Understanding Validiums and Volitions

Lens is an open social network project that, along with Warpcast and Friend.tech, is among the biggest names in the contemporary crypto social scene.

To date, Lens has relied on an infra combo of Polygon and Momoka, the latter being a bespoke data availability solution, to power its decentralized app ecosystem.

That’s why Lens made waves this week when it announced it was building a new chain, Lens Network, to support its future via zkSync’s ZK Stack framework.

This new network will start as a Layer 2 (L2) solution known as a validium and later evolve into a volition. Many people don’t know exactly what these solutions are and why they matter, so let’s break them down.

The Basics of Validiums and Volitions

By now, you’re likely familiar with ZK rollups like Starknet, zkSync Era, and Linea. These L2s execute transactions offchain and use zero-knowledge proofs (ZKPs) for onchain data, i.e. validating and batching transactions to Ethereum.

Conversely, when you combine offchain execution with onchain data via fraud proofs instead of ZKPs, you get optimistic rollups like Arbitrum and Optimism.

That said, if you imagine the Ethereum scaling scene like a tree, validiums and volitions are solutions that branch out on the ZK side past ZK rollups. They’re both focused on facilitating high transaction throughput in a decentralized fashion, yet they approach this challenge differently.

Let’s compare them below.

Validiums

Validiums are a type of L2 that use ZKPs for transaction validation but store data offchain in a separate data availability (DA) layer. The main points to remember here:

- Offchain DA: Unlike ZK rollups, which post data onchain, validiums keep transaction data offchain in a DA provider. This separation reduces costs significantly since storing data on Ethereum can be expensive.

- High Throughput: By offloading data storage, validiums can achieve impressive transaction throughput levels, e.g. in the ballpark of tens of thousands of transactions per second (TPS).

- Trusted Security: While validiums offer strong cryptographic guarantees for transaction validity through ZKPs, their reliance on offchain data availability introduces a trust element. Users must trust the DA provider to make data available when needed.

- Use Cases: Validiums are well-suited for apps that require high throughput and can tolerate some trust in data availability, such as social networks, gaming, and non-financial transactions.

Volitions

Volitions are a hybrid scaling solution that combines the best features of ZK rollups and validiums. They allow users or apps to choose between onchain and offchain DA for different transactions within the same network. The big ideas:

- Flexible DA: Volitions allow users to choose to use onchain data availability (like zk-rollups) for high-security transactions and offchain data availability (like validiums) for less critical transactions. This choice can be made on a per-transaction basis.

- Scalability and Security: By enabling this hybrid approach, volitions can optimize for both cost and security, catering to a wide range of use cases without compromising scalability and ensuring users can tailor their security needs based on the nature of their transactions.

- Use Cases: Volitions are ideal for complex projects like decentralized social networks or financial apps that need the flexibility to dynamically balance transaction costs, speed, and security.

The Lens Network Example

There are a couple of validiums active in the cryptoeconomy today that you may recognize, like Immutable X and Sorare.

The Lens team is looking to join the ranks of these projects and become one of the first volitions to launch through its phased rollout of Lens Network.

The first phase will see the chain launch as a validium, while the second will see separate public and private validiums launched to support privacy use cases. The final phase will see Lens Network evolve into a volition so its users can switch between ZK rollup and validium capabilities as they please.

The mission? Create a new hub for the Lens ecosystem that can scale up to support billions of transactions in the future.

Why zkSync’s ZK Stack

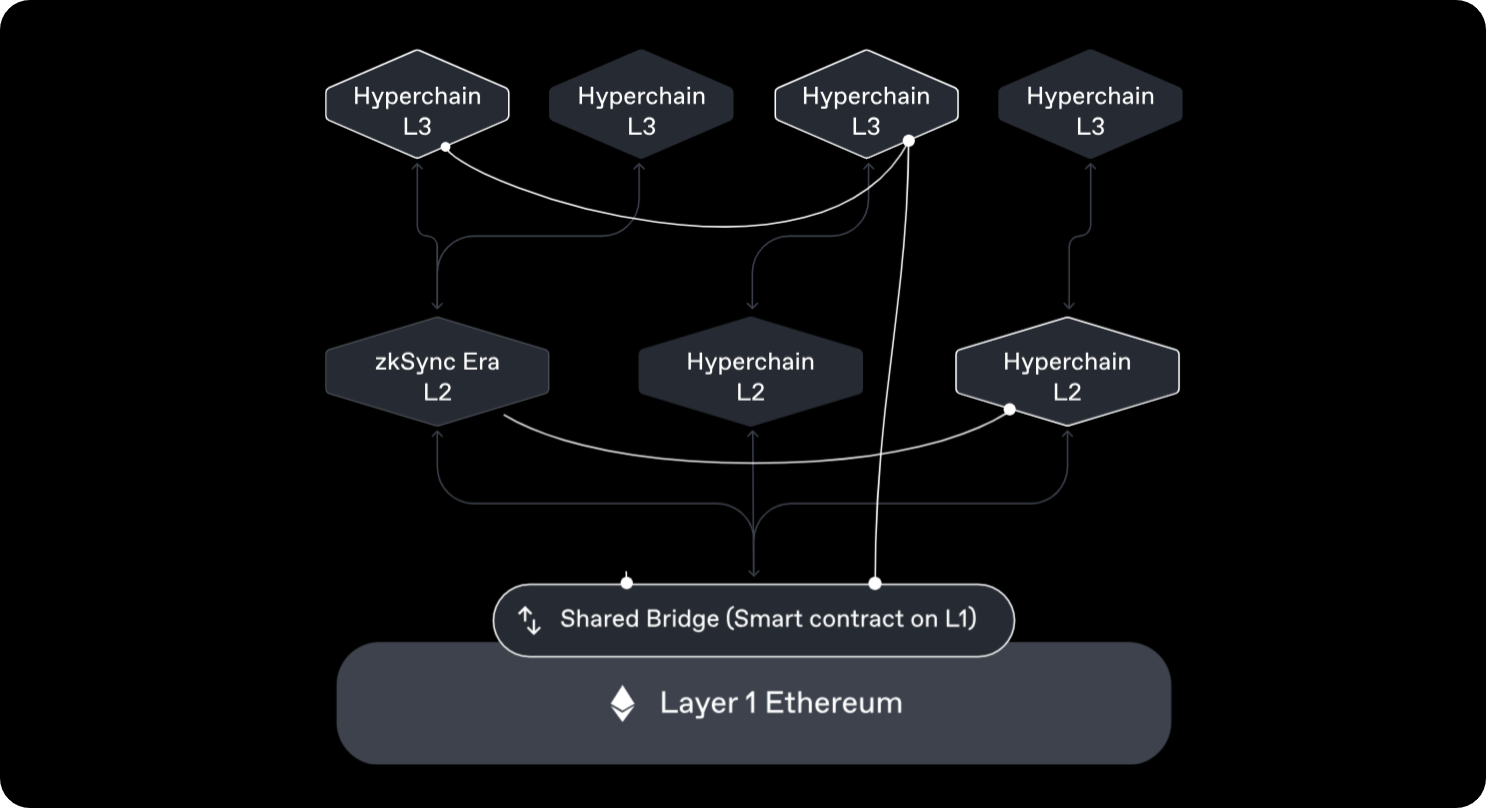

As mentioned earlier, the ZK Stack is a framework designed for readily creating ZK Chains. It offers several unique benefits that align with the goals of Lens Network:

- Modular Architecture: The ZK stack allows for customizability, enabling Lens Network to tailor its features to specific needs, such as DA options and transaction processing methods.

- High Security: Using ZKPs ensures that all transactions are cryptographically secure, which is critical for maintaining user trust and network integrity.

- Scalability: The Lens Network can handle a massive number of transactions by using a combination of validiums and volitions, making it suitable for a social network looking to grow to millions of active users.

- Interoperability: zkSync’s framework supports interoperability with other chains and apps via hyperbridges, which is crucial for facilitating an integrated social ecosystem.

All in all, as the Lens team completes this L2 transition, it will likely inspire a new wave of projects to take a closer look at what the ZK Stack, and validiums and volitions in general, have to offer. The need for crypto infra that can handle complex, high-throughput use cases will only grow.

Of course, the endgame is facilitating apps that are indistinguishable from mainstream apps today when it comes to UX, and Lens Network is just the latest demonstration that that vision is coming closer into focus. In the meantime, keep an eye on the progress of the L2 and others like it going forward.