Trending Project: Solana 📈

- Ticker: SOL

- Sector: L1

- Network: Solana

- FDV: $19.6B

- Hotness Rating: 🔥🔥🔥

SOL is the native token of the Solana blockchain. SOL has outperformed since June 12, rallying 37.9% from $27.87 to $38.44, while the crypto market has fallen 12.6% during this period. The token has also shown considerable strength against the majors up 71.2% and 55.2% against BTC and ETH respectively over the past fifteen days.

One factor bolstering sentiment around SOL is the upcoming launch of three network upgrades with the goal of improving network stability, including the introduction of fee-markets. Although these fee-markets have yet to be implemented, the first of these changes, QUIC, a protocol which will help improve communication between RPC nodes, has been deployed on mainnet and is in the process of being rolled out. The tangible progress towards strengthening the network is likely increasing the markets confidence that Solana will sort through its stability issues. The blockchain has been plagued with numerous bouts of degraded performance and outages since September 2021, including three periods of downtime since April 30 alone.

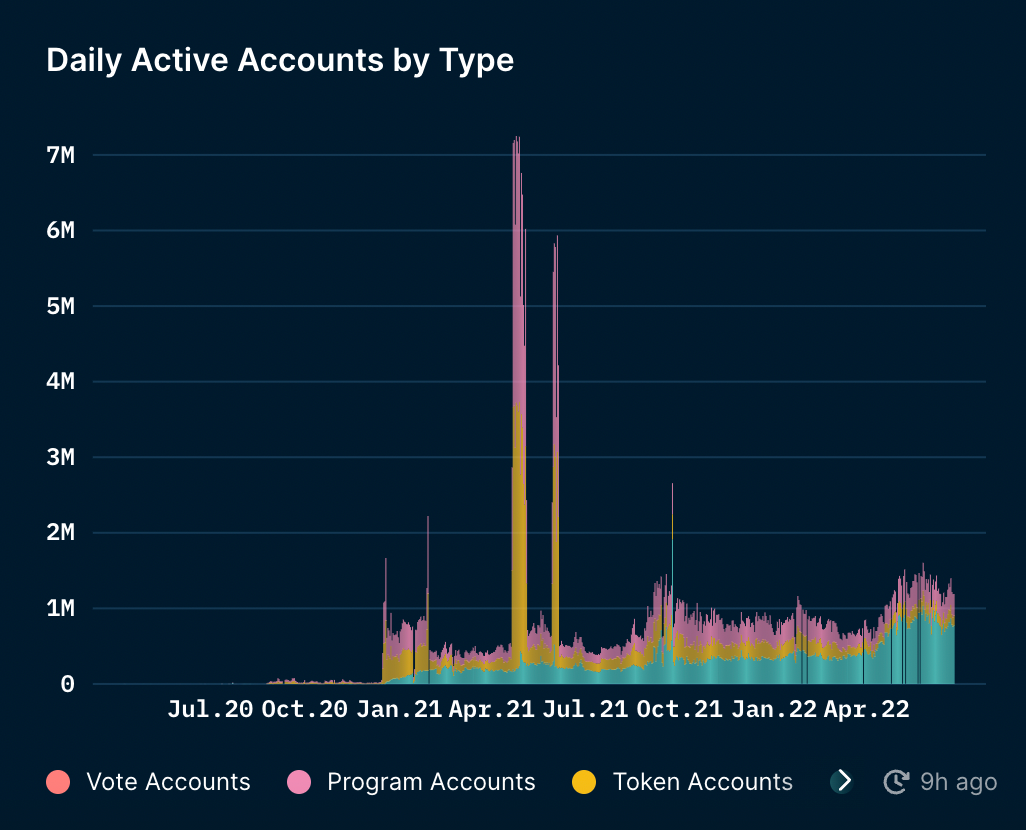

Another factor helping to improve sentiment around Solana are improved network fundamentals. Despite the issues surrounding stability and decrease in speculation as a result of broader market weakness, Solana has seen strong user growth, with monthly active addresses (MAA) surpassing 37.2M in May. This represents MoM growth of 60%, and a 114% increase relative to March, and coincides with the adoption of “Move-2-Earn” app STEPN. Although MAA’s are on pace to fall in June, they are still on-track to exceed 30M.

This growth, coupled with the announcement of Solana’s Web3-native phone, Saga, may be renewing confidence that the blockchain will be able to grow its user base via mobile and continue to serve as an attractive venue for developers.

A final reason as to why SOL has outperformed the majors has been the lack of forced sellers. Although difficult to glean specific insights due to the lack of transparency in CeFi, large-cap assets such as BTC and ETH were likely used as collateral by many of the large entities that have faced insolvency over the past several weeks. This has likely resulted in substantial sell-pressure within BTC and ETH, rather than smaller-cap assets that are used less frequently as collateral, such as SOL, as lenders liquidated their counterparties.

Conclusion (🔥🔥🔥/5):

The fundamentals of Solana are improving, with strong user growth and network upgrades that should help to improve network stability. While SOL has likely benefited from a lack of forced sell pressure due to not being commonly used as collateral, it stands to reason that the smaller-cap asset will likely resume bleeding against the majors if the market heads lower at a less accelerated rate.