Trending Project: Gearbox (GEAR)

- Ticker: GEAR (token currently non-transferable)

- Sector: DeFi - Yield Aggregator/Derivatives

- Network: Ethereum

- FDV: N/A

- Hotness Rating: 🔥🔥🔥🔥

Tl;dr: Gearbox is a new DeFi protocol for yield and leverage on Ethereum

Gearbox is a new protocol enacting a two-sided marketplace: one for users looking for passive yields on major assets like BTC, ETH, and USDC, and another for traders looking for access to leverage that they can deploy into higher risk, higher yielding farms. There are two types of accounts – Earn Accounts and Credit Accounts. Those using Earn Accounts are depositing assets to earn a yield + GEAR. Those using Credit Accounts are borrowing from the pool of liquidity to deploy into partnered protocols where yields are higher.

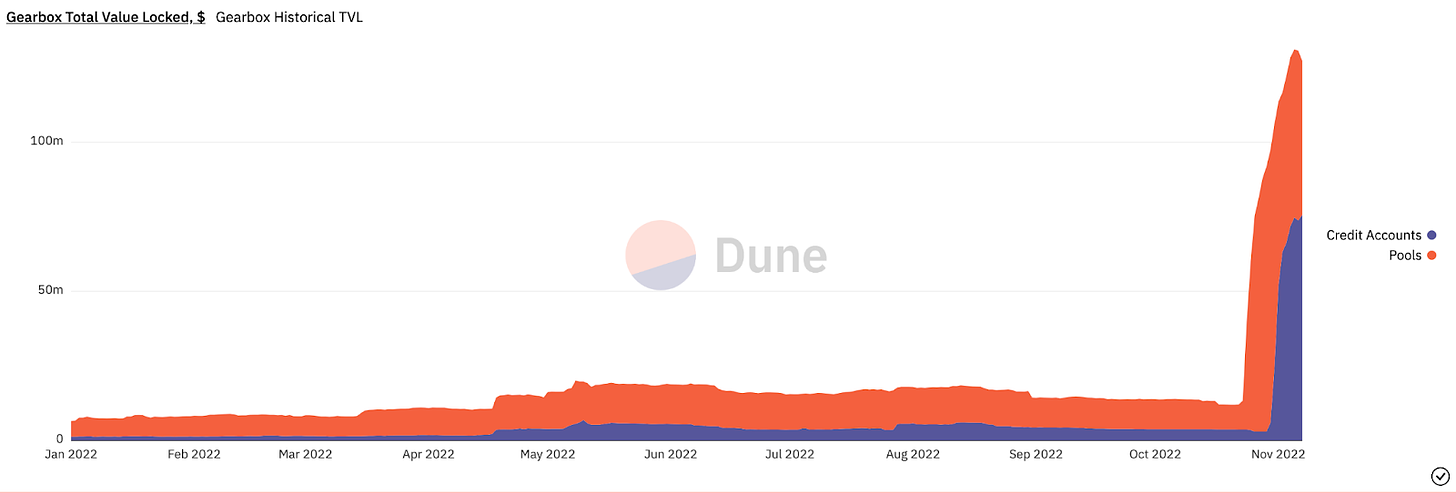

Gearbox recently launched the GEAR liquidity mining program to help bootstrap liquidity into the protocol. It’s important to note that the token is currently non-transferable and not liquid for trading. Regardless, Gearbox has seen an explosion of growth since launching its liquidity mining, where TVL has soared to north of $130M

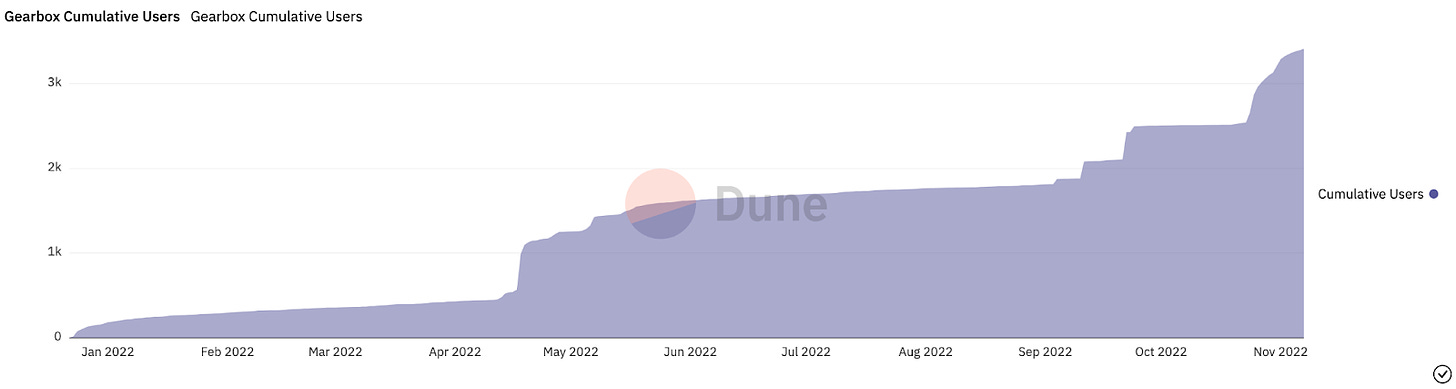

On top of garnering a fair amount of interest on Crypto Twitter, Gearbox is seeing an influx of new users to the protocol – adding nearly 1,000 cumulative users since launching the liquidity mining program in late October.

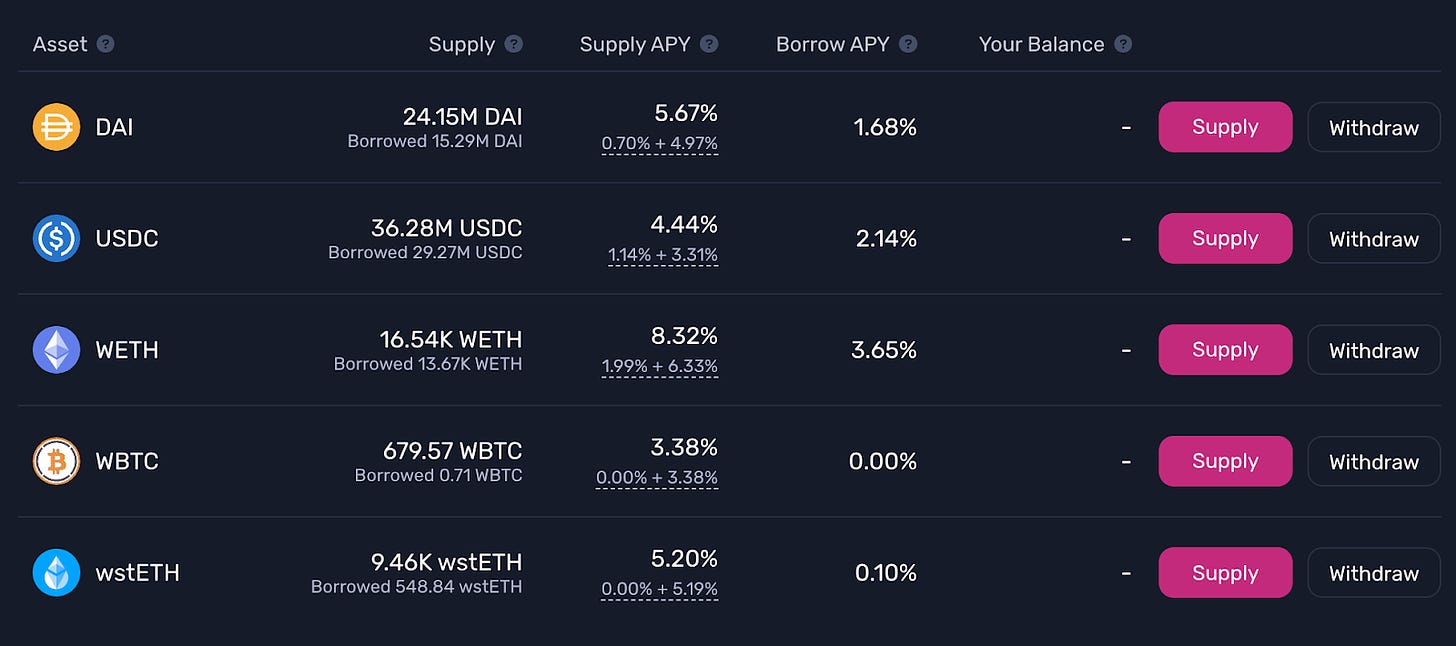

For those interested, there’s plenty of yield to be earned for those seeking a higher return than what they can find in major DeFi protocols like Aave and Compound. When factoring in GEAR rewards (valued at $200M FDV), depositors can earn up to 8.3% on ETH and 5.6% on DAI. You can also borrow DAI and USDC at fairly cheap rates.

Lastly, a liquidity mining program for borrowers – aka credit account users – should be going live soon. Keep an eye out for that if you’re interested in borrowing cash!