Trump Win Spurs Up-Only ($)

View in Browser

Sponsor: Mantle — Mass adoption of decentralized & token-governed technologies.

1️⃣ Bitcoin Hits Record High

Surging on the back of Donald Trump’s re-election and a Federal Reserve rate cut, Bitcoin rallied to new all-time highs this week, going as far up as $77K. Monumental spot ETF inflows have come in the wake, with $1.3B being recorded on Thursday as Blackrock’s IBIT saw a new record of $1.1B.

Overall, the potential of a uniquely supportive pro-crypto environment in the U.S., complete with lofty plans of strategic Bitcoin reserves, has mixed with the 25 basis points cut to create the perfect storm for Bitcoin and crypto overall. While the real test will come when Trump ascends to office and does (or does not) deliver on his promises, until then, we look clear for takeoff.

2️⃣ Crypto-Swept Congress After Election

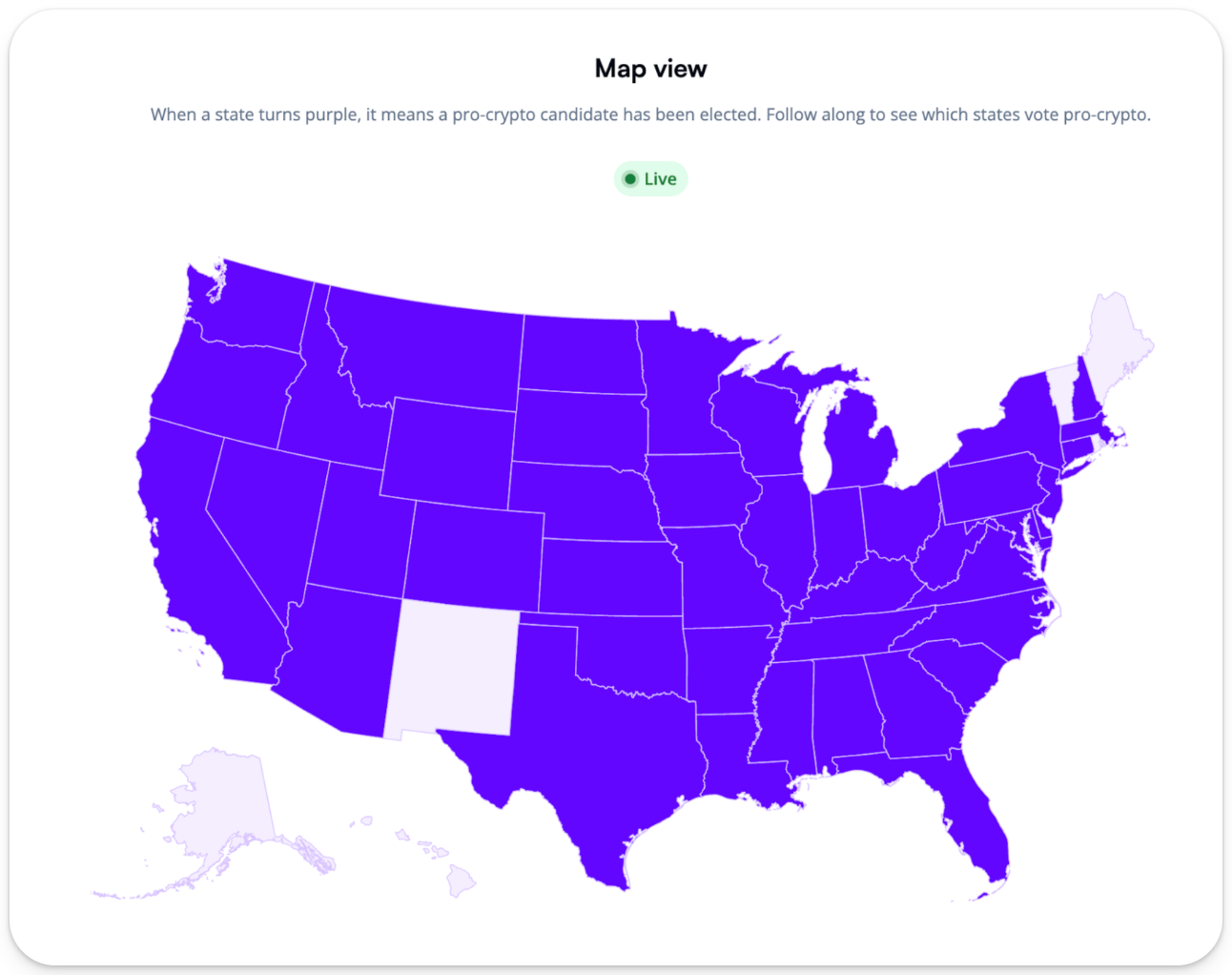

Besides having the first crypto-friendly president, the U.S. now boasts a crypto-friendly Congress as pro-crypto candidates gained seats across the board. In the House, 266 representatives with pro-crypto stances were elected, far outnumbering the 120 anti-crypto candidates.

The Senate also saw notable gains, with 18 pro-crypto candidates compared to 12 anti-crypto additions, though races are still in progress. Nationwide, 45 out of 50 states elected pro-crypto officials to Congress — a groundbreaking achievement, especially considering this was the first election cycle with crypto on the ballot. While some critical races remain undecided, the outcome appears to be a resounding win for crypto advocacy, potentially setting a new course for the industry within U.S. policy.

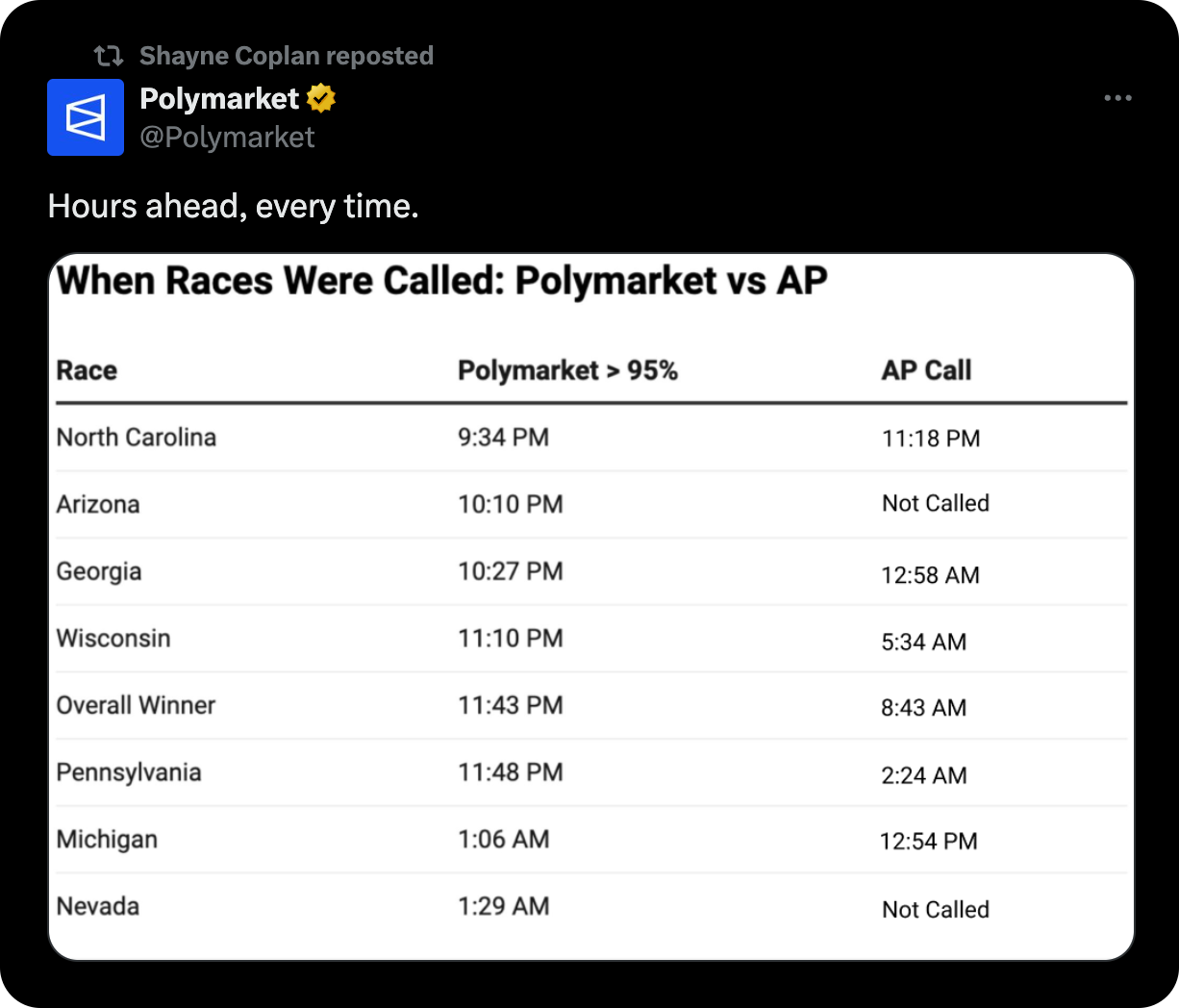

3️⃣ Polymarket Breaks Records

Polymarket experienced a massive surge in activity over the election cycle, seeing over $300M in volume over two days, with election-related bets accounting for 85% of the trading. This influx pushed Polymarket to the top of the charts on Apple’s App Store, and CEO Shayne Coplan even confirmed that Trump’s campaign headquarters used Polymarket to gauge public sentiment.

Not everyone was satisfied with Polymarket’s success though. In the wake of the Trump Polymarket whale raking in $50M in profits off his bets, France announced that they had begun investigating Polymarket as an illegal gambling site. Regardless, Polymarket’s accuracy forecasting the election’s outcome stands as a strong testament to its value.

4️⃣ Ethereum Alts Surge

Ethereum itself has surged alongside its ecosystem of DeFi tokens on a wave of speculation that it could become Wall Street’s next yield play. With a new SEC regime potentially arriving with Trump’s presidency – if staking gains approval within ETFs, Ethereum could offer a stable return avenue akin to traditional financial instruments, making it highly attractive for institutional capital.

This comes amid a squeeze from ETH staked being at all-time highs, with ETFs also starting to see strong inflows — $80M on Thursday and $50M on Wednesday. While still far from Bitcoin’s growth, the world computer does look like it wants to play catch up to Bitcoin, making up for its underperformance so far this year. This same speculation is fueling core Ethereum DeFi tokens like Ethena and Aave, which are boasting among the highest weekly returns in the top-100.

5️⃣ Coinbase Stock Soars

Coinbase’s stock saw a ~50% surge this week, riding a wave of optimism following Donald Trump’s re-election. The stock climbed from $180 to $267 on Friday, driven, in part, by Fairshake PAC’s influence and the bullish outlook for the crypto industry under a Trump administration.

Brian Armstrong, Coinbase’s founder, has been a prominent backer of the Fairshake PAC, and this post-election surge demonstrates the market’s confidence in both Coinbase’s leadership and how they stand to benefit from new, pro-crypto policies. In parallel, Coinbase expanded support for cbBTC — their 1:1 pegged Bitcoin derivative — to Solana, with integrations with Jupiter, Kamino Finance, and other core DeFi platforms coming right off the bat.

Mantle kickstarts Season 1 of Methamorphosis. Building on the success of their Liquid Staking Token, mETH, Mantle LSP announces plans for a new Liquid Restaking Token, cmETH, along with a governance token, COOK. With Methamorphosis, participants can now farm Powder for future COOK tokens and position themselves early for upcoming cmETH release.

It's the Bankless Weekly Rollup!

In this episode, we cover price action, pro-crypto shifts in Congress, and big players like Elon Musk and Michael Saylor making moves. Plus, is the DeFi Renaissance here? Tune in for an in-depth look at what this political shift means for the future of crypto.

Hear all of the analysis! 👇

📰 Articles:

📺 Shows: