David's Take: It's Vampire Season

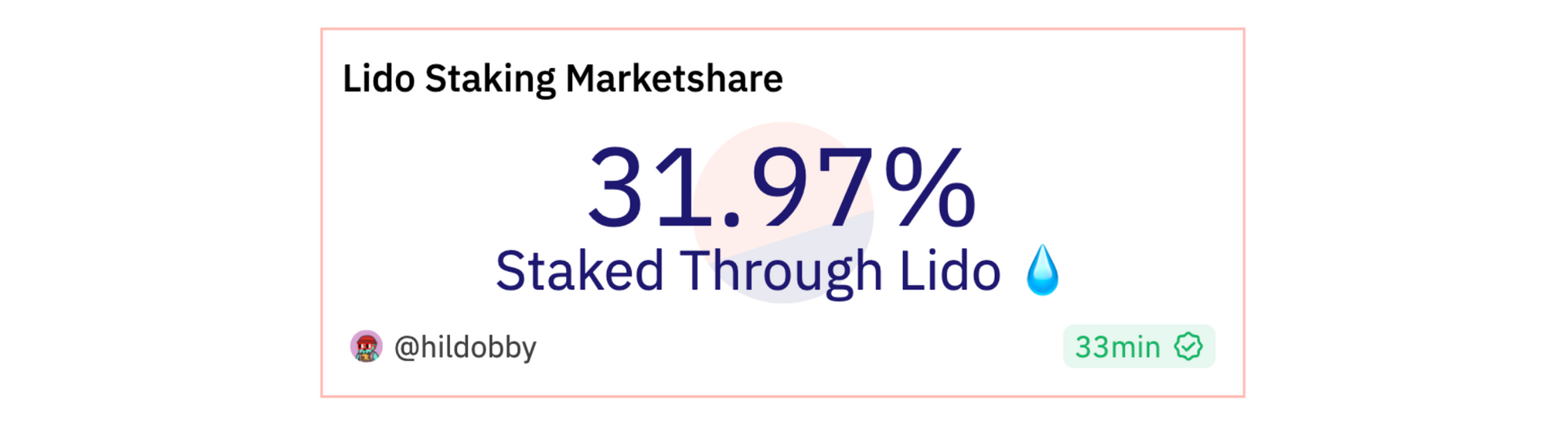

Lido dominance is roughly 1% of ETH staking market share away from crossing a key influence threshold over the Ethereum protocol.

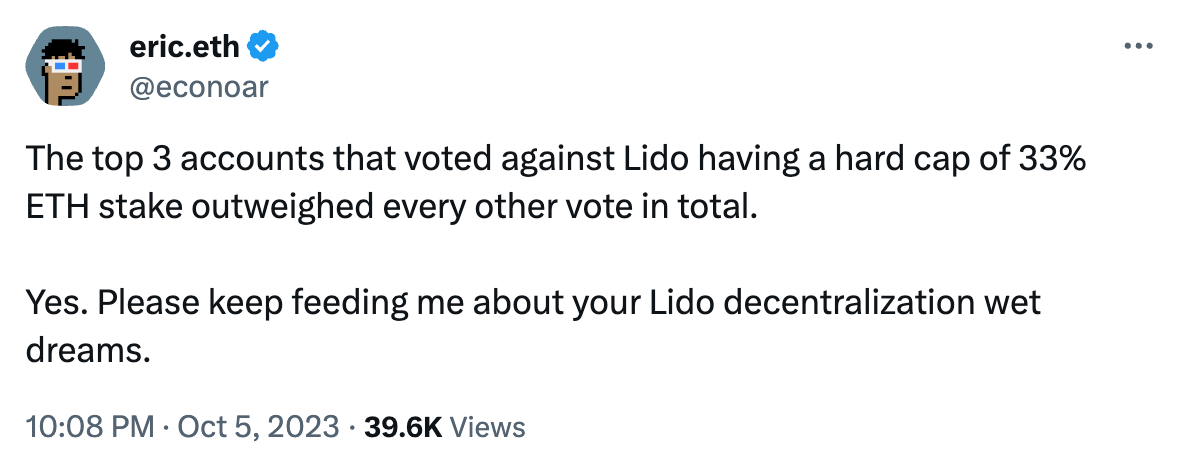

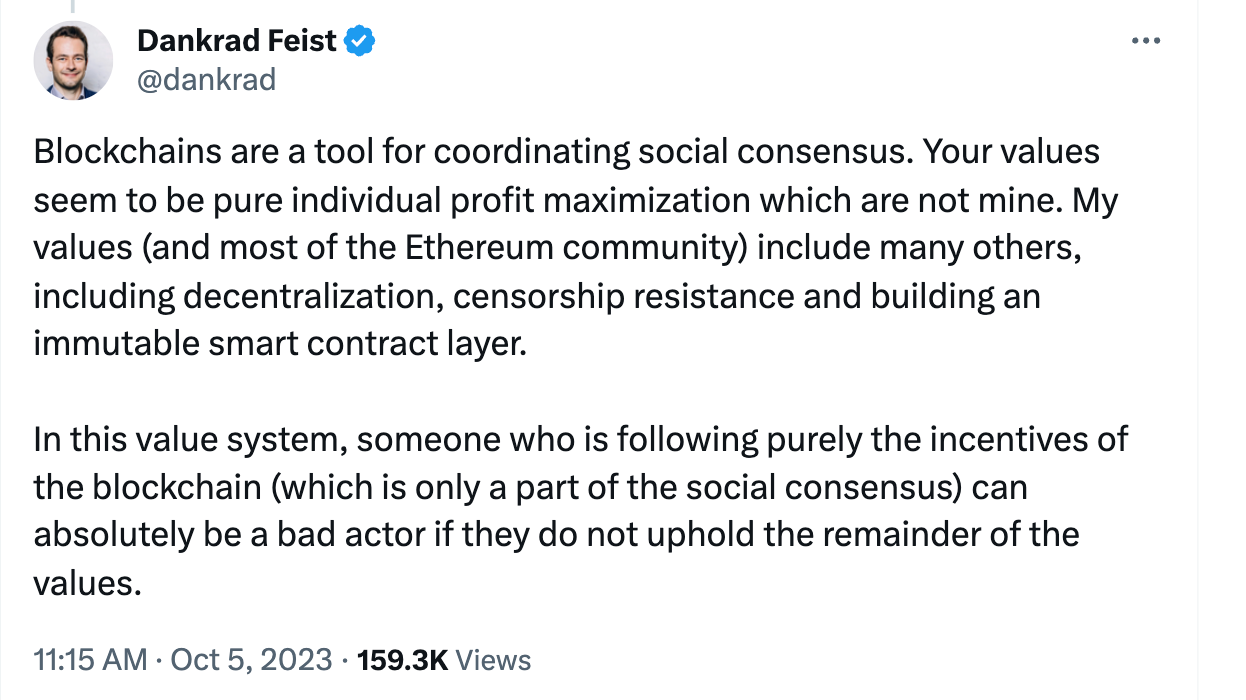

While Lido is not a monolithic organization, the Ethereum community has still voiced dissatisfaction with the Lido organization, its structure, and its perceived recklessness towards the credible neutrality of Ethereum.

More recently, Ethereum researchers, coordinators, and community members have all begun to rally around the need to do something about the growing threat that Lido presents toward the decentralization and credible neutrality of Ethereum.

"Where are the competitors? Where's the vampire attack?" - Danny Ryan

Just in case it wasn't perfectly clear already... pic.twitter.com/5TDqMt0kmc

— pub-gmn.eth🦇🔊👻🛡️ (@B3Rhunter) October 6, 2023

Until recently, I've felt at a loss for what to do about the Lido problem. Complaining without action is not my vibe, and I felt at a loss without a place to focus my energies.

But as of recently, there is something we can do about it!

Ladies and Gentlemen, it's Vampire season 🧛♀️

⚠️ Disclaimer #1: I'm a small-time angel investor in Diva, so I have a conflict of interest!! **However, I am also an investor in other LST protocols and hold LDO and RPL, so I think my economic incentives are relatively balanced. See disclosures here.

⚠️ Disclaimer #2: Diva is new! Like all new things, there's risk. There's a risk that cannot be measured -- mainly smart contract risk. While I've sat next to Diva team members and given them the ocular patdown, those assurances can only go so far. No protocol is 100% secure, and if you stake with Diva, you could lose all your funds in a catastrophic smart contract hack or by other means!

🧛♀️🩸 Vampire Season

Diva, a brand new LST protocol, is about to vampire attack Lido's $14b of ETH.

What is a vampire attack?

A vampire attack is a bootstrapping mechanism that newer protocols can leverage to grow adoption and TVL by incentivizing defection and capital migration from an existing entrenched player.

This new protocol enters the arena by economically incentivizing users and their capital to defect from their current protocol and join the new protocol. Once the vampire attack has concluded, a new equilibrium is set in, with the incumbent player losing some amount of dominance while the new player has captured some of its TVL, users, and evangelists.

Why should you care?

Lido is pushing up on the 33% threshold of Ethereum stake, which represents the first of three major thresholds of influence over Ethereum. Crossing this threshold is breaking through a line firmly held by many in the Ethereum space, representing a core commitment to decentralization and credible neutrality. These values ought to be preserved!

If these values-based reasons don't compel you, speculative upside might do the trick. If you don't care about the tech, do it for the money 😈. Depending on how much Diva can suck Lido's blood, the $DIVA token would, in theory, represent that success. If you missed my disclaimers above, please reread them.

Introducing Diva... and its vampire attack

Diva is, in my opinion, a technically superior staking system compared to Lido and is executing a Lido vampire attack to bootstrap its network.

Diva staking is designed to be philosophically and technically downstream of Ethereum staking. It even goes so far as using the identical infrastructure as Ethereum staking to produce its LST protocol. Some L2s like Optimism and Arbitrum are going for "EVM equivalence," and Diva is doing the same for Ethereum staking.

Node Operators become eligible Diva staking validators by depositing at least 1 ETH into the Diva staking contract. This act registers them with the Diva protocol and adds them to the pool of eligible Diva validators.

Using the Ethereum Beacon Chain RANDAO randomness, Diva selects 16 eligible validators to form a DVT 'squad' to perform the Ethereum staking duties. Like Ethereum PoS, Node Operators are randomly chosen by code, and that code is shared between vanilla Ethereum PoS and the Diva LST protocol.

Eventually, the goal of Diva is full immutability without governance.

Protocols, not People. Code, not Kings.

Diva = Distributed Validation

Diva is a technically superior LST protocol, thanks to the power of DVT.

DVT, or 'Squad Staking,' is the mechanism that enables Diva to achieve better decentralization and better economics than competitors.

What is DVT?

Distributed validator technology (DVT) spreads validator keys and signing responsibilities across multiple parties to reduce single points of failure and increase validator resiliency. Multiple different node operators come together to produce a shared 'virtual validator,' allowing individual staking operators to go from ~97% uptime efficiency to 99.99+%

DVT can make Ethereum more resilient, produce more total Ethereum validators, and increase $ETH staking yields. Diva is taking DVT into production to create a technically superior staking protocol.

While Diva does not own the concept of DVT, they are the first LST protocol to take this technology into production and leverage its power to increase its accessibility, decentralization, and yields.

Lido's strategy is to delegate validator duties to well-resourced 'experts' to professionalize the Lido validator set.

Diva's strategy is to use DVT technology to enable the common solo stakers to band together to create a far more powerful virtual validator that even a professional validator couldn't compete with. Diva is a tool to validate using network consensus, coordinated by cryptoeconomic guarantees, not token governance (and, in Lido's case, "knock-on-three-doors governance").

Through DVT, Diva is producing a protocol that embodies an alternative set of values that allows Ethereum community members who share those values the tools they need to be powerful.

$DIVA

The $DIVA snapshot was taken on June 3rd, 2023, and represents a significant but surgical targeting of Ethereum solo stakers, Rocket Pool and Lido participants, and active DAO governors.

Tl;dr: Roughly 15,000 addresses received 10% of the share of $DIVA, and in my opinion, the Diva airdrop distribution has already shown success in garnering attention and alignment from a wide distribution of Ethereum community participants. 40% of $DIVA is in DAO reserves; this is the fuel in the tank that Diva has to fund liquidity mining, bootstrap divETH liquidity, and pay for the incoming vampire attack upon Lido💧➡🩸

The Diva Vampire Attack 💧👉🩸

Information about the Diva Vampire attack on Lido can be viewed and interacted with here.

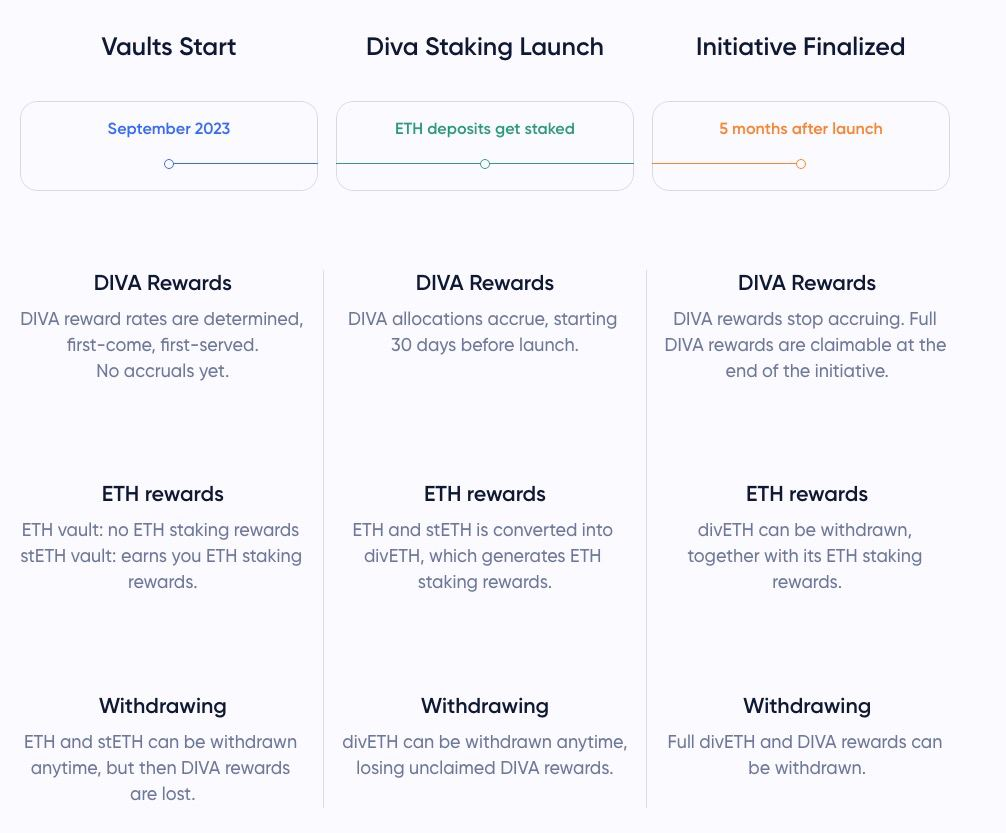

The mechanism is simple:

Deposit Lido stETH (or vanilla ETH) into the Diva enzyme vaults, and you will begin to earn $DIVA rewards based on the size and time of your deposits.

You retain control of your funds the entire time and can withdraw if you desire.

If you deposit stETH, you still earn ETH staking yields since it is still your staked-ETH.

The $DIVA reward schedule incentivizes earlier depositors by rewarding them with more $DIVA, but everyone is earning the same amount of $DIVA at any one moment.

⚠️ Diva is currently in testnet and is expected to launch for Ethereum Mainnet in Q1 2024. The vampire attack will continue for this entire length of time.

⚠️ Enzyme isn't new, and it's had some battle testing ($200m TVL during 2022). But, like all DeFi apps, it has smart contract risk! You can view the audits here, but audits are not assurances.

The Schelling Point is Emerging

I've been watching various communities discuss Diva with increasing interest. Some are enthusiastic; others are kicking the tires and trying to measure risk. While some will never be able to accept the risk of being "first through the door," others are taking this opportunity head-on.

- Karpatkey, one of the largest DAO treasury managers in DeFi, deposited 305 stETH (~$500k) to the Diva Vampire Attack contracts.

- Gnosis has deposited 3,011 stETH ($4.7m) into the Diva vampire attack vault.

- Ethereum community member Superphiz wrote an r/ETHfinance post titled: Why I'm supporting Diva's vampire attack against the oversized LSD.

- Jasper, a Rocket Pool community leader, also signaled support for Diva, its values, and its potential capacity for execution.

- Danny Ryan gave a non-endorsing acknowledgment of Diva for finally producing a project that's hungry and aspirational enough to go after Lido's TVL.

In the numerous conversations I have had with other Ethereum community members (thanks to being relentlessly online) it's become clear to me that the Diva Schelling point is begging to be set. No one is the arbiter of whether a Schelling point is set, but I think the writing is on the wall. The vampire attack is on! 🧛♂️

The ball is rolling, and now we have to watch the economics play out.

Action steps

- 🟦 Check out our tactic to Diva's Early Staking Vaults

- 💧 Read Leave Lido Alone