Dear Bankless Nation,

Happy ultra sound money week.

If still you haven’t listened to the podcast with Justin Drake do it now. This episode is fast becoming required listening for anyone on the bankless journey.

Today David dives deeper to explain why ETH might become the best money the world has ever seen. In other words…

ETH is ultra sound money.

- RSA

Want to listen to the audio for this? David has you covered:

WRITER WEDNESDAY

Bankless Writer: David Hoffman, Bankless Founder & Co-Host

Ultra Sound Money 🔊🦇

Crypto-economics represents a paradigm shift in how humans are able to engage as economic agents. Good crypto-economic engines are minimally extractive hosts of economic activity, and offer strong incentives to adopt these more efficient economic platforms.

Like with all human inventions, crypto-economics was birthed with an experimental MVP; and due to the reflexive nature of money and human Schelling Points, Bitcoin has quickly risen to become the world's 6th most valuable asset by market capitalization.

Crypto-economic researchers however are not satisfied with the first MVP that crypto-economics has to offer, and ask themselves “what happens when we deconstruct, optimize, and refine the components that make crypto-economics function?”

Good crypto-economic systems optimize both cryptography and economics. The optimization of one without the other leaves an inefficient imbalance in the system and can lead to long-term wear on the system. This is the fundamental critique that crypto-economic researchers have of the bitcoin system: an optimized economic asset but powered by an inefficient economic engine.

With the domain of crypto-economics unlocked, we must ask ourselves: With 12 years of compounding crypto-economic research… how far can we take this?

Economic Engines

Economies are frequently illustrated as engines. Economies are integrated systems which consume resources and produce economic output. Economic engines are evaluated on their power-output, measured in Gross Domestic Product.

In order to maintain operation, economies must be protected by some kind of powerful force. Economies produce value, and are therefore desirable; if they are desirable, they must be guarded. If economies are not meaningfully protected, then the incentive to try and capture the economic system may outweigh the costs of trying; therefore the economy is exposed, and an attack can be expected.

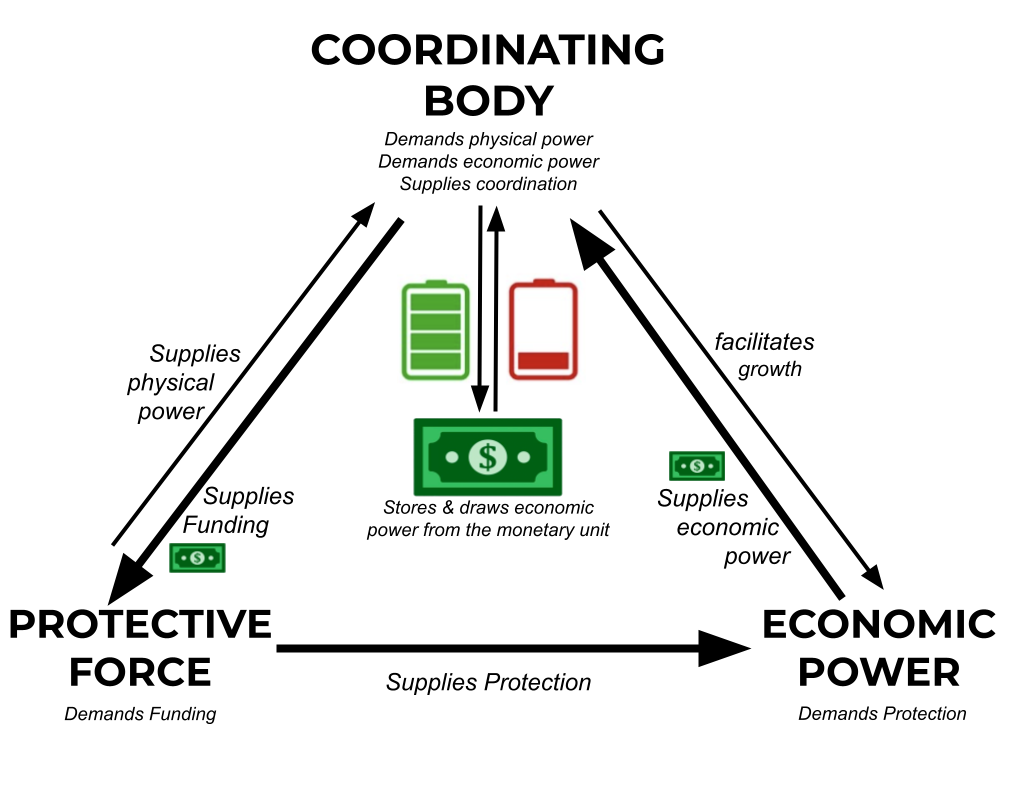

An integrated relationship is established between the three parties that make up an economy:

- The Coordinating Body (the leadership, government, or ‘party in power’)

- The Economic Power (the productive output of the economy)

- The Protective Force (the army, militia, or defense force of a Nation)

When these three parts of an economic system are composed together, they create a ‘Nation-State’, a composed integrated body of productive internal organs (the economy), a central nervous system for coordination and long-term planning (the government), and teeth, claws, and weapons for protection (the protective force)

‘Money’ is created (or selected) to allow for the circulation of resources around the economy, and also enables the coordinating body to siphon off adequate economic energy to fund its security.

Governments, with their control over money, direct the resources as optimally as possible; defense, infrastructure, research, education etc. This funding of progress allows for sustainable, long-term energy production by the economy. This is a good long-term plan because maintaining control over an economic body is a long-term game.

Governments also direct resources into defense. Defense is critically important because without it, the economic body can be captured by the first adversary that tries. The protection of the economic engine is of the utmost priority, because the loss of the economic engine means that the coordinating party is ‘out of power’. Historically, transitions of power are not smooth events; much economic loss occurs, which ultimately manifests as human strife. Strong defense allows the coordinating body to maintain control over the economy in the face of external threats of takeover.

Defense expenditure is not designed to return economic energy back into the economic system. Defense spending expends economic energy. Funding a defensive force does not increase the strength of the economy; it is strictly a consumptive endeavor. The economic benefits of defensive funding come from the long-term strategy for maintaining long-term control over the economic engine.

The Economic Unit

Fiat money is the value transfer tool that is created from the power of the government which makes it the only lawful legal tender of the land, and charges taxes in it. The economic engine then adopts the currency, and in doing so bestows the power of seigniorage upon the government.

By leveraging the physical power of the military, the government can use this physical power to force the economy to use its declared money, and also can physically restrain people who attempt to generate counterfeit money. This makes money ‘hard’ for the people; it can’t be freely minted or produced, but ‘easy’ for the government, because they have the power to mint new money, and no one can restrain this right, because they have a monopoly on violence (power).

With the power of seigniorage unlocked, governments don’t have to collect taxes 1:1 with expenditures. They can collect taxes at any given rate, and issue new coinage at any given rate. Having these two variables decoupled from each other gives more flexibility and choice in how the government chooses to leverage the currency.

The freedom to issue new money is advantageous to ensuring the long-term funding of security. Economic GDP isn’t always stable; it fluctuates up and down and spikes or troughs randomly at times. The Protective Force that defends an economy would be more effective if long-term funding was guaranteed and able to be integrated in long-term plans. This makes the dependably regular issuance of new coin an optimal defense funding strategy.

Discharging Monetary Power

When new coin is issued, new power isn’t created. It’s borrowed. Because currency is fungible, the value of newly minted coin is equal to the worth of already-existing coin.

The act of minting new money does not increase the total value of all outstanding money. Rather, the existing supply of money becomes diluted, and power is drawn out of the circulating supply of money, and funneled into the newly minted coin.

Minting money does not create value, it displaces it from the circulating supply into the newly minted supply. Then this new coin is allocated to fund defense, and thus the economic engine is secured from would-be attackers.

Drawing power out of the monetary unit can lead to catastrophic outcomes if done in an unsustainable or inappropriate fashion; the value stored in the money is not infinite.

Over time, persistent borrowing of energy becomes unsustainable, especially as the energy continually gets expended in outputs that do not efficiently recycle value back into the economic engine (e.g., the costs of the U.S. military). If the energy of the economic system is expended at a faster rate than it is produced, then the economic value of money slowly drains over time.

Hyperinflation occurs when the expenditures of the Coordinating Body are so large that it enters into a state of perpetual currency issuance to fund these expenditures. This perpetual issuance generally still works, so long as the people using the money aren’t bothered by the devaluation. But, once they wake up to the rampant discharging of the monetary battery, they tend to quickly flee away from the unit.

This can markedly accelerate the draining of value behind the economic unit, and lead to hyperinflation.

Charging Monetary Power

The money of an economy becomes charged by adding value to it.

Someone might labor for 8 hours, and receive 100 economic units as compensation. Then, they might build a mechanism (such as a business) that achieves the same economic output, yet only costs 50 economic units to produce the same economic output. If the entire economy becomes twice as efficient, and the supply of monetary units stays the same, then the money unit has twice as much economic power behind it.

Growth in economic output charges the monetary unit with economic power.

If the GDP of an economy doubles and the supply of money units stays the same, the money becomes backed by twice as much economic power. The economic unit is capable of discharging double the power and thus has become charged with energy.

As economies grow in efficiency, they are capable of achieving similar levels of economic outputs for less costs. The premise of sound enterprise is that a business can produce a product at less costs than any other viable alternative. If this is true, then the business is capable of receiving money, and producing products, while still having some money left over.

Having money leftover after costs and expenditures means that good businesses are net-buyers of money. Economic growth means that there are more businesses competing over the same supply of money (so long as the supply of money stays the same).

Money is backed by the power it bestows upon the owner. This power increases when money has more power behind it, which is a function of the size of the economy that backs the money. The magnitude of the economy behind the money is the system that produces persistent buying-pressure on money.

Ultimately, the mechanism that charges or discharges the money is the act of buying or selling the unit. As good businesses are built, they bestow the power of being able to produce 1 unit of currency for less than 1 unit of cost.

Economic engines run better on sound money.

Economic engines don’t need money, they need power. Money is only a vehicle; it must also be backed by power. You can’t just inject money into a system if that money has no power stored within it.

Take, for example, the economic engine of Venezuela, when the Coordinating Body (the government/leadership/party-in-power) attempted to make the economic engine run on money that had no power stored in it. Instead of receiving sound money, the Venezuelan economy became flooded with low-grade Venezuelan bolivars. The engine seized.

Gresham's law is an observation in economics that “bad money drives out good.”

If humans notice that their money is leaking value, they will try and find a different place to store their value. They will discharge the power in their money into alternative reservoirs, in order to get rid of the liability of the draining monetary units.

The monetary units are sold.

The mass discharging of economic units becomes critically dangerous when the coordinating governments have large economic liabilities they must fund. As the power drains from the monetary battery, the coordinating body must issue new money at a higher and higher rate in order to adequately fund the economic security and investments of the nation-state.

They must issue more money, as the declining value of the money means that the money doesn’t go as far. With every new instance of issuance, the power is drained away from the supply circulating of money in the economy, and into the new supply.

When humans collectively decide to not use the economic unit of a system, the resource coordination between the economy, the Coordinating Body, and the Protective Forces falls apart. Money needs to have value in order for this system to function.

‘Buying’ money charges it with power. ‘Selling’ money discharges its power. Long-term net-buying bestows long-term value accrual to the money, while long-term net-selling discharges the value captured.

Efficient Economic Security

Humanity has discovered a new type of economic engine, powered by a new kind of fuel. These new crypto-economic engines are strongly suited to ensure the accrual and retention of monetary power in their native assets.

These new economic engines promise to host internet-scaled economic activity, while simultaneously consuming fewer resources to host this activity. Thanks to the powers of cryptography and decentralized computing networks, securing the economic output of crypto-economic systems is highly efficient compared to the previous economic engine models that humans have developed.

The fundamental innovation that crypto-economic engines bring is their ability to host economic activity with significantly reduced consumptive cost requirements placed upon its native economy, allowing the native economy to retain more of the economic power that it generates. This retention of economic power output is stored inside the money of these crypto-economic systems.

Resistance to Physical Power

Much of the efficiency leveraged by crypto-economic engines is achieved by simply not existing in the physical domain. Crypto-economic economies are hosted on the internet, and thus do not respond to physical force in the same way that Nation-State economies do. Crypto-economic systems are therefore highly resistant to physical attack; some more than others.

The purely digital nature of crypto-economic systems invalidates the might of the physical powers of the world. Not having to be concerned about the strength of the US military is extremely advantageous for the economic activity being facilitated by these new crypto-economic engines.

In contrast to nation-state economies, crypto-economic systems are inside their own plane of existence.

Bitcoin’s Proof of Work exists in the SHA-256 world, and only responds to other SHA-256 competitors (Bitcoin Cash being the only other force-of-power in this plane, and not a very strong one).

Similarly, Ethereum’s PoW only exists in the Ethash (the Ethereum consensus algorithm) plane, but will soon be migrating to Proof of Stake, in which power is defined by the value of ETH. In Proof of Stake, the only power-force that Ethereum responds to is the native asset ETH; all other sources of power are not capable of attacking Ethereum.

Proof of Work, Bitcoin’s defense force, is powered by ~$5B of yearly electricity consumption and ASIC unit production.

Similarly, Ethereum’s Proof of Stake system is producing a $6.6B energy-shield of economic security to its preliminary beacon chain (the future host of all Ethereum economic activity), while only costing ~$0.5B in yearly maintenance costs (economic efficiency is one of the main perks of Proof of Stake)

Meanwhile, the USA spent ~$720B in 2019 to fund its military and protect its economic empire.

Resistance to Human Folly

Crypto-economic networks like Bitcoin and Ethereum are non-discretionary about their spending. Nation-State governments attempt to optimize expenditures across a wide variety of strategies; infrastructure, defense, education, research, etc. These strategies are attempts to accelerate growth and to produce a more productive economy.

However, there are no guarantees that these endeavors pay off in the long term. Attempts to accelerate growth are investments and not all investments are wise. If the coordinating bodies of an economic system ultimately end up funding efforts that do not produce net-new economic energy, then these efforts ultimately come out of the value of the monetary unit.

Too much malinvestment results in the draining of power from the money; especially if the coordinating body has committed to recurring expenditures.

Nation-State coordinating bodies are forced into investing in their own future, due to the arms-race that they find themselves in. All Nation-States live in the same plane of existence, the physical world, and there is little meaningful difference between ‘defensive’ and ‘offensive’ security forces. Because of this reality, Nation-States must invest in their own future; if they don’t and an alternative nation-state power does, and succeeds; they will not be able to match this opponent in its economic-power, and therefore become susceptible to attack.

With investment in the future comes risk. No one knows the future, not even Nation-States. No investment in the future is guaranteed to pay off. Because of the Nation-State arms-race competition for growth, the long-term prosperity of these economic systems becomes a function of human leadership and effective coordination. Long-term health of nation-state economies is tied to ability and power of collective human brains.

Sometimes, humans mess things up.

Crypto-economic systems, on the other hand, are solely focused on powering defense, and nothing else. Baked into the values of crypto-economic systems is the goal of establishing strong economic foundations, and letting the economy grow under its own power.

Crypto-economic systems protect the economic engines, but they do not tinker or manipulate them.

Crypto-economic systems are not led by a collection of human brains; they are powered by numbers and algorithms. Crypto-economic systems do not make subjective investments or bets on the future. They do one thing, and one thing only: provide economic security.

This constraint on the scope of crypto-economic systems is theorized to produce better social-scalability. No longer do the economic actors on these platforms need to place their trust in the competence of human leadership; instead they have assurances about the long-term operation of these systems, as these systems have automated away the need for human coordination, and replaced centralized leadership with code and math.

A Revolution in Economics

Crypto-economic systems are orders of magnitude more economically efficient compared to Nation-States.

The net result of reduced security costs and eliminated debt financing is significantly reduced power draw from the economic engine to fund security.

Because of these cost reductions in system maintenance, more monetary power is redirected back into the value of these crypto-economic monetary units. Crypto-economic systems do not issue new coin as a function of the size of the economies they control. Instead, when these crypto-economies grow larger, the cryptocurrency assets that power these systems grow in value instead of supply.

This is advantageous for the economic actors that transact on these systems; less of human productive output needs to be taxed to fund public economic security. If the economic system costs less to maintain, those that produce the economic output on which the engine runs are better equipped to retain the full value of their economic labor.

Crypto-economics are extortion-minimized economic systems, which is a compelling feature for the economic actors of the world.

The Crypto-Economic Design Space

We are in the era of crypto-economics. Crypto-bulls believe improvements offered by crypto-economic engines offer a natural basin that will slowly attract the economic activity of Planet Earth. Economic activity is simply more efficient when using crypto-economic engines, and people desire efficiency in their economic engagements.

Yet, not all crypto-economic engines offer comparable levels of efficiency.

Proof of Work is Inefficient

Bitcoin built the first viable crypto-economic engine, and has proven viability as a construction.

A critique of the Bitcoin system is that it is using ‘stone-age economics’. Bitcoin is an attempt to produce an economic system in which the money is most similar to Gold. ‘Gold 2.0’ is a frequent term used to describe the Bitcoin system.

It’s important to remember that ‘Gold 2.0’ is only describing one side of the Bitcoin system; the monetary unit. The other component of economic systems is the engine itself. BTC is the fuel, Bitcoin is the engine.

The Bitcoin economic system is an attempt to re-create a tried-and-true economic model for its money: perfect scarcity of the money. While gold is constantly being dug up from the Earth and added into the circulating supply of gold, we know from the laws of physics that there is a finite supply of gold found on Earth. Because we know this, gold acts as a sound monetary battery because it cannot be freely minted by anyone.

There is a fundamental breakdown, however, between the comparison between BTC and Gold. Gold achieves its security through a deep connection to physics. Nothing in the universe can create gold other than an exploding star. Gold is secured by the energy of a supernova. After the energy in an exploding star is released, all gold has been minted from this event and no more. All economic costs to maintain the security of gold is paid for at genesis. There are no ongoing costs to secure the value of gold; it gets its security for free.

Bitcoin, unfortunately, does not have this feature. Bitcoin has ongoing costs for maintaining economic security:

- Perpetual energy consumption

- Perpetual ASIC degradation and turnover

Bitcoin Proof-of-Work operates through an endless competition to mine Bitcoin blocks faster than everyone else. Those that produce more hashes mine more blocks, and receive more rewards.

This PoW competition perpetually gets more and more fierce as the value of BTC goes up. The incentive to participate in the ‘consensus engine’ of a crypto-economic system is a function of the value of the unit that is being competed for. If there is value being issued to fund security, there will be interested parties willing to compete for that value. If there is more value being issued, then there will be more people in competition.

Under Proof-of-Work, this endless competition to mine Bitcoin blocks adds security to the Bitcoin system, at the cost of expending the energy inside the BTC monetary unit. As the margins for PoW miners get slimmer and slimmer, more and more BTC must be sold to pay for the operational costs. Selling the unit discharges the energy, and Bitcoin security is fundamentally designed to instigate a race to consume as much energy as possible.

Bitcoin is secured by long-term perpetual selling pressure on the economic unit.

The GDP of the Bitcoin economy generates the economic fees for making a transaction in the Bitcoin crypto-economic system, and these fees are sent to the miners and sold to fund the mining operation.

This is a constant drain on the BTC monetary unit. Bitcoin’s security is persistently funded by BTC sell-pressure from miners. While the 21 Million BTC supply cap makes BTC an attractive place to store one’s wealth, it comes with a secret hidden tax of miner sell-pressure to fund the security of the system.

As described above, monetary units are charged by buying and discharged by selling. The net outcome of this design is that the value of Bitcoin’s native economy won’t be able to be fully expressed by BTC the asset.

BTC the asset leaks its value due to significant power-draw placed on it by the Bitcoin Proof-of-Work security engine. Bitcoin’s expenditure-based security is persistent, reliable long term sell pressure of BTC from PoW miners, because Bitcoin does not meter resource consumption by its security providers.

Just as economic systems before it, Bitcoin is secured by taxation on GDP produced by its economic engine. Bitcoin’s military, its PoW force-shield is running at an extremely high burn rate.

Security Through Transaction Fees is Inefficient

A second inefficiency in the Bitcoin economic engine is its inability to control its security budget.

Bitcoin’s long-term security comes from the transaction fees paid to the network. Those transaction fees are paid by those who want to make a transaction on Bitcoin, and the fee for including your transaction in the ledger is paid to the Bitcoin miners.

Bitcoin does not know how much fees it will receive at any given moment; it just collects the revenue it receives and sends all of it to the miners. Bitcoin has no capacity to give long-term assurances to its security providers about the future size of the security budget. As stated above, the GDP of economies fluctuate and spike, and Bitcoin’s security budget is a function of economic exchange on top of Bitcoin.

BTC fees paid to miners are volatile. Sometimes they are low, sometimes they are high. This is like injecting fuel into an engine by stomping on the gas and then immediately releasing it. Rather than finding the exact right spot to go the desired speed, Bitcoin just throws all of its received transactional revenue into the engine as soon as it receives it.

Not being able to meter the economic resources inputted into the Bitcoin security engine means two things:

- Bitcoin miners have an unpredictable security budget

- Bitcoin is overpaying for security

Giving up the power of issuance at the protocol level means that Bitcoin’s security acts as a sail, powered by the winds of its economic engine. It is not actually capable of generating its own power; its security is a function of its own economy. Bitcoin’s native economy may be enough to keep the sail filled with air, but long-term security assurances are absent.

Additionally, because Bitcoin directs 100% of all received transaction fee revenue towards miners, it never gives itself the opportunity to pocket excess revenue to save for a rainy day. If the Bitcoin economy is running hot, Bitcoin forwards all of this revenue directly to the miners, instead of taking those economic excesses and saving them for later.

Bitcoin doesn’t manage a balance sheet; all economic excesses end up getting paid to the Bitcoin miners, who are perpetually in a race to increase their energy consumption.

In Nation-State economics, central banks raise and lower interest rates as economies heat-up or cool-down. Lowering interest rates means that the central bank is capturing less economic fees, and promoting economic activity. Increasing interest rates means that the economy is heating up, and it’s safe to charge more in transaction fees to pocket this revenue, in case this reserve is needed in the future.

Bitcoin sheds this entire notion, and simply lets the free market determine the transaction fees, based on demand to transact on Bitcoin, and then directs 100% of these fees to the PoW miners.

Not having the option to pocket these fees and save them for later is the forfeiting of an extremely powerful value-capture mechanism, and leads to less soundness in BTC over time.

Ethereum’s Advances in Crypto-Economics

Bitcoin has been obsessed with optimizing very specific parts of its crypto-economic system.

BTC the asset is prioritized above all other components. Bitcoin is designed to preserve the 21 Million hard cap supply of BTC, and everything else is a means to produce this end.

From the perspective of a holistic, integrated system design of both an economic engine and monetary fuel, Bitcoin has sacrificed the efficiency of its engine to produce scarcity in the asset.

But crypto-economic systems are composed systems; the aggregate output of these things are the result of the interaction between the power of the money and the efficiency of the engine. Optimizing for one and not the other leaves you with an inefficient system that is a drag on the economy that it hosts.

As with all technological innovations that humans have ever come up with, there have been 12 years of crypto-economic research and development to leverage.

Leveraging these advances in crypto-economics means that we can move away from the stone-age economics of ‘Gold 2.0’, and move into the full expression of sci-fi economics using optimizations in both cryptography and digital economies.

Proof of Stake is Efficient Security

Proof of Stake is an alternative to Proof of Work that leverages the value of the native asset of a crypto-economic system to provide security to the economy.

Bitcoin Proof-of-Work secures itself via a competition in resource consumption, and forces potential attackers to match and surpass the rate of economic consumption to attack the network.

Ethereum Proof-of-Stake secures the system by erecting a ‘wall-of-value’ that a potential attacker must overcome in order to attack the system.

Currently, there is 3,618,200 ETH ($6.7B) staked to the Ethereum beacon chain (the early foundation for Ethereum 2.0). An attacker must stake an equivalent amount of value to attack Ethereum, denominated in ETH. If an interested party wants to attack Ethereum, they will need to source 3,618,200 ETH in order to do so. $6.7B of buying pressure on ETH the asset is likely to significantly increase the price of ETH, so the US-Dollar value of Ethereum security is actually likely much higher.

What’s more important, however, is that Proof of Stake systems do not consume economic resources. All that is needed to secure Ethereum under PoS is a Raspberry Pi, an internet connection, and 32 ETH.

Stakers are not required to sell their ETH rewards to pay for the economic costs of providing security. The ‘economic costs’ of Ethereum are the opportunity costs of holding ETH.

Proof of Stake operates on the assumption that there is a sufficient supply of interested parties who will hold ETH in order to access ETH-denominated rewards.

Naturally, the disposition of people who are particularly suited to do this are those who are bullish ETH. People who are bullish ETH always want more and more ETH. These people will both purchase ETH off the secondary market in order to stake it, and keep the ETH dividends that they receive.

The juxtaposition between Proof of Work and Proof of Stake couldn’t be clearer. PoW generates a rat-race of energy consumption that leads to long-term persistent selling of the asset by miners. PoS surgically targets the party of people who are most bullish on the asset, and provides them with a transaction validation system that allows them to not have to sell any ETH to express their belief in the growth of the Ethereum economy.

PoW miners fight to more efficiently produce hashes for Bitcoin, in the hopes that their efficiencies mean that they have to sell less BTC than their competition. PoS validators compete in their bullishness on ETH, by pricing out lesser-bulls out of ETH rewards.

Those who are fundamentally the most bullish on ETH the asset are also those that are willing to accept the least amount of ETH rewards as compensation for locking up their capital in ETH to stake to Ethereum.

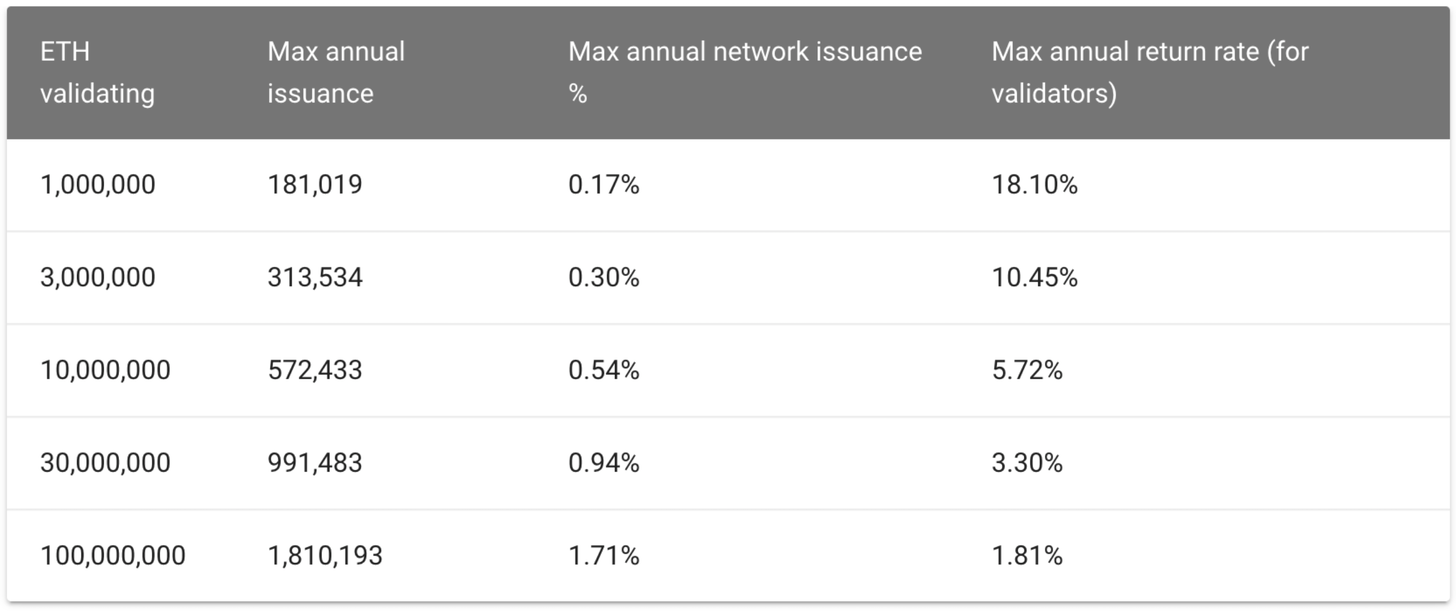

Proof of Stake rewards increase or decrease as a function of the supply of ETH being staked to Ethereum. If there is less ETH staked, ETH rewards are higher and vice versa. As more and more validators stake ETH to Ethereum, the ETH-denominated rewards are reduced. This process will wash out the lesser-ETH bulls who are less interested in reduced rewards, leaving those who are willing to receive the least amount of ETH possible.

Through this mechanism, Ethereum organically discovers the optimal balance between Ethereum security and ETH issuance.

This mechanism leverages control-theory to optimize for sufficient Ethereum security, while maximally retaining ETH scarcity.

Additionally, this mechanism tilts the axis of power towards those who are the most bullish on the economic asset that powers the Ethereum economy: ETH. ETH holders are the individuals who are most interested in Ethereum’s health and success, and Ethereum perpetually rewards these individuals with the asset they love the most: ETH.

This is how Proof of Stake erects the highest walls around its economy, while specifically compensating the party of people who are the most inclined to uphold the network, for the cheapest cost.

As a result of this mechanism, Ethereum needs to issue the least amount of new currency to provide adequate security for Ethereum.

Once Proof of Stake is adopted and the Proof of Work system is forked away, yearly ETH issuance drops from ~4.75M ETH (4.1% of outstanding supply; 2,372,500 blocks/year, 2 ETH/block), to a projected 0.6-1M ~0.5-1% issuance (staked ETH projected between 10M and 30M).

Capturing Economic Excesses: EIP1559

EIP1559 is a mechanism for capturing the economic excesses of the Ethereum economy, and funneling these excesses back into the value of ETH.

EIP1559 formally links the economic power behind the Ethereum economy with the value of the ETH currency.

BASEFEE is paid by economic actors on Ethereum to get a transaction included on the Ethereum ledger. The size of BASEFEE is determined by the demand to get a transaction included. If there is significant demand to transact on Ethereum, BASEFEE moves upwards.

BASEFEE operates as a governor over Ethereum’s economy. If the economy gets hot, BASEFEE increases; if Ethereum’s economy cools down, BASEFEE decreases.

BASEFEE is burnt.

Unlike Bitcoin and other non-EIP1559 crypto-economic systems, Ethereum’s transaction fees aren’t paid to those that provided security. They are simply removed from supply, effectively returning the value of the burned units back into the remainder of the circulating supply.

This is the exact opposite of issuance, where the minting of new coin is borrowing monetary power from the circulating supply. EIP1559 makes the flow of power go in reverse: value flows from the excesses of the economic engine into the economic unit.

All systems generate heat loss, but EIP1559 is a heat-recycling mechanism that recaptures Ethereum’s economic excesses.

BASEFEE is the crypto-economic analogue to Central Bank interest rates; it goes up when the economy heats up, and it falls when the economy cools down. It adds value back to the balance sheet of the holistic economic system.

This is restoring power back to the economic unit. BASEFEE is a persistent buyer of ETH. It is a ‘stock buy-back’ of company equity. It is the central bank charging interest rates, to add strength to the currency. Every single transaction on the Ethereum economy is adding power into its monetary asset, ETH.

This mechanism benefits all ETH holders equally, as all ETH holders have a higher percentage of remaining ETH supply. As a monetary unit, EIP1559 makes ETH a more compelling money to hold.

EIP1559 is a mechanism that associates economic output to economic unit scarcity. ETH gets more scarce as Ethereum’s economy produces economic output. As we discussed above, sound money is money that tracks the economic output of an economy.

Growth in the economic output of an economy charges the monetary unit with economic power. If the GDP of an economy doubles, and the supply of money stays the same, the power-output of money should have also doubled.

With EIP1559 and the burning of BASEFEE, the supply of ETH reduces as a function of the growth of the Ethereum economy.

This is the new paradigm specifically enabled by crypto-economics. This is the difference between trying to recreate ‘stone-age’ economics (gold 2.0), and the creation of something brand new, using new tools.

Sound money is money that grows in scarcity as a function of the growth in the size of the economy that uses it. But what is money that receives outsized tailwinds from economic growth?

Importantly, the more power lies behind ETH the asset, the less ETH is needed to be issued to fund economic security, as one economic unit of ETH goes further as a reward for providing security.

The rate at which BASEFEE will burn ETH won’t truly be known until it is implemented; test-nets and economic models only go so far. But the Ethereum researchers estimate that BASEFEE will burn 50-70% of Ethereum’s current fees (50-70% estimation from a conversation with Ethereum core devs).

There are reasons as to why EIP1559 doesn’t burn 100%.

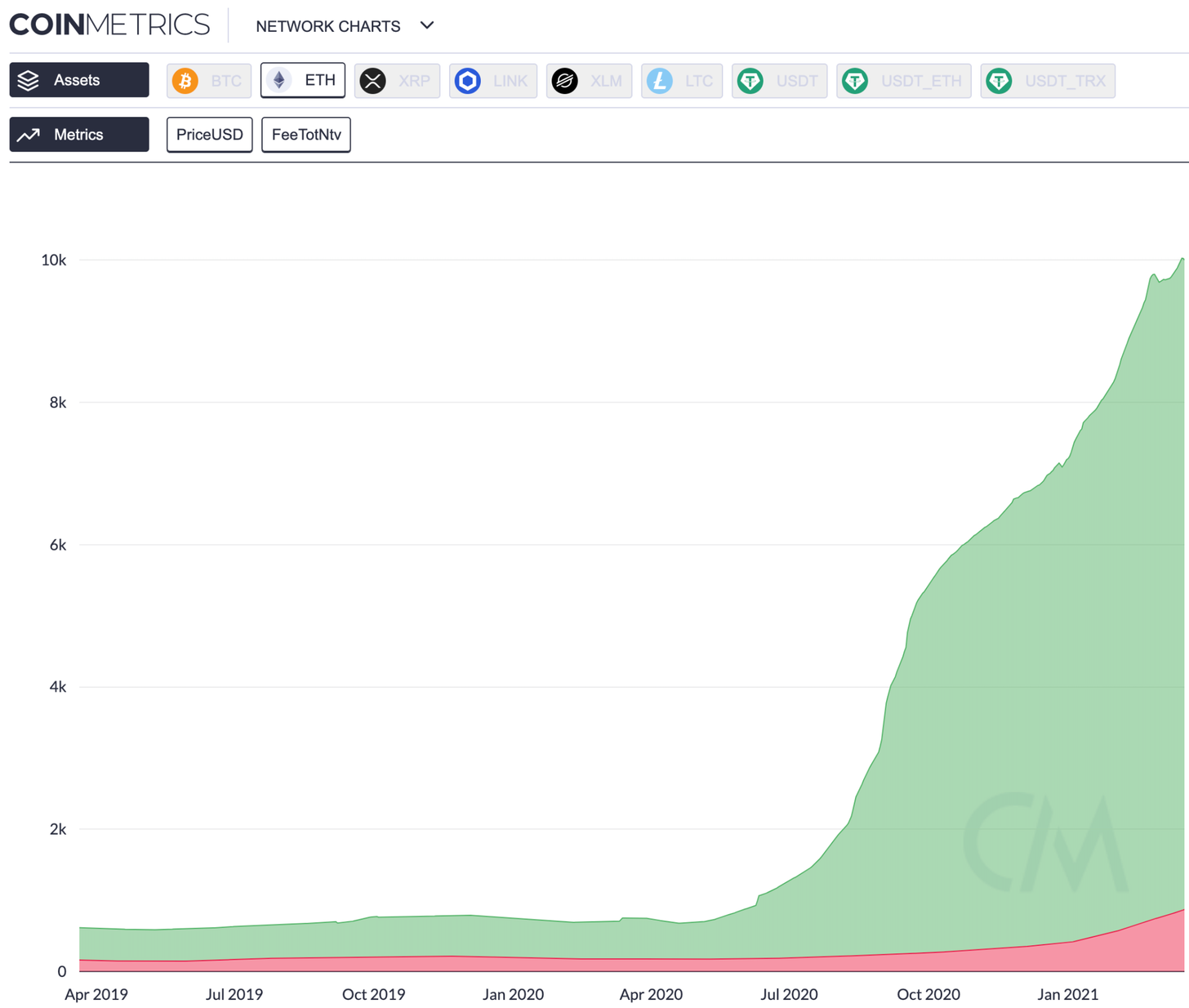

According to CoinMetrics, the 200-day moving average for ETH fees paid to Ethereum is ~10k ETH per day (March 2021).

If EIP1559 were to be implemented right now, the yearly ETH burn rate would be projected to be about 2.2M ETH (60% burn rate, 10k ETH paid in daily fees).

The ETH burn rate is strongly correlated to the total economic activity that is hosted on Ethereum. Ethereum fees have never found any sort of equilibrium; there is no ‘normal’ fee level. Future fee magnitude is highly unpredictable.

Critics of Ethereum will point towards Ethereum’s current state of highly speculative, yield-chasing, gambling-esque behavior and claim that Ethereum fees are only sustained by a greater-fools game.

Those bullish on Ethereum will rattle off a seemingly endless list of possible economic activities that Ethereum is uniquely suited for, as mechanisms for long-term sustainable fee demand.

To discern between these two ends of the spectrum, I’ll ask the reader to review the above sections discussing the power that efficient crypto-economic engines provide to the economic transactors who leverage the platform:

“The economic activity hosted on Ethereum’s native DeFi ecosystem is better equipped to retain the full value of the labor put behind it.”

Ultra Sound Money 🔊🦇

Ultra Sound Money refers to the compounding synergies created from EIP1559 and Proof of Stake.

EIP1559 puts perpetual buy-pressure on ETH from the fee revenue it generates from its native economy. In contrast to the federal reserve being the ‘lender of last resort’ for the USD, Ethereum is the ‘primary buyer’ of its own native currency, and it uses all of its excess revenues to buy-and-burn ETH from the circulating supply.

Simultaneously, Proof of Stake inherently rewards the smallest viable cohort of ETH bulls who are willing to accept the least amount of ETH rewards possible while providing adequate Ethereum security.

The power of these components are multiplicative. They are a function of each other; a recursive relationship between the power behind one function feeding into the others.

With Proof of Stake, yearly ETH issuance is under 1% (~25% ETH staked). ETH issuance drops from 4.75M ETH per year (4.5% monetary base inflation) to between 0.5M ETH and 1.2M ETH per year (~0.5-1% monetary base inflation).

With EIP1559, yearly ETH burn is at 1.9%, an estimated ~1M ETH will be burnt in fees (at current fee markets, assuming 60% fee burn).

All of these factors feed into each other and make each other stronger, creating a positive feedback loop into the value of ETH.

This positive feedback loop is furthered by the fact that ETH is the most trustless asset on Ethereum. As the native asset on Ethereum, ETH has favorable risk parameters as collateral on DeFi. There is no matching ETH’s level of trustlessness, as all other assets on Ethereum were issued by humans (who are folly) or code (which can be buggy).

We can see this in applications like MakerDAO, Aave, or Compound, who give favorable interest rates and collateralization ratios to ETH collateral, enabling ETH capital to be more efficient than alternative assets.

We also see this in applications like Uniswap or Sushiswap, where ETH is the dominant trading asset. Total Uniswap liquidity is $5B as of March 2021, and ETH represents $2.1B of this total supply of liquidity. The second most liquid asset on Uniswap is USDC, sitting at $350M.

We also see this in applications like RAI, which attempts to make a self-referential, governance-eliminated, non-USD stable collateral, which logically can only use ETH to back it, due to the design-goal of eliminating human governance.

ETH’s privileged position as pristine collateral in DeFi applications will add to the scarcity tailwinds to the supply of ETH; an additional source of power that feeds into the monetary energy behind ETH.

The 12 years of crypto-economic advances made since the introduction of Bitcoin in 2009 are coming to a head with Ethereum and Ether. With the integration of EIP1559 and Proof of Stake, along with a native economic layer on the internet, Ether is will be the most economically optimized asset that humanity has ever come up with.

A new era of economic efficiency and monetary soundness will be unlocked, and will assist humans everywhere to more effectively achieve their economic goals and aspirations.

With the Ultra Sound Money putting power into our engine, a new age of human coordination and flourishing is upon us!

Should we say it one more time?

ETH is ultra sound money 🔊🦇

Action steps

- Understand the core concepts behind sound money and economic engines

- Consider the case for ETH as ultra sound money

- Listen to Ultra Sound Money | Justin Drake