Trending Project: Lyra Finance

- Ticker: LYRA

- Sector: DeFi - Options

- Network: Optimism, Arbitrum

- FDV: $140.6M

- Hotness Rating: 🔥🔥🔥🔥

Lyra is a decentralized options protocol live on Optimism and Arbitrum. Lyra enables users to write and/or trade puts and calls through its newly upgraded AMM, Newport. Lyra is governed by the LYRA token, which can be staked to earn emissions, boosted rewards when providing liquidity, and rebates for trades.

Lyra initially deployed on Optimism, and used Synthetix to hedge out exposure to price fluctuations (delta-hedge) for liquidity providers in the AMM. On January 31st, Lyra went multi-chain by deploying Newport on Arbitrum. Newport makes several key improvements relative to Lyra's V1 (known as Avalon) by allowing options in the AMM to be partially collateralized with stablecoins, rather than the underlying spot asset. These design choices improve capital efficiency, returns for LPs, and leads to tighter spreads for traders.

Lyra is now live on @Arbitrum, integrating with @GMX_IO 💚

— Lyra (@lyrafinance) February 1, 2023

Get started 👉 https://t.co/AX7yv8b87Z pic.twitter.com/E8M0hEG18O

(If you’d like to read more about Newport, click here).

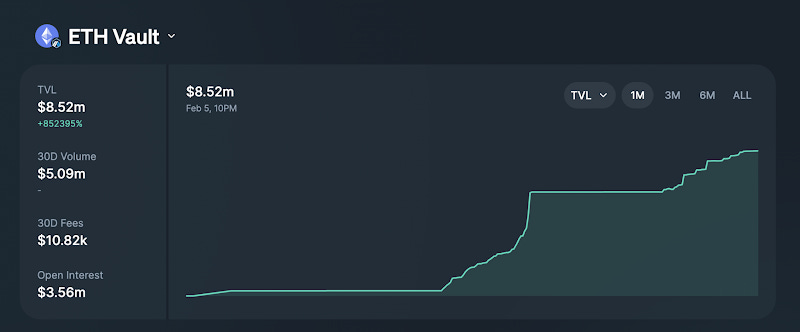

Newport utilizes GMX on for delta-hedging on Arbitrum, though it can theoretically be integrated with any perpetual exchange due to its use of stablecoins as collateral. The protocols ETH MMV (market-maker vault where users provide liquidity) currently holds $8.5M in liquidity, and has facilitated $5.1M in trading volume since launch.

The price of Lyra has soared 202% against USD and 167% against ETH since the proposal to deploy Newport on Arbitrum went live on November 24. This includes an increase of 24% and 15% vs ETH and USD respectively since the Arbitrum deployment went live on January 31. While some of the rally can of course be attributed to the broader rise in crypto prices during this time, it does suggest that the market was excited by the growth prospects brought about by Lyra’s multichain expansion.

Hotness Rating (🔥🔥🔥🔥/5): Lyra has gone multichain by deploying its Newport AMM on Arbitrum. While competition in the L2 options landscape remains fierce with protocols like Dopex, Premia, Numeon, IVX and others vying for market-share, the upgrades brought about by Newport should make Lyra highly competitive with these alternatives and help power future growth for the protocol. Investors looking for L2 exposure should keep LYRA on their radar.