Wall Street's Eager for ETH

View in Browser

Sponsor: Uniswap Labs — Unichain is live! Bridge & swap with Uniswap Labs' web app or wallet.

1️⃣ ETH’s MicroStrategy Moment

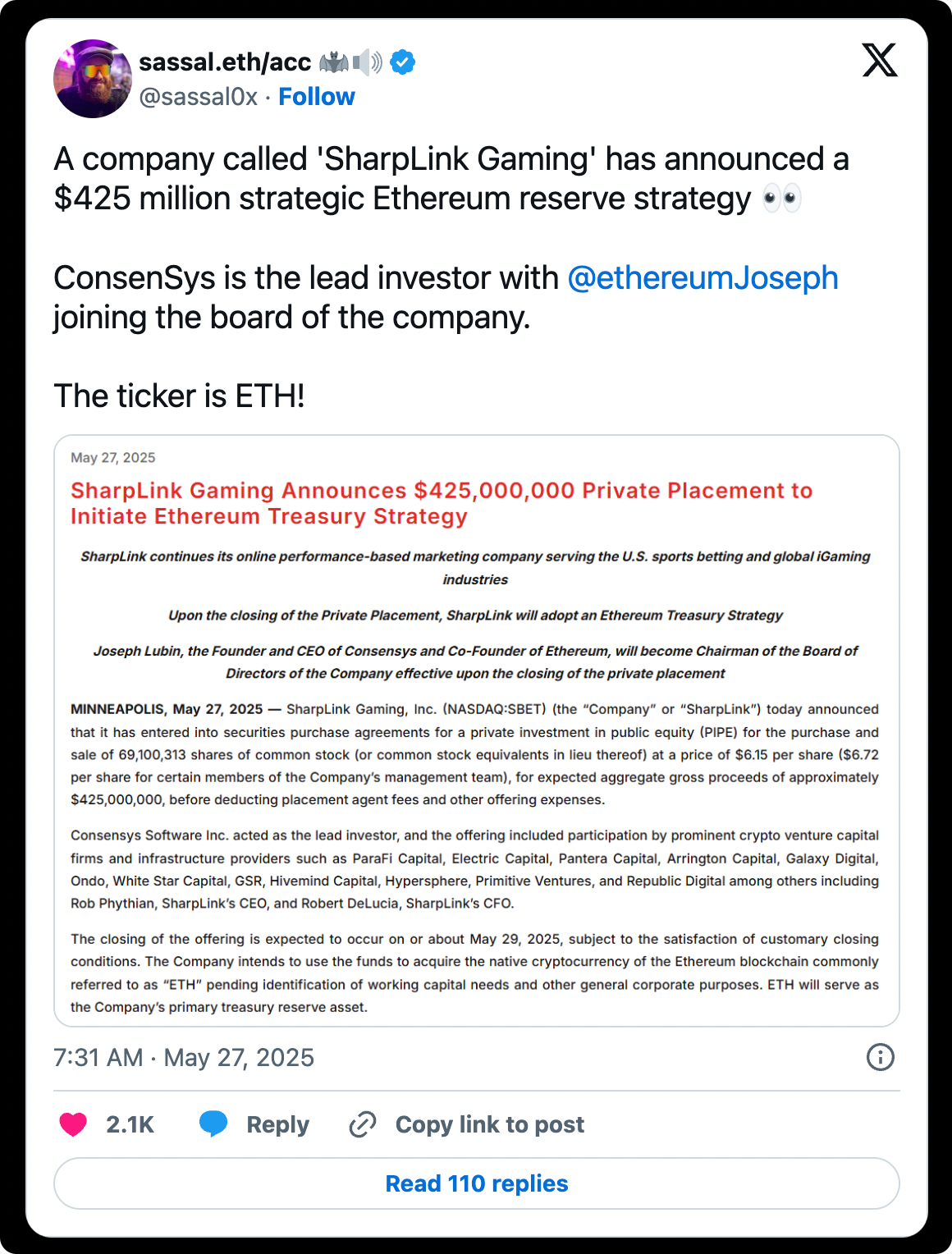

On Tuesday, SharpLink Gaming—a marketing partner for online sportsbooks and casino gaming operations listed on the Nasdaq exchange under ticker $SBET—saw shares surge 640% on the announcement it would adopt an Ethereum treasury strategy.

Led by Ethereum software developer Consensys, with participation from prominent crypto venture capital firms including ParaFi Capital, Electric Capital, Pantara Capital, Arrington Capital, and Galaxy Digital, the deal will enable private investors to receive 69M SBET shares at a price of $6.15 in exchange for their contribution of $425M; proceeds will be used to buy ETH.

While ETH surged on Tuesday's announcement, this likely explains the $700 rally we saw a few weeks back—either from insiders frontrunning the news or the actual buying happening ahead of this week's public disclosure.

Consensys CEO Joseph Lubin was named Chairman of SharpLink upon the deal’s close on May 29, and going forward, ETH will serve as the Company’s primary treasury reserve asset.

2️⃣ Slots and Sats: BTC Hits Vegas

The Bitcoin 2025 conference took Sin City by storm this week, packed with speakers ranging from foreign dignitaries and White House emissaries to BTC’s staunchest supporters and most fervent detractors.

With Bitcoin price (at the time) flirting with all-time highs, the Conference was abuzz with price predictions. Blockstream CEO Adam Back and Maelstrom CIO Arthur Hayes both provided $1M price targets as achievable benchmarks, and Eric Trump outdid them both with claims that just 0.1 BTC “is going to be worth an absolute fortune.”

During the multi-day event, GameStop announced it had bought $512M BTC, frontrunning statements from the nation of Pakistan and European football giant Paris Saint-Germain that they too will establish strategic BTC reserves.

U.S. Vice President JD Vance decried the Biden Administration’s assault on crypto and declared that BTC is here to stay, meanwhile NYC Mayor Eric Adams asserted he will fight to issue “bitbonds” and repeal the “BitLicense” registration requirement in New York.

All together, the Conference appears to have been a watershed moment for Bitcoin, one that solidified the technology’s acceptance among the political class and underscored the asset’s transition from a niche asset into a global financial force.

3️⃣ DJT Dives into Digital Gold

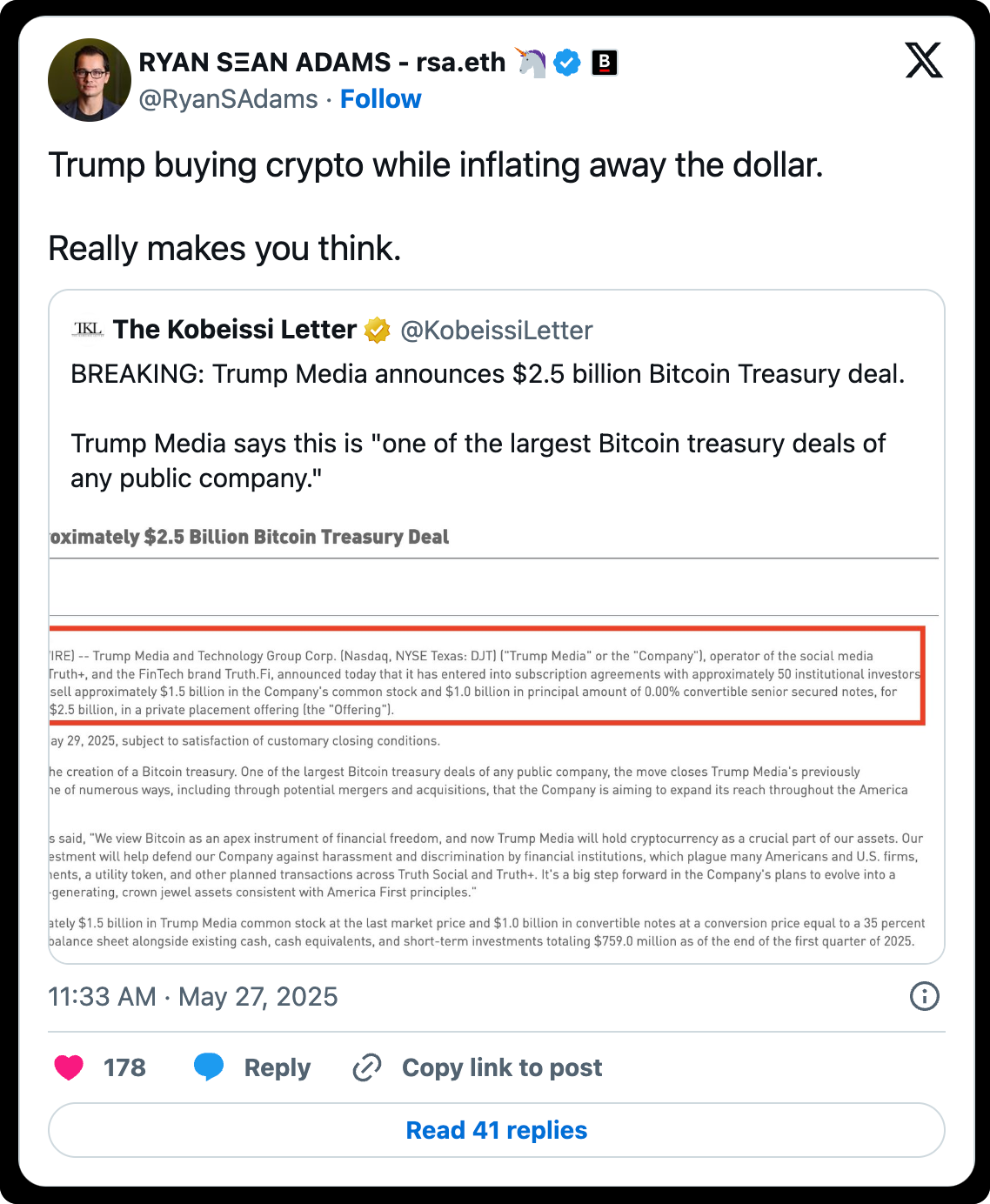

Among the litany of headlines to come out of Bitcoin 2025, perhaps most notable was President Donald Trump’s DJT—operator of Truth Social and parent company of fintech platform Truth.Fi—disclosing it raised $2.5B from approximately 50 institutional investors for the creation of a Bitcoin treasury.

Trump Media CEO and former congressman Devin Nunes framed the move as a financial and ideological statement that will defend the company from "harassment and discrimination from financial institutions,” while helping it evolve into a “holding company by acquiring profit-generating, crown jewel assets consistent with America First principles.”

Many within the crypto community were quick to point out the irony of Trump’s company buying BTC at the same time his policies of fiscal recklessness continue to rapidly debase the dollar.

4️⃣ OpenSea’s Evolution

NFT marketplace OpenSea officially launched OS2, removing the “beta” tag and making its updated interface the default experience for all users.

In a post published to X on Thursday, OpenSea CMO Adam Hollander detailed recent changes to the platform and provided an update for how an eventual $SEA airdrop will be distributed, indicating that users will be rewarded for their past history, current activity, and accumulated XP.

The next phase of OpenSea will be “Voyages,” a badge-linked program that rewards users with XP for exploring OpenSea features that serve as permanent records of user impact and will be “meaningfully considered” as part of any future reward program.

While Hollander states the OpenSea Foundation is excited to unleash SEA, he notes several additional features must be put into place before the token’s release to ensure long-term utility and staying power.

5️⃣ SEC Bails on Binance Battle

The Securities and Exchange Commission (SEC) filed paperwork with Binance on Thursday to drop its lawsuit against the crypto exchange and its founder over allegedly breaking U.S. securities laws by targeting American investors.

Under the Biden Administration in June 2023, the SEC alleged that multiple tokens trading on Binance.US were unregistered security offerings. It also questioned the degree of independence that Binance International afforded its U.S. subsidiary, provided evidence for the co-mingling of customer funds, and highlighted internal self-dealing activities undertaken to artificially inflate trading volumes on Binance.US.

Subject to court approval, the case is slated to be dismissed with prejudice, meaning the SEC will release its claims of wrongdoing and that future enforcement actions cannot be brought against Binance for issues outlined in the initial charging complaint.

Unlock the power of Unichain – a fast, decentralized Ethereum Layer 2 network built to be the home for DeFi and cross-chain liquidity. To bridge tokens to Unichain and start swapping today, get started with Uniswap Labs’ web app or mobile wallet.

This week, Ryan and David break down the political storm brewing around crypto—from JD Vance’s fiery Bitcoin 2025 speech to the Trump memecoin dinner that triggered bipartisan backlash.

They also cover Ethereum’s biggest capital inflow yet, as SharpLink Gaming just raised $425M to buy and stake ETH, drawing MicroStrategy comparisons.

Plus, the duo digs into the court ruling halting Trump's tariffs, Circle’s IPO finally moving forward, and early signs of a “Stablecoin Summer” as banks eye dollar-backed coins.

Catch all the intrigues by tuning into this week's rollup! 👇

📰 Articles:

📺 Shows:

Thoughts on how to make Bankless even better? Tweet me!

🧑💻 Lucas Matney, Bankless Editor