Understanding Ethereum’s Withdrawal Queue

Ethereum staking has long been the ultimate “set and forget” crypto trade. Simply stake ETH, secure the network, and collect passive rewards!

Amid the recent run-up for ETH prices, Crypto Twitter's attention has recently centered on the record two-plus-week wait times for staking withdrawals. But what is the withdrawal queue, how does it work, and why is everyone suddenly obsessed with this obscure aspect of Ethereum’s architecture?

Let's dig in👇

📤 What is the Withdrawal Queue?

The successful implementation of the Merge in September 2022 marked the completion of Ethereum’s transition from Proof-of-Work to Proof-of-Stake; it formally transferred control of network security to stakers.

Under Ethereum’s PoS regime, each staker must post a minimum 32 ETH bond collateral for the ability to store network data, process transactions, and add blocks to the chain. Stakers earn ETH rewards for securing the network.

Staking ETH was initially a one-way/deposits-only commitment, but in April 2023, the Shapella upgrade enabled stakers to withdraw their ETH from staking.

To ensure network security and prevent undesirable downtime, the Ethereum network enforces a “withdrawal queue” for all stakers who want to withdraw ETH from their validator.

🧐 How Does the Withdrawal Queue Work?

The withdrawal queue supports both partial withdrawals (claiming only accrued validator rewards and remaining in the validator set) and full withdrawals (removing all ETH rewards and bonded ETH to exit the validator set).

A combined maximum of 16 partial and full withdrawals are processed per block in a clock-like fashion, starting with the first validator established and working towards the most recently established validator before restarting the clock. It currently takes about 9 days for this process to “sweep” across the entire active validator set.

Partial withdrawal requests are automatically included in the withdrawal queue if an account holds an ETH balance in excess of its node bond, but to make a full withdrawal, stakers are first subject to the additional exit queue.

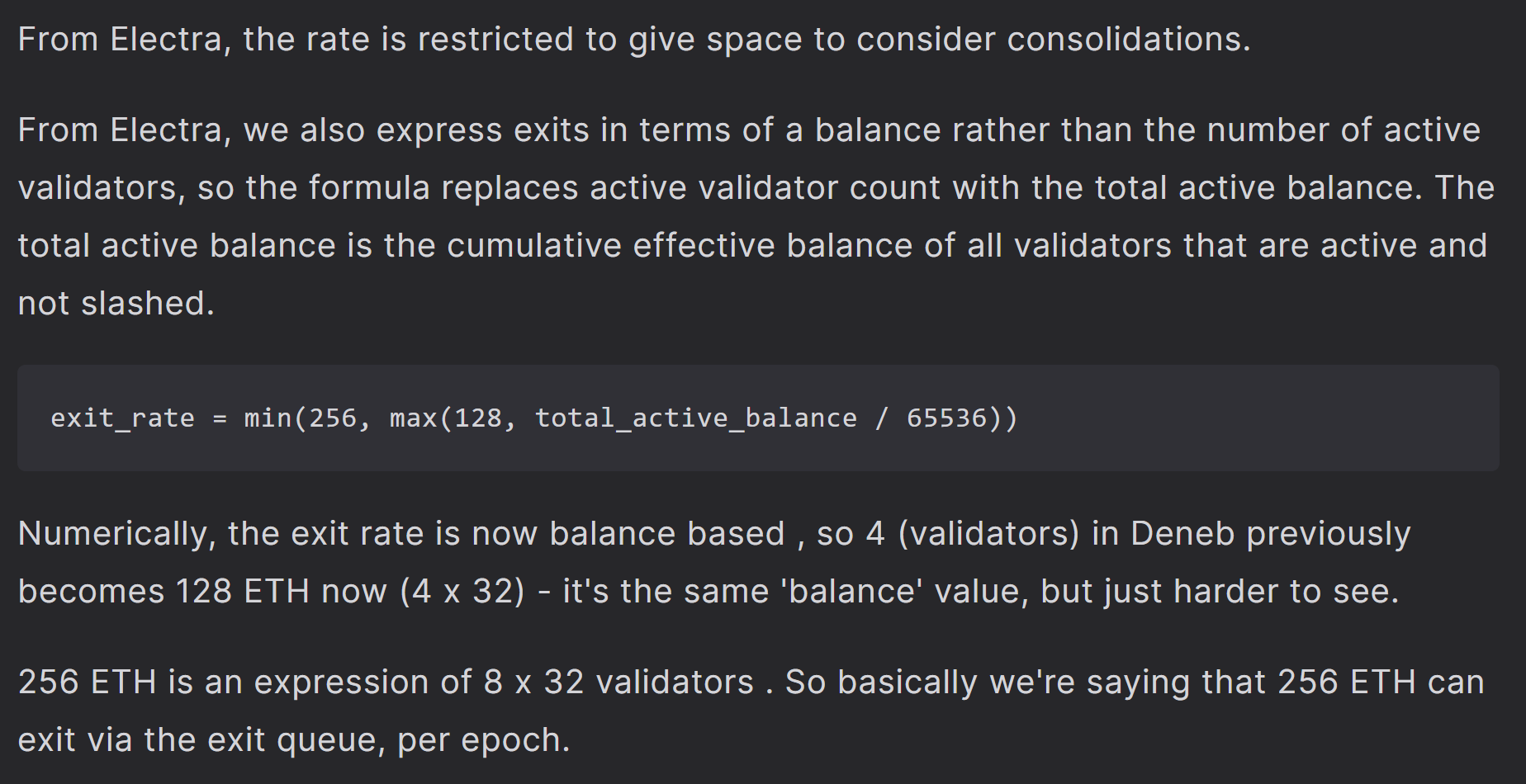

Although the exit queue scales alongside the number of active validators, it has a much narrower bore than the withdrawals themselves. Ethereum's Electra upgrade capped the exit queue at 256 ETH per epoch, effectively limiting processed exit requests to a maximum of 8 full nodes every 32 blocks.

🧠 Why does the Withdrawal Queue Matter?

The implications of a clogged queue extend well beyond the inconveniences facing “solo stakers” waiting a couple extra days for their withdrawal to clear.

Liquid staked ETH underpins Ethereum capital markets. By combining passive ETH yield with transferable deposit receipts, these tokens have evolved into a primary fuel source for the DeFi economy and lifeblood of onchain leverage.

When someone wants to sell a liquid staked ETH token, like Lido’s stETH, their order can either be routed through the ETH unstaking process or a spot market.

Although unstaking requests can be processed in as little as one day (particularly for large staking operators like Lido and Coinbase with large numbers of validators dispersed throughout the set), with a record amount of validators now rushing for the exit door, the exit queue alone is now bogged down with a 16+ day wait.

Ethereum's validator exit queue has recently hit new highs! Validators wanting to exit Ethereum's proof-of-stake consensus must wait over 15 days (approximately 870,000 ETH waiting) to exit.

— prestonvanloon.eth (@preston_vanloon) August 16, 2025

Why does Ethereum have an exit queue?

👇🧵👇 pic.twitter.com/oO0VJQIMpi

Time costs money in financial markets, and now that staking withdrawals take upwards of two weeks to process, parties that provide LST liquidity (i.e.; market makers) are demanding greater “haircuts.”

In an ideal scenario, liquid staked ETH tokens can be converted at a 1:1 rate into the amount of ETH they represent. However, once the withdrawal queue imposes substantial wait times on full validator exits, market makers begin factoring greater LST holding costs into their bids.

As exit times become even longer, they may begin demanding greater discounts.

This poses a vicious cycle, in which increasing LST deviations from their natural 1:1 peg causes forcible LST liquidations, flushing market makers with LST inventory that needs to be redeemed and creating even longer exit queue wait times.

Further, should the ETH perpetuals and futures used to eliminate the price risk of warehoused LSTs slide into backwardation (i.e.; negative funding rates), market makers will face higher hedging costs, which get passed onto end swappers through even greater LST discounts!

Despite the recent increase in validator exit requests, the overall state of Ethereum staking remains balanced. Staking inflows have roughly counteracted withdrawals, allowing total ETH staked to remain static at around 35.5M since mid-July.

Unfortunately, this dynamic does nothing to prevent the implications of swelling withdrawal wait times, as Ethereum’s deposit and exit queues are two entirely separate mechanisms.

Ether bulls have been quick to dismiss concerns over exit queues as “FUD,” citing an incessant digital asset treasury-driven bid for ETH and anecdotal evidence of strong price performance following similar spikes, yet longer withdrawal wait times are not merely an optics issue.

This well-intentioned structural bottleneck is also a DeFi chokepoint: longer exit times translate into deeper LST discounts, higher hedging costs, and risk a reflexive leverage unwind.