- Ticker: CANTO

- Sector: L1

- Network: Canto

- FDV: $240M

- Hotness Rating: 🔥🔥🔥

Tl;dr: A fast-growing L1 is breaking new ground in DeFi.

- Canto is an EVM-compatible Layer 1 blockchain built using the Cosmos SDK. Canto is unique in that it launched with core DeFi primitives available as public goods, with these protocols having no individual governance tokens or ability to extract rent. These primitives include a fee-less decentralized exchange, the Canto Lending Market (CLM), and NOTE, an over-collateralized stablecoin that can be minted directly into the CLM. Canto is governed by CANTO stakers who secure the network in order to earn inflation and transaction fees.

- Canto has experienced significant inflows over the past several weeks, with TVL on the network soaring 8982% since August 15 from $961K to $87.4M.

- This explosive growth has been fueled by the launch of a liquidity mining program which went live on August 19. The program will distribute 62.5M CANTO, 6.25% of the initial supply minted at genesis, to CLM lenders over a 30-day period. The program incentivizes both stablecoin deposits and DEX liquidity for several trading pairs, with USDC, USDT, and the LP tokens for CANTO/NOTE, CANTO/ETH, and CANTO/ATOM, NOTE/USDC and NOTE/USDT all earning rewards.

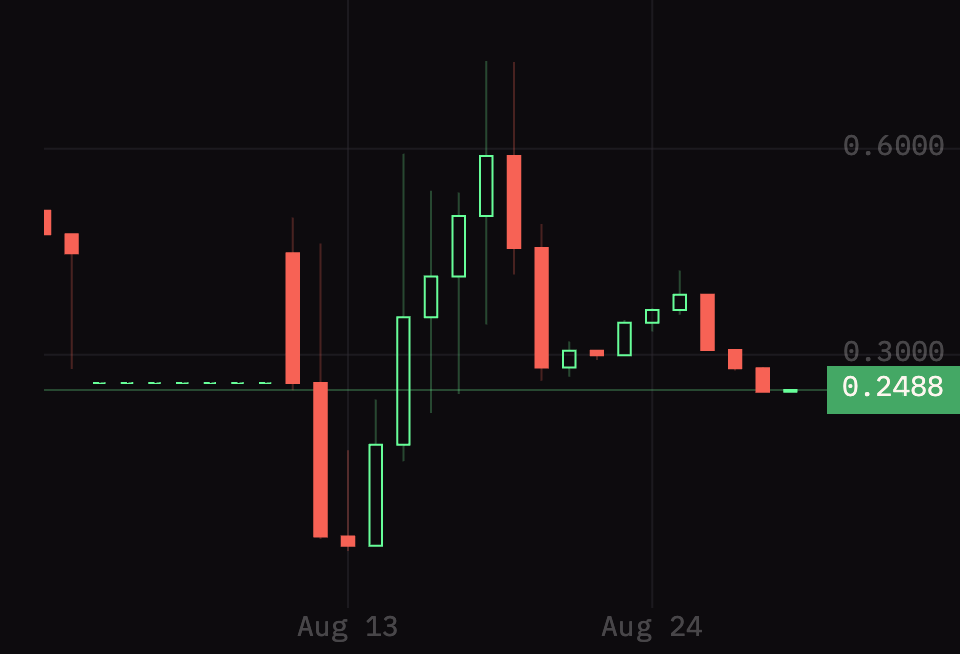

CANTO has experienced significant volatility following the launch of the liquidity mining program, rising more than 2799% from $0.02 to as high as $0.58 between August 13 and August 18 while having since fallen 56.8% to $0.25. This initial price increase was likely fueled by yield farmers buying CANTO before incentives went live in order to maximize their rewards, while the sell-off has been driven by those farmers selling said rewards coupled with broader market weakness.

Hotness Rating (🔥🔥🔥)

Canto is an intriguing L1 that is pushing the boundaries of DeFi experimentation. While it is unclear if the ecosystem will be able to attract long-term developers and liquidity after incentives run dry, Canto’s unique value proposition and parabolic growth make it worth keeping an eye on over the coming weeks and months.