- Ticker: FXS

- Sector: DeFi

- Network: Ethereum

- FDV: $1.0B

- Hotness Rating: 🔥🔥🔥

Tl;dr: Frax’s LSD offering is taking off.

Frax Finance is a DeFi conglomerate. Frax is the fifth largest stablecoin with a circulating supply of $1.0B, a partially-collateralized, partially-algorithmic, USD-pegged stablecoin.

Within the Frax empire is also the entity behind the creation of FraxSwap, a time-weighted AMM (TWAMM), Frax Lend, an isolated lending and borrowing protocol, FPI, a stablecoin pegged to CPI, and Frax Ether, a liquid-staking protocol. Frax is governed by the FXS token, which is used as seigniorage for the FRAX stablecoin and can be locked for veFXS, which entitles holders to governance rights and protocol revenues.

Frax Ether has emerged as one of the fastest growing liquid staking solutions. Frax Ether utilizes a two-token model, where ETH stakers will receive a liquid staking derivative (LSD), frxETH, that represents a claim on their underlying deposit. frxETH can then be staked for sfrxETH, which entitles holders to staking rewards generated by the protocol. This model has allowed frxETH to quote a higher nominal yield relative to other LSDs, as not all frxETH is staked for sfrxETH.

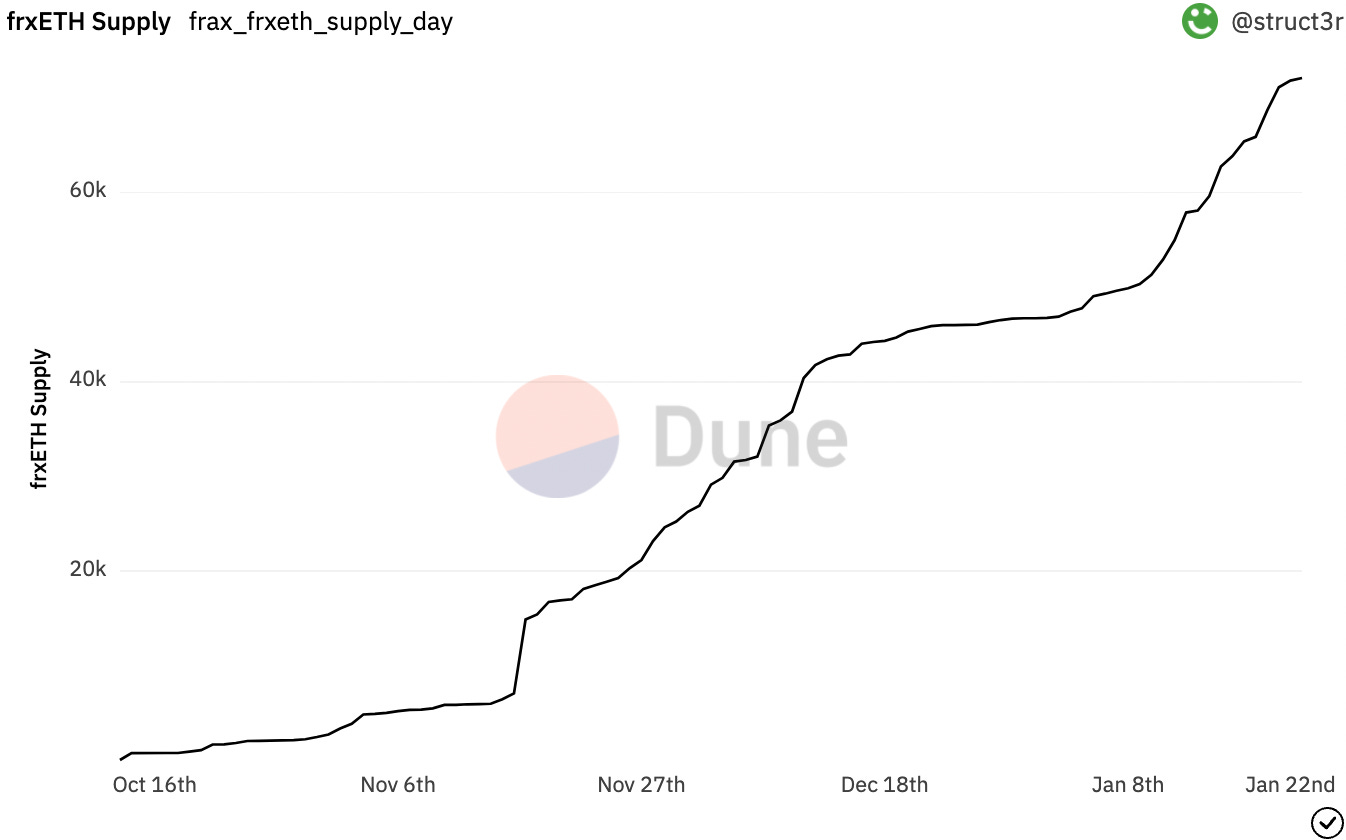

Frax Ether has grown considerably since its October 2022 launch, with the protocol attracting 72,091 in ETH deposits. This makes frxETH the fifth-largest LSD behind Lido, Coinbase, Rocket Pool, and StakeWise. Notably, the protocol has been growing the fastest of any LSD over the past 30 days, increasing its supply by 57.7% during this period.

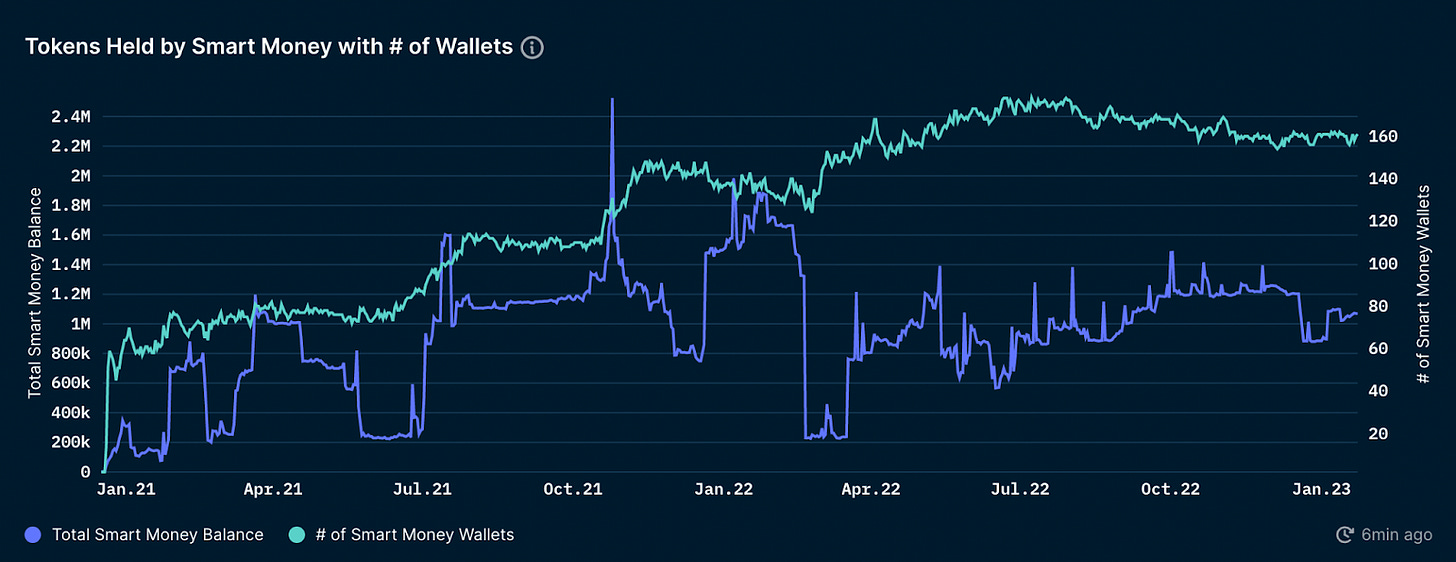

The price of FXS has soared to start 2023, soaring 143.1% and 74.3% against USD and ETH respectively YTD. Along with a rally in the border crypto market, this outperformance is likely driven by the growth of Frax Ether and the rally in all LSD governance tokens in anticipation of the Shanghai upgrade, which will enable withdrawals from staking. Perhaps as an encouraging sign for FXS bulls, this move has been driven in part by smart money holders, whose balances of the token have increased 20.9% YTD.

Hotness Rating (🔥🔥🔥/5):

FXS has outperformed considerably to start the year as markets have rebounded and with Frax Ether growing at a rapid rate. With Shanghai poised to accelerate growth in LSDs, and Frax armed with a stockpile of CVX, a meta-governance token that is used to control emissions and in doing so build up liquidity on the Curve decentralized exchange, it’s likely that the supply of frxETH will grow considerably in 2023. Despite this, FXS still faces several risks including its use as seigniorage for FRAX, as well as Frax Ether centralization risks stemming from all validators for the LSD solution being run by the Frax team.