Unpacking Ethereum's Future ($)

View in Browser

Sponsor: Kraken — Sign up for an account and see what crypto can be.

📊 Agony and ecstasy. Crypto has patiently awaited spot Bitcoin ETFs for the better part of a decade. They were approved and started trading this week! While it feels like there are plenty of reasons to celebrate, BTC has cratered a shocking 12.4% off its ETF debut high. WTF happened to TradFi buying our bags?

| Prices as of 10am ET | 24hr | 7d |

|

Crypto $1.69T | ↘ 3.1% | ↗ 2.4% |

|

BTC $43,125 | ↘ 3.5% | ↘ 1.7% |

|

ETH $2,562 | ↘ 3.4% | ↗ 14.1% |

1️⃣ Ethereum Plots its Future

This week, the r/ethereum subreddit held its latest AMA with Ethereum Foundation researchers, featuring Vitalik Buterin, Justin Drake, Dankrad Feist, and more. The session covered a wide range of topics related to future development and current pitfalls.

Some takeaways? Advancing Ethereum’s data capacity is a huge priority. Universal composability across rollups is on the horizon. Also, a slight gas limit increase could be near.

Be sure to catch the entire thread if you haven’t already; there are many bits of wisdom and glimpses of the future!

2️⃣ Spot Bitcoin ETFs Arrive

Trading around highly-anticipated spot Bitcoin ETFs began in the U.S. this week, with hefty volumes finding their way to 11 SEC-ordained spot BTC ETFs.

The market embrace was swift and sent prices skyrocketing, only for the dial to shift and bring prices back down to earth. The BTC price has more than erased the approval bump and the early surges in trading – down nearly 2 percent on the week.

Crypto-aligned equities also got hit hard, with MicroStrategy stock down nearly 25% on the week and Coinbase also getting hit hard.

Traders hoping for an ETF-shaped silver bullet were disappointed with the impact on their bags, but it's the early innings!

3️⃣ PayPal’s Stablecoin Surge

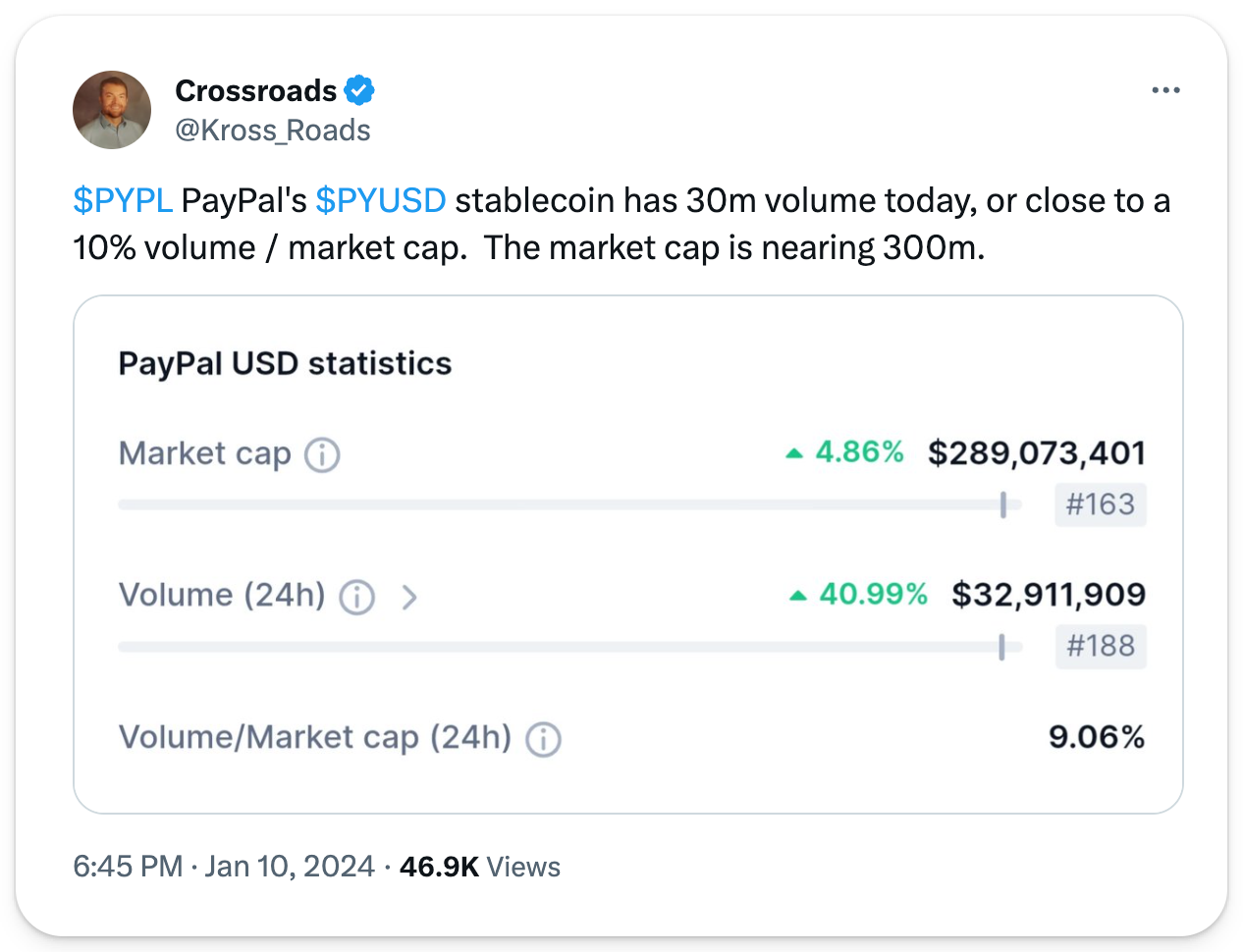

One of the biggest growth stories in the early leg of this bull market? $PYUSD.

Indeed, this week, chatter grew around PayPal’s stablecoin, which has seen its market cap swell +70% over the past month to nearly $300 million.

The stablecoin is now the 10th-largest in the cryptoeconomy, which is remarkable considering the token is just five months old!

4️⃣ Circle Files for IPO

Circle, the issuer of the popular USDC stablecoin, just announced that it’s filed a draft registration statement “S-1” form with the SEC.

The move, an official step toward Circle becoming a publicly traded firm, comes after Circle initially planned to go public in 2021. The company was reportedly valued at $9 billion as recently as 2022.

“The initial public offering is expected to take place after the SEC completes its review process, subject to market and other conditions,” Circle said in a press release.

5️⃣ Satoshi’s New Windfall?

A fat finger mistake? A troll? The Bitcoin creator topping up his wallet?

No one knows why for now, but just days ago, an address associated with a Binance account sent 26.9 BTC ($1.15 million) to the first-ever Bitcoin “Genesis” wallet, which was created and owned by Satoshi Nakamoto.

If it was a mistake, it’s certainly a curious one. If it wasn’t a mistake, then someone out there has some serious explaining to do!

Kraken is one of the largest and most secure crypto platforms in the world. They've been in the crypto game for over a decade, and now they're inviting us all on a journey to see what crypto can be.

With a seemingly endless supply of new market entrants, the L2 space has never been more diverse. In our latest episode, David is joined by Paradigm CTO Georgios Konstantopoulos and Conduit founder Andrew Huang to discuss the evolving L2 opportunity.

Bankless Citizens get Early Access to our Monday podcast👇

📰 Articles:

📺 Shows:

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.