Trending Project: Uniswap (UNI)

- Ticker: UNI

- Sector: DeFi - DEX

- Network: Ethereum

- FDV: $6.2B

- Hotness Rating: 🔥🔥🔥🔥

Tl;dr: DeFi’s biggest DEX moves to flip on the fee-switch.

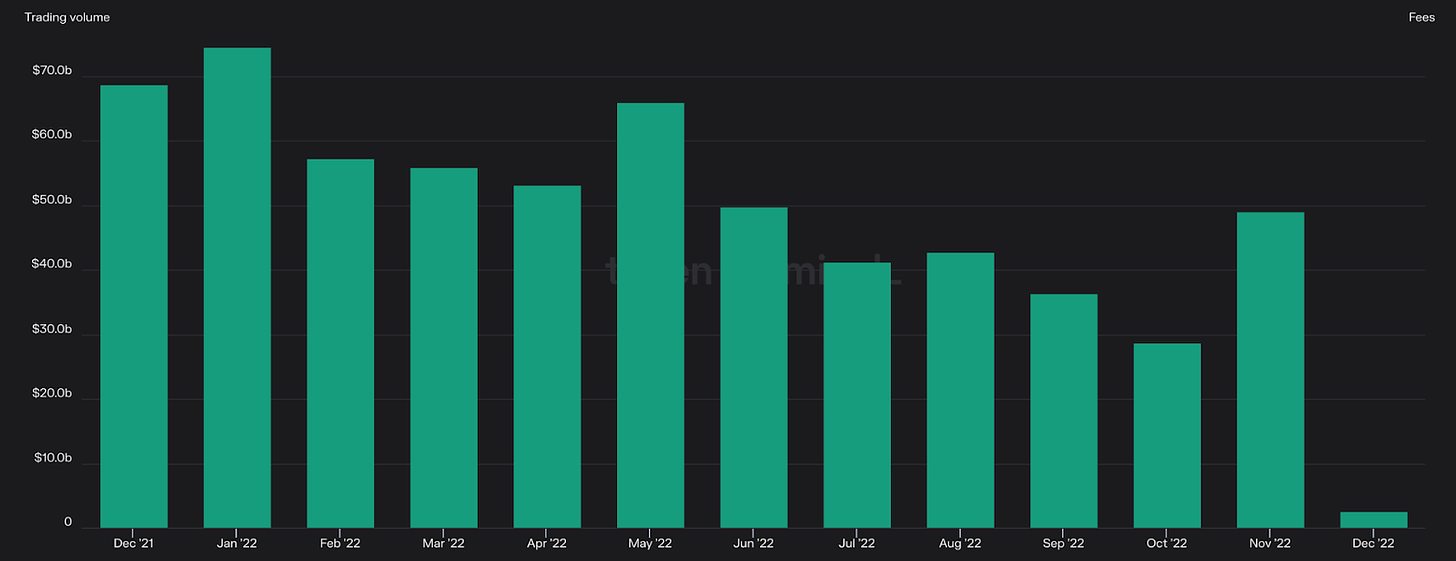

Uniswap is DeFi’s largest decentralized exchange, facilitating $625.7B in trading volumes over the past year. The protocol utilizes a concentrated liquidity AMM, where users can provide liquidity over specific price ranges, increasing capital efficiency and improving execution for traders. Uniswap is governed by the UNI token, with holders having the ability to toggle the protocols “fee-switch”, which enables the Uniswap DAO to take up to a 25% cut of fees paid out to LPs. The “switch” must be toggled on a pool-by-pool basis.

The Uniswap community has moved to begin activating the fee-switch. The initiative began in July 2022, when Uniswap community member and PoolTogether co-founder Leighton Cusack proposed toggling the fee-switch for three different pools to test whether the protocol can generate revenue without losing liquidity and market-share. At the time, these pools accounted for roughly 5.6% and 6.4% of Uniswap’s total trading volumes and LP fees respectively. This initial proposal passed through the first two phases of Uniswap governance, temperature and consensus check, with near-unanimous votes.

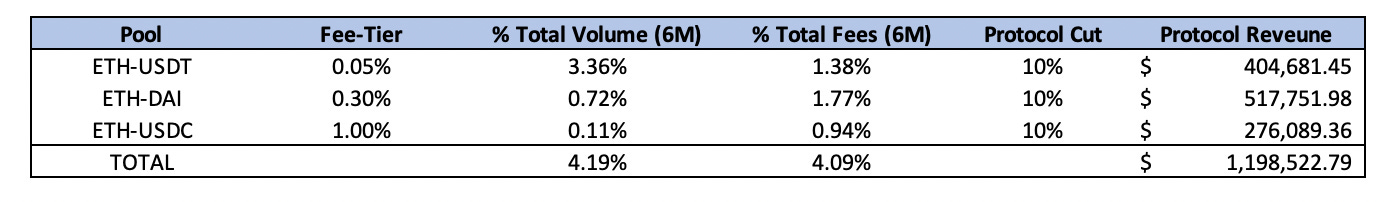

On December 2, following research and community feedback, Leighton posted an update on the Uniswap governance forums with revised parameters for the proposal. This new proposal would see Uniswap toggle the fee-switch for three pools with differing fee-tiers: ETH-USDT (0.05%), ETH-DAI (0.3%) and USDC-ETH (1%). The protocol would take a 10% cut of fees paid to LPs within these pools. Notably, the proposal states that this revenue would not be shared with tokenholders and instead would be used to fund public goods. These pools accounted for 4.2% of trading volumes and 4.1% of LP fees over the past six months, and would have generated $1.2M in revenue for the protocol over this period were it to have been active.

The price of UNI has risen 6.5% against USD and 5.1% against ETH since the forum post went live on December 2. This indicates that the market believes the proposal will pass and is a net-positive despite the lack of fee-sharing. Although early, whales seem to be less enthused, as Nansen Smart Money balances remained largely unchanged following the forum post, falling 0.1%. The proposal is set to be put to a binding, on-chain vote within the next 10 days. The vote will last a week and should it pass, will see the fee-switch activated 48 hours later.

Hotness Rating (🔥🔥🔥🔥/5): Uniswap seems likely to finally turn on its fee-switch. Yes, it is unclear how effective this pilot program will be and it will not see any revenue being shared with tokenholders. However, a successful activation of the fee-switch will demonstrate that the Uniswap protocol can capture value, and make the UNI token more analogous to non-dividend paying equity rather than a pure valueless governance token.