🔵 Unpacking the Coinbase L2 Opportunity

Dear Bankless Nation,

We’ve got a special issue for you today, unpacking a particularly exciting development from a massive crypto powerhouse. We’ve got a lot of details — and, of course, lots of bear and bull takes 🙂

- Bankless team

Feeling blue balled, anon? CT was captivated with blue dot fever after Coinbase posted a cryptic short video designating TODAY as the big day.

Optimism even joined in on the fun!

tybg pic.twitter.com/L4KT9ExnDV

— Optimism (✨🔴_🔴✨) (@optimismFND) February 22, 2023

All day yesterday, CToors read between the lines, with some imagining they had discovered the legendary Arbitrum airdrop!

Might be reaching and left-curving it hard but:

— CC2 (@CC2Ventures) February 22, 2023

Optimism = Red🔴

Arbitrum = Blue🔵

tybg = Thank You Based God

🔵 jumps into the air [dropping], while 🔴 congratulates/thanks its closest competitor [tybg due to more TVL].https://t.co/7UUXvZeJz1

I’m here to inform you that these theories are not only wrong, they’re completely off-base! Okay, so what is happening then?

The Big Release 📜

🔵 Coinbase is launching its own optimistic Layer 2 rollup, called Base

🔴 Built on top of Optimism’s OP Stack

Coinbase tells us they’ve twice considered launching a Binance Smart Chain-esque L1, but decided against the approach, fearing that doing so would silo their chain off from the burgeoning crypto economy.

The OP Stack – Optimism’s modular, open-source blueprint for creating highly scalable, highly interoperable blockchains of all kinds – proved to be a game changer for Coinbase and provided them the opportunity to build their own chain: Base.

Launching to mainnet in approximately two months, Base will operate as a permissionless L2. Despite speculation, this is no KYC'ed blockchain, anon!

We’re getting a straight-over-tackle optimistic L2 rollup, open to all developers and users, settling on Ethereum. Unfortunately, at genesis, Coinbase will be the sole sequencer for the chain, with Base categorized as a full training wheels “Stage 0” rollup, inline with Vitalik’s rollup taxonomy.

Coinbase’s general fidelity with crypto values is showcased by their stated commitment to decentralization and security:

- Base will transition to a fully permissionless validator set

- Base will operate as a limited training wheels “Stage 1” rollup by EOY 2023

- Base will upgrade to a no training wheels “Stage 2” rollup by the end of 2024

Widespread attainment of the limited training wheels stage and the rollout of EIP-4844 will bring Ethereum to the “basic rollup scaling milestone” on Vitalik’s Ethereum roadmap, completing step one of two in the Surge 🌊

Reaching the "basic rollup scaling" milestone in my roadmap diagram.

— vitalik.eth (@VitalikButerin) December 31, 2022

That means:

* EIP-4844 rolled out

* Rollups partially taking off training wheels, at least to "stage 1" as described here https://t.co/qNQonDQkzG pic.twitter.com/7HePctWw1l

Rapid progression toward decentralization, insanely quick leaps in chain security, and Base’s ability to go from a testnet launching on February 1 to mainnet within two months is made possible by the OP Stack. Coinbase’s ability to fork battle-tested Optimism code for its rollup is a huge tailwind for the development speed of Base.

So, are they just mooching off the fruits of the Optimism team’s labor?

Not quite. In fact, Coinbase is partnering with Optimism, becoming the OP Stack’s second core contributor. With two L2 teams building on the same stack, development will be turbocharged!

Base’s development will benefit an open-source and freely available scaling solution codebase, with the rollup itself being built on top of Ethereum, an open-source and freely available blockchain!

A portion of Base’s transaction fees will go towards the Optimism Collective, funding public goods on Optimism, with Coinbase also committing to launching a Base-native ecosystem fund!

Beyond juicing launch speeds and empowering inter-team cooperation, the future of the OP Stack provides atomically composability for chains sharing a sequencer set, thanks to the standardized message-passing format between OP Stack chains!

This is the wei of the OP Stack flywheel, anon.

Coinbase’s Vision 👁️

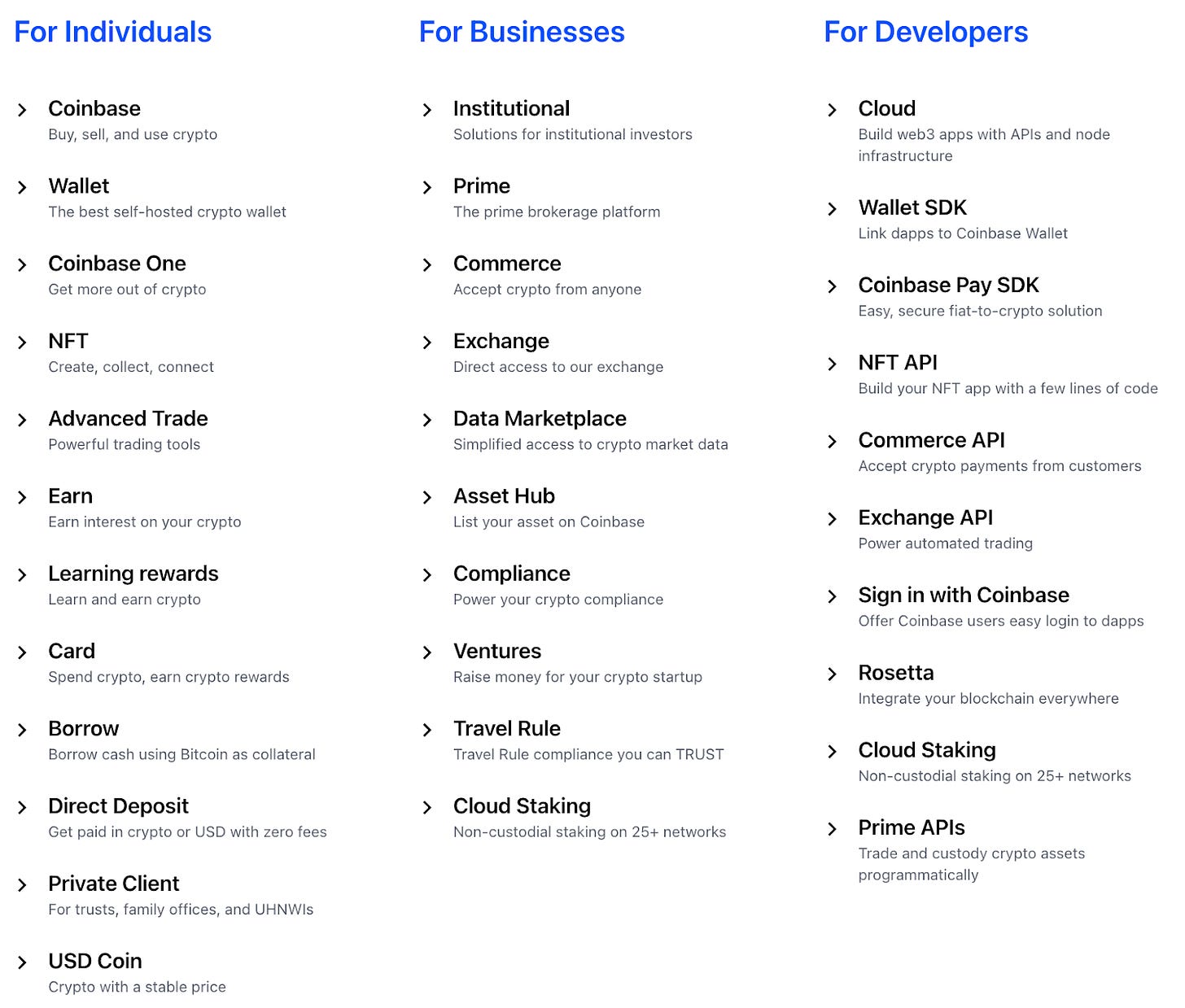

Coinbase is not simply just an exchange.

Its product offerings span digital asset staking solutions, liquid staking derivatives, institutional custody solutions, non-custodial wallet products, in-app integrated DeFi accessibility and a lot more. Base is a natural extension of this product line and could provide Coinbase users with a direct integration into the world of Web3.

While Coinbase has established a reputable brand and serves as a trusted user interface for cryptocurrency trading and speculation, growing adoption of DeFi and other on-chain primitives will create demand for straightforward and dependable interfaces for servicing a growing array of user needs —Coinbase aims to be their service provider and trusted front-end.

Seeing itself as a primary gateway to on-chain activity, Coinbase believes that Base and the protocols built on top of it 👀 including Coinbase developed dApps 👀 will not only be positive for the company’s bottom line, but will likely provide positive tailwinds to the broader crypto economy.

For the broad majority of Coinbase’s users, a simple, relatively riskless solution to interacting with Web3 is highly desirable. The firm aims to provide a default, out of the box experience, with the goal of stripping user fears of interacting with blockchains – a major friction point in Web3 onboarding.

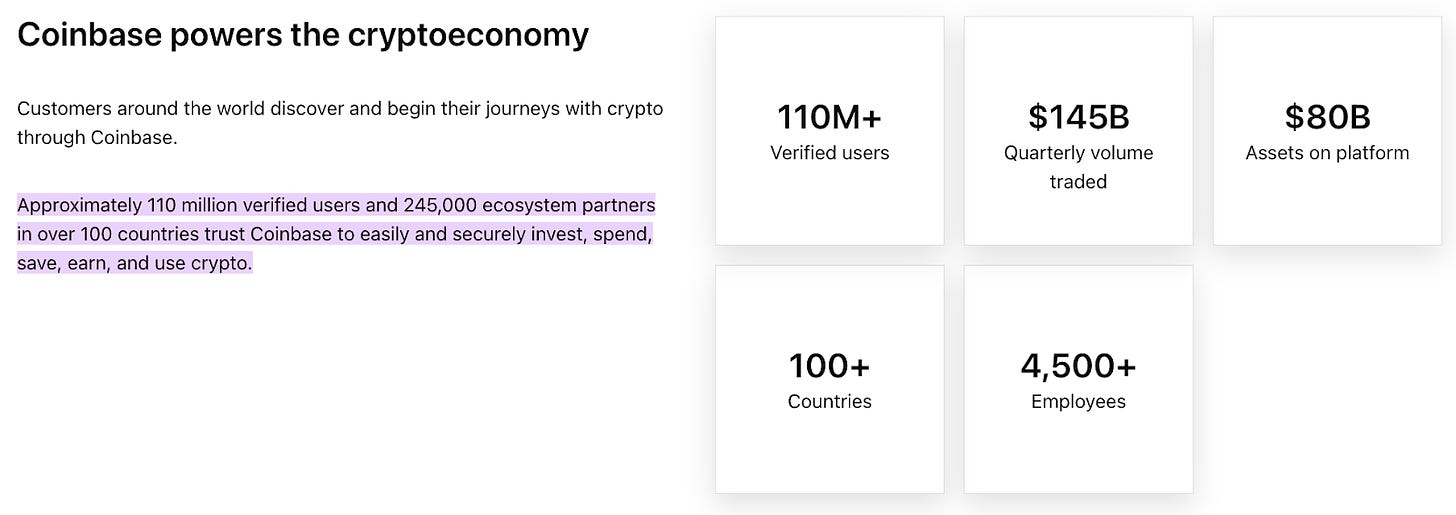

Additionally, Coinbase aims to bootstrap its 110M verified users to facilitate cost-effective dApp user acquisition.

Current airdrop schemes are highly susceptible to gaming, and often provide fleeting increases in activity and TVL. Base will serve as an infrastructure layer for protocols looking to acquire new users, while in tandem presenting users options and connecting them with services they need.

Credit card providers and banks use financial incentives to attract new users and change behavior; Coinbase believes that it can revolutionize consumer acquisition in Web3 via similar models.

Wen Token 🤑

Were you hoping that your down 90% Coinbase shitcoin portfolio would qualify you for a $BASE airdrop, anon? Maybe you’re a $COIN equity holder looking for a token distribution?

It pains me to be the bearer of Coinbase’s bad news: THERE IS NO PLAN FOR A BASE TOKEN.

BNB Competitooor 🔶

We think not…

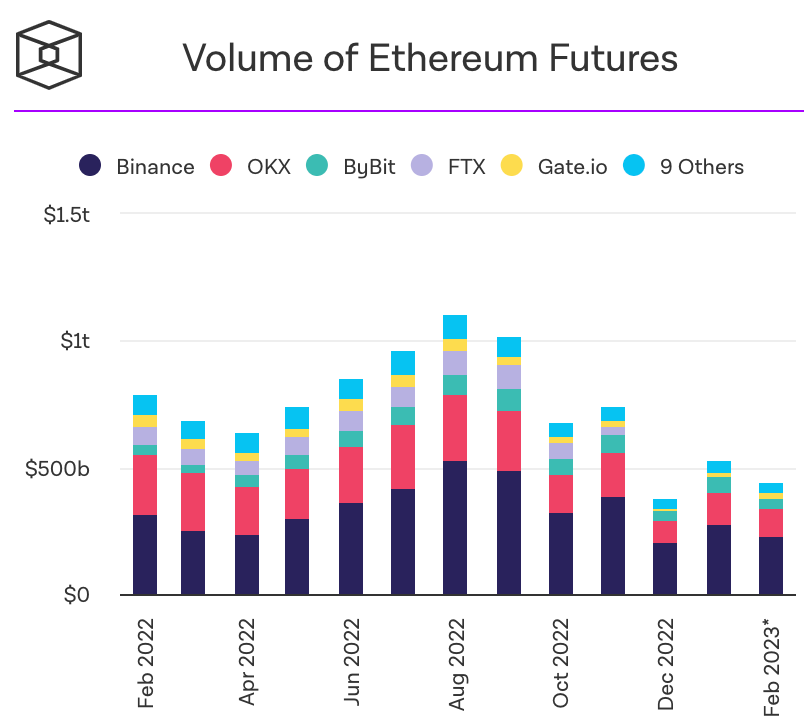

Coinbase’s user base is considerably less degen, given the absence of perps and other high-leverage trading solutions. With Coinbase customers serving as Base’s likeliest users, it is unlikely that we will see similar fervor for leverage. Borrowing for leverage facilitates yield generation, which attracts TVL.

Not only is a major DeFi use case likely to gain less traction on Base, but the resulting lack of demand for leverage may translate to lower yield generation, diminished TVL, and reduced volumes; cutting into network activity and fee generation.

Additionally, many of Coinbase’s users already have access to alternative financial solutions in established TradFi markets.

BNB has found a niche serving as a low-fee alternative for users in developing markets who lack access to stable currencies or sophisticated financial systems. Despite volatility in crypto asset pricing, tokens (specifically of the money variety) provide a valuable alternative to local currencies subject to high inflation rates. Peer-to-peer transactions are commonplace on the chain and permissionless lending markets substitute for traditional interest-earning savings accounts.

In January 2023, Coinbase’s monthly spot trading volume totaled 5.0% ($55.32B) of Binance’s recorded $1.108T in monthly combined spot, BTC futures, and ETH futures trading volumes.

Unfortunately, the Western financial system is stuck in the days of yesteryear.

Peer-to-peer transactions occur over Venmo and CashApp and take three days to settle. We have accepted the fractional reserve banking system that we are forced to participate in to live in a society that runs on plastic cards and ApplePay.

The transition to Web3 is more difficult for consumers in markets where Coinbase has the deepest penetration, as they have access to conventional financial solutions and feel more comfortable continuing old habits than making the switch to the unknown world of Web3.

Bullish $OP 🔴

The absolute undisputed winner of Coinbase’s announcement is $OP. Coinbase choosing to build Base on the OP Stack is a massive victory for the Optimism ecosystem!

Today’s announcement essentially informs the public of an absolutely massive Optimism core team acquisition! Not only does Optimism acquire this developer support for free, but Base is also giving up a slice of transaction revenues to its sister chain!

This move from Coinbase truly validates the OP Stack flywheel thesis: onboarding one massive core contributor provides additional incentives for rollups to build on or migrate to the OP Stack!

It’s no secret that Optimism is built on the OP Stack; so are Metis and Boba! Adding Coinbase as the first core contributor will allow the combined team to destroy blockers and develop the best possible optimistic rollup solution. As more rollups build on OP Stack, the design flexibility offered will only increase, powered by the modularity and open-sourced code!

With atomic composability looming in the future, OP Stack can unlock a world of highly specialized rollup solutions for DEXs, GameFi, NFT trading, or whatever else the optimists desire.

The barrier to entry to build your own rollup was reduced by the launch of OP Stack and just as liquidity begets liquidity, core contributors beget core contributors.

Rollup summer coming to an OP Stack near you?

Trouble in Paradise? 🔵

How peculiar… Why is there a blue dot next to “Trouble in Paradise?”

As bullish as launching a Coinbase-native L2 may sound, we’re not quite convinced it (should) significantly alter your $COIN investment thesis. Coinbase certainly has the users and the assets, but they are a long way from onboarding them to Base and the world of Web3.

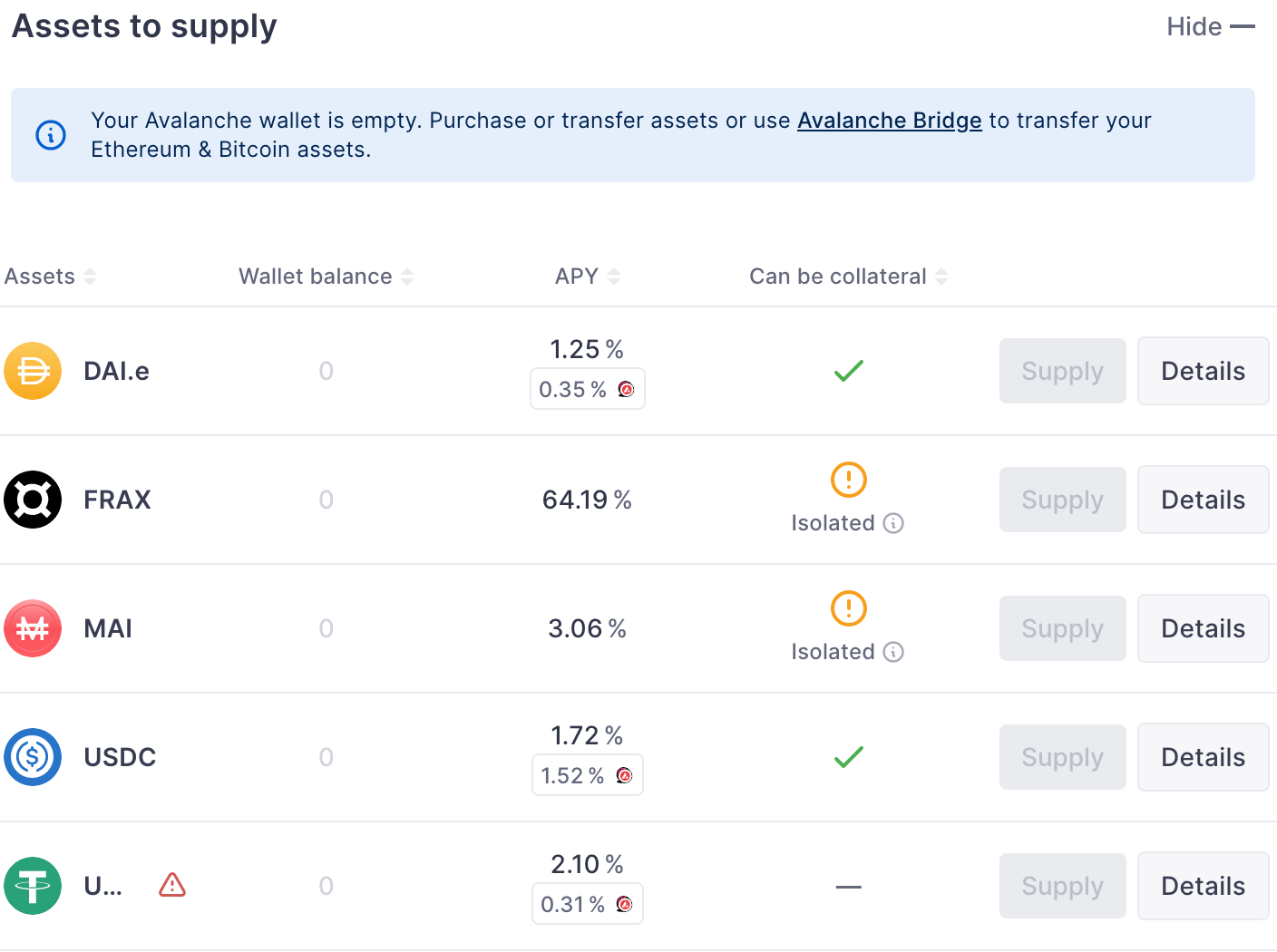

But the interest rates offered on stables by crypto-native lending markets are vastly superior to the 0.0001% accruing annually to my Wells Fargo saving account!

Won’t everyone want to make the switch?

If they did, they might already have, anon: Coinbase already provides their customers with an in-app, custodial method of onboarding to Web3 and using dApps. It cannot get too much easier than that!

While Coinbase claims Base will lower user acquisition expenses compared to airdrops, while simultaneously connecting users with protocols they need, providing guidance along the way, these claims seem baseless.

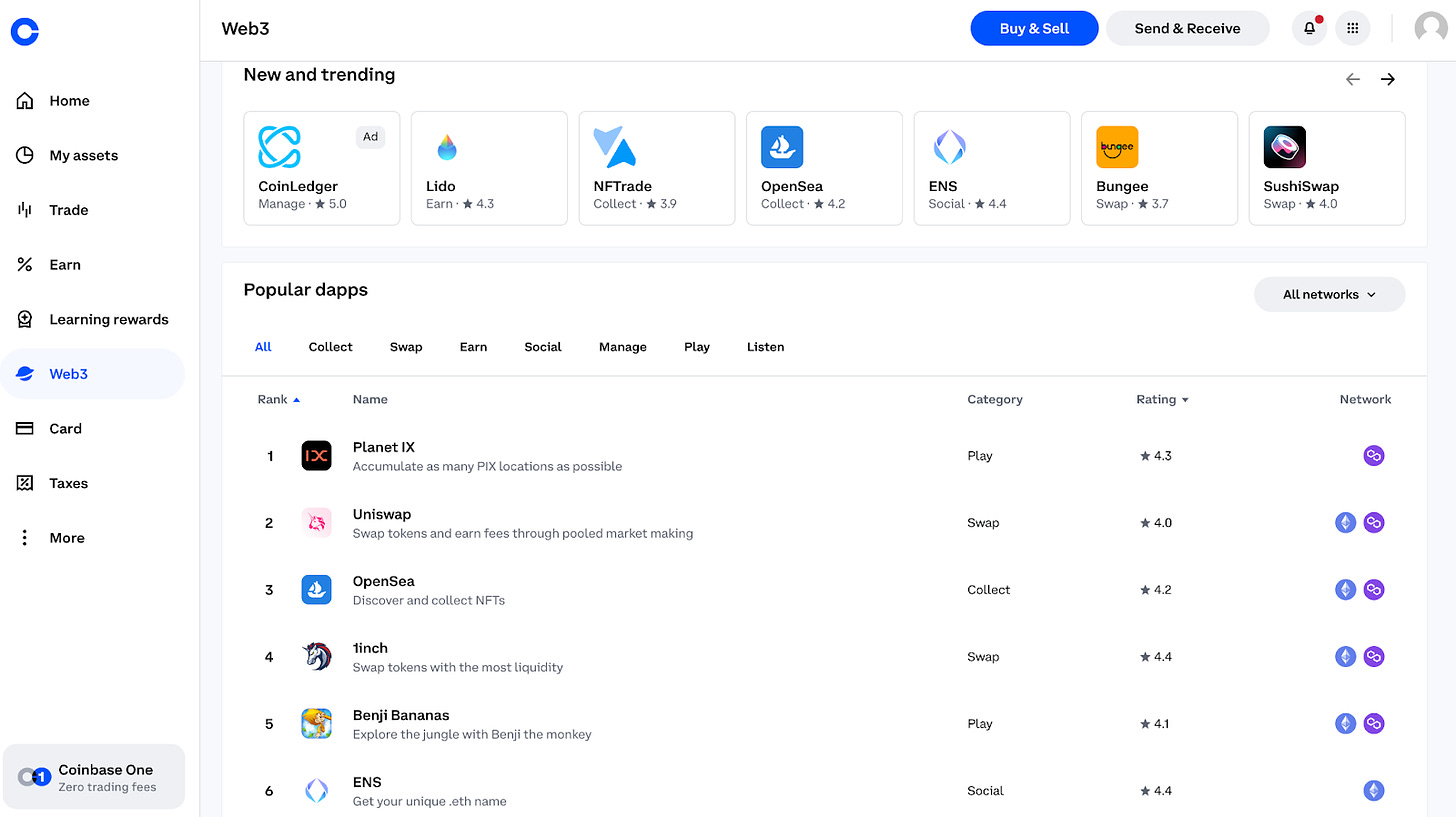

Coinbase’s “Learning Rewards” tab already provides protocols with a platform to connect with their 110M users. Additionally, the “Web3” tab already provides users with recommended dApps and even provides social signaling in the form of community star ratings.

Perhaps the largest obstacle to Base’s success is the challenging regulatory environment Coinbase operates in as a publicly traded company on the U.S. stock market.

Unlike Optimism, which uses $OP to fund public goods and incentivize behaviors via recurring drops — or its competitor Arbitrum, which has yet to launch a token and will likely implement a carefully crafted airdrop designed to attract liquidity and sustainable adoption — the chances of Coinbase launching a token any time soon are infinitesimally small.

Getting legal to sanction a permissionless rollup was likely an onerous task and there may still be a chance the SEC, NYDFS, OCC, or another multi-letter agency with jurisdiction over the US financial system comes knocking at Coinbase’s door over Base.

A token launch? Laughably out of the question.

Until the US begins to develop a clear regulatory framework for airdrops and how a US equity can issue them, Base will be at a significant disadvantage to its competitors in the absence of a potential token.

Optimistic Prospects 😁

Coinbase does have one factor working in its favor: the firm still has solid brand equity.

While consumers may have been reluctant to use the Aaves and Uniswaps listed in Coinbase’s Web3 portal, that may change with the launch of Coinbase-branded dApps. I can certainly see that the most frictionless way to onboard non-crypto natives unfamiliar with our brands is through trad-ier branded products.

Base may very well be the portal to permissioned, KYC’ed DeFi, but the chain is certainly not a KYC-only zone.

After all, as Coinbase web3 lead Jesse Pollak mentioned in an interview, Coinbase’s foray into scaling solutions includes a suite of infrastructure products with decentralized identity primitives.

With institutions unclear how to approach DeFi with limited regulatory clarity and litigious regulators breathing down their necks, Coinbase branded, semi-permissioned dApps may serve as a kiddie pool within the scary world of DeFi. Coinbase already has the connections, serving as a custodian and prime brokerage for institutions and high net worth individuals alike.

🤦Those institutions🤦

Is it possible that Base will serve as a launchpad for Coinbase-branded dApps that provide comfort to these entities from a regulatory risk and safety of funds perspective? If so, this may be a huge unlock, opening the world of DeFi to a class of reluctant investors who previously faced structural barriers to entering the space!

No doubt, the launch of Base is a massive accomplishment for the entire Coinbase team and represents an incredible leap forward for the OP Stack. Unfortunately, the reality is that consumers remain hesitant to go on-chain, preferring to live within TradFi’s walled garden. While Coinbase has 110M verified users and holds $80B in assets on the platform, only a fraction of that is likely to migrate onto Base.

Thankfully for Coinbase, however, $80B is an extremely large number, with the migration of a meager 2.5% being large enough to flip Arbitrum, securing Base’s spot as the number four largest chain by TVL.

Blockchain tech remains in its infancy! With 10M monthly active addresses and probably around 1M actual humans transacting on-chain monthly, the potential for growth within the space is ENORMOUS.

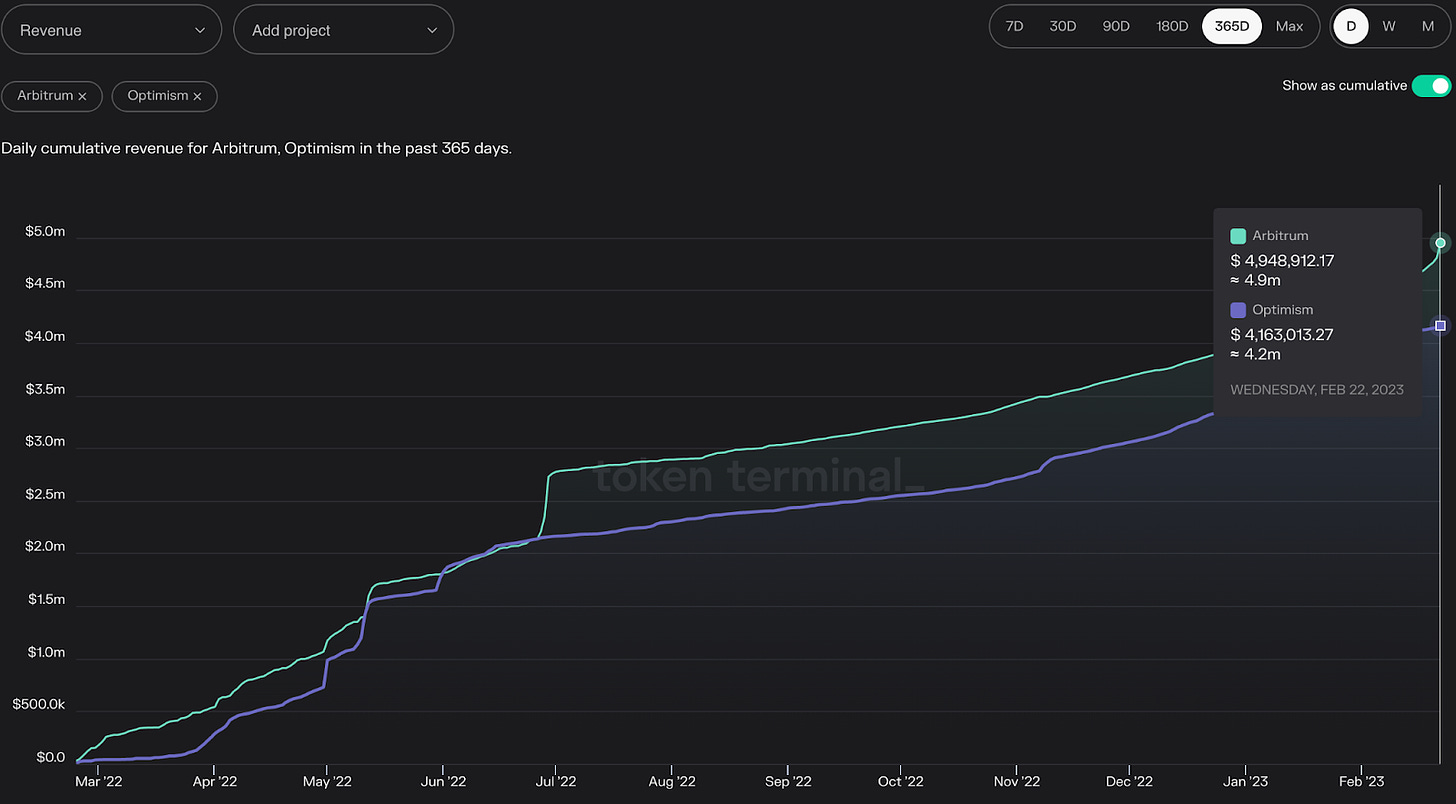

Coinbase’s decision to strike out and create its own L2 is an enormous vote of confidence in Ethereum and the broader crypto financial system that may pay off handsomely at some unknown future point, however it is worth noting that Optimism and Arbitrum took in just a hair above $9M over the past year and Coinbase is doing over $3B in topline revenue.

It is highly unlikely that Base will serve as anything more than a money pit for the foreseeable future.

While Coinbase has provided every indication that it intends to be a faithful steward of the Ethereum ecosystem, promoting decentralization via contributing to OP Stack and becoming a RocketPool oDAO member (among other actions), it remains crucial to hold the company to their promises!

And remember, anon: DYOR and don’t ape. By the time you read this disclaimer, the facts reflected herein are likely incorporated in the prices of $COIN and $OP!

Your edge is not trying to outcompete a high-frequency algo trader using fiber connections to get a 200 millisecond advantage over the other jock halfway across the planet. Your edge is in learning about the developments occurring in the crypto space and making high-conviction bets in tokens (and crypto equities 🙄) with huge asymmetric upside!

Bullish? Bearish? Check out our livestream now for more details on this huge announcement from Coinbase: