Will Trump Push for State Ownership of Crypto Infra?

“Trump's brand of US capitalism faces ‘socialist’ backlash from conservatives” – BBC

“Republican Senators Sound Alarm on Donald Trump’s ‘Step Toward Socialism’” – Newsweek

“Investors worry Trump’s Intel deal kicks off era of US industrial policy” – Reuters

These headlines this past week seemed to capture the uneasy sentiment of business leaders who witnessed the United States federal government's acquisition of a 10% stake in Intel with alarm.

While the move has fractured opinions across party lines, drawing unusual retorts from hardcore conservatives and applause from more socialist corners, one thing is clear: the playbook of American laissez-faire capitalism is being rewritten in real time.

ALL HAIL CHAIRMAN TRUMP! WITH HIS GLORIOUS 10% PURCHASE OF INTEL, THE SOCIALIST REPUBLIC OF AMERICA ENTERS A BOLD NEW ERA OF GOVERNMENT-RUN BUSINESS. pic.twitter.com/GOYV8ZKvlX

— Governor Newsom Press Office (@GovPressOffice) August 23, 2025

President Trump has now clashed at least twice with free market conservatives during his second stint in office. In June, his administration only approved the acquisition of U.S. Steel by Japan’s Nippon Steel on the condition Washington received a “golden share” that would grant broad governance authority over the U.S. subsidiary.

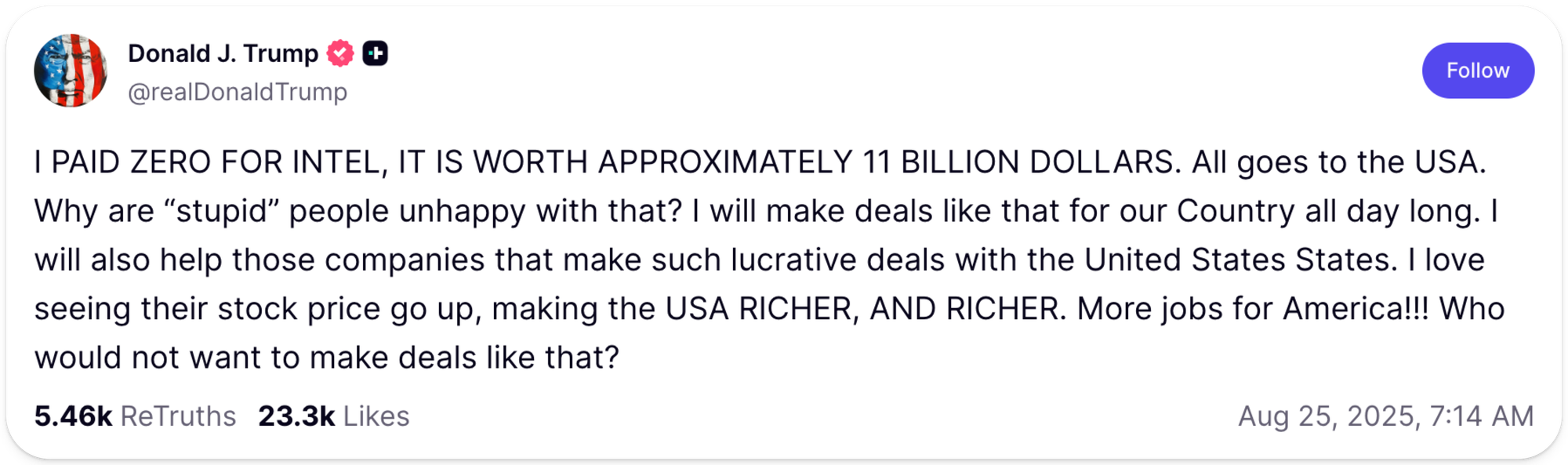

Intra-party critiques may be a rare phenomenon in American politics, but Trump had no problem shrugging off this round of conservative condemnation without a second thought, declaring to Truth Social followers on Monday that he would make similar deals “all day long.”

In a comment to The Hill, one anonymous Republican strategist defended Trump’s takeover of companies like U.S. Steel and Intel, arguing the move is justifiable considering that their outputs are “vital to U.S. defense needs and national security.”

🧐 Crypto Connection

Although the current U.S. crypto hoard consists of forfeited coins seized by law enforcement, if Intel is any indication, this acquisition dynamic is far from enshrined.

Since the early days of his campaign trail, Donald Trump has committed to making crypto clarity a policy priority. Early Trump Administration accomplishments include:

- Enacting GENIUS Act legislation to clear a pathway for mainstream stablecoin adoption

- Creating a crypto strategic reserve to safeguard government-held digital assets

- Revitalizing the SEC with a dedicated Crypto Task Force and “Project Crypto”

- Dismissing major pending regulatory actions against crypto companies

Trump administration insiders have long insisted on using “budget neutral” pathways to expand federal crypto asset holdings, and the Intel acquisition seems to establish a precedent to conduct such purchases.

As the only cutting-edge U.S. chip manufacturer, Intel plays a critical role in securing America’s digital future. Through this framing, it makes sense that the federal government might desire Intel ownership to protect the national best interest with actions like directing production focuses or prohibiting undesirable behavior (like divesting from loss-leading chip foundries).

The Intel acquisition was “funded” by a Biden-era CHIPS Act grant, and while the funds disbursed by this program certainly cost taxpayers, the money was always intended to be spent on semiconductor R&D, meaning the government’s INTC equity interest is technically free.

It is well past due to modernize money, and much like the critical contributions made by computer chips in contemporary society, blockchain-based payments certainly have an important role to play in the next-generation financial system.

🚨THE CRYPTO REPORT IS OUT!

— Coin Bureau (@coinbureau) July 30, 2025

🇺🇸 The Trump administration officially backs crypto as a pillar of America’s future — calling it a grassroots revolution that deserves recognition.

The goal? Make the U.S. the “Crypto Capital of the World.” pic.twitter.com/VrN9D6sykR

Passage of the GENIUS Act underscored bipartisan recognition for this fact, and while any progress in Washington D.C. is notoriously sluggish, future legislation could feasibly authorize expenditures on grant programs to strengthen blockchain payments systems.

Such a key domestic payments network would logically be classified as vital to U.S. national security, and considering the precedent established by the Intel transaction, these grants may serve as consideration for token interest in that network.

So, at this point, the only real question is which crypto asset Washington will choose to embrace. Does the U.S. consolidate its position as the world’s largest nation-state BTC holder, or instead select a different network to serve as the backbone of its digital economy?

Whatever the outcome, precedent has been set: the U.S. government is no longer just a regulator of high tech, it is becoming an active market participant.