Wall Street's Stablecoin Stunner

View in Browser

Sponsor: Mantle — Mantle is building the largest sustainable hub for onchain finance.

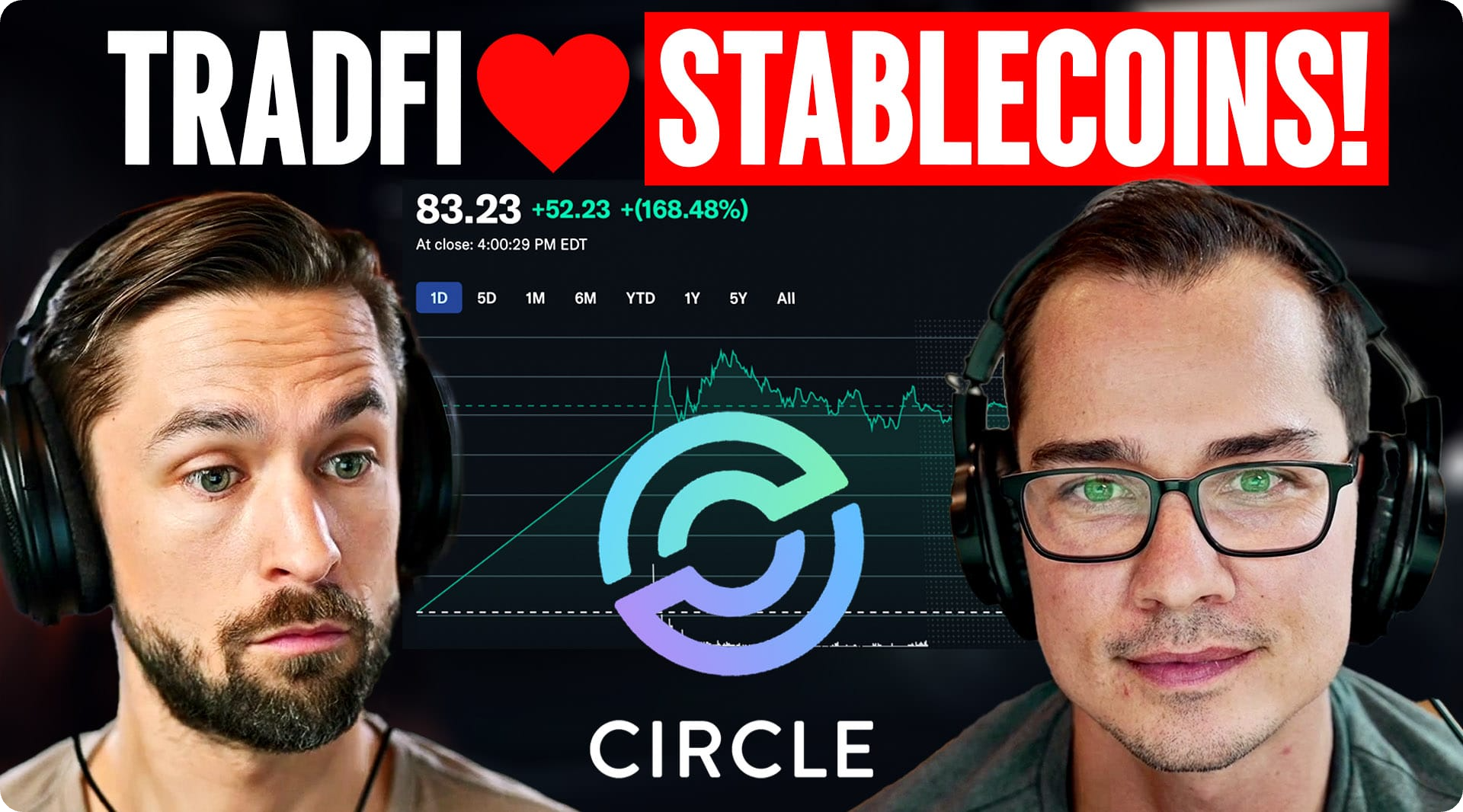

1️⃣ Circle’s Stock Market Debut

Circle stunned crypto and TradFi observers alike on June 5 as its stock ripped to a day-one high of $103 within 15 minutes of its New York Stock Exchange debut. CRCL shares traded as high as $123.50 on Friday, suggesting a market capitalization of over $27B and a lofty price-to-earnings multiplier of 177, implying investors are expecting stupendous future profit growth from the firm.

Cathie Wood’s ARK Invest bought nearly 4.5M shares of CRCL on the stablecoin issuer's first day of trading, meanwhile, BlackRock (a key Circle partner and the manager of USDC stablecoin reserves) indicated it wanted to ape ~10% of the IPO.

The NYSE welcomes @circle in celebration of its IPO! For over a decade, Circle has connected traditional finance and digital assets, seeking to create a secure, always-on digital economy. $CRCL@jerallaire pic.twitter.com/YnHL34puz7

— NYSE 🏛 (@NYSE) June 5, 2025

2️⃣ Trump Wallet Controversy

The Trump-backed World Liberty Financial has reportedly served a cease and desist letter to “Fight Fight Fight LLC," the issuer behind the TRUMP memecoin, for partnering with NFT platform Magic Eden to launch the TRUMP Wallet.

According to Donald Trump Jr., President Donald Trump’s eldest son and a “Web3 ambassador” for WLFI, the Trump Organization had zero involvement with this TRUMP Wallet and was instead working “tirelessly” to deploy its own wallet solution through WLFI. In turn, fellow Trump relation and WLFI Web3 ambassador Eric Trump admonished Magic Eden for using his family name to promote a project that “has not been approved and is unknown to anyone in our organization.”

The @TrumpWalletApp account has since been suspended on X, and while trumpwallet.com had been hosting a waitlist sign-up for the Trump-branded wallet earlier in the week, at the time of writing, the webpage was no longer live.

On Friday, Eric Trump confirmed the TRUMP Wallet will not move forward, but noted that the TRUMP memecoin is now “aligned” with World Liberty Financial, who intends to acquire a “substantial” TRUMP position for its treasury.

This project is not authorized by @Trump. @MagicEden I would be extremely careful using our name in a project that has not been approved and is unknown to anyone in our organization. https://t.co/OovJGvGOkO

— Eric Trump (@EricTrump) June 3, 2025

3️⃣ Polymarket’s X Partnership

On Friday, Polymarket founder Shayne Coplan announced a partnership as the “Official Prediction Market Partner” of social media heavyweight X and its artificial intelligence group (xAI).

Polymarket’s prediction markets went mainstream in 2024 for the valuable insight they yield about the likelihood of a given event’s occurrence. This most recent partnership aims to help the platform’s users by combining X data with Grok analysis to “provide contextualized, data-driven insights to millions of Polymarket users around the world instantaneously.”

Grok already sources Polymarket data to inform predictions about uncertain real-world events, and it is unclear how this partnership will impact the X user experience.

Proud to announce @Polymarket’s partnership with @X and @xai as their Official Prediction Market Partner. The two top truth seeking apps on the internet are stronger together.

— Shayne Coplan 🦅 (@shayne_coplan) June 6, 2025

Welcome to News 2.0.

Stay tuned https://t.co/P6Xd7yKlmt

4️⃣ Pump.fun Plans Token Sale

Two sources confirmed to Blockworks this week that viral memecoin launchpad pump.fun intends to raise $1B via token sale.

Considering pump.fun’s users have minted nearly 11M tokens for a cumulative market capitalization of roughly $4.5B, many crypto commentators identified pump.fun’s intended raise valuation of $4B to be overzealous.

The development dashed the hopes of airdrop hunters who hoped they would receive a free money allocation by holding pump.fun tokens and wreaked havoc on token prices across the Solana ecosystem as holders capitulated on their memecoin bags.

SCOOP: Sources confirm to Blockworks that pumpdotfun will sell its token at a $4 billion valuationhttps://t.co/Dk8aVTNfeB

— Blockworks (@Blockworks_) June 3, 2025

5️⃣ Plasma's $50M ICO starts Monday

On Monday, Cobie's new ICO platform Sonar will open pre-deposits for its first token sale: Plasma. Plasma is a Bitcoin sidechain for stablecoins that is fully EVM-compatible. On Sonar, 10% of its XPL token supply will be sold at $0.05 each, valuing the network at $500M — matching the terms of Founders Fund's recent equity-plus-token investment.

While commonly referred to as "the upcoming Tether chain," Plasma's relationship to Tether remains "unofficial," though it counts backing from Tether CEO Paolo Ardoino and Bitfinex. At launch, Plasma will support both native USDT and USDT0, enabling zero-fee USDT transfers — seemingly making it a rather "official" unofficial partnership.

Pre-deposits for the XPL sale go live Monday, June 9 at 9am ET. The actual token sale follows a few weeks later.

Experience the next generation of onchain finance with Mantle—where blockchain meets everyday banking. Powered by a $4B treasury, Mantle Network and mETH Protocol, Mantle is launching three innovation pillars: Enhanced Index Fund for optimized crypto exposure, Mantle Banking for blockchain-powered banking, and MantleX for AI-driven innovation. Stay tuned and enter the future of on-chain finance with Mantle.

This week, Ryan and David unpack Circle’s explosive $20B IPO—crypto’s second biggest—and what it signals about Wall Street’s newfound love for stablecoins.

They break down the confusing Trump wallet drama – where even Trump’s own sons deny involvement, and explore why Pump.fun’s rumored $4B valuation token raise has the industry split. Ethereum enters “wartime mode” as the Foundation lays off staff and spins up a lean new R&D force called Protocol. Plus, Ray Dalio says “a bit of Bitcoin,” Trump’s Big Beautiful Bill adds $2.4T to the deficit, and SBF is headed to Netflix.

It’s a jam-packed Weekly Rollup you don’t want to miss 👇

📰 Articles:

📺 Shows:

Thoughts on how to make Bankless even better? Tweet me!

🧑💻 Lucas Matney, Bankless Editor