Ultimate Guide to NFT-Fi

Dear Bankless Nation,

NFTFi is the intersection of decentralized finance (DeFi) and NFTs.

This new sector unlocks a range of actions for collectors:

- Take a loan against your NFT.

- Pay for an NFT in 3-month installments.

- Rent an NFT for a period for social clout.

- Hedge against the volatility of your NFT assets with a financial option.

- Appraise the value of your NFT while receiving liquidity for it at the same time.

- Fractionalize and own an NFT collectively as a community.

How can you do this? How do these protocols actually work?

Are they safe? What challenges do they face?

The NFTFi landscape is wide and blooming — Donovan takes us into this ecosystem today.

- Bankless team

What is NFTFi?

Are NFTs an investment or a digital collectible – is one of my favorite questions for those active in the scene.

Builders tend towards “not investment” because, well, Gary Gensler is watching. Moreover, if floor price number doesn’t go up, it relieves builders of some accountability to their holders to deliver a profit (it’s not an investment, it’s a community token!).

Yet, we clearly treat NFTs as investments in many unspoken ways. Crypto Twitter is flooded with questions and tutorials like, “What % of my crypto portfolio should be NFTs?” and Investopedia runs articles like “Pros and cons of investing in NFTs”. We cheer when the values of our NFTs go up and where they don’t, most holders believe it gives them some right to grief to project founders.

Enter NFTFi

But my question is getting increasingly irrelevant. A vibrant and innovative submarket known as NFTFi (Non-fungible-token Finance) has emerged around the financialization of NFTs – regardless of how builders want to classify the nature of their projects.

It’s hardly surprising that such a market has sprouted. NFT markets in 2021 saw a trading volume of $17.6B. That is an astounding 27% of the sales volume for global traditional art markets ($65B) in the same year.

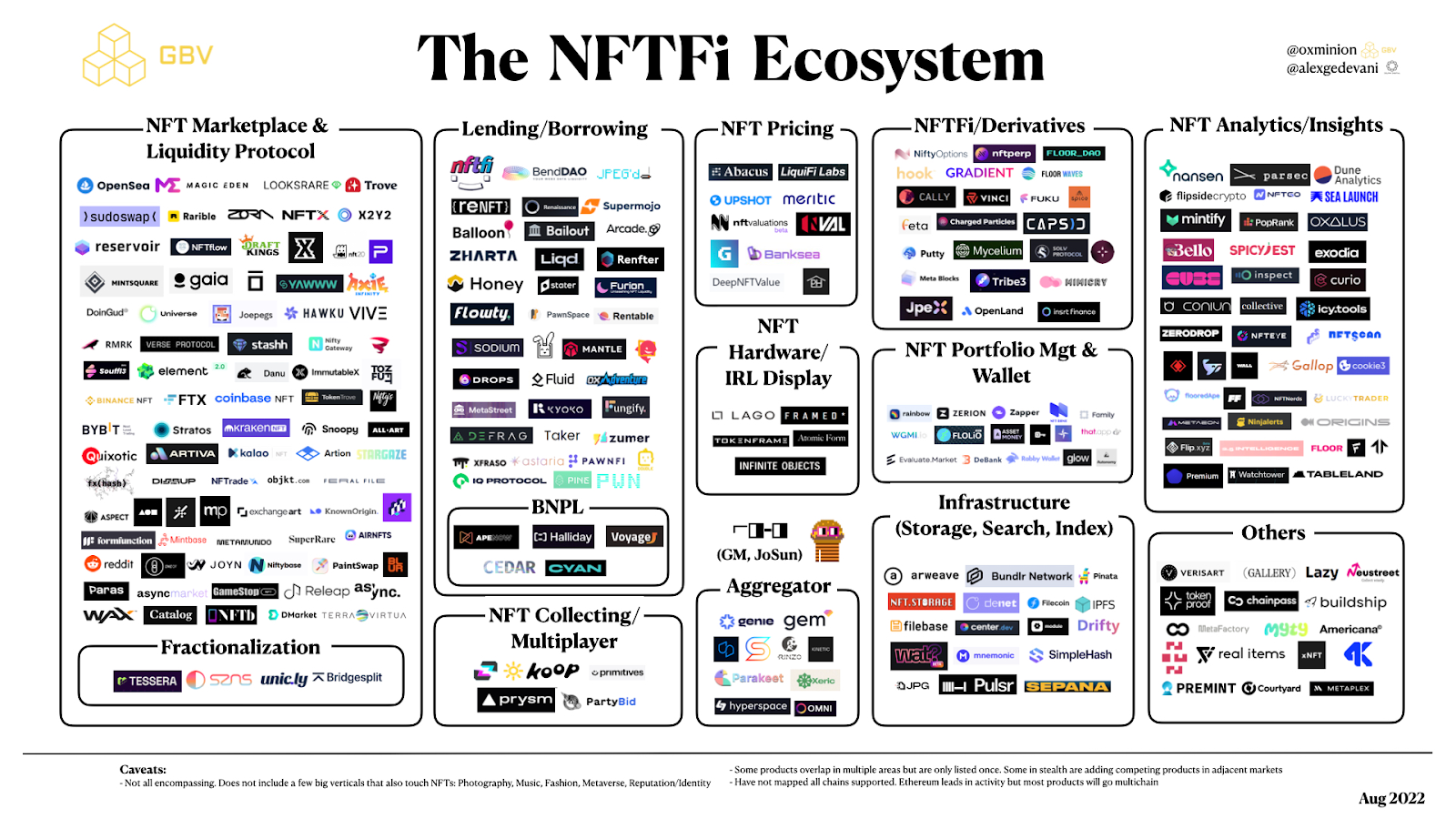

NFTFi is simply DeFi applied to NFTs. It enables more efficient forms of NFT trading – from swapping, hedging, fractionalizing and appraisals to renting. Let’s start with the largest subsector in NFTFi: simple lending/borrowing.

Lending/Borrowing

If you spent 100 ETH on a Cryptopunk, flexing it on Twitter is nice but maybe you’d also like to unlock some of that dead capital and take a loan on it. Lending protocols like NFTfi, Arcade, and Metastreet lets you do exactly that. Instead of putting up fiat/ETH like on Aave or Compound to take a loan, borrowers can put up NFT assets as collateral.

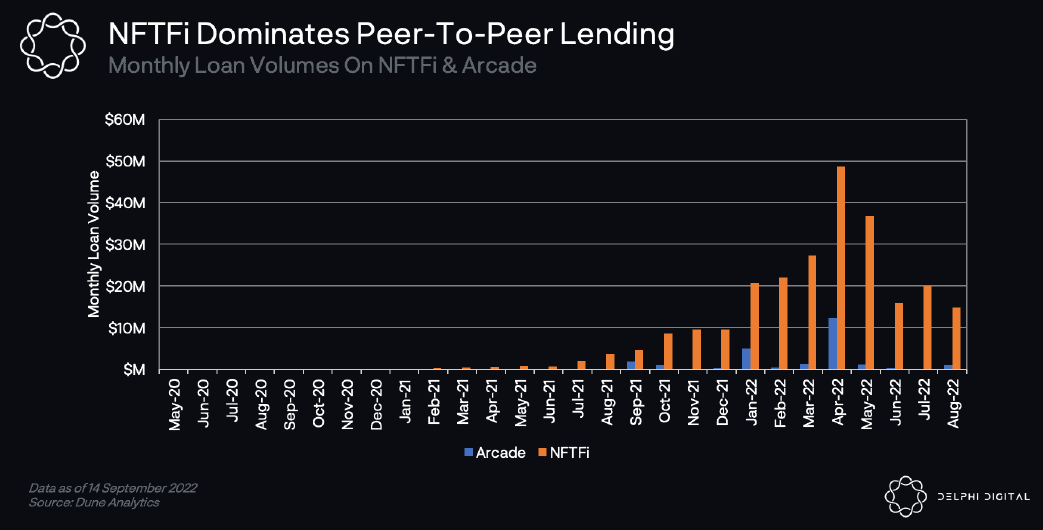

“NFTfi” is the leading project on this front, far exceeding its competitors in loan volumes. It deploys a “peer-to-peer” model that functions exactly as an order-book exchange does.

From the protocol’s perspective, this is really risky, for obvious reasons. NFT markets are speculative and rugpulls commonplace. If someone asked for a 10 ETH loan backed by a bunch of jpegs as collateral, you’d want to know if those jpegs are run by credible projects with skin in the game. For that reason, lending NFTFi protocols try to mitigate that risk by typically accepting only established “blue-chip” NFTs like Bored Apes, CryptoPunks, Doodles, Art Blocks, etc.

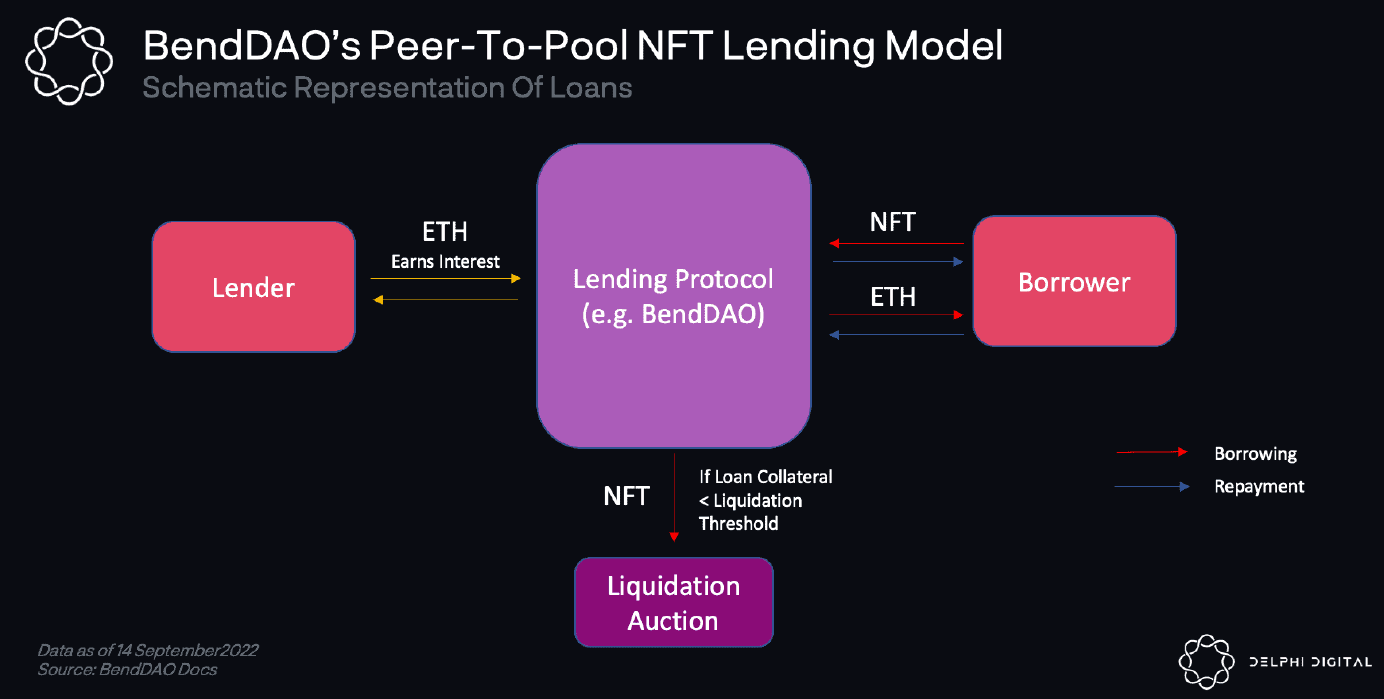

The drawback with peer-to-peer models is its capital-inefficiency, as trades depend on matching borrowers and lenders with a double coincidence of wants. In response, projects like BendDAO and JPED’d have introduced a more liquidity-efficient “peer-to-pool” model that connects demand and supply in a customizable liquidity pool instead, eliminating the need to make and wait for bids.

But peer-to-pool models aren’t perfect either. They suffer from the same drawbacks as pooled liquidity protocols in DeFi where lenders panic en masse and liquidity dries up.

What happens when floor prices of NFTs drop below the amount in loan volumes that it’s collateralized in? In theory, the protocol would liquidate the NFT collateral by putting it up for auction once it fell beyond a set threshold (based on the loan) in order to protect lenders. In practice, they may not work so smoothly.

Most NFT projects were down bad by ~60-70% in the past year and in August, BendDAO saw such a protocol-wide “bank run”. As the protocol started to commence liquidation auctions, there was a lack of bids due to liquidation thresholds being too close to floor prices. Nobody wanted to buy an NFT so dangerously close to a liquidation threshold i.e., BendDAO underestimated the likelihood of a market crash.

Lenders to BendDAO’s liquidity pool panicked and the protocol’s ETH deposits plummeted from 15,000 ETH on 19th August to as low as 12.5 ETH. The DAO then passed an emergency vote to cut the liquidation threshold to 70%, reduce auction durations from 48 to 4 hours, and remove the first bid limitation of 95% of the floor price – nipping its bad debt in the bud.

(See William Peaster’s tactic yesterday on how to lend and borrow NFTs.)

Buy now, pay later

In the Fintech world, one trend among tech-savvy Millennials and Gen-Zs of recent years is “buy now, pay later” (BNPL). Web3 builders are applying this fashionable new wave of budget-friendly financing to NFT markets.

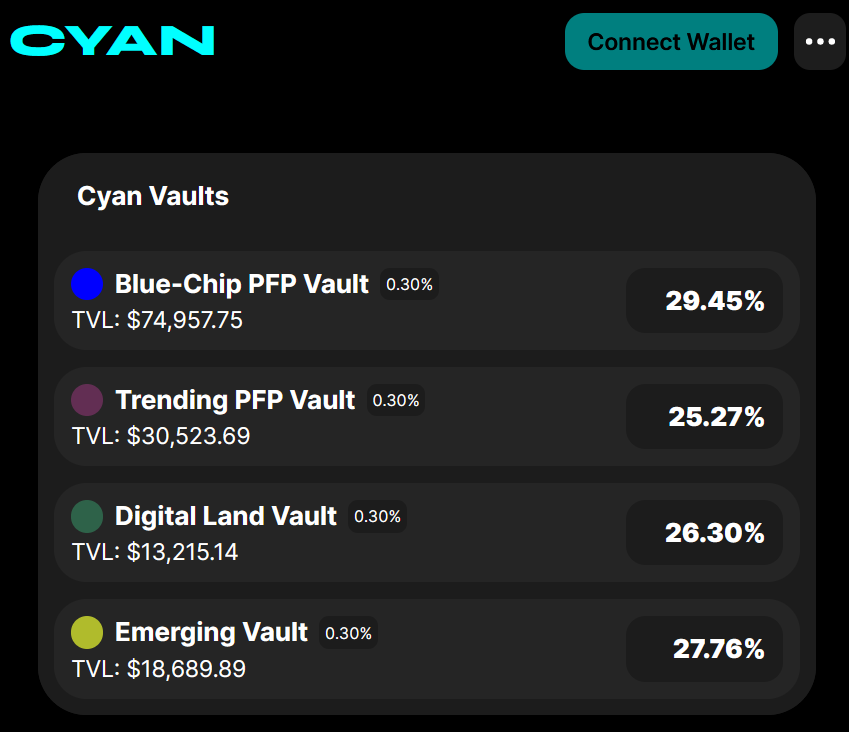

Cyan is the largest and prime example of such a BNPL protocol. Here’s a rundown of how it works from the perspective of a buyer:

Bob wants a Pudgy Penguin. Bob initiates a BNPL plan on Cyan for any Penguin that is currently listed on Opensea, LooksRare or X2Y2.

Cyan offers Bob an installment plan with interest rates quoted upfront that he needs to pay down over a 3-month installment period. Regardless of fluctuations in NFT prices, installment payments don’t change and are fixed over the three month period.

If Bob accepts the plan, ETH from Cyan’s vaults are used to purchase the NFT and is held in escrow under a Cyan wrapped smart contract.

Cyan’s vaults as of September 2022

- When Bob finishes paying all his installments, the NFT transfers into his wallet and he has full ownership. (Tip: if the price of the NFT appreciates in the meantime, Bob can pay the BNPL plan in full ahead of time and sell the NFT.)

- Missed payments are considered a default, and the NFT will remain in the appropriate Cyan Vault to be liquidated.

How does Cyan generate revenue?

Cyan offers a “pawning” service that lets users temporarily post their NFT up as collateral in exchange for a loan. Loans are then repaid with interest, which goes directly into Cyan’s vaults. To guard against plan defaults, Cyan employs a variety of risk management measures like higher interest rates to regulate loans and prevent overweight into higher risk NFT collections.

Cyan leads in the NFT BNPL submarket, with a variety of competitors in the space building something similar like Teller protocol’s “Ape Now, Pay Later”, Cedar, Halliday and Pine Loans.

Rentals

NFT rental protocols is an up and coming NFTFi submarket that lets users pay to access NFTs for a time. Players include reNFT or Vera that offer both collateralized and non-collaterized renting.

- Collateralized renting requires capital to secure the trade.

- Non-collaterized renting involves the creation of a “wrapped NFT” for the renter which is burned once the contract ends. The renter never receives the original NFT, unlike collateral renting.

In this early stage, NFT renting’s product-market-fit seems to be most aligned with utility-based gaming NFTs for now. Why?

Blockchain games tend to require users to pay an upfront cost via the purchase of a NFT, a business model that was pioneered by Axie Infinity last year. Due to skyrocketing costs of Axie NFTs, GameFi DAOs like Yield Guild Games and Merit Circle emerged to democratize entry for millions of players through a profit-sharing model where the guild would sponsor the upfront entry cost for a player that played the game and earned a share of the profits.

Later games like Polygon’s Pegaxy then built internally a guild management system that let players rent the entry NFT without having to invest a substantial upfront cost. NFT rental serves a similar purpose by letting borrowers access a NFT with a small fee, while at the same time allowing NFT owners to unlock earning power with their assets.

NFT rentals naturally complement blockchain gaming, but there are also other obvious use-cases. In particular, utility-based NFTs where users would need to have the NFT for some practical use, like accessing a Metaverse-gated world or a real-world event or service. Suppose you needed a Bored Ape to access a party in New York. NFT renting would then let you gain the NFT for a short time and join the party without having to pay a gargantuan cost.

Derivatives

NFT derivatives work exactly as they do in TradFi. The most prominent NFT derivative project NiftyOption lets you purchase NFTs in the form of financial options, giving the buyer the right but not the obligation to execute the trade at a specified price and date in the future.

This enables NFT assets to be hedged in interesting ways that mitigates market volatility. Example:

- The price of the latest NFT project Degentown is pumping and you snag one for 10 ETH, hoping to sell it off for a profit in the short-term.

- This is a risky trade and you tell yourself you’re willing to stomach a 20% loss (2 ETH) on Degentown if the trade goes south. To hedge against that worst-case scenario, you create an NFT option, deposit your NFT into it as escrow, and set an incentive of 0.5 ETH.

- Bob comes along. Bob is a bigger degen than you and thinks Degentown is likely to keep rising in price. He’s also incentivized by your 0.5 ETH fee bait and he bites.

- Bob deposits 8 ETH (the strike price) into the smart contract in escrow, and the 0.5 ETH fee is paid to.

- From here on out, you can then choose to exercise the option by taking the escrowed amount of 8 ETH any time within six months.

- Your incentive: If Degentown appreciates beyond 10 ETH at the end of six months, you should cancel the option contract and all you’ve lost is the fee paid to Bob.

- If your trade doesn’t work out however and Degentown plummets below 8 ETH, you have the choice to exercise the contract since Bob’s already committed to buying it at 8 ETH and you’re insured against a larger loss than 2 ETH.

(On NiftyOption, when an option contract is created, it is also minted as a new NFT. Upon filling the NFT option, the NFT equals the value of ETH in the option and is freed up to be used as collateral.)

Other NFT derivative projects include Hook and nftperp.

Appraisals

Valuation of NFTs is tough due to its illiquid and low-velocity nature. NFT projects try their best to “predict” them by tweaking a range of mechanisms like borrowing rates, loan-to-value (LTV) ratios and liquidation thresholds. But they amount to an experimental attempt to protect against volatile market movements at best.

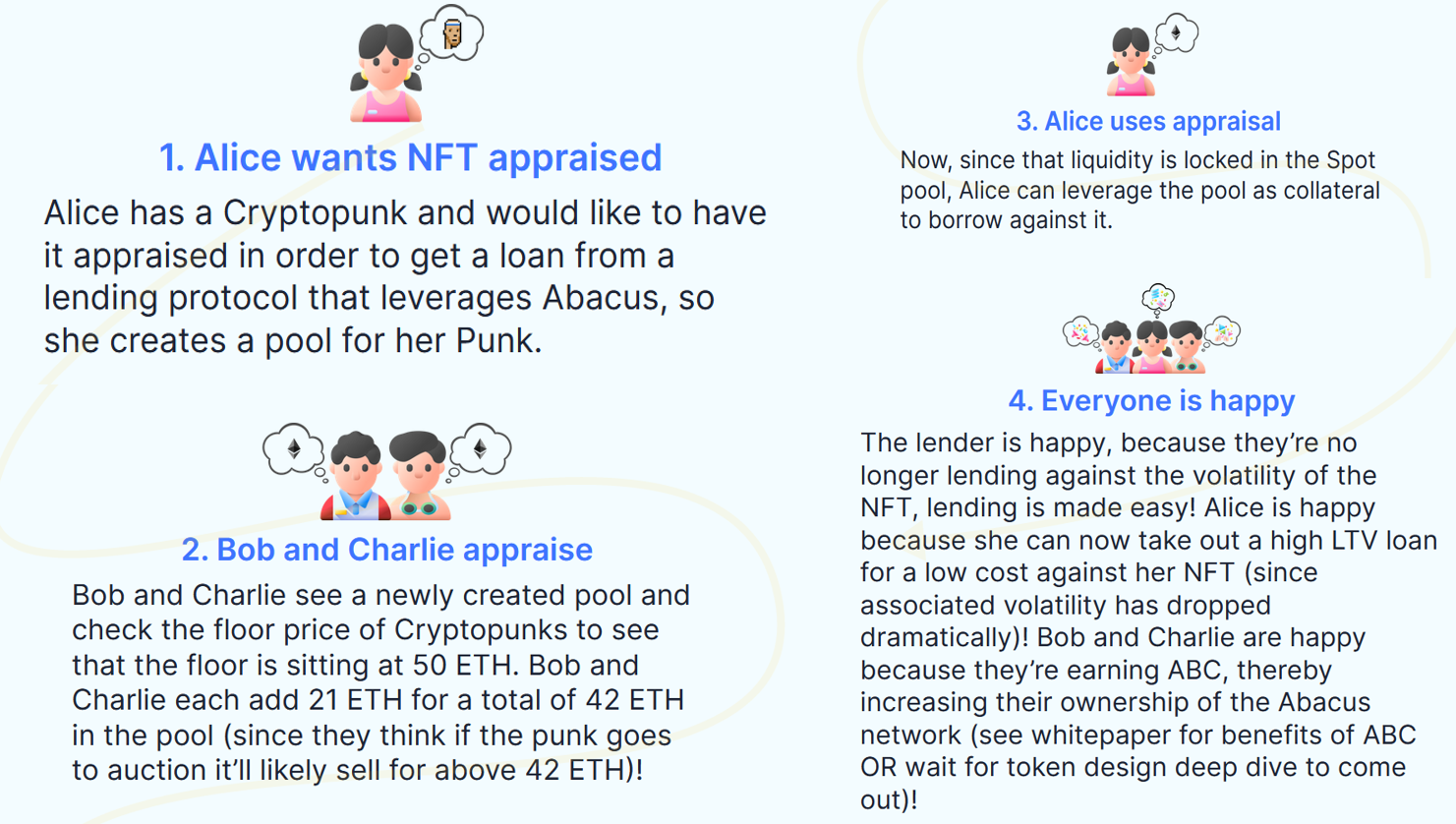

What if this centralized valuation process could be removed from third-party intermediaries and determined by market speculators facing price incentives? A number of NFT appraisal projects like Abacus, NFTBank and Upshot are making an attempt at that.

For instance, Abacus makes innovative use of proof-of-stake technology to create a liquidity-backed valuation system. Appraisers act as validators that guess NFT values and stake their money at different levels of valuation tranches. In turn, NFT owners receive a liquid backing to use their NFT as collateral.

Upshot, on the other hand, uses a “peer prediction” model that involves huge groups of people answering subjective questions, and then rewarding them with tokens for answering them honestly, similar to how prediction markets leverage the wisdom of the masses. For more on Upshot, see Metaversal’s coverage.

NFTBank offers a proprietary machine-learning-based tool to model NFT price appraisals. The attractiveness of NFTBank and Upshot is its ease of integration through their APIs but unlike Abacus who are in direct control of liquidity pools, their appraisals might be seen as lacking skin in the game.

Fractionalization

Fractionalization is ironic perhaps because it attempts to make fungible what investors herald as a non-fungible asset. But when your assets are valued at thousands of dollars, the ability to split them up into more liquidity so you can use them as collateral elsewhere makes a lot of sense, not to mention that it is also in line with the decentralization ethos of Web3.

Fractional (recently rebranded as Tessera) is the leading player in this space that lets users fractionalize their beloved NFTs and democratize collective ownership. On Fractional, you can mint an NFT and break it into tradable, ERC20 tokens within a vault.

Un-fractionalizing NFTs is one of the hardest challenges builders in this space face. In Fractional, un-fractionalization is determined by token holders voting on a reserve price, a weighted average of all reserve price votes. When a big enough majority of holders vote on a minimum price, a buyout is triggered and all owners can trade in their tokens for ETH (see here for fuller details).

The obvious problem here is that of a whale being able to outbid an entire community of token holders. Another fractionalization project Unicly tries to improve on this by bundling the fractionalization of multiple NFTs in one vault, as opposed to a single NFT like on Fractional. This allows users to hold a fractionalized asset of a collection of NFT assets. While this does not technically make it harder for whales to sweep a whole NFT, it preserves the fractionalized ownership of the average user.

In closing

Commodification of art tends to be seen as a bad thing. Philosophers and intellectuals have long argued that capitalism perverts the essence of the art form in pursuit of greed. If that’s true, then NFTFi’s hyper financialization of NFTs surely sounds a death knell for Web3 culture.

But contrary to this strand of cultural pessimism, history has shown that commercialization enables the arts to flourish as a form of creative expression and communication for the public. In one of Mozart’s letters, the musician wrote: “Believe me, my sole purpose is to make as much money as possible; for after good health it is the best thing to have.”

Through immutable smart contracts, NFTFi opens up a world of financing possibilities to ownership of NFTs, empowering the masses to no longer be restricted to a passive spectator role of culture, but to gain ownership and partake in its very creation.

(If you’re looking out for airdrops, see Metaversal’s Potential airdrop opps in NFTs 🪂)