Ticker: RAGE (No Token)

Sector: DeFi - Perps and Asset Management

Network: Arbitrum

Hotness Rating: 🔥🔥🔥🔥

Rage Trade initially developed an omnichain ETH perp that takes advantage of concept recycled liquidity: the Protocol deploys 80% of LP TVL to yield generating protocol (Curve, GMX, SushiSwap, etc.) and uses the remaining 20% to provide concentrated liquidity for traders.

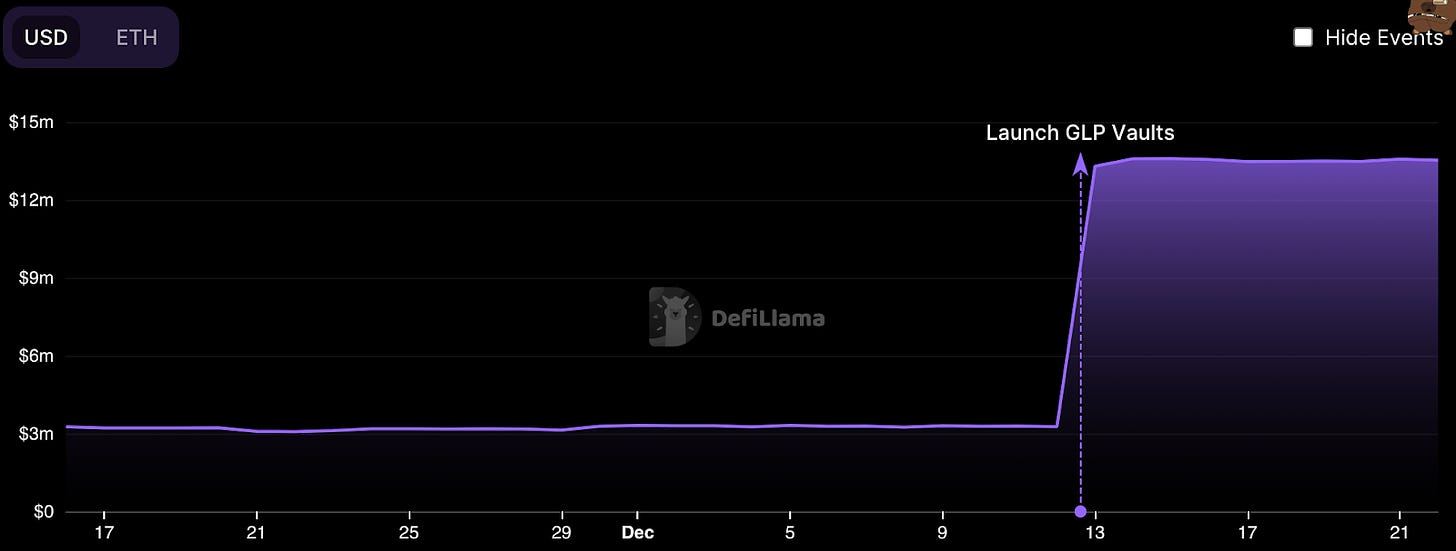

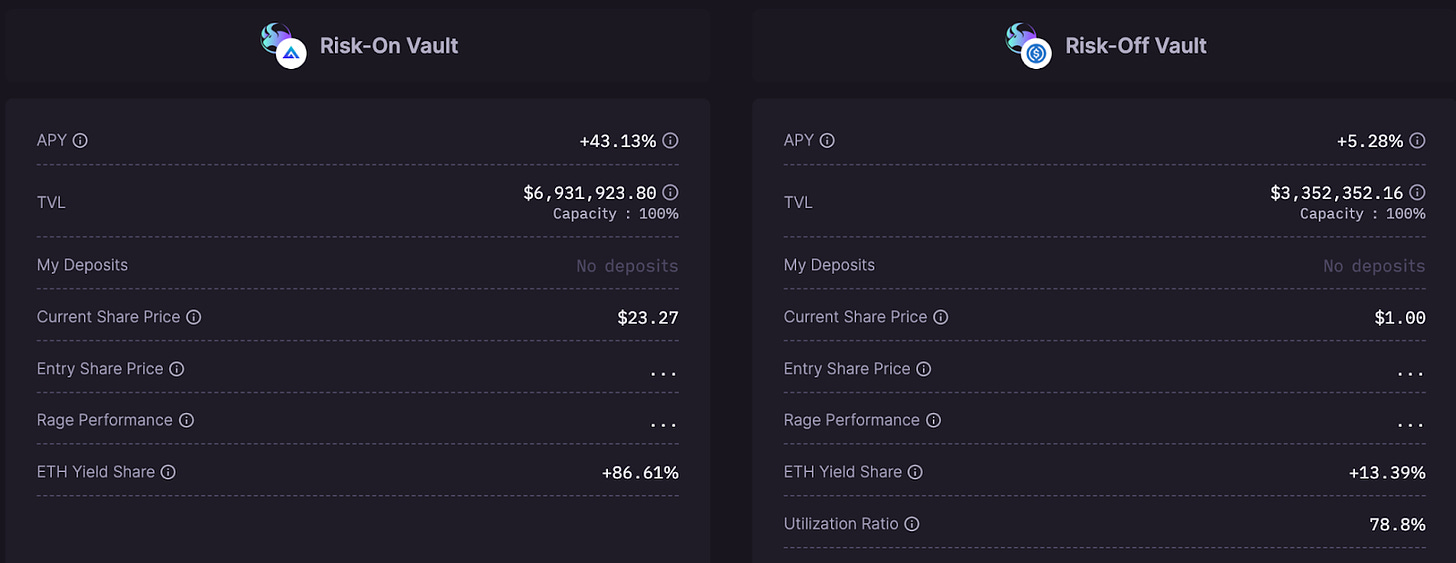

On December 12, Rage Trade opened its much anticipated delta neutral GLP vaults to depositors. These vaults aim to pass through high yields offered by GMX’s liquidity provider token while neutralizing GLP price risk for depositors. Two vaults were deployed. Both were filled to capacity immediately.

Both vaults filled instantly in minutes, bringing an additional $10M TVL into @GMX_IO!

— Rage Trade (@rage_trade) December 12, 2022

Thank you for your patience as we slowly grow our TVL.

Next cap increase within the next few weeks after our second audit.

More details soon..! pic.twitter.com/CpXCojNs3s

Combined, these vaults increased Rage Trade’s TVL by over 300%, with the risk-off vault contributing $3.35M in USDC and the risk-on vault contributing $6.6M in GLP, at the time of analysis.

Self-imposed vault caps minimized TVL inflows. Without these, it is highly probable that the growth in TVL would have been much greater.

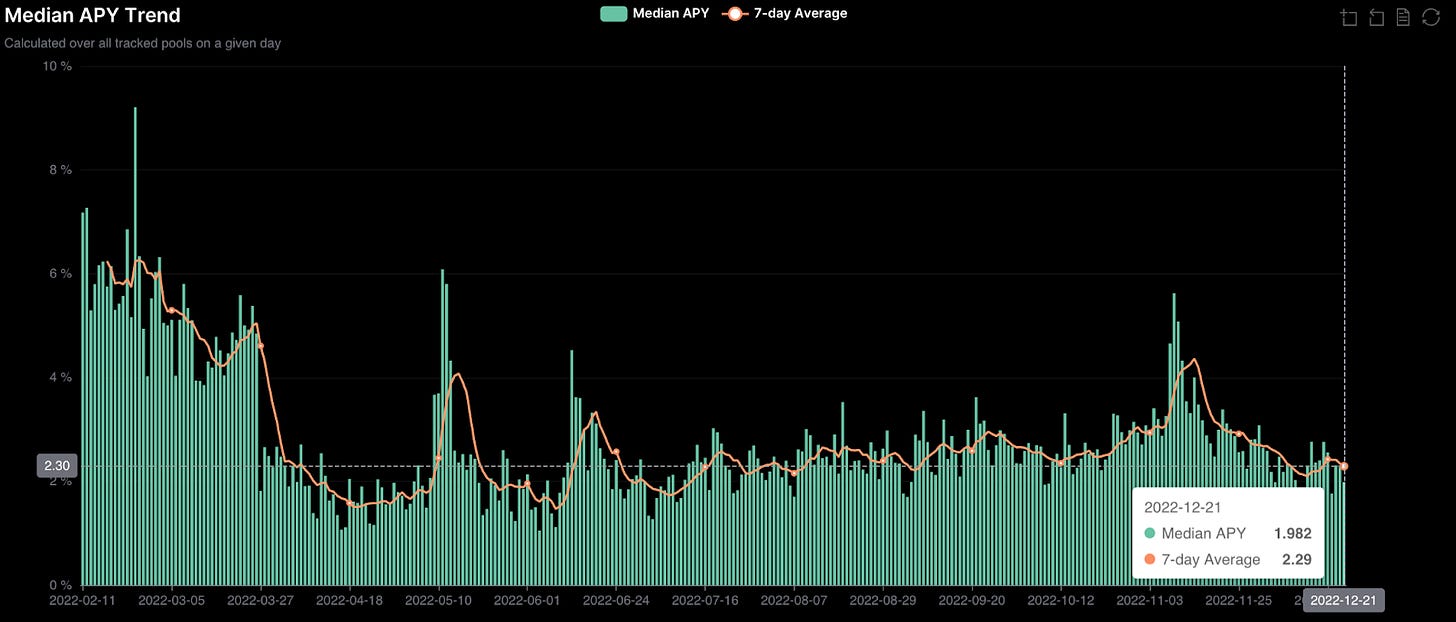

At the time of analysis, the 7-day average median yield of DeFi was 2.29% while U.S. 1 Month T-Bills yield 3.73%. Trad markets are yielding more than crypto: what a trip!

While partially driven upwards by the fixed term, yields on US Treasuries do not carry any default or smart contract risks, both of which are present in all sources of crypto native yield.

Rage Trade’s immediate explosion in vault TVL is a strong signal for the Protocol’s delta neutral vaults in and of itself. Crypto natives are famished and seeking yield!

Rage Trade is a gateway to the past, providing astonishing yields on high quality assets like the 2021 bull market all over again. The risk-on vault yields a mind boggling 43.1% APY! All while hedging against price risks from GLP’s volatile underlying collaterals (primarily ETH and BTC).

While there is currently no token for the protocol, interacting with dApps is a proven formula for setting yourself up for a future airdrop. To potentially qualify, trade Rage Trade’s ETH perp and provide liquidity to the Protocol’s recycled liquidity or delta neutral vaults.

Hotness Rating (🔥🔥🔥🔥/5)