Unpacking the endless FTX nightmare

Dear Bankless Nation,

Here’s a recap of the biggest crypto news in the second week of November.

Goodbye FTX

What a week.

If you haven’t followed the events around FTX at all, I recapped a play-by-play in The Shocking Collapse of the FTX Empire this past Wednesday on how the chaos has transpired. But crypto moves at the speed of sound, and this week has been moving at Star-Wars-level lightspeed, so there have been plenty of updates since.

A tldr: A CoinDesk article on November 2nd alleged that FTX’s sister hedge fund Alameda Research over-levered in holding way too much of FTX’s illiquid FTT token, and people got scared. Binance CEO CZ subsequently announced he was selling $2.1B FTT, so people got more scared and things escalated to a full-blown panic over the weekend with record withdrawals of ~$8.6B from FTX since the 10th. (See Bankless’s previous article for insight into how users and institutions rushed for the exit.)

If you’d like a more visual recap in the language of The Office:

This is too perfect 😂 pic.twitter.com/D9FV5mFLQI

— Goomba (@im_goomba) November 11, 2022

Where does that leave us?

Binance has pulled out of a potential purchase of FTX, citing reasons of “mishandled customer funds”. SBF confirmed that he lent ~$10B of funds (out of $16B) to sister hedge fund Alameda Research with the use of customer deposits, despite previous claims in a now-deleted tweet that “FTX has enough to cover all client holdings. We don’t invest client assets.”

SBF filed for chapter 11 bankruptcy and resigned as FTX CEO yesterday, but not before apologizing profusely for fucking up.

In response to law enforcement, Tether has frozen $46.2 million USDT on an FTX account.

Justin Sun is offering a 1:1 redemption for all Tron-based assets on FTX (and no, he’s not seriously bailing out FTX).

Due to regulatory pressure, FTX is also resuming withdrawals for users in the Bahamas where it’s based. Because trading on FTX hasn’t been halted, this has produced a million-dollar opportunity for users to indirectly cash out of FTX by “buying” an NFT on FTX’s NFT marketplace with their stuck funds from a KYC’d Bahamas user, which they can then off-ramp from FTX.

Looks like NFTs are finally getting some of the “utility” that users were clamoring for.

People now withdrawing FTX balances by buying NFTs from Bahamian accounts for six- and seven-figure amounts, buyer then gets side payment and Bahamian withdraws funds

— foobar (@0xfoobar) November 11, 2022

Tens of millions of Tether taken so far pic.twitter.com/UVnz5FUBNT

Regulatory backlash

Regulators already don’t love crypto, and this week’s events didn’t help much.

The regulatory hawks of the SEC and CFTC are already circling the fresh carcass of FTX, as reported by Bloomberg.

Contrary to initial expectations, American regulators are still unfortunately committed to pushing forth the SBF-championed Digital Commodities Consumer Protection Act (DCCPA) bill.

Washington’s resident anti-crypto senator, Elizabeth Warren, tried to capitalize politically on FTX and got shut down by Brian Armstrong.

https://t.co/0HxlRiI6Sy was an offshore exchange not regulated by the SEC.

— Brian Armstrong (@brian_armstrong) November 10, 2022

The problem is that the SEC failed to create regulatory clarity here in the US, so many American investors (and 95% of trading activity) went offshore.

Punishing US companies for this makes no sense.

The problem of course with Warren’s line of thinking is that the entire fiasco demonstrates more of a failure with the mechanics of traditional finance, rather than crypto. FTX had a giant hole in their balance sheets for as long as they did because their balance sheets were precisely that: a balance sheet that didn’t exist on a publicly verifiable blockchain.

When SEC chair Gary Gensler was asked in a CNBC interview about why they had focused crypto enforcement efforts on smaller targets like Kim Kardashian and small DAOs rather than big players like FTX, he responded, “Building the evidence, building the facts, often takes time.”

I guess Gensler is free to take all the time he needs now.

Ideally you’ll spend some time to explain how, once again, the commission’s enforcement priorities focused on entities trying to deploy technology to prevent these market failures & asymmetries while you were meeting with the perpetrators or overlooking their malfeasance? pic.twitter.com/q88u5kQxNM

— Collins Belton (@collins_belton) November 10, 2022

Tom Emmer also alleges that Gensler was “helping SBF and FTX work on legal loopholes to obtain a regulatory monopoly”.

Interesting. @GaryGensler runs to the media while reports to my office allege he was helping SBF and FTX work on legal loopholes to obtain a regulatory monopoly. We're looking into this. https://t.co/SznowgcP6V

— Tom Emmer (@RepTomEmmer) November 10, 2022

Wen Proof of Reserves? (right now)

The downfall of FTX is opening a productive conversation around how the industry can improve transparency around centralized exchanges through Proof of Reserves (PoR) audits. PoR lets users verify that centralized crypto custodians actually do hold the funds they claim to hold by matching them to on-chain records, and are solvent.

Here’s how PoR work:

- A CEX claims to hold $1B in assets

- The CEX lets a third-party auditor take a snapshot of these funds

- The auditor aggregates this snapshot into an anonymized Merkle tree

- This Merkle tree is untamperable, cryptographic proof that all the funds audited at that time of the audit matches up to on-chain data.

- Any user can independently verify that their funds were included in the PoR audit

PoR is an industry standard that has been embraced by exchanges like Kraken, BitMex and Nexo. Many exchanges are late to the game, but the FTX blowup is prompting almost all the major players like Binance, KuCoin, OKX, Poloniex and Huobi into action.

1/ We are working with exchanges to display proof-of-reserves on @nansenportfolio for everyone to track their token holdings and transactions.

— Nansen 🧭 (@nansen_ai) November 11, 2022

Here's the current list of exchange portfolios and we will live update this thread with more, so make sure you are following! 🧵

Don’t be misled into thinking PoR is a perfect solution however. It still requires trust in the third-party auditor. Even if auditors can be trusted, it’s also only a routine update depending on how often auditors conduct that audit. User funds that were deposited post-audit won’t be immediately updated and transparent like an on-chain transaction would be on a public blockchain.

Moreover, a centralized exchange can prove that they hold all of the user's funds, but lie on the liabilities side of their balance sheet. An exchange can technically hold all of their reserves 1:1 to customer’s deposits (as it should be in theory), but their liabilities might far exceed those assets, and aren’t solvent.

It’s why it’s called “Proof of Reserves”, not “Proof of Solvency”, even though the point of PoR is to try and prove solvency.

The silver lining is that PoR is a huge step up from the status quo of zero transparency.

If you want to eliminate all risk, move your funds to a hardware wallet. At the risk of sounding like a boomer: not your keys, not your crypto.

Several exchanges contacting us last 24 hours to display proof-of-reserves.

— Alex Svanevik 🐧 (@ASvanevik) November 11, 2022

We're happy to help (for free) - DM me if you want your exchange to be more transparent.

Example we did for Binance: https://t.co/rtuUAkpdcU pic.twitter.com/vlfH1hrzeP

Some unimportant Ethereum stuff

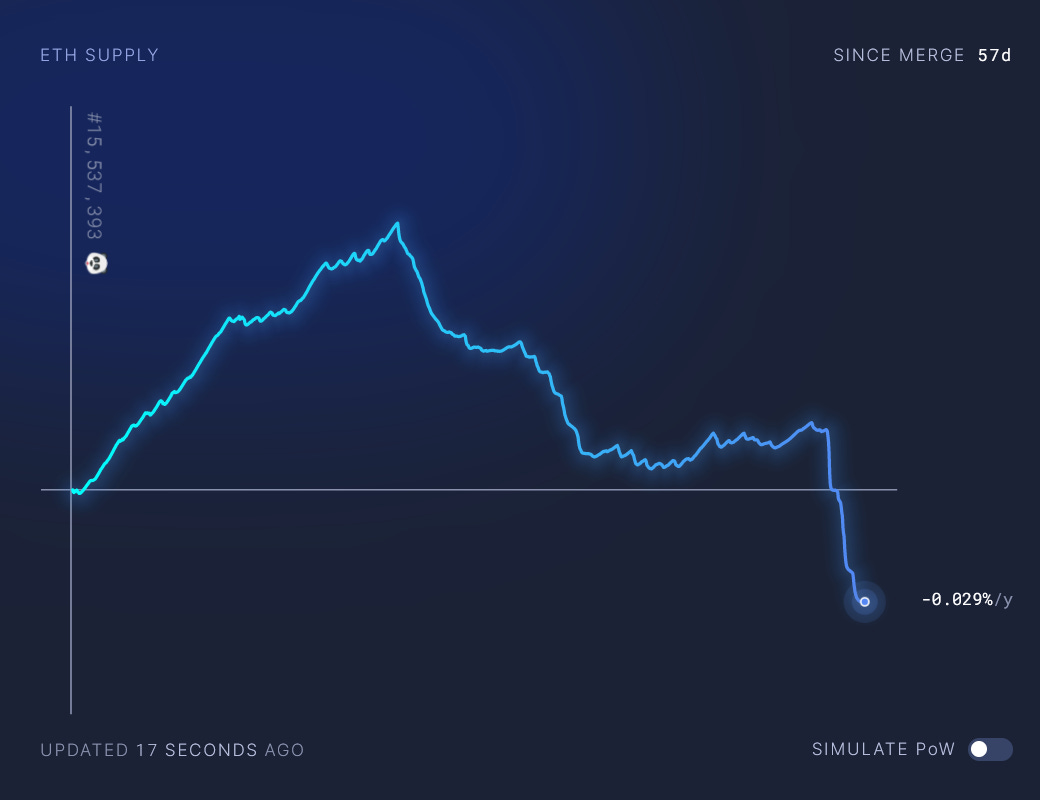

Ethereum is officially deflationary as of November 9, which means ETH is being burned at a faster rate than what is being minted.

Bankless livestreamed this amidst the week’s chaos. ETH Goes Ultra Sound | ETH Staker Livestream

Vitalik announces an updated Ethereum roadmap.

Updated roadmap diagram! pic.twitter.com/MT9BKgYcJH

— vitalik.eth (@VitalikButerin) November 4, 2022