag here.

Self-Custody

You can hold crypto by memorizing 12 words or discretely keeping a hardware wallet in your pocket.

Sometimes, being able to hold your savings in the palm of your hand is the form factor needed to enable you to keep it during times of war.

Russian citizens’ flight to Bitcoin?

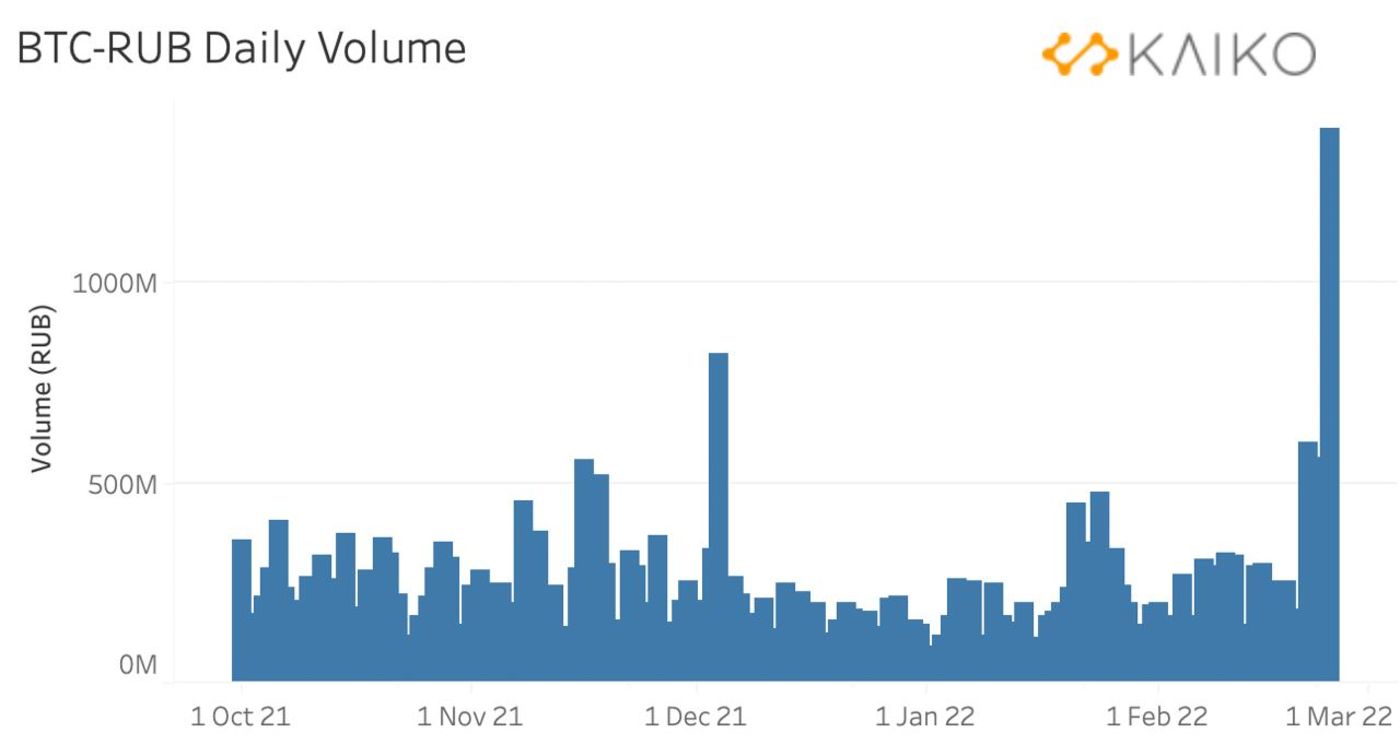

BTC volume on Russian exchanges jump to ATHs as Russian citizens flee the Ruble.

Crypto is here for the people.

Whether it’s a Ukrainian fleeing from war or a Russian protecting their savings, the self-custody of non-sovereign money enables people to protect the value of their wealth from the decisions of misaligned political leaders.

Fiat currencies devalue when governments make poor choices.

Maybe this is why Bitcoin surpassed the Ruble today in market cap:

The Cliffhanger

Once the Ukraine conflict is over, I expect the conversation of global economic sanctions and cryptocurrency to take center stage.

So here’s where we are now:

These conversations are just getting started; we’ll need to wait and see how they develop.

One thing is likely certain: anti-crypto government leaders will likely use this as an example as to why “crypto is bad” and why draconian crypto regulation is justified.

My heart goes out to the Ukrainian families who have to endure the invasion and destruction of their homeland.

It also pains me to see Russian soldiers who clearly have no interest in being there either.

I take some solace in that I see the entire world all being on the same page for once about something:

F*ck Vladimir Putin.

- David