View in Browser

Sponsor: Kraken — Sign up for an account and see what crypto can be.

ETF euphoria. Crypto market participants have become infatuated with spot Bitcoin ETFs after an acceleration in inflows last month helped place BTC within 8% of all-time highs.

The industry is flush with opinions these days on whether spot Ether ETFs will receive SEC approval, but the decision already appears to be settled! Is Wall Street about to wake up to another crypto asset?

The Alpha 🧐

Mike Novogratz, CEO of crypto investment firm Galaxy Digital, made his opinions on the matter public this week, stating that he sees spot ETH ETFs receiving approval sometime this year in a Bloomberg interview.

There is a litany of reasons that Novogratz may be eyeing this year for approval, but chief among them is the SEC’s May 23 deadline to approve or deny VanEck’s spot ETH ETF application, the earliest final approval date among active proposals...

Click through for more alpha and our favorite chart of the week 👇

| Prices as of 10am ET | 24hr | 7d |

|

Crypto $2.33T | ↗ 1.4% | ↗ 18.9% |

|

BTC $61,949 | ↗ 0.7% | ↗ 21.2% |

|

ETH $3,422 | ↗ 0.7% | ↗ 15.7% |

1️⃣ Bitcoin Breaks Records for ETFs

If there were any doubts, this right here is a bull market.

Bitcoin's climb this week blew past anything we could have expected, briefly surpassing the $64,000 mark for the first time since November 2021.

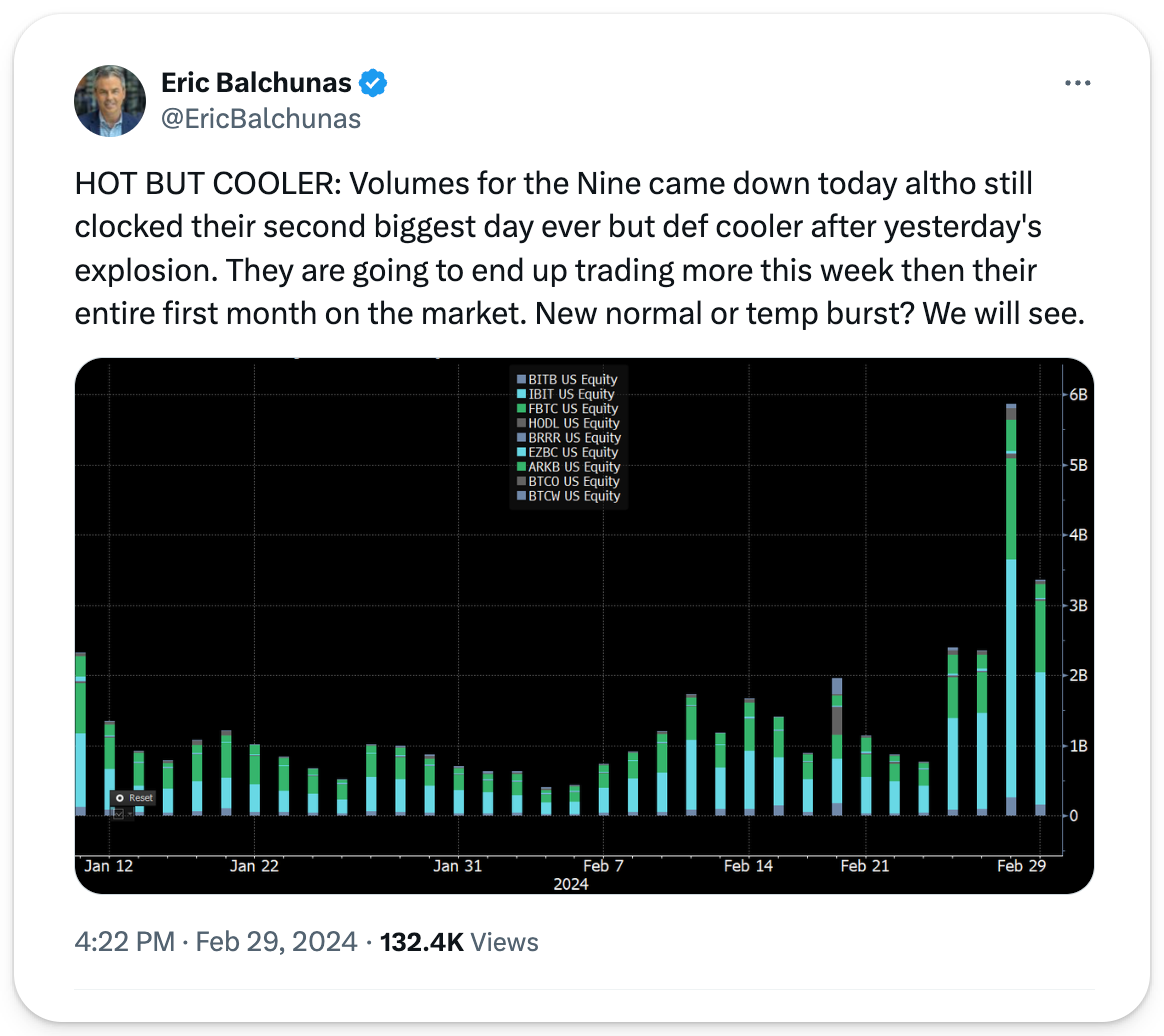

Bitcoin ETF inflows and volume contributed greatly to BTC’s price action, with Wednesday marking a new peak for inflows with $673M across the funds. As of Friday, Blackrock’s IBIT ETF had hit $10B in volumes. Whether or not a pullback proves imminent is beside the point; we are going so much higher.

2️⃣ Blast Takes Off

As expected, Blast's launch started with a bang, reeling in 502k transactions from 18.8k wallets in just under an hour post-official launch, though degens had already unofficially bridged to the network hours before.

This heightened activity resulted in fees to bridge to the network exceeding $500 on average for a few hours, keeping many sidelined or searching for other routes like through Orbiter. As eagerly as users joined, though, many left, withdrawing nearly $2B and dropping TVL from $2.3B to ~$500M between the network and leftover deposits.

Despite setbacks, activity remains high, with users still eyeing the 50% of airdrops reserved for depositing and using the network, leaving the rest for developers. The level of immediate outflows sure raises eyebrows though, begging the question: Can Blast pull this off?

3️⃣ Celebrating the End of the Bear at ETH Denver

As the market rallied, so did all those converging out West for ETHDenver. While significant announcements like Lens going permissionless and Arbitrum's integration with Robinhood punctuated the conference, the real purpose seemed to be celebrating the end of the bear and sticking it out together.

Bear market friends are real friends. If you were there, we hope you got to join our morning run or meetup! If not, don’t worry — Bankless will surely be present at many more events this year.

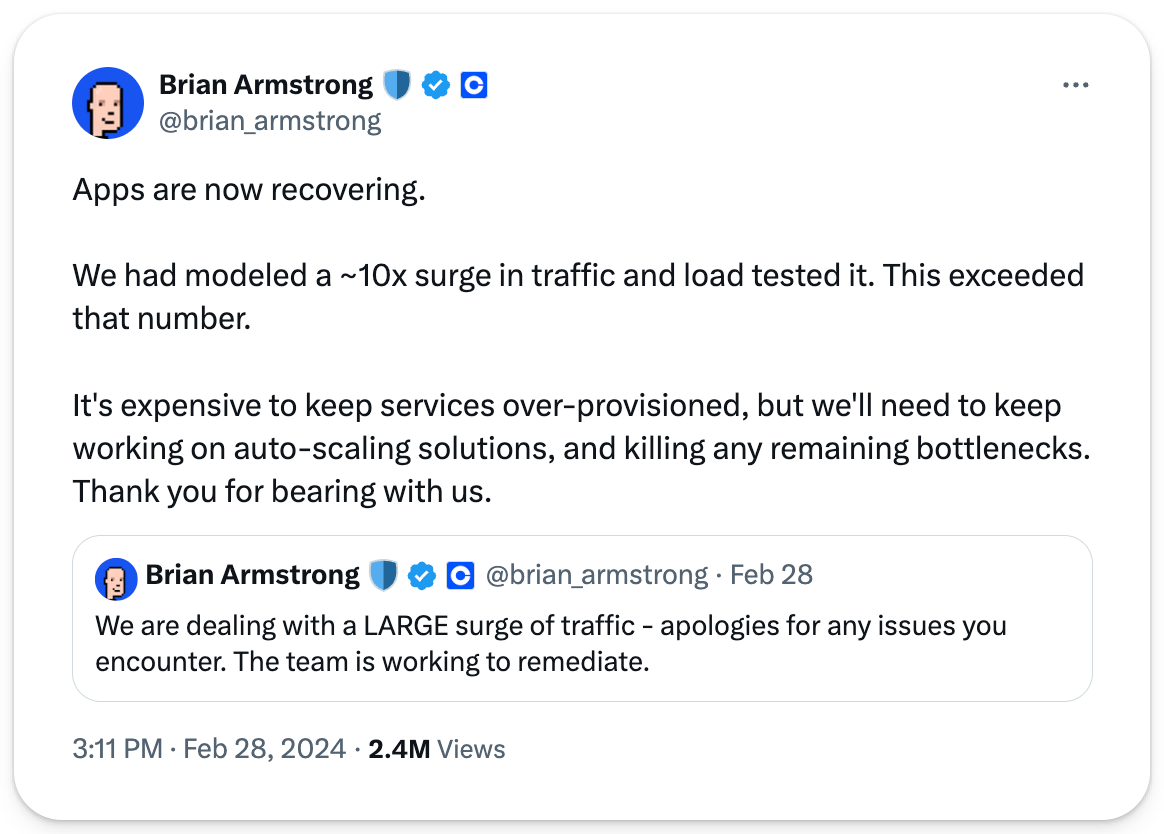

4️⃣ Coinbase Goes Down

Bitcoin's surge caused Coinbase's first outage since May 2020 amid a 10x volume spike. An odd glitch accompanied this outage, making many account balances mistakenly read zero. Service has since been restored with CEO Brian Armstrong acknowledging the need for improved scaling function to accommodate such surges.

5️⃣ Uniswap's Proposal Sparks DeFi Frenzy

Last week, the Uniswap Foundation’s announcement of voting to activate the fee switch boosted UNI's price by over 50% in a day.

The proposal, aimed at fostering more engaged and thoughtful governance involvement, would have UNI holders who have delegated or staked their tokens share in the rewards accrued by the DEX’s swap fees.

Amid this, Lido, Sushi, and Aave surged on speculation they might follow the proposal if it proves successful, though most have retraced since. Following Uniswap, Frax Finance plans a vote to reactivate its fee switch. All in all, much depends on the proposal's outcome, with voting ending on March 6. UNI holders, don't forget to vote!

Kraken is one of the largest and most secure crypto platforms in the world. They've been in the crypto game for over a decade, and now they're inviting us all on a journey to see what crypto can be.

This was a crazy week.

You saw the Bitcoin market madness, but you probably didn't catch everything. Let David and Ryan walk you through what went down.

Get the full rundown👇

📰 Articles:

📺 Shows:

Many Bankless Citizens who completed the Jito quests in our Airdrop Hunter app just earned $10k+ airdrop paydays!

It's airdrop season and plenty of other protocols are preparing to reward early users. Get on their lists. Start hunting!

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.