Trending Project: Optimism (OP)

- Name: Optimism

- Sector: Layer 2

- Network: Optimism

- FDV: $7.02B

- Hotness Rating: 🔥🔥🔥🔥

Tldr: The explosive price action in OP is kicking off L2 summer.

- Optimism is an optimistic-rollup (ORU) that settles to Ethereum and provides users with lower fees and faster transaction speeds.

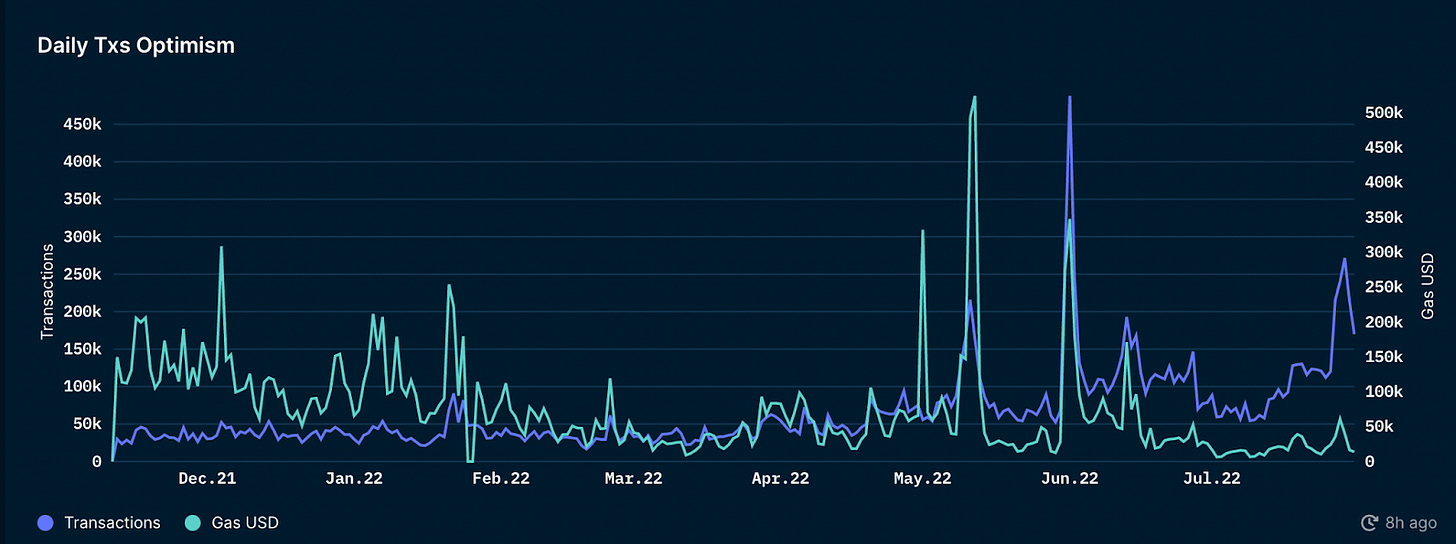

- OP has seen explosive price action over the past several weeks. The token has soared more than 245.2% since July 13, which includes a run-up of 145.3% from $0.75 on July 27 to $1.84 on July 30.

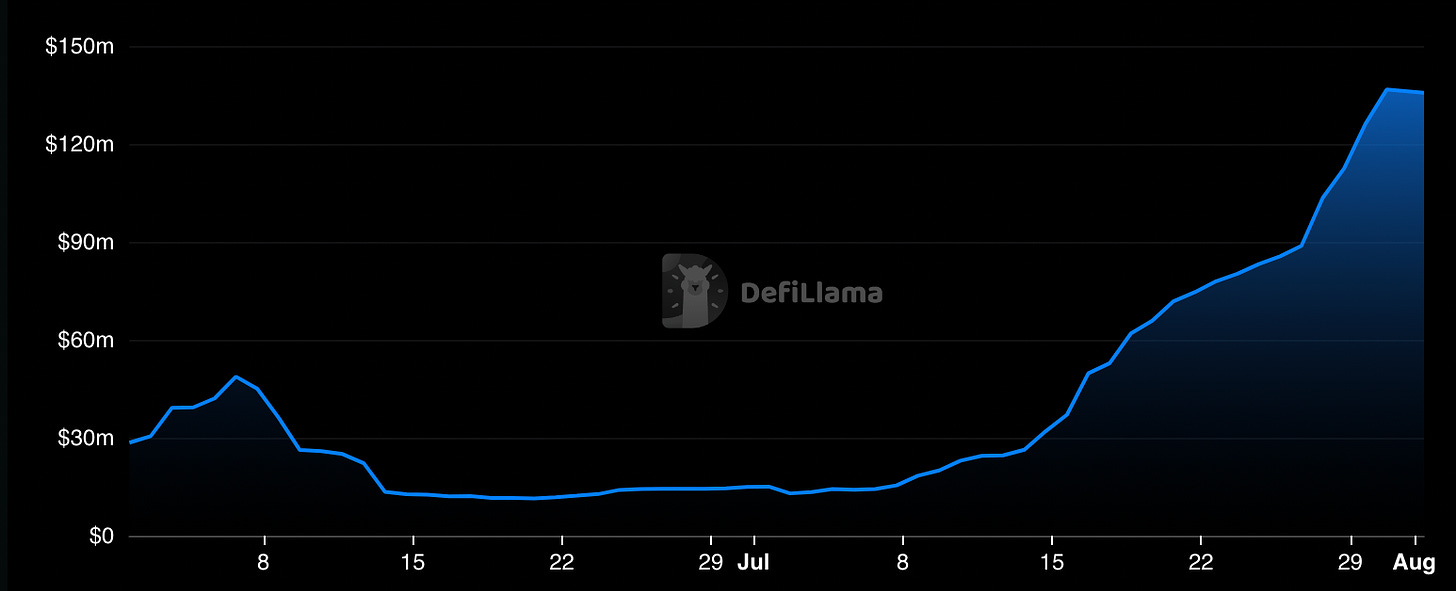

- Along with the broader relief in the crypto and equity markets, the rally in OP is likely driven in part by the rise of Velodrome, a decentralized exchange on Optimism. Velodrome has seen its TVL explode 915% from $15.01M to $137.37M since July 1 and its token VELO, soar 1022% during this time, helping sustain high-yields for providing liquidity on the DEX, which are as high as triple digits on certain pools. This has placed significant buy pressure on OP, as liquidity providers have had to buy the token in order to earn rewards in OP based pools. There is currently ~5.36M OP, 2.49% of the circulating supply and worth ~$7.82M at current prices, deposited in Velodrome.

- OP’s price rise has coincided with a significant spike in both transaction activity and liquidity on Optimism. The rollup has seen its DeFi TVL increase 102.1% from $274.46M to $554.92M since July 1 while seeing its market share among rollups grow from 26.7% to 39.6% during this period. Although the gap between the two has shrunk, Optimism still lags behind Arbitrum on both metrics, with its chief competitor having a TVL of $797.33M and market share of 56.9% respectively.

Hotness Rating (🔥🔥🔥🔥/5):

The explosive rise of OP has brought a flurry of attention and usage to the Optimism and the Layer-2 ecosystem. While the token has run red hot, long-term oriented investors may want to add the token to their dip-buying shopping cart should it see any pullbacks.