Undoing Globalization

Dear Bankless Nation,

It feels like there are massive tectonic shifts happening in the world.

There has been a lot of reshaping and reconfiguring how humans are organizing themselves on a global scale.

There’s an underlying current that is defining how this phase change is unfolding:

Undoing globalization.

Ray Dalio’s book “Principles for Dealing with the Changing World Order” is illustrating a period of human history in which the structure and organization of the world go from something old… to something new.

Meanwhile, the crypto community’s discourse is increasingly aware of "the 4th turning” theory, which claims that we’re due for a changing of the guard… whatever that may look like.

Using this lens, we can interpret some of the macro events that are unfolding in front of us

Overindexed on Globalization

The COVID-19 pandemic revealed just how globalized we’ve become.

The manufacturing of the world’s goods has naturally centralized into the cheapest and most efficient means possible. Prior to Covid, we didn’t give much attention to the risks of China producing all of the world’s masks, or Taiwan producing all of the world’s semiconductors. But when a pandemic comes and disrupts a very fragile ‘just-in-time’ supply chain paradigm, all of a sudden the efficiencies gained from a globalized economy turn into weaknesses, dependencies, and risks.

Perhaps we over-indexed on globalization.

Just 2 years later, we’re seeing similar knock-on effects as a result of the Russian invasion of Ukraine. Ukraine and Russia combine for about 30 percent of global wheat exports. The Ukrainian government banned the export of wheat and other food staples this week, to “meet the needs of the population in critical food products”.

But it’s not just wheat. Fertilizer, phosphate, and potash are also key exports out of Russia, which stopped exporting all of these things since invading Ukraine.

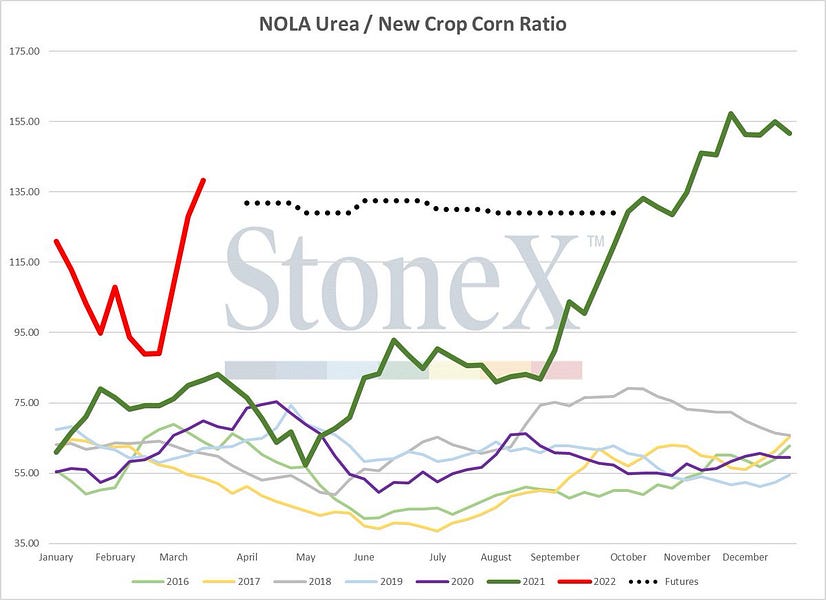

Fertilizer has gone from $200/ton to $1,500/ton.

The world has a 90-day food production cycle. If we stopped producing food, we’d have about 90 days of food left before we ate it all. So we’ve got about 90 days before the full effect of these changes in markets starts showing up in the thing that literally all humans must purchase: food.

Once again, perhaps we’ve let our global interdependency grow a little too strong.

Splinterverse

Meanwhile, in the digital realm, the metaverse is at risk of becoming a splinterverse.

In order to control the flow of information, Putin has lowered a digital iron curtain around the Russian internet.

Meta is now “an extremist organization”, and all of its products are blocked (Facebook, Instagram, Whatsapp). But also, plenty of Western companies are willingly withdrawing their service from Russia (Apple, Microsoft, TikTok, Netflix, others)

Ukraine has called on ICANN to remove “.ru” sites from the internet. While the internet is decentralized tech, we still need to agree on the standards that we use for how to communicate data, and ICANN is the organization that provides that coordination.

A quote from the above-linked article:

“A splinternet remains very possible—driven by politics rather than technology”

Driven by politics…

And another from this piece:

“Even the very backbone of the internet—this DNS routing system—is fragile and potentially subject to government manipulation. The DNS system that makes it work is literally controlled by fourteen people who hold seven sets of keys.”

The internet is losing its credible neutrality.

When the relevant players are some of the world’s largest nation-states, the legitimacy of the internet itself is being called into question.

End of the Dollar Standard

The dollar has a central role in this story, as the dollar is the main tool that the United States has to maintain power and control over the world.

And now, the world just watched the U.S. freeze Russia’s central bank, ruining the assurances that the dollar is a good place to store one’s savings, further incentivizing countries to find ways to store wealth that is outside of the dollar system.

Arthur Hayes put out an amazing article last week which stated:

"The current PetroDollar / EuroDollar monetary system ended last week with the confiscation of the Russian Central Bank’s fiat currency reserves by the US and EU, and the removal of certain Russian banks from the SWIFT network. In a generation hence, when hopefully this sad episode of human history concludes, historians will point to 26 February 2022 as the date on which this system ended, and a new, currently unknown-to-us system sprouted.”

An article out of Credit Suisse from Zolton Pozsar memed the idea of “Bretton Woods III” into existence, illustrating the case of a new monetary order that seems to be inevitably ahead of us.

There seems to be a consensus that the end of the dollar standard is just over the horizon.

Remember: Money is the ultimate coordination tool.

When it breaks, we lose a critical tool in our toolbelt that allows us to coordinate with others.

The Theme of the 2020s: Reducing Globalization, becoming independent

To summarize:

- We have a world in which global supply chains are breaking.

- External dependencies are turning into systemic risks and creating the possibility of global financial contagion to the point that people are worried about famines.

- The world’s largest coordination tool (the dollar) seems to be losing the confidence of basically everyone.

The 2020s seem to be showing us every way that we over-indexed for globalization.

Globalization and warring nations don’t really go well together, and if we are indeed in the decline of the 80-year conflict cycle, then you can expect the world to enter into a paradigm of conservative protectionism rather than liberal cooperation.

The Counter Force: Cryptocurrency

As the trajectory of the world turns from globalization to balkanization, crypto is here to take the globalization story the rest of the way.

Putin’s Internet Iron Curtain can change what Russians see on the internet, but it can’t change Ethereum.

There is no ‘China’s Ethereum’ or ‘Russia’s Bitcoin’. The whole point of these things is that they are universal coordination tools, and they exist on a scale that is larger than Nations.

So while Ukrainians and Russians are being presented with two different versions of the world, when they look at the state of Ethereum or the account balances of Bitcoin, they’re seeing the same story as everyone else in the world.

This is why blockchains are called ‘truth-machines’. Blockchains don’t lie.

While the Nation States of the world are ‘going their separate ways,’ the people of the world are all getting onto the same Web3 protocols.

Maybe we over-indexed on globalization in the physical world, but in the digital world… we’re just getting started.

If we are indeed at the start of changing the new world order, you can expect the physical world to become more isolationist. Food and energy will be produced and sourced locally, so we don’t have to deal with international trade and supply chains.

But the metaverse is inherently global. So while our Nation States put up walls around its citizens, the metaverse passes right through these walls, connecting the individuals of the world on the same plane of existence.

This has always been the promise of crypto:

- The dollar network is losing faith.

- The supply chain networks are breaking down.

- Even the internet itself is losing global consensus.

Yet, the march of humans trying to figure out how to coordinate with each other at larger and larger scales will not wait for Nation States to figure it out.

Humans just want to coordinate.

We’re going to do it whether or not our Nation States help us achieve this goal.

- David