Watching Tokens with Dex Screener

Dear Bankless Nation,

There's a lot of alpha out there. It has never been easy to find, but the tools to visualize it are getting a whole lot better.

Today, we take a look at Dex Screener – a popular tool among traders that can be a secret weapon (if you know what you're looking for!)

-Bankless team

Getting Started with Dex Screener

Bankless Writer: William Peaster | disclosures

A few years ago there were maybe a dozen Ethereum tokens worth watching closely.

Fast forward to present day, and dozens of tokens are launched on Ethereum daily. Of course, many of these new tokens are riff raff, and some are definite scams, so you have to be careful and do your due diligence before taking a ride on the coin of the day or searching for diamonds in the rough.

Toward that end, a great token analytics platform is Dex Screener. Dex Screener is a one-stop platform for all things related to decentralized exchanges, so if you can trade it in DeFi, then you can analyze it on Dex Screener. The big idea? Track, analyze, and act on real-time data from a vast array of DEXs across a range of different chains. Surface the signal from the noise on Dex Screener’s web platform or its Android and iOS mobile apps.

As for diving in, it’s easy to get started. For example, on the website you can begin customizing your dashboards by signing in with an Apple or Google account or connecting your Ethereum wallet, e.g. MetaMask.

As you can see below, the main dashboard on the platform currently defaults to automatically sorting token pairs by the number of transactions over the past 24 hours. You can use the “Last 24 hours” button at the bottom of the page to pick a different time frame, e.g. 5 minutes, or the “Rank & Filter” button to search for tokens in more granular fashion.

At this point, you can click on a specific token pair of interest to zoom in on its recent transactions, top traders, liquidity stats, market cap stats, and more. For example, this page tracks the Wrapped Mantle and USDT pair on the Agni DEX:

That’s just the front page of the platform though. If you want to start checking out some of the other functionalities, look over to the left sidebar – here, you’ll find Watchlist and Alerts hubs, where you can pick out specific token pairs you want to watch closely and create price alerts to let you know if/when your price targets are reached.

Next up is the Multicharts dashboard, where you can pick out multiple token charts and place them alongside each other so you can watch price action across a range of token pairs simultaneously.

The last trio of dashboards are particularly interesting for us token analyzooors.

First is the New Pairs page, which surfaces liquidity pools that have just been created from around DeFi and tells you how old the pools are, the number of buys and sells they’ve facilitated, etc.. Next, is the Gainers and Losers center, where you can readily sort by which liquidity pools have seen the biggest price drops and rises over the past day. Lastly, there’s the Trends tab, that helps you quickly identify tokens that have just recently begun to trend sharply upward or downward.

Of course, the buck stops with you as far as how to best use these analytics resources. But if you do your part and bring caution and shrewdness to the table, then Dex Screener has everything you need to elevate your trading game, whether you’re a DeFi novice or veteran.

From customizable dashboards to trending tokens, this is a great tool for diving in and making educated decisions while you navigate the crypto frontier. Dive in, stay informed, and make the most of new DeFi happenings with Dex Screener.

Action steps

- 📈 Check out Dex Screener: Explore the platform

- 👾 Catch up on the previous tactic: Leveling up your NFTs with Arcade

MARKET MONDAY:

Scan this section and dig into anything interesting

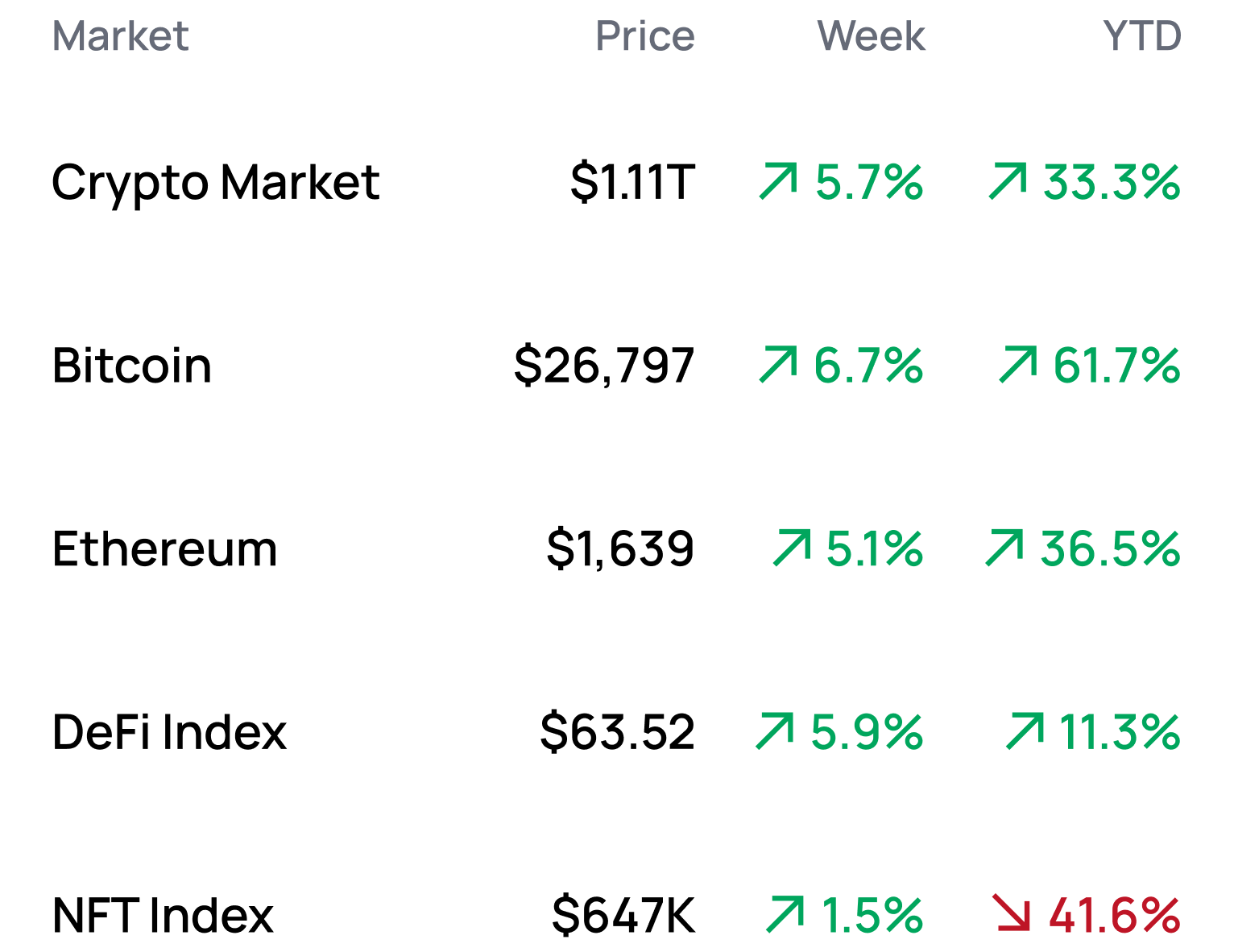

*Data from 9/18 5:00 pm EST (DeFi Index = $DPI, NFT Index = $Blue-Chip-10)

Market Opportunities 💰

- Explore non-EVM chains using MetaMask Snaps

- Diversify your crypto holdings with Index Coop’s large cap index

- Trade on Mauve, a KYC enabled DEX for RWA trading

- Log-in to dApps on Sui using Web2 credentials

- Test Synapse’s Interchain Communication Network

Yield Opportunities 🌾

- BTC: Earn up to 7.4% APR with 03Swap’s BTC vault on Arbitrum

- ETH: Earn up to 8.3% APY with Beefy’s wstETH/rETH pool on Polygon zkEVM

- ETH: Earn up to 8.4% APR with Hop’s ETH pool on Arbitrum Nova

- USD: Earn up to 24.0% APR with Aura’s DOLA/USDC pool on Arbitrum

- USD: Earn up to 19.5% APR with Velodrome’s FRAX/DOLA pool on Optimism

What’s Hot 🔥

- Mark Cuban loses $870k to crypto scam

- SEC charges Stoner Cats with offering unregistered securities

- FTX receives permission to liquidate crypto assets

- Offchain Labs partners with Espresso Systems

- More Binance.US layoffs, CEO departs

- Deutsche dives deeper into digital asset custody, tokenization

- CFTC enforcement director labels DEXs “obvious threat”

- 3AC founders banned from trading in Singapore for 9 years

- LayerZero partners with Google Cloud as oracle provider

- Rogue Milady dev embezzled $1M from treasury

- Azuki explores considers offering next collection as tokens

- Canto to become an Ethereum L2 build on Polygon’s CDK

Kraken, the secure, transparent, reliable digital asset platform, makes it easy to instantly buy 200+ cryptocurrencies with fast, flexible funding options. For the advanced traders, look no further then Kraken Pro, a highly customizable, all in one trading experience and our most powerful tool yet.

Money reads 📚

- Are We There Yet? - Arthur Hayes

- Reduce Churn Limit to Slow Validator Set Growth - dankrad

- Liquid Restaking Tokens and New Era Ponzinomics - Ignas

- Regime Change in Stablecoins - Castle Island Ventures

- Capitalism Onchained - Packy McCormick

Governance Alpha 🚨

- Polygon releases proposal for 2.0 upgrade and POL token migration

- The Graph looks to increase percentage of rewards distributed on L2

- Disgruntled Nouns HODLers exit with $27M from treasury

- Uniswap seeks approval to distribute ARB airdrop via grants program

Token Hub: BNB 📈

Analyst: Jack Inabinet

We are initiating coverage of BNB with a rating of bearish

Catalyst Overview:

Binance has repeatedly found itself in the regulatory dog house throughout the second half of 2023. Both the CFTC and SEC have filed enforcement actions against the CEX and the DOJ is rumored to be weighing charges, but has allegedly hesitated over fears that charges could cause an FTX-style bank run.

BNB plays an opaque role on the exchange’s balance sheet and US regulators have already alleged that Binance has commingled user and exchange funds. Concerningly, the SEC is now requesting an urgent inspection into Binance.US usage of Ceffu, a custody service with unclear ties to Binance.

Price Impact:

BNB has been down-only throughout 2023 and we anticipate that this trend will continue. With custody practices coming under further scrutiny and the US regulatory apparatus cracking down on the exchange, it seems like only a matter of time before the full extent of Binance’s sins come to light.

See more ratings in the Token Hub.

Meme of the Week 😂

Bear market conferences are better pic.twitter.com/seujfAcKB7

— RYAN SΞAN ADAMS - rsa.eth (@RyanSAdams) September 16, 2023