- Ticker: RBN

- Sector: DeFi - Options

- Network: Etheruem

- FDV: $338.7M

- Hotness Rating: 🔥🔥🔥

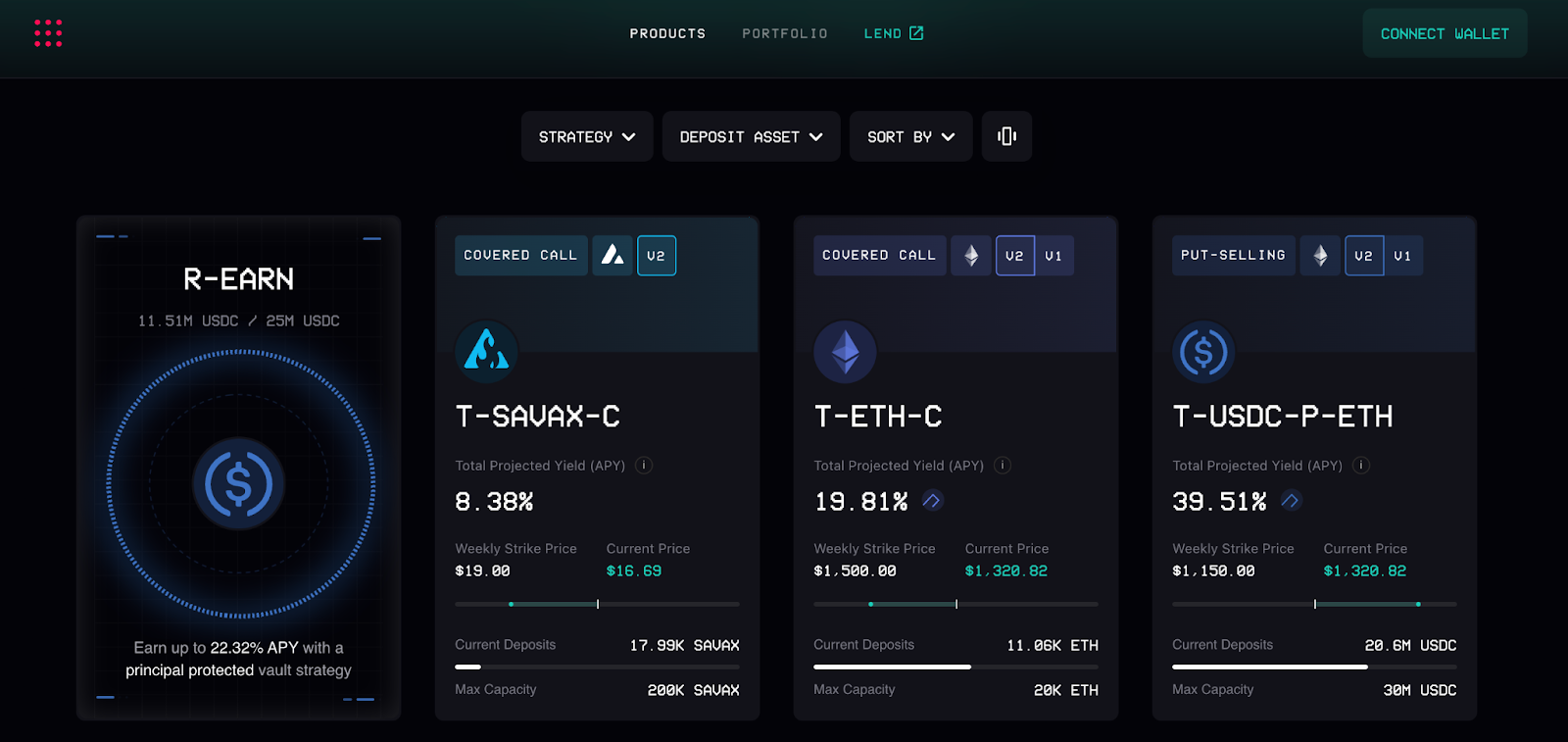

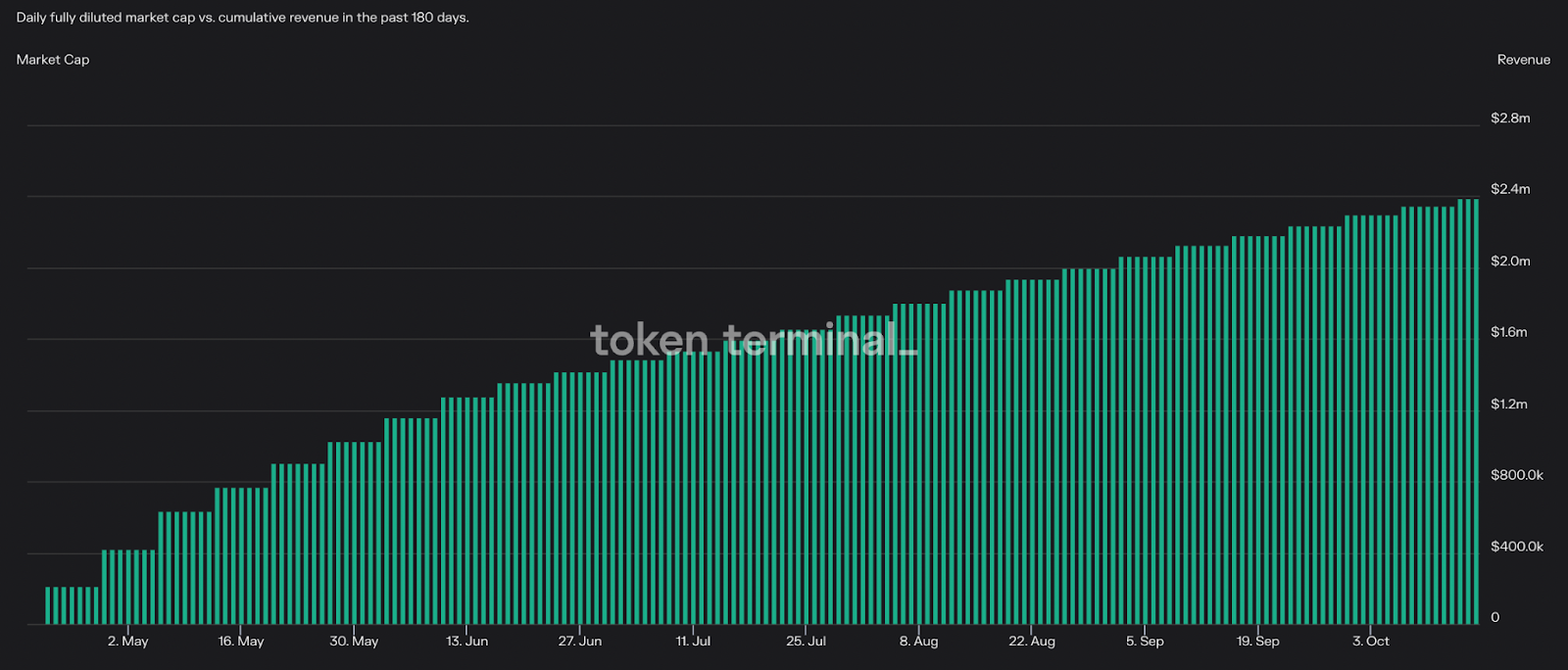

Ribbon is a derivatives protocol. Ribbon offers users a suite of different products including Decentralized Options Vaults (DOVs), which generate income through running automated covered call and cash secured put strategies, as well as undercollateralized lending to institutions through Ribbon Lend. Ribbon is governed by the RBN token, which accrues 50% of protocol fees and can be used to vote on emissions to different vaults on the platform. The protocol currently holds $72.0M in TVL and has been profitable over the past six months, generating $2.6M in revenue while emitting $2.4M of tokens for earnings of $201K.

Ribbon recently announced that they are developing Aevo, an order-book based options exchange. Aevo will run on its own custom rollup that settles to Ethereum, which should increase transaction throughput and reduce gas costs for end-users. Aevo has the potential to serve as one of the first major competitors to centralized options exchanges like Derebit as by using an order-book model, it is likely to attract liquidity from institutions who prefer trading and market making on that type of venue. Aevo is scheduled to launch its mainnet by the end of Q4.

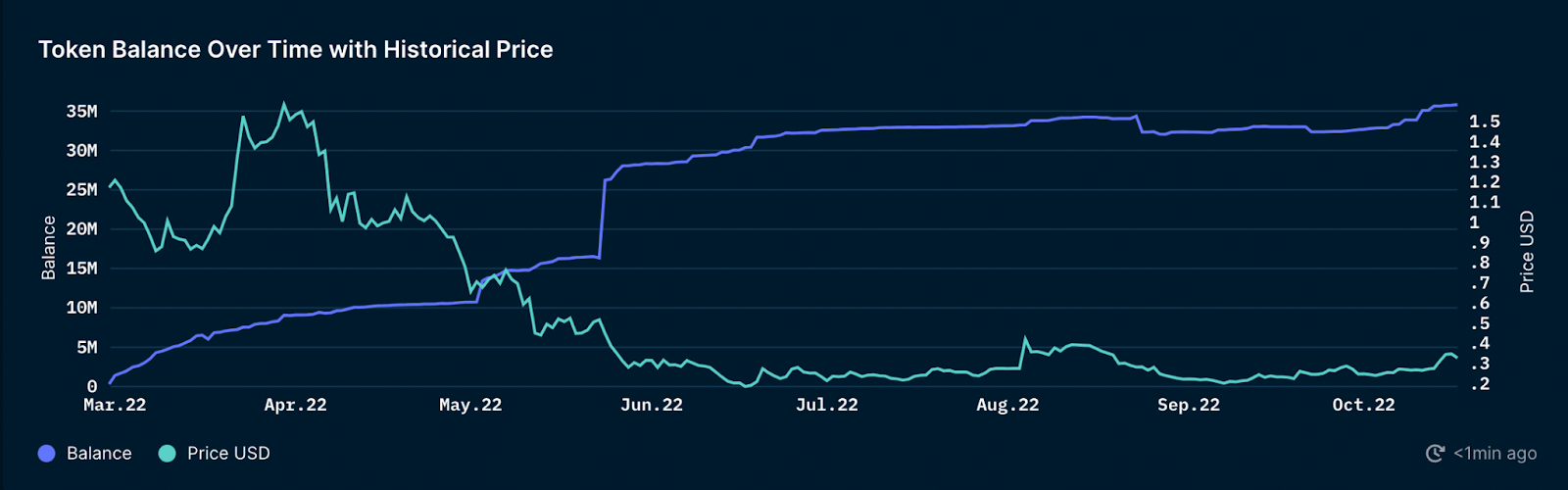

The price of RBN has increased 57.5% and 88.7% against USD and ETH respectively over the past six weeks. This outperformance is likely due to anticipation for the launch of Aevo, as it is possible that RBN holders will either be entitled to sequencer revenues or some allocation of AEVO tokens. The number of Ribbon locked for veRBN has also increased during this period, rising 10.9%.

Hotness Rating (🔥🔥🔥/5): Ribbon’s has outperformed on the back of strong fundamentals and a major upcoming catalyst in the launch of Aevo. Although it may continue to outperform as the DEX’s launch grows closer, long-term investors may want to exercise caution, as it is still unclear how or if RBN holders will reap the rewards of Aevo’s success.