Warren's Anti-Crypto Crusade

Dear Bankless Nation,

Elizabeth Warren is trying to throw gas on the flames of anti-crypto sentiment in Washington as she wages a multi-pronged effort to regulate crypto out of the country.

For our weekly recap, we dig into:

- Elizabeth Warren reignites anti-crypto crusade

- Uniswap Labs announces new fee, catches heat

- Fake news pumps Bitcoin price

- Reddit bails on Community Points experiment

- SEC dismisses charges against Ripple execs

- Bankless team

📅 Weekly Recap

1. Elizabeth Warren reignites anti-crypto crusade

US Senator Elizabeth Warren is trying to attack crypto on every possible front, and she's found her latest opportunistic play.

Her latest move is to amplify how crypto-based terror financing signals that the entire industry is rotten to its core. In a letter authored by Warren and signed by more than 100 lawmakers, the Senator pushed top security officials for action in reining in crypto financing for terror groups, explicitly highlighting reports that Hamas had raised millions soliciting Bitcoin donations.

Crypto analytics firm Chainalysis already issued a report highlighting that claims of crypto playing a vital role in terror financing were overblown.

"Although terrorism financing is a very small portion of the already very small portion of cryptocurrency transaction volume that is illicit, some terrorist organizations raise, store, and transfer funds using cryptocurrency," a company blog post reads. "Terrorist organizations have historically used and will likely continue to use traditional, fiat-based methods such as financial institutions, hawalas, and shell companies as their primary financing vehicles."

2. Uniswap Labs announces new fee, catches heat

Uniswap Labs founder Hayden Adams announced this week that the popular frontend would be adding a 0.15% swap fee for certain tokens in the company web app and wallet.

The reason for the new fee? So they can keep building, Adams said.

The announcement almost immediately garnered backlash. Savvy traders on the platform will still be able to avoid the fee by sidestepping the Uniswap Labs frontend and using the protocol directly, but what angered token holders was that Labs had rolled out their own marketplace fee while UNI holders have had little support in enabling a protocol fee which returns funds to token holders.

3. Fake news pumps Bitcoin price

A misreported tweet on Monday from Cointelegraph announcing that a spot BTC ETF had been approved sent crypto into a frenzy, causing a spike in the crypto markets, which was soon walked back after the truth surfaced, but not before $65 million in shorts were liquidated.

Cointelegraph caught some major heat for running on false information, even earning it a subtweet from the SEC.

But broadly, the saga caused crypto investors to rally around how bullish a spot BTC ETF would be for the industry, pushing prices higher over the week towards $30k.

Kraken is one of the largest and most secure crypto platforms in the world. They've been in the crypto game for over a decade, and now they're inviting us all on a journey to see what crypto can be.

4. Reddit bails on Community Points experiment

One of the more high-profile rollouts of a crypto project at a major consumer tech company went south this week, with Reddit announcing that it was discontinuing its blockchain-based Community Points initiative. The effort aimed to reward users who positively contributed to certain subreddits.

The shutdown of the effort was due in part to regulatory concerns, a report in TechCrunch noted.

“Though we saw some future opportunities for Community Points, the resourcing needed was unfortunately too high to justify,” Reddit’s director of consumer and product communications Tim Rathschmidt told TechCrunch. “The regulatory environment has since added to that effort.

The announcement of the shutdown took a sinister note after it was discovered that Reddit moderators had front-run the announcement, selling off some of the impacted tokens before prices further crashed.

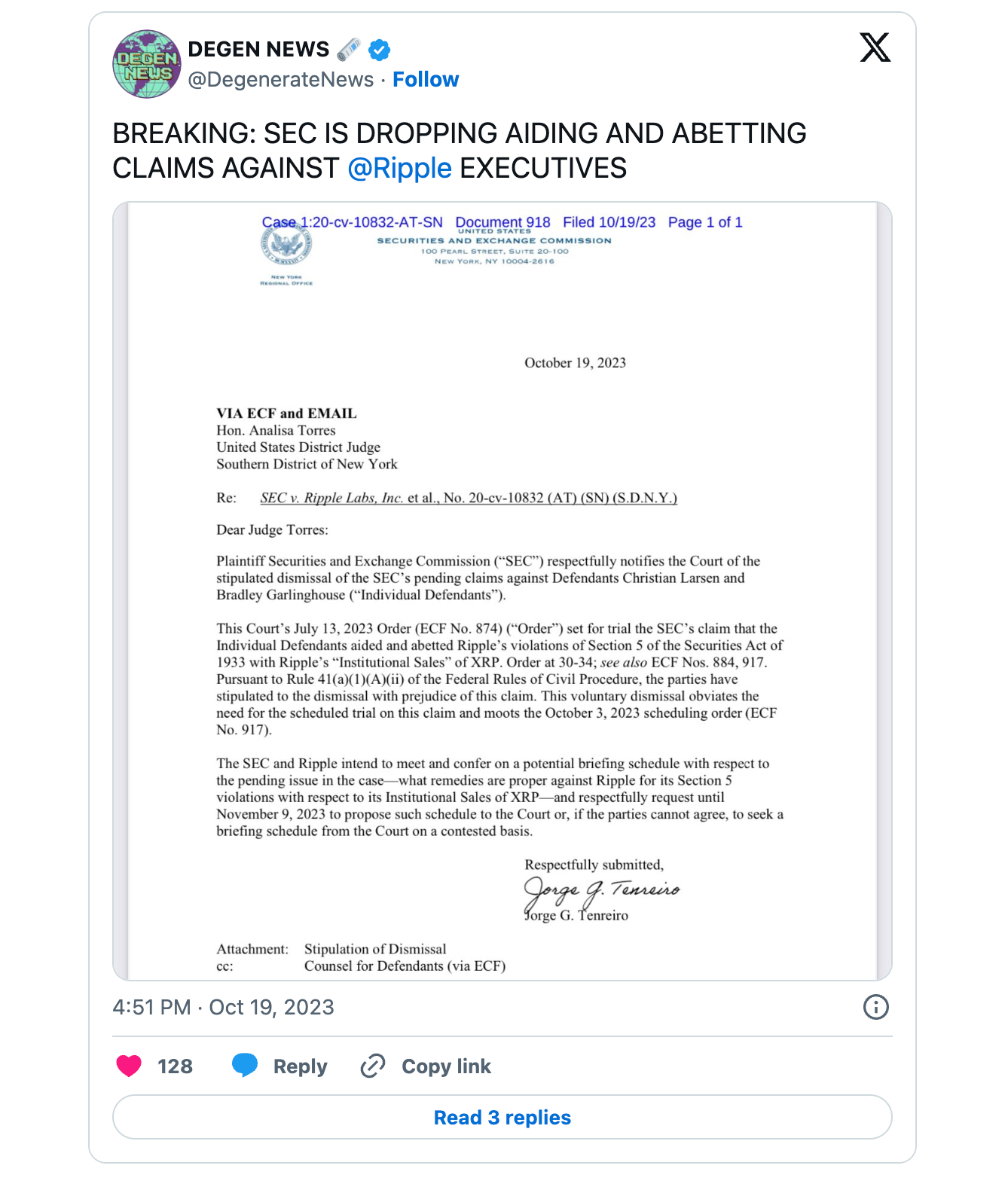

5. SEC dismisses charges against Ripple execs

Ripple Labs execs seem to be staying one step ahead of the SEC. This week, the SEC announced that it was dismissing its claims against top execs Chris Larsen and Brad Garlinghouse.

It's another win for Ripple after a judge ruled in July that XRP was not in itself an investment contract.

📺 Bankless Weekly Roll-Up

Other news:

- Fantom Foundation hot wallet hacked for $550K

- The Crypto Winter May Be Over: Morgan Stanley Wealth Management

- FDIC lacks ‘clear procedures’ for crypto-related risks, report says

- Yuga Labs CEO Is Learning Making NFT Games Is Hard

- Coinbase-incubated Layer 2 Base open-sources code to enhance transparency

- Binance.US asks users to convert USD into stablecoins for withdrawals

- US government among largest Bitcoin hodlers with over $5B in BTC: Report

- Sam Bankman-Fried Can't Focus Without His Medication: Defense

🔐 Try out a free trial of Doppel today