Trending Project: Gains Network (GNS)

- Ticker: GNS

- Sector: DeFi - Perpetuals

- Network: Polygon

- FDV: $325M

- Hotness Rating: 🔥🔥🔥

Tl;dr: A fast-growing perpetuals DEX is outperforming.

Gains Network is a perpetual futures DEX. Gains utilizes a unique model where users deposit collateral (DAI) into a vault in order to trade equities, crypto, and forex with up to 100x, 150x, and 1000x leverage respectively. This DAI vault acts as the counterparty on the DEX, paying out profits to traders while accruing fees and losses. Gains is governed by the GNS token, which holders can stake to earn 40% of trading fees generated from market orders and 15% from limit orders. GNS is also used to backstop the protocol, as treasury tokens will be sold OTC in the event that the DAI vault becomes undercollateralized.

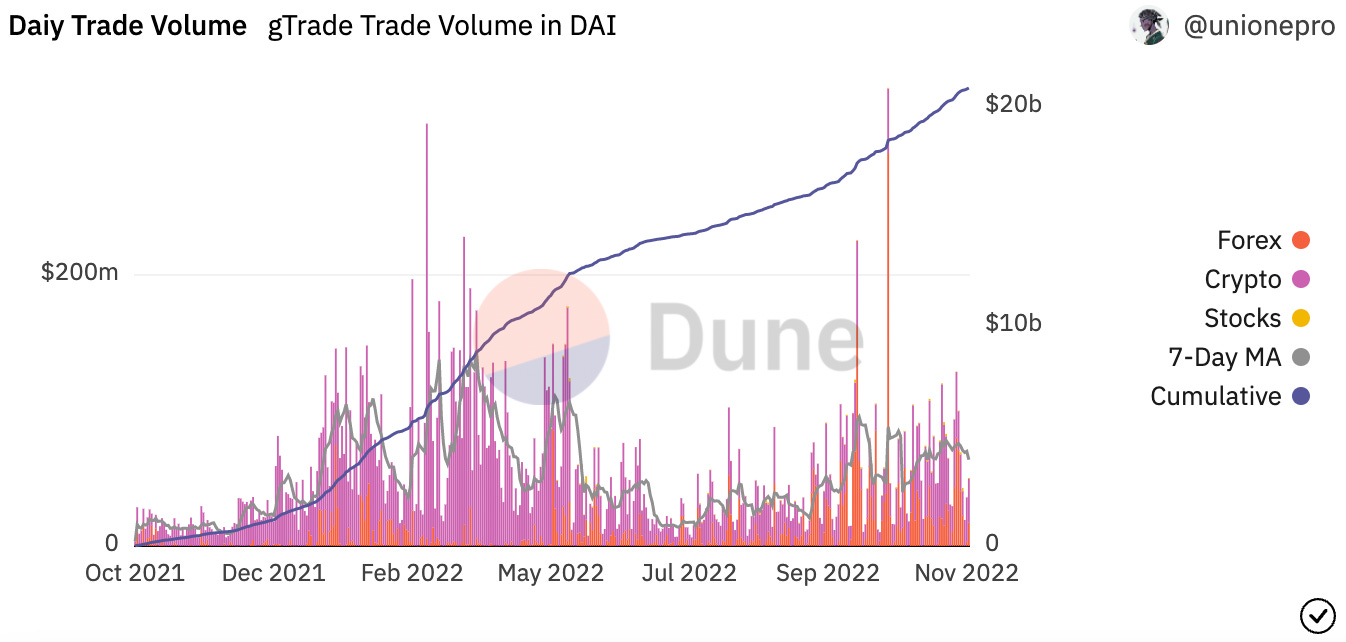

Gains has facilitated $21.1B in trading volumes since its launch in October 2021. Gains has managed to grow in the back half of 2022 despite depressed trading volumes in the broader market. The protocol has managed to post four consecutive months of growth between June and October 2022, with monthly trading volumes rising 115% from $847.5M to $1.8B. The protocol also generated $1.7M in revenue during this period. This growth has been due in large part to the protocol diverse set of tradable assets, as the DEX has become a popular destination for trading forex, which has experienced tremendous volatility in recent months, on-chain.

The GNS token has outperformed considerably over the past six months, soaring 365% and 717% against USD and ETH. This outperformance can likely be attributed to the aforementioned growth in revenues for the Gains platform, increasing the yield paid out to stakers, as well as buy-pressure from token burns, as GNS is burned when the DAI vault is overcollateralized by more than 130%.

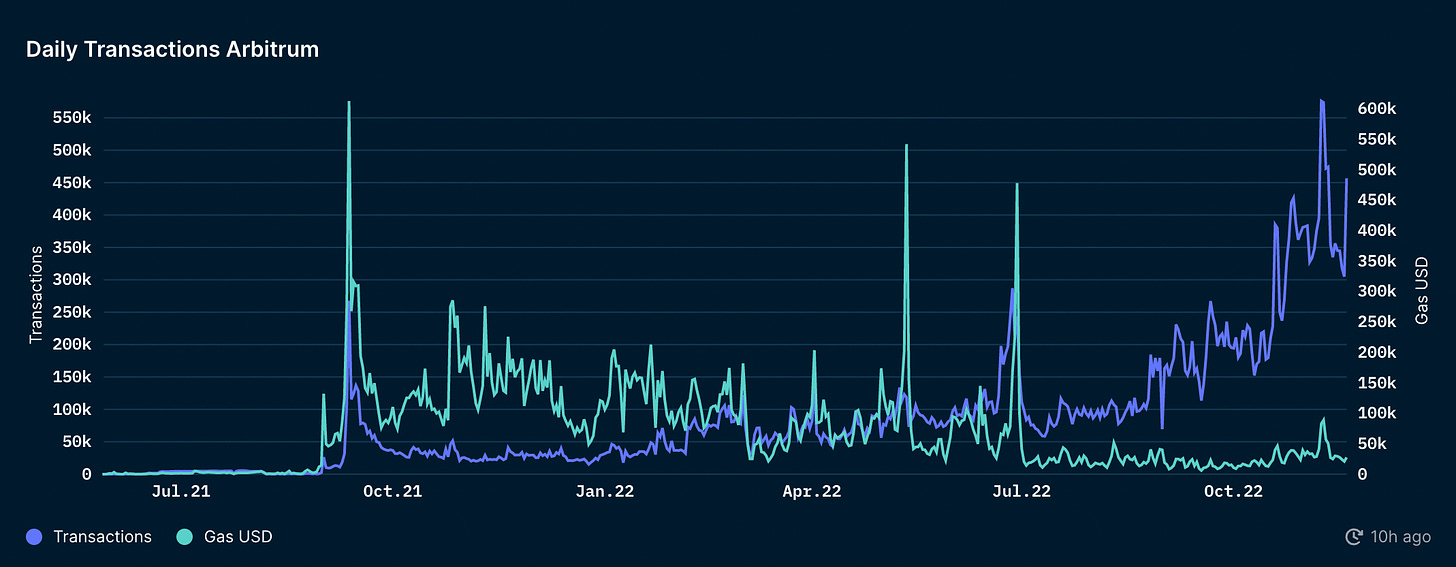

Gains has several upcoming catalysts, the most notable of which is a highly anticipated deployment on Arbitrum. This presents a significant growth opportunity for the protocol, as the L2 has an established base of perpetuals traders who use platforms such as GMX, while the network as a whole is poised to see a significant inflow of liquidity upon the resumption of Arbitrum Odyssey and a possible token launch. Gains should also benefit from a broader shift to perpetual DEX’s following the collapse of FTX. These tailwinds should increase both trading volumes, and in doing so, the yield earned by GNS stakers.

Hotness Rating (🔥🔥🔥/5): GNS has surged in the back-half of 2022 as the Gains platform has continued to grow. Although market conditions are treacherous following the collapse of FTX, long-term oriented investors willing to stomach volatility may want to keep GNS on their radar.