1️⃣ Vitalik Proposes PoS Simplification

Ethereum is designed to support a very high number of validators, which allows even regular individuals to participate in staking without needing to cede control to a staking pool.

While this design is intended to support decentralization, it requires Ethereum to process a huge number of signatures each block and the chain must make certain technical sacrifices to do so.

As such, this week Vitalik proposed three different methods to reduce the number of validator signatures required and lighten the load on the network, the idea being to help Ethereum retain its decentralized nature while making consensus simpler and circumventing the technical limitations of its current state.

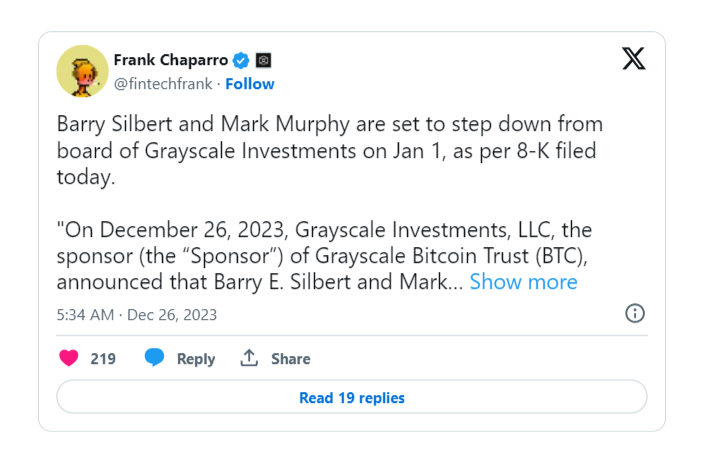

2️⃣ Resignations Rock Grayscale

Barry Silbert, the founder and CEO of embattled crypto conglomerate Digital Currency Group (DCG), alongside Mark Murphy, the group’s president, will step down from the board of DCG subsidiary Grayscale Investments effective January 1st, according to an 8-k filed on Tuesday.

Replacing Silbert as Grayscale’s chair is Mark Shifke, the current CFO of DCG, who was joined in his appointment to the board by Matt Kummell, a senior vice president of operations at DCG, and Edward McGee, Grayscale’s CFO. Michael Sonnenshein, the CEO of Grayscale, will retain his position on the board.

The filing does not reveal the rationale behind the personnel change, but DCG and Silbert have found themselves in hot water after recognizing the 10-year promissory note used to smooth over the gap left by the 2022 collapse of Three Arrows Capital as a current asset on their balance sheet.

However, it seems possible this move is intended to distance Grayscale from DCG and bolster the campaign to convert the Grayscale Bitcoin Trust (GBTC) GBTC into a spot ETF.

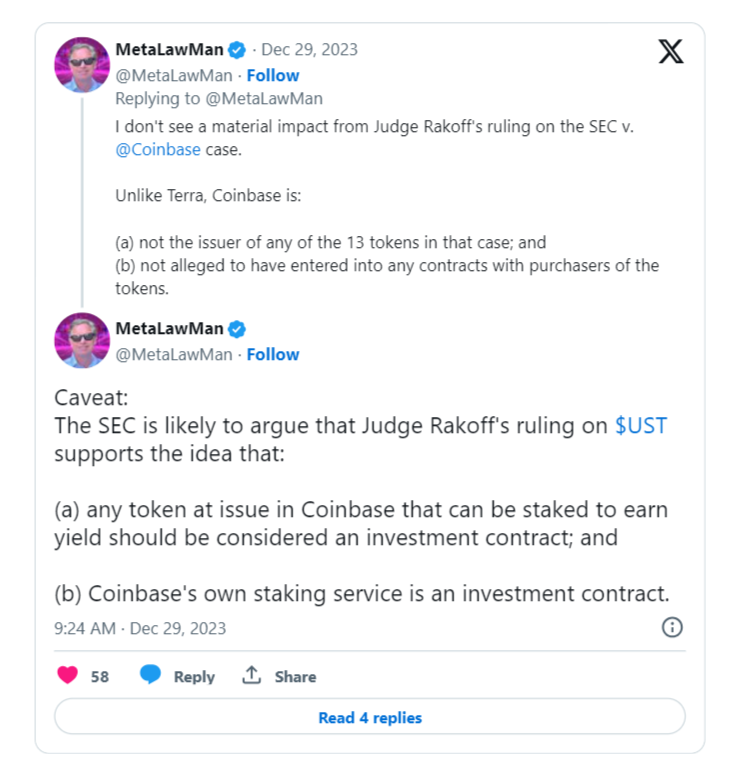

3️⃣ Terra Takes an L

A US federal court sided with the Securities and Exchange Commission (SEC) on Thursday, ruling that Terraform Labs violated federal securities laws when it sold LUNA, MIR, and UST (different Terra ecosystem cryptocurrencies) to the public.

The presiding Judge Jed Rakoff ruled that because Terraform Labs represented LUNA as an equity investment in the company and as a stake in the network’s transaction fees, it was openly declaring that it was selling investment contracts.

Zooming in, MIR and UST were found to be sold as investment contracts because they were yield-bearing instruments, a point that will likely be seized upon by the SEC in its attempt to argue that staking services offered to US citizens by exchanges like Coinbase constitute security offerings.

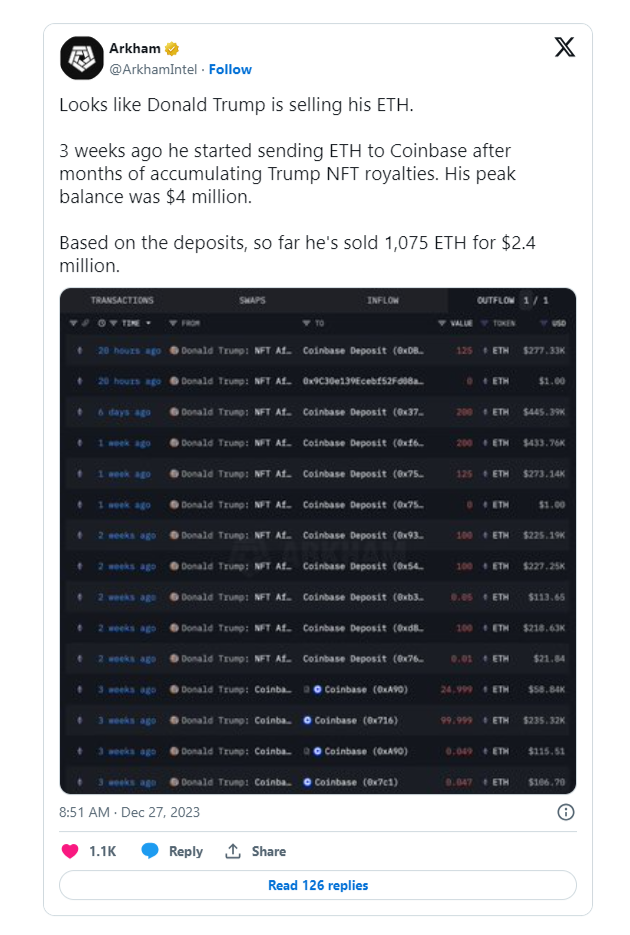

4️⃣ Donald Dumps ETH

Former US President Donald Trump appears to have dumped his ETH after the wallet that received royalty payments from his NFT trading card collection sent 1.1k ETH ($2.4M) to Coinbase deposit addresses over the past three weeks.

Trump has unveiled three NFT collections to date, all of which have each completely minted out despite their high price tag of $99 and extremely large collection sizes. Purchasers of large quantities of cards from each drop have been eligible for special perks, ranging from a dinner with Trump to a piece of the suit he wore for his Georgia mugshot in August.

5️⃣ Saylor Buys More BTC

MicroStrategy (MSTR) founder and chair Michael Saylor announced Wednesday that his company had acquired an additional 14.6k BTC for $616M at an average cost of $42.1k per token.

This most recent purchase means MicroStrategy now holds 189k BTC, nearly 1% of Bitcoin’s circulating supply. With an average acquisition price of $31.2k per coin, MicroStrategy and Saylor are currently sitting on nearly $2.4B in unrealized gains on their BTC position.